Chapter 11

advertisement

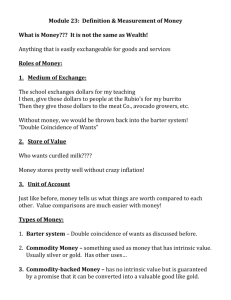

CHAPTER 12 Competition Competition What is perfect competition? How are price and output determined in a competitive industry? Why do firms enter and leave an industry? How do changes in demand and technology affect an industry? Why is perfect competition economically efficient? Perfect Competition Perfect competition arises when: There are many firms, each selling an identical product. There are many buyers. There are no restrictions on entry into the industry. Firms in the industry have no advantage over potential new entrants. Firms and buyers are completely informed about other firms’ prices. The Firm Has No Control Over the Price It Charges Since each firm produces a small fraction of total industry output and the products are identical, no firm has any control over price. Firms are price takers in perfectly competitive markets. A price taker is a firm that cannot influence the price of a good or service. Elasticity of Industry and Firm Demand A price taker firm faces a demand curve that is perfectly elastic (horizontal) because the product from firm A is a perfect substitute for the product from firm B. However, the market demand curve will still slope downward; elasticity will be positive, but not infinite. Competition in the Real World In reality, there are no markets that are absolutely perfectly competitive. However, competition in some industries is so fierce that the model of perfect competition predicts extremely well how firms will behave. Examples are computers, soft drinks, TVs, DVD players, potato chips, etc. Economic Profit and Revenue Total revenue (TR) Value of a firm’s sales TR = P Q Marginal revenue (MR) Change in total revenue resulting from a oneunit increase in quantity sold. MR = TR/ Q Average revenue (AR) Total revenue divided by the quantity sold — revenue per unit sold. AR = TR/Q = PxQ/Q = P In perfect competition, Price = MR = AR Economic Profit and Revenue Suppose Cindy sells her sweaters in a perfectly competitive market. What are Cindy’s TR, MR, and AR? Demand, Price, and Revenue in Perfect Competition Quantity Price sold (P) Total (Q) (dollars revenue (sweaters per day) per TR = P ´ Q sweater) (dollars) 8 25 9 25 10 25 Marginal revenue Average revenue MR TR / Q AR = TR/Q (dollars per (dollars additional sweater) per sweater) Demand, Price, and Revenue in Perfect Competition Quantity Price sold (P) Total (Q) (dollars revenue (sweaters per day) per TR = P ´ Q sweater) (dollars) 8 25 9 25 10 25 200 Marginal revenue Average revenue MR TR / Q AR = TR/Q (dollars per (dollars additional sweater) per sweater) Demand, Price, and Revenue in Perfect Competition Quantity Price sold (P) Total (Q) (dollars revenue (sweaters per day) per TR = P ´ Q sweater) (dollars) 8 25 200 9 25 225 10 25 Marginal revenue Average revenue MR TR / Q AR = TR/Q (dollars per (dollars additional sweater) per sweater) Demand, Price, and Revenue in Perfect Competition Quantity Price sold (P) Total (Q) (dollars revenue (sweaters per day) per TR = P ´ Q sweater) (dollars) 8 25 200 9 25 225 10 25 250 Marginal revenue Average revenue MR TR / Q AR = TR/Q (dollars per (dollars additional sweater) per