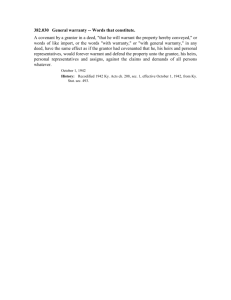

Taxable Income for a Grantor Trust.

advertisement

Bradley J. Frigon, CELA, JD, LLM Law Offices of Bradley J. Frigon 6500 S. Quebec St. Suite 330 Englewood, CO 80111 720-200-4025 www.bjflaw.com Case Example A young lady, age 23, whose income is $225/week ($11,700/yr) comes from a third party trust. In Florida, she cannot get Medicaid Expansion because it doesn’t exist. She also cannot get the IRS Premium Tax Credits, because her income has to be approximately $16,000 per year. If she has “Modified Adjusted Gross Income” of $16,000 per year, she can buy private health insurance for Monthly Premium = $8/mo. Annual Deductible = $500/yr Maximum Out-of-Pocket = $750/yr. Copayments/Coinsurance: Primary Doctor: $25 Specialist Doctor: $35 Generic Prescription: 17 ER Visit: 20% Coinsurance after deductible Case Example (cont.) We can get her on Florida Medicaid’s “Medically Needy” program, but her monthly cost is $805/mo. So, ironically, we can get her Medicaid for $805/month with all of its limitations, or we can get her on private insurance (selecting one of 137 different carriers and plans – PPOs, EPOs, HMOs) where she is guaranteed by ACA the right to select her doctor, has no annual or lifetime limits (which Medicaid DOES have), etc. for private insurance cost of $8/month. But ONLY if we can increase her taxable income to $16,000. Her current $11,700 isn’t enough under the MAGI calculations to trigger the IRS Advanced Tax Credits. Introduction Under the Patient Protection and Affordable Care Act (ACA; P.L. 111-148, as amended), the definition of income for eligibility for certain Medicaid populations and premium credits in the exchanges is based on modified adjusted gross income (MAGI). Medicaid Eligibility and ACA States that choose to participate in this ACA expansion will cover most nonelderly citizens (including childless adults, parents, individuals with disabilities) up to 133% FPL, and the income that is compared with this threshold for individuals in this group will be based on MAGI. MAGI MAGI is equal to adjusted gross income (AGI) plus certain foreign earned income and taxexempt interest. AGI is equal to gross income minus certain exclusions (e.g., public assistance payments, contributions to retirement plans) minus some above-the-line deductions (e.g., trade and business deductions, losses from sale of property, and alimony payments. Income Eligibility for Premium Credits Beginning in 2014, qualifying individuals will be able to receive premium tax credits toward the purchase of exchange coverage. The credit is an advancable, refundable tax credit, meaning taxpayers need not wait until the end of the tax year to benefit from the credit (advance payments will actually go directly to the insurer) and may claim the full credit amount even if they have little or no federal income tax liability. Amount of Premium Credits The amount of the tax credit will vary from person to person: it depends on the MAGI of the tax-filer (and dependents), the premium for the exchange plan in which the tax-filer (and dependents) is (are) enrolled, and other factors. In certain instances, the credit amount may cover the entire premium and the taxfiler will pay nothing toward the premium. In other instances, the taxpayer may be required to pay part (or all) of the premium. Amount of Premium Credits (cont.) For this latter scenario, the amount that a taxpayer who receives a premium credit would be required to contribute toward the premium is capped as a percentage of MAGI. That percentage will be less for those with lower MAGI compared with those with higher MAGI, where income is measured based on MAGI relative to the FPL. For tax payers with MAGI between 100% FPL and 133% FPL, the amount they would be required to contribute toward the premium will be capped at 2% of MAGI. Amount of Premium Credits (cont.) For taxpayers with income 300%-400% FPL, their premium contribution will be capped at 9.5% of MAGI. ACA further specified the “applicable percentages” that premium credit recipients, whose incomes are between those two MAGI bands, would be required to pay toward the cost of exchange coverage. The premium credit amount would be the arithmetical difference (if any) after subtracting the maximum premium contribution amount from the premium for the second-lowest-cost silver plan in the enrollee’s local area. Income Source Gross Income Adjusted Gross Income Modified Adjusted Gross Income Fully Included Wages, Salary Yes Yes Yes Interest Yes Yes Yes Dividends Yes Yes Yes Alimony and Separate Maintenance Payments Yes Yes Yes Life Insurance and Endowment Contracts Yes Yes Yes Estate or Trust Interest Income Yes Yes Yes