Chapter 8

advertisement

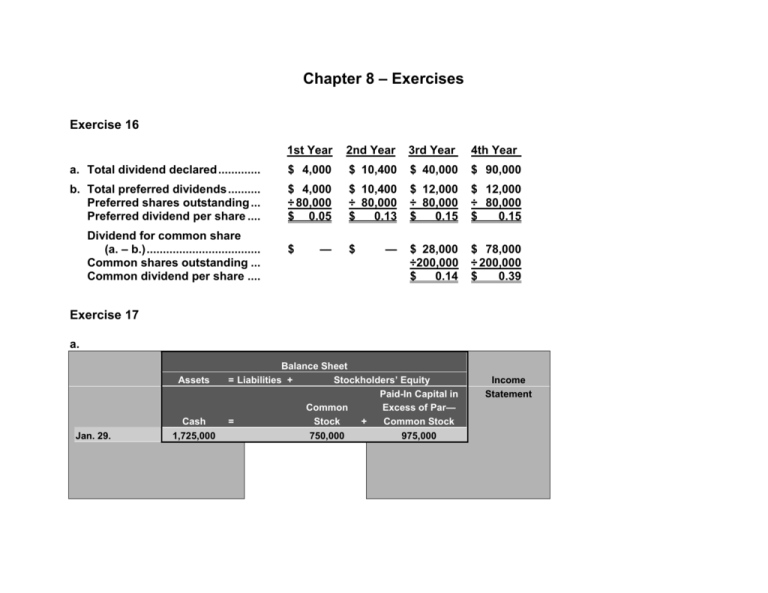

Chapter 8 – Exercises Exercise 16 1st Year 2nd Year 3rd Year 4th Year a. Total dividend declared ............. $ 4,000 $ 10,400 $ 40,000 $ 90,000 b. Total preferred dividends .......... Preferred shares outstanding ... Preferred dividend per share .... $ 4,000 ÷ 80,000 $ 0.05 $ 10,400 ÷ 80,000 $ 0.13 $ 12,000 ÷ 80,000 $ 0.15 $ 12,000 ÷ 80,000 $ 0.15 — $ 28,000 ÷200,000 $ 0.14 $ 78,000 ÷ 200,000 $ 0.39 Dividend for common share (a. – b.) ................................... Common shares outstanding ... Common dividend per share .... $ — $ Exercise 17 a. Assets Cash Jan. 29. 1,725,000 Balance Sheet = Liabilities + Stockholders’ Equity Paid-In Capital in Common Excess of Par— = Stock + Common Stock 750,000 975,000 Income Statement Assets Cash May 31. Balance Sheet = Liabilities + Stockholders’ Equity Paid-In Capital in Preferred Excess of Par— = Stock + Preferred Stock 600,000 400,000 Income Statement 200,000 b. $2,325,000 ($1,725,000 + $600,000) Exercise 21 a. $990,000 ($33 × 30,000 shares) b. Stockholders’ Equity section as a reduction (decrease) c. Banff Water Inc. may have purchased the stock to support the market price of the stock, to provide shares for resale to employees, or for reissuance to employees as a bonus according to stock purchase agreements. d. Assets Cash Balance Sheet = Liabilities + Stockholders’ Equity Treasury Paid-In Capital = Stock + from Treasury Stock 800,0001 Jan. 25. 1 $800,000 = 20,000 shares × $40 2 $660,000 = 20,000 shares × $33 3 $140,000 = $800,000 – $660,000 660,0002 Income Statement 140,0003 Exercise 23 (1) (2) (3) (4) (5) Declaring a cash dividend Paying the cash dividend declared in (1) Authorizing and issuing stock certificates in a stock split Declaring a stock dividend Issuing stock certificates for the stock dividend declared in (4) Assets Liabilities Stockholders’ Equity 0 + – – – 0 0 0 0 0 0 0 0 0 0 Exercise 24 a. 72,000 shares (18,000 × 4) b. $70 per share ($280 ÷ 4) Chapter 8 – Problems Problem 2 1. $46,875 ($625,000 × 7.5%) 2. Balance Sheet Assets = Liabilities Employee FICA Bond Group Income Tax Tax Deduction Ins. Payable + Payable + Payable + Payable July 17. 98,000 46,875 15,000 12,500 + Stockholders’ Equity + Salaries Payable 452,625* + Income Statement Retained Earnings –625,000 July 17. Income Statement July 17. Sales salaries exp. –315,000 Warehouse salaries exp. –185,000 Office salaries exp. –125,000 *$452,625 = $625,000 – $98,000 – $46,875 – $15,000 – $12,500 Problem 2, Concluded 3. (a) (b) (c) $46,875 ($625,000 × 7.5%) $26,250 ($625,000 × 4.2%) $5,000 ($625,000 × 0.8%) 4. Assets = FICA Tax Payable July 17. 46,875 Balance Sheet Liabilities + Stockholders’ Equity SUTA FUTA Retained + Payable + Payable + Earnings 26,250 5,000 July 17. –78,125 Income Statement Payroll tax exp. –78,125 Income Statement July 17. Problem 3 1. July 1. Assets = Cash = 25,000,000 Balance Sheet Liabilities + Stockholders’ Equity Income Statement Bonds Payable 25,000,000 2. Dec. 31. Assets = Cash = Balance Sheet Liabilities + Stockholders’ Equity Retained Earnings –1,000,000* –1,000,000 Income Statement Dec. 31 Income Statement Dec. 31. Interest exp. –1,000,000 *$25,000,000 × 8% × 1/2 = $1,000,000 3. June 30. 4. Assets = Cash = –25,000,000 Balance Sheet Liabilities + Stockholders’ Equity Income Statement Bonds Payable –25,000,000 The bonds would have sold at a premium since the market rate of interest is less than the coupon rate of interest. Thus, investors will be willing to pay more than the face amount of the bonds when the interest payments they will receive from the bonds are more than the amount of interest that they could receive from investing in other bonds.