sweater) Demand, Price, and Revenue in Perfect Competition Quantity Price sold (P) Total (Q) (dollars revenue (sweaters per day) per TR = P ´ Q sweater) (dollars) 8 25 200 9 25 225 10 25 250 Marginal revenue Average revenue MR TR / Q AR = TR/Q (dollars per (dollars additional sweater) per sweater) - Demand, Price, and Revenue in Perfect Competition Quantity Price sold (P) Total (Q) (dollars revenue (sweaters per day) per TR = P ´ Q sweater) (dollars) Marginal revenue Average revenue MR TR / Q AR = TR/Q (dollars per (dollars additional sweater) per sweater) 8 25 200 - 9 25 225 25 10 25 250 Demand, Price, and Revenue in Perfect Competition Quantity Price sold (P) Total (Q) (dollars revenue (sweaters per day) per TR = P ´ Q sweater) (dollars) Marginal revenue Average revenue MR TR / Q AR = TR/Q (dollars per (dollars additional sweater) per sweater) 8 25 200 - 9 25 225 25 10 25 250 25 Demand, Price, and Revenue in Perfect Competition Quantity Price sold (P) Total (Q) (dollars revenue (sweaters per day) per TR = P ´ Q sweater) (dollars) Marginal revenue Average revenue MR TR / Q AR = TR/Q (dollars per (dollars additional sweater) per sweater) 8 25 200 - 9 25 225 25 10 25 250 25 25 Demand, Price, and Revenue in Perfect Competition Quantity Price sold (P) Total (Q) (dollars revenue (sweaters per day) per TR = P ´ Q sweater) (dollars) Marginal revenue Average revenue MR TR / Q AR = TR/Q (dollars per (dollars additional sweater) per sweater) 8 25 200 - 25 9 25 225 25 25 10 25 250 25 Demand, Price, and Revenue in Perfect Competition Quantity Price sold (P) Total (Q) (dollars revenue (sweaters per day) per TR = P ´ Q sweater) (dollars) Marginal revenue Average revenue MR TR / Q AR = TR/Q (dollars per (dollars additional sweater) per sweater) 8 25 200 - 25 9 25 225 25 25 10 25 250 25 25 Demand, Price, and Revenue in Perfect Competition Cindy’s demand, average revenue, and marginal revenue 50 50 25 25 0 Total revenue (dollar per day) Price (dollars per sweater) Price (dollars per sweater) Sweater Industry 9 20 Quantity (thousands of sweaters per day) 0 Cindy’s total revenue 225 10 20 0 Quantity (sweaters per day) 9 20 Quantity (sweaters per day) Demand, Price, and Revenue in Perfect Competition Total revenue (dollar per day) Price (dollars per sweater) Price (dollars per sweater) Sweater Industry 50 50 S 25 25 225 D 0 9 20 Quantity (thousands of sweaters per day) 0 10 20 0 Quantity (sweaters per day) 9 20 Quantity (sweaters per day) Demand, Price, and Revenue in Perfect Competition Price (dollars per sweater) Price (dollars per sweater) Sweater Industry 50 50 S Cindy’s demand curve AR= MR 25 25 Total revenue (dollar per day) Cindy’s demand, average revenue, and marginal revenue 225 D 0 9 20 Quantity (thousands of sweaters per day) 0 10 20 0 Quantity (sweaters per day) 9 20 Quantity (sweaters per day) Demand, Price, and Revenue in Perfect Competition Cindy’s demand, average revenue, and marginal revenue 50 50 S Cindy’s demand curve AR= MR 25 25 Total revenue (dollar per day) Price (dollars per sweater) Price (dollars per sweater) Sweater Industry Cindy’s total revenue TR 225 a D 0 9 20 Quantity (thousands of sweaters per day) 0 10 20 0 Quantity (sweaters per day) 9 20 