Interest on State and Local Bonds (tax-exempt interest) No No Yes Prizes or Awards Yes Reimbursement of Moving Expenses Yes Yes Yes Yes Income Source Gross Income Adjusted Gross Income Modified Adjusted Gross Income Social Security and Tier 1 Railroad Retirement Benefits Yes Yes Yes Partially Included In MAGI Annuities Yes Yes (partial) Yes (partial) Pension Benefits Yes (partial) Yes (partial) Yes (partial) Partnership Gross Income Yes Yes (less deductions) Yes (less deductions) Earned Income of US Yes (partial) Citizen Living Abroad Yes (partial) Yes (partial) Retirement Contributions Yes (partial) Yes (partial) Yes (partial) Business (including Property, Rental, or Royalties) Income Yes Yes (less deductions) Yes (less deductions) Income Source Gross Income Adjusted Gross Income Fully Excluded from MAGI Modified Adjusted Gross Income Income from Discharge of Indebtedness Yes Yes Yes Gifts and Inheritance Yes Yes Yes Death Benefits Yes Yes Yes Cafeteria Plans Yes Yes Yes Certain Fringe Benefits Yes Yes Yes Contributions to Defined Contribution Plans Yes Yes Yes Trust Tax Rates Except for a grantor trust, a trust is taxed as a separate entity for federal income tax purposes. A non-grantor trust has similar tax rates as individuals under §1 of the Internal Revenue Code of 1986, as amended (the Code). Although similar tax rates (15%, 25%, 28%, 33%, and 35%) apply to both individuals and trusts, the tax brackets for a trust are more compact than for an individual. In 2013, a trust with taxable income over $11,950 is taxed at a 39.6%-rate bracket. In contrast, an unmarried individual must have taxable income over $400,000 to reach the 39.6% rate bracket for 2013 (or taxable income of $450,000 for married individuals filing joint returns). Understanding the Definitions in Subpart E Whether one seeks to create a grantor trust or to avoid grantor trust status, one must become closely familiar with the list of powers that make the grantor (or another) the deemed owner of all or a portion of the trust. A grantor trust is not treated as a separate taxpayer. Instead, the income from a grantor trust is taxed to the grantor (or sometimes to another person) because he or she holds some prescribed interest in or control over the trust’s assets. Grantor Trust Rules IRC Sections 671-678 If the trust violates one provision of grantor trust rules, then trust is taxed as a grantor trust. Violating one of the "grantor trust" rules for income tax purposes is generally fairly easy. IRC §677 provides that "the grantor shall be treated as the owner of any portion of a trust, . . . whose income without the approval or consent of an adverse party, is, or in the discretion of the grantor or a nonadverse party, or both, may be distributed to the grantor or the grantor's spouse; [or] held or accumulated for future distribution to the grantor or the grantor's spouse; . . .." What could be a clearer description of a (d)(4)(A) special needs trust? Grantor Trust Powers In addition to Section 677, Subpart E enumerates several powers, any one of which will render the grantor or some other person as the owner of all or a portion of the trust for federal income tax purposes. The grantor retains a power to revoke the trust. (Section 676). The grantor has a reversionary interest in either principal or income and the value of the reversion is worth at least 5% of the value of the property subject to the reversion at the time the reversionary interest is created. (Section 673). Certain Administrative Powers under Section 675. Adverse Party (AP) and Nonadverse Party (NAP) An adverse party (AP) is anyone with a substantial beneficial interest in the trust that would be adversely affected by the exercise or nonexercise of a power with respect to the trust. Not surprisingly, a nonadverse party (NAP) is anyone who is not an AP. Generally, if a trustrelated power is exercisable only with the consent or permission of an AP, such power by itself will not render the power-holder the tax owner of the portion of the trust to which the power relates. (Section 672(a)) What does it mean to have a substantial beneficial interest in the trust? A general power of appointment over all or a portion of the trust property is sufficient. Beyond that, however, Treasury will only say that “[a]n interest is a substantial interest if its value in relation to the total value of the property subject to the power is not insignificant.” Family Member Serving As Trustee Often the trustee of a (d)(4)(A) trust is a parent or other family member. A family member serving as trustee would be an “adverse party” if that family member is also a residual trust beneficiary. In other words, the trustee is adversely