Principles of Cost Accounting, 16th Edition, Edward J. VanDerbeck, ©2013 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for

use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

Chapter 4

Accounting for Factory

Overhead

Learning Objectives

Identify cost behavior patterns.

Separate semivariable costs into variable

and fixed components.

Prepare a budget for factory overhead

costs.

Account for actual factory overhead.

Learning Objectives (cont.)

Distribute service department factory

overhead costs to production departments.

Apply factory overhead using predetermined

rates.

Account for actual and applied factory

overhead.

Factory Overhead

• Overhead costs are a very big deal costing

companies, large and small, thousands of

dollars each year.

• It must be allocated in a rational way to all

jobs produced during the period.

• All costs incurred in the factory that are not

chargeable directly to the finished product

are called factory overhead.

Factory Overhead

• Factory Overhead includes:

(1) indirect materials consumed in the

factory, such as glue and nails in the

production of wooden furniture and oil

used for maintaining factory equipment.

(2) indirect factory labor, such as

wages of janitors, forklift operators and

supervisors, and overtime premiums

paid to all factory workers.

Factory Overhead (cont.)

(3) all other indirect manufacturing

expenses, such as insurance, property

taxes, and depreciation on the factory

building and equipment.

Cost Behavior Patterns

• Variable costs are costs that vary in direct

proportion to volume changes.

• Fixed costs are costs that remain the

same in total, when production levels

increase or decrease.

• Semivariable costs have characteristics of

both variable and fixed costs.

Cost Behavior Patterns

Analyzing Semivariable

Factory Overhead Costs

• Observation Method relies heavily on the

ability of an observer to detect a pattern of

cost behavior by reviewing past cost and

volume data.

• High-Low Method compares a high

production volume and its related cost to a

low production volume with its related

cost.

Analyzing Semivariable

Factory Overhead Costs

• Scattergraph method estimates a straight

line along which the semivariable costs will

fall.

Analyzing Semivariable

Factory Overhead Costs

• The high-low and statistical scattergraph

methods use historical cost patterns to

predict future costs and are, therefore

subject to limitations that apply to all

forecasting techniques.

• Statistical software packages are often

used to analyze semivariable factory

overhead.

Analyzing Semivariable

Factory Overhead Costs

• Least-squares regression method uses all

of the data to separate a semivariable cost

into its fixed and variable elements based

on the equation for a straight line:

Y = a + bX, where:

X = activity level

Y = the total semivarible cost

a = the total fixed cost

b = the variable cost per unit

Analyzing Semivariable

Factory Overhead Costs

Budgeting Factory Overhead

Costs

• Budgets are management’s operating

plans expressed in quantitative terms,

such as units of production and related

costs.

• The segregation of fixed and variable cost

components permits the company to

prepare a flexible budget. A flexible budget

is a budget that shows estimated costs at

different production volumes.

Accounting for Actual Factory

Overhead

• Cost accounting systems are designed to

accumulate, classify, and summarize the

factory overhead costs actually incurred.

Schedule of Fixed Costs

Summary of Factory

Overhead

Distributing Service

Department Expenses

• Departments are divided into two classes:

service departments and production

departments.

• A service department is an essential part of

the organization, but it does not work directly

on the product.

• A production department performs the actual

manufacturing operations that physically

change the units being processed.

Distributing Service

Department Expenses

• Direct Distribution Method

• Sequential Distribution or Step-Down

Method

• Reciprocal Method

Direct Distribution Method

Sequential Distribution

Method

Applying Factory Overhead

to Production

• Predetermined factory overhead rates are

computed by dividing the budgeted factory

overhead cost by the budgeted production.

• The budgeted production may be expressed

in such terms as machine hours, direct labor

hours, direct labor cost, and units produced.

• Management should give a high priority to

attaining the most accurate predetermined

factory overhead rate.

Applying Factory Overhead to

Production

• Direct Labor Cost Method

• Direct Labor Hour Method

• Machine Hour Method

• Activity-based Costing Method

Accounting for Actual and

Applied Factory Overhead

• Entry to apply estimated FOH to

production:

Work in Process XXX

Applied Factory Overhead XXX

Accounting for Actual and

Applied Factory Overhead

• At the end of the period, the applied

factory overhead account is closed to the

FOH control account:

Applied Factory Overhead

Factory Overhead

XXX

XXX

Under and Over applied

Factory Overhead

• The debit balance indicates that the

factory overhead costs were underapplied

or underabsorbed.

• The credit balance indicated that the

factory overhead costs were overapplied

or overabsorbed.

Under and Over applied

Factory Overhead

• At the end of the year, the balance of the

under and overapplied account will be

closed to Cost of Goods Sold, or allocated

on a pro rata basis to Work in Process,

Finished Goods, and Cost of Goods Sold.

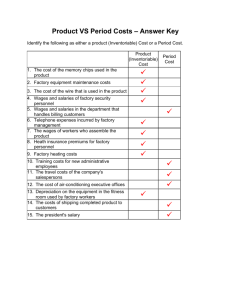

Period and Product Cost

• Period cost

Costs that directly reduce net income for

the current period.

• Product Cost

Costs that are included as part of the

inventories and expensed when the

goods are sold.