DE MINIMIS AID – clarification I would like to ask you whether my

advertisement

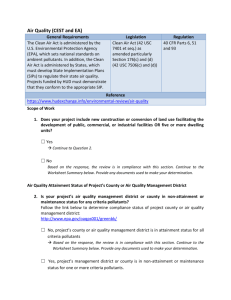

DE MINIMIS AID – clarification I would like to ask you whether my understanding of the below mentioned answer is correct. You wrote that according to the case law of the European Court of Justice the enterprise should have been assessed as one undertaking also in connection to the partner and linked enterprises. However, this condition was not included in the Commission Regulation (EC) No 1998/2006 on the application of Articles 87 and 88 of the Treaty to de minimis aid. My understanding is: Given that the above mentioned condition was not included in the previous de minimis regulation, the aid provider can set any additional conditions concerning the size of the undertaking and he/her can also decide how to assess them, as long as the de minimis conditions are respected at the level of the group. The interpretation provided by the case law applies directly to the Commission Regulation (EC) No 1998/2006 on the application of Articles 87 and 88 of the Treaty to de minimis aid. As long as the de minimis ceilings are respected at the level of the 'group' defined in accordance with such case law, the MS may set additional conditions of eligibility. It goes without saying that the additional conditions should not go against the case law that applies directly to the Commission Regulation (EC) No 1998/2006. COMP_Answer to SK reguest of 3-10 DE MINIMIS AID Aid provider was providing de minimis aid based on a De minimis aid scheme (further as „scheme“) according to the Commission Regulation (EC) No 1998/2006 on the application of Articles 87 and 88 of the Treaty to de minimis aid (further as “De minimis Regulation“). Eligible beneficiaries (when it comes to their size) according to the scheme were: 1. SMEs [according to SME definition in Annex I of the COMMISSION REGULATION (EC) No 800/2008 declaring certain categories of aid compatible with the common market in application of Articles 87 and 88 of the Treaty (General block exemption Regulation), further as “GBER”)], 2. Large enterprises (enterprises which did not comply with the SME definition under previous paragraph) for which the aid provider set additional condition beyond de minimis aid rules – could not employ more than 1000 employees and had annual turnover not exceeding 50 mil. EUR. Concrete example of large enterprise X applying for de minimis aid under the scheme concerned: - the enterprise itself (without partner and linked enterprises) employed 800 persons and had annual turnover 40 mil. EUR, - the „group“ (the enterprise X together with its partner and linked enterprises) employed 1 200 persons and had annual turnover 65 mil. EUR. Total amount of aid was respected (de minimis aid provided to the beneficiary and its partner and linked enterprises did not exceed 200 000 EUR over any period of three fiscal years). Questions: Was the enterprise X eligible to get de minimis aid under the scheme concerned? How should the fulfillment of the additional condition have been assessed? Can a member state/aid provider determine its own way of assessment of fulfillment of additional condition set beyond the respective EU rules – in this concrete case, to take into account only data for the large enterprise itself? Or should also the data for partner and linked enterprises have been taken into account not only in determining the size of the enterprise (SME or large enterprise), but also when checking the fulfillment of the additional condition? Answer: Under the provisions of the Commission Regulation (EC) No 1998/2006 on the application of Articles 87 and 88 of the Treaty to de minimis aid (further as “ previous De minimis Regulation“) there was no specific definition of the terms 'undertaking' or 'single undertaking'. As a consequence, to interpret the notion of 'undertaking', recourse must be had to the case law of the European Court of Justice. That means, in essence, that all entities that are controlled, on a legal or a de facto basis, by the same entity must be considered as one undertaking for this purpose1. In your example above, the undertaking would be the enterprise X together with its partner and linked enterprises. Therefore, any conditions in the scheme regarding the undertakings benefitting of the aid would have to be met at the level of the 'group'. Secondly, as long as the de minimis conditions are respected at the level of the group, it remains for the Member State to decide what data of which legal entity and for which purpose is being taken into account to design their national scheme. 1 In the Dutch petrol stations case C-382/99 – concerning the de minimis rule – the Court of justice confirmed the approach taken by the Commission regarding the use of the concept of “de facto control” for determining which legal entities are together to be considered as the relevant “undertaking” for de minimis purposes.