affected as a residuary beneficiary to the extent he or she exercises his or her power to consent to distributions to the primary beneficiary. When the trustee makes a distribution he or she logically has to make it with his or her own consent, i.e., with the consent of an "adverse party". As a result, the trust may be taken out of "grantor trust" treatment. Can I Get Grantor Trust Status with a Family Member Serving As Trustee? (cont.) Don’t be fooled by IRC §674(b)(3) which expressly takes out of Grantor Trust treatment a power "exercisable only by will" to appoint the income of the trust where the income is accumulated for such disposition by the grantor or may be so accumulated in the discretion of the grantor or a nonadverse party, or both, without the consent or approval of any adverse party. Although IRC §674(b)(3) appears to take a testamentary limited power of appointment out of grantor trust treatment, the reference under §674(b)(3) is to ordinary income and not accounting income. Because SNT allows Trustee discretion to accumulate all income (and not just ordinary income), §674(b)(3) does not apply. Powers Invoking Grantor Trust Status Reversions: A reversion is a power to reclaim possession or enjoyment of the trust property. To the extent the grantor has a decent chance of reclaiming possession of property held in trust, it is fair to consider the grantor as owner of the property subject to the reversion. If the grantor holds a reversionary interest in any portion of the trust’s principal or income, the grantor will be treated as the owner of the portion of the trust if, at the inception of that portion of the trust, the value of the reversion exceeds 5% of the value of the trust portion to which the reversion relates. (Section 673). Powers Invoking Grantor Trust Status (cont.) Section 673 provides as follows: “The grantor will be treated as the owner of a trust or any portion of the trust in which the grantor has a reversionary interest in either the corpus or the income there from, if, as of the creation of the trust (or such portion), the value of such interest exceeds 5% of the value of the trust (or such portion).” For 673 to apply there must be a reversionary interest to the grantor. Actuarial rules under Section 2031 are used to value the reversion. Example: T creates a trust for 50 years for A. After 50 years, the trust then terminates and reverts to the grantor T. If the interest rate is 1.4% at the time the trust is created, the value of the reversion is 49.9%. Since it exceeds 5%, T would be treated as the grantor under Section 673. Reversions Section 673(c) is a valuation subsection to the general rule stated in 673(a). In other words, 673(c) does not create an additional category of rules to make a trust a grantor trust, it is an instruction on how the reversionary interest must be valued. “673(c) Special Rule For Determining Value Of Reversionary Interest For purposes of subsection (a), the value of the grantor's reversionary interest shall be determined by assuming the maximum exercise of discretion in favor of the grantor.” Reversions (cont.) For example, a grantor funds a discretionary trust for the benefit of his children to last for 20 years. At the expiration of the 20 year period, the trust fund is to revert to the grantor. In determining whether the trust is a grantor trust under 673(a), the value of the grantor’s reversionary interest at the inception of the trust needs to be determined by assuming the maximum exercise of discretion in favor of the grantor. This means that in determining the value of the grantor’s reversionary interest, 673(c) requires an assumption that no distributions are made to the grantor’s children during the trust’s 20 year term. Reversions (cont.) A well drafted SNT will require the trustee to exercise maximum discretion in favor of the beneficiary. The trust document also provides that the grantor (beneficiary) cannot compel the trustee to make any distributions to or for the benefit of the grantor (beneficiary). If the document provided otherwise, it would not be a valid first party SNT. The exercise of maximum discretion for the benefit of the grantor (beneficiary) is not a reversionary interest as contemplated under Section 673(a). As previously explained, 673(c) is a direction on how a reversionary interest is to be valued. It does not impose grantor tax status to a discretionary trust where no reversionary interest exists in the first place. Administrative Powers Section 675 lists six administrative powers that give rise to grantor trust status. Planners seeking grantor trust status therefore, may obtain it by adding one of these powers to the trust instrument, although it should be noted that the addition of some of these powers alone will not make the grantor the deemed owner of the entire trust, since the powers may only relate to a portion of the trust (i.e., income or principal). On the other hand, planners seeking to avoid grantor trust treatment should make sure that the following powers are not included in the trust instrument. Power to Reacquire Trust Assets by Substitution A power held by anyone in the nonfiduciary capacity to “reacquire the trust corpus by substituting other property of an equivalent value” will cause the grantor to be the deemed owner of the trust property. The same presumption that a trustee would exercise such a power in a fiduciary capacity applies here. The use of the word “reacquire” connotes that only the grantor could have this power, since no one else can “reacquire” property transferred by the grantor. But the statute expressly states that the power may be held by “any person” and the IRS has informally concluded that grantor trust status occurs even when someone other than the granter holds the power. Inter Vivos Third Party SNT How to avoid grantor trust status for parents: Control powers. Name independent trustee. No Reversionary interest. Power to control beneficial enjoyment, Section 674: Power to control principal distributions. The power to control principal distributions will not be imputed to parents if the distribution standard is limited to a reasonably measurable standard. Power to distribute for the “maintenance, education, support or health” of a beneficiary is a reasonably measurable standard. A power to distribute for the “happiness, desire or pleasure” will not qualify. Power to control income distributions. The power to control income distributions is not imputed to grantor if the document allows income to be accumulated for beneficiary with a disability. The Trust document cannot contain any of the six prohibited administrative powers. Simple or Complex Trust If the grantor is not deemed as the owner of a portion of the trust assets, then the trust is taxed as a separate entity for federal income tax purposes. If a trust is taxed as a separate entity then it will be taxed as a simple or complex trust unless the trust is a charitable trust. Simple Trust- Mandatory distribution of income. Complex Trust- Discretionary distribution of income. Simple – Complex Trusts Distributable Net Income (DNI). It limits the deductions allowable to estates and trusts for amounts paid, credited, or required to be distributed to beneficiaries and is used to determine how much of an amount paid, credited, or required to be distributed to a beneficiary will be includible in his gross income. It is also used to determine the character of distributions to the beneficiaries. Distributable net income means for any taxable year, the taxable income (as defined in section 63) of the estate or trust, computed with the modifications set forth in §§1.643(a)–1 through 1.643(a)– Amount that the beneficiary must take into income; Amount that trust can claim as a distribution deduction. Capital Gains Excluded from DNI Computation Gains from the sale or exchange of capital assets are ordinarily excluded from DNI and ordinarily are not considered as paid, credited or required to be distributed to any beneficiary unless they are, pursuant to the terms of the governing instrument and applicable local law, or pursuant to a reasonable and impartial exercise of discretion by the fiduciary (in accordance with a power granted to the fiduciary by applicable local law or by the governing instrument if not prohibited by local law. Section 643(a)(3). Gross Income and Exclusions The General definition of gross income applies to a trust. § 61 defines gross income to mean “income from whatever source derived, including (but not limited to)” items of income specifically enumerated in that section. Some of the specially enumerated items that generally apply to a trust are interest, dividends, rents, royalties, gross income derived from business, the distributive share of a partnership’s gross income, income from an interest in an estate or trust, income from life insurance and endowment contracts, gains derived from dealings in property, and income in respect of a decedent. Deductions A trust is entitled to various deductions if it holds property for the production of income, whether for current income or longterm growth. These transactions are usually investments entered into for profit. The deductions in this group include deductions for: (a) ordinary and necessary expenses paid or incurred (i) for the production or collection of income, or (ii) for the management of property that is held for the production of income, including administration expenses such as fees for executors, trustees, attorneys, and accountants; (b) interest paid or incurred on indebtedness properly allocable to property held for investment (subject to the restrictions on investment interest and passive activity losses); Deductions (cont.) (c) taxes paid or incurred in connection with the production of income or property held for the production of income; (d) losses incurred in a transaction entered into for profit, not connected with a trade or business (including any short-term capital loss resulting from the total worthlessness of a non-business bad debt), subject to the limitations on capital losses; (e) depreciation of property held for the production of income, but only to the extent the deduction is not allocable to the beneficiaries of the trust. Other General or Personal Deductions A trust is entitled to certain deductions that are not dependent upon the trust engaging in a trade or business, an income-producing activity, or a profit transaction. These include deductions for: (a) ordinary and necessary expenses paid or incurred for tax advice and representation, with respect to the determination, collection or refund of any tax; (b) personal casualty or theft losses, subject to the $100 deductible and the 10% adjusted gross income limitations; Other General or Personal Deductions (cont.) (c) taxes set forth in § 164, including real and personal property taxes, state income taxes, and the GST tax imposed on income distributions; (d) charitable contributions for amounts paid for charitable purposes (or set aside for such purposes under certain preOctober 9, 1969, trusts); and (e) a personal exemption of $300 for a trust required to distribute all income currently, whether a simple or complex trust for the year, and $100 for all other trusts (other than qualified disability trusts). Miscellaneous Itemized Deduction Subject to 2% Floor For individuals, estates, and trusts, miscellaneous itemized deductions for any taxable year are allowed only to the extent that the aggregate of such deductions exceeds 2% of adjusted gross income. The proposed regulations provide that a cost is subject to the 2% floor to the extent the cost is: (1) included in the definition of miscellaneous itemized deductions; (2) incurred by an estate or non-grantor trust; and (3) commonly or customarily incurred by a hypothetical individual holding the same property. Trust Payments for Personal Expenses of Beneficiary Payments from the trust for personal expenses of the beneficiary (care providers, transportation, medical expenses, ect) are not a deductible expense for trust administration purposes. A payment from the trust for personal expenses of the beneficiary will be treated as a distribution for the benefit of the beneficiary and, for income tax purposes, be classified as a distribution of trust income or principal. 65 Day Rule – Complex Trust With respect to discretionary distributions, whether of income or principal, the year of payment by the trust will generally be the year of deduction and will set the year for determining inclusion of the payment. If within the first 65 days of the taxable year of a trust an amount is properly paid or credited and if the fiduciary makes a proper election, the distribution is treated as having been made on the last day of the preceding taxable year. 65 Day Rule- Complex Trust (cont.) While the distribution must be made within 65 days of the new year, the election must be made no later than the deadline for filing the fiduciary income tax return for the taxable year for which the distribution is treated as made, plus extensions. In rare cases, a further extension may be allowed. Because trusts must use the calendar year, the elections deadline for trusts is April 15, plus any extensions. Investment Income Beginning in 2013, certain investment income will be subject to an additional 3.8% surtax, enacted as part of the Health Care and Education Reconciliation Act of 2010 (commonly called the “Medicare Surtax”). This tax will also have to be taken into account for estimated tax purposes. For trusts, the 3.8% surtax is imposed on the lesser of (i) undistributed Net Investment Income (NII) or (ii) the excess of adjusted gross income over the dollar amount at which the highest trust income tax bracket begins ($11,950 for 2013). With such a low threshold, the surtax could apply much more easily to non grantor trusts than to individuals. There is one respect in which the surtax applies to trusts much differently than it applies to individuals: the concept of “undistributed NII.” Trusts are subject to a set of income tax rules where if the trust earns income but distributes it to the beneficiaries, then the beneficiaries are taxed on that distributed income (as discussed above in the preceding paragraph). If the trust retains the income, then the trust is taxed on that retained income. If the trust distributes some of its income but also retains some, then the beneficiaries are taxed on the portion distributed, and the trust is taxed on the portion retained. Examples Taxable Income Taxable Interest $ 4,500.00 Tax exempt interest $ 500.00 Dividends $10,000.00 Capital Gains $10,000.00 Total Income $25,000.00 Deductions Trustee fees $ 5,000.00 Attorney fees $ 5,000.00 Trust Distributions for the benefit of the beneficiary for Example 1 and 2 total $20,000.00 The Beneficiary only income is SSI payments $8,544.00. Example- One Taxable Income for a Complex Trust. Taxable Income Taxable Interest Tax exempt interest Dividends Capital Gains Total Income Deductions Trustee fees Attorney fees Gross Income Less Exemption Distributions to beneficiary 2013 Trust Tax Liability MAGI * 2013 Beneficiary Tax Liability $ 4,500.00 $ 500.00 $10,000.00 $10,000.00 $25,000.00 $5,000.00 $5,000.00 $15,000.00 $3,900.00 $20,00000 $6,100.00 $5,000.00 $0.00 *Adjusted $168 for tax exempt interest. Example- Two Taxable Income for a Complex Trust. Taxable Income Taxable Interest Tax exempt interest Dividends Capital Gains Total Income Deductions Trustee fees Attorney fees Gross Income Less Exemption Distributions to beneficiary 2013 Trust Tax Liability MAGI * 2013 Beneficiary Tax Liability $ 4,500.00 $ 500.00 $20,000.00 $25,000.00 $5,000.00 $5,000.00 $15,000.00 $3,900.00 $20,00000 $0.00 $15,000.00 $0.00 *Adjusted $300 for tax exempt interest. Example- Three Taxable Income for a Grantor Trust. Taxable Income Taxable Interest Tax exempt interest Dividends Capital Gains Total Income Deductions Trustee fees Attorney fees $ 4,500.00 $ 500.00 $10,000.00 $10,000.00 $25,000.00 $5,000.00 $5,000.00 2013 Trust Tax Liability MAGI* 2013 Beneficiary Tax Liability *Adjusted $500 for tax exempt interest. $0.00 $25,000.00 $0.00 Tax Due Trustee fees and expenses are itemized deduction to beneficiary subject to 2 % floor. In 2013, the standard deduction for a single individual is $6,100. Beneficiary cannot deduct trustee fees since standard deduction exceeds the beneficiary’s itemized deductions listed on Schedule A. Does not impact MAGI since only deduct above the line deductions from Gross Income to calculate MAGI. Although SSI payments are not taxable, SSDI payments may be potentially taxable if beneficiary’s income exceeds threshold. Taxable portion of SSA payments are not part of MAGI. Planning Opportunities – Impact MAGI 65 day Rule Trust Toggle Provisions Investment Allocations Toggle Provisions The Grantors reserve the right to reacquire any property constituting the Trust estate by substituting other property of equivalent value; provided, however, that this power shall not apply to any interest in a life insurance policy insuring the life of the Grantors, to any residence that was contributed to the Trust from a Qualified Personal Residence Trust of the Grantors and to any voting stock of a controlled corporation within the meaning of Section 2036(b) of the Code. The power to substitute property shall not be exercised in a fashion that will shift the benefits of the beneficiaries. The Trust Advisory Committee may appoint an Independent Special Trustee who shall have the power and the absolute right, exercisable in a non-fiduciary capacity and without the approval or consent of any person in a fiduciary capacity, to revoke the Grantors’ right to substitute property under this Section. Toggle Provisions (cont.) If an Independent Special Trustee is appointed and revokes the Grantors’ right to substitute property under this Section, the Independent Special Trustee shall provide written notice to the Grantors of such revocation, which revocation shall only apply to such future tax years as the Independent Special Trustee shall determine, and not to the tax year in which the notice of the revocation of the right to substitute property is given to the Grantors. Investment Allocation How trust assets are invested will dramatically impact taxable income. To increase income, investment allocation should focus on dividend paying stocks, REITS, utilities, preferred stocks. Understand the impact of an income driven investment allocation to your beneficiary. Does your trust document allow you to invest exclusively for income? Does your state follow Prudent Investor Rule? Work with an investment advisor that understands these issues. I have worked out an arrangement to pool multiple (smaller) trust accounts with one investment advisor.