Quantity (sweaters per day) Economic Profit and Revenue The firm’s goal is to maximize economic profit. Total cost is the opportunity cost — including normal profit. The Firm’s Decisions in Perfect Competition A firm’s task is to make the maximum economic profit possible, given the constraints it faces. In order to do so, the firm must make two decisions in the short-run, and two in the long-run. The Firm’s Decisions in Perfect Competition Short-run A time frame in which each firm has a given plant and the number of firms in the industry is fixed Long run A time frame in which each firm can change the size of its plant and decide whether to leave or stay in the industry. The Firm’s Decisions in Perfect Competition In the short-run, the firm must decide: Whether to produce or to shut down. If the decision is to produce, what quantity to produce. Price is not a decision because firm is a price taker. The Firm’s Decisions in Perfect Competition In the long-run, the firm must decide: Whether to increase of decrease its plant size Whether to stay in the industry or leave it We will first address the shortrun. Total Revenue, Total Cost, and Economic Profit Quantity Total (Q) revenue (sweaters (TR) Per day) 0 1 2 3 4 5 6 7 8 9 10 11 12 13 (dollars) 0 25 50 75 100 125 150 175 200 225 250 275 300 325 Total cost (TC) (dollars) 22 45 66 85 100 114 126 141 160 183 210 245 300 360 Economic profit (TR – TC) (dollars) Total Revenue, Total Cost, and Economic Profit Quantity Total (Q) revenue (sweaters (TR) Per day) 0 1 2 3 4 5 6 7 8 9 10 11 12 13 (dollars) 0 25 50 75 100 125 150 175 200 225 250 275 300 325 Total cost (TC) (dollars) 22 45 66 85 100 114 126 141 160 183 210 245 300 360 Economic profit (TR – TC) (dollars) -22 Total Revenue, Total Cost, and Economic Profit Quantity Total (Q) revenue (sweaters (TR) Per day) 0 1 2 3 4 5 6 7 8 9 10 11 12 13 (dollars) 0 25 50 75 100 125 150 175 200 225 250 275 300 325 Total cost (TC) (dollars) 22 45 66 85 100 114 126 141 160 183 210 245 300 360 Economic profit (TR – TC) (dollars) -22 -20 Total Revenue, Total Cost, and Economic Profit Quantity Total (Q) revenue (sweaters (TR) Per day) 0 1 2 3 4 5 6 7 8 9 10 11 12 13 (dollars) 0 25 50 75 100 125 150 175 200 225 250 275 300 325 Total cost (TC) (dollars) 22 45 66 85 100 114 126 141 160 183 210 245 300 360 Economic profit (TR – TC) (dollars) -22 -20 -16 Total Revenue, Total Cost, and Economic Profit Quantity Total (Q) revenue (sweaters (TR) Per day) 0 1 2 3 4 5 6 7 8 9 10 11 12 13 (dollars) 0 25 50 75 100 125 150 175 200 225 250 275 300 325 Total cost (TC) (dollars) 22 45 66 85 100 114 126 141 160 183 210 245 300 360 Economic profit (TR – TC) (dollars) -22 -20 -16 -10 Total Revenue, Total Cost, and Economic Profit Quantity Total (Q) revenue (sweaters (TR) Per day) 0 1 2 3 4 5 6 7 8 9 10 11 12 13 (dollars) 0 25 50 75 100 125 150 175 200 225 250 275 300 325 Total cost (TC) (dollars) 22 45 66 85 100 114 126 141 160 183 210 245 300 360 Economic profit (TR – TC) (dollars) -22 -20 -16 -10 0 Total Revenue, Total Cost, and Economic Profit Quantity Total (Q) revenue (sweaters (TR) Per day) 0 1 2 3 4 5 6 7 8 9 10 11 12 13 (dollars) 0 25 50 75 100 125 150 175 200 225 250 275 300 325 Total cost (TC) (dollars) 22 45 66 85 100 114 126 141 160 183 210 245 300 360 Economic profit (TR – TC) (dollars) -22 -20 -16 -10 0 11 Total Revenue, Total Cost, and Economic Profit Quantity Total (Q) revenue (sweaters (TR) Per day) 0 1 2 3 4 5 6 7 8 9 10 11 12 13 (dollars) 0 25 50 75 100 125 150 175 200 225 250 275 300 325 Total cost (TC) (dollars) 22 45 66 85 100 114 126 141 160 183 210 245 300 360 Economic profit (TR – TC) (dollars) -22 -20 -16 -10 0 11 24 Total Revenue, Total Cost, and Economic Profit Quantity Total (Q) revenue (sweaters (TR) Per day) 0 1 2 3 4 5 6 7 8 9 10 11 12 13 (dollars) 0 25 50 75 100 125 150 175 200 225 250 275 300 325 Total cost (TC) (dollars) 22 45 66 85 100 114 126 141 160 183 210 245 300 360 Economic profit (TR – TC) (dollars) -22 -20 -16 -10 0 11 24 34 Total Revenue, Total Cost, and Economic Profit Quantity Total (Q) revenue (sweaters (TR) Per day) 0 1 2 3 4 5 6 7 8 9 10 11 12 13 (dollars) 0 25 50 75 100 125 150 175 200 225 250 275 300 325 Total cost (TC) (dollars) 22 45 66 85 100 114 126 141 160 183 210 245 300 360 Economic profit (TR – TC) (dollars) -22 -20 -16 -10 0 11 24 34 40 Total Revenue, Total Cost, and Economic Profit Quantity Total (Q) revenue (sweaters (TR) Per day) 0 1 2 3 4 5 6 7 8 9 10 11 12 13 (dollars) 0 25 50 75 100 125 150 175 200 225 250 275 300 325 Total cost (TC) (dollars) 22 45 66 85 100 114 126 141 160 183 210 245 300 360 Economic profit (TR – TC) (dollars) -22 -20 -16 -10 0 11 24 34 40 42 Total Revenue, Total Cost, and Economic Profit Quantity Total (Q) revenue (sweaters (TR) Per day) 0 1 2 3 4 5 6 7 8 9 10 11 12 13 (dollars) 0 25 50 75 100 125 150 175 200 225 250 275 300 325 Total cost (TC) (dollars) 22 45 66 85 100 114 126 141 160 183 210 245 300 360 Economic profit (TR – TC) (dollars) -22 -20 -16 -10 0 11 24 34 40 42 40 Total Revenue, Total Cost, and Economic Profit Quantity Total (Q) revenue (sweaters (TR) Per day) 0 1 2 3 4 5 6 7 8 9 10 11 12 13 (dollars) 0 25 50 75 100 125 150 175 200 225 250 275 300 325 Total cost (TC) (dollars) 22 45 66 85 100 114 126 141 160 183 210 245 300 360 Economic profit (TR – TC) (dollars) -22 -20 -16 -10 0 11 24 34 40 42 40 30 Total Revenue, Total Cost, and Economic Profit Quantity Total (Q) revenue (sweaters (TR) Per day) 0 1 2 3 4 5 6 7 8 9 10 11 12 13 (dollars) 0 25 50 75 100 125 150 175 200 225 250 275 300 325 Total cost (TC) (dollars) 22 45 66 85 100 114 126 141 160 183 210 245 300 360 Economic profit (TR – TC) (dollars) -22 -20 -16 -10 0 11 24 34 40 42 40 30 0 Total Revenue, Total Cost, and Economic Profit Quantity Total (Q) revenue (sweaters (TR) Per day) 0 1 2 3 4 5 6 7 8 9 10 11 12 13 (dollars) 0 25 50 75 100 125 150 175 200 225 250 275 300 325 Total cost (TC) (dollars) 22 45 66 85 100 114 126 141 160 183 210 245 300 360 Economic profit (TR – TC) (dollars) -22 -20 -16 -10 0 11 24 34 40 42 40 30 0 -35 Total Revenue, Total Cost, and Economic Profit Quantity Total (Q) revenue (sweaters (TR) Per day) 0 1 2 3 4 5 6 7 8 9 10 11 12 13 (dollars) 0 25 50 75 100 125 150 175 200 225 250 275 300 325 Total cost (TC) (dollars) 22 45 66 85 100 114 126 141 160 183 210 245 300 360 Economic profit (TR – TC) (dollars) -22 -20 -16 -10 0 11 24 34 40 42 40 30 0 -35 Total revenue & total cost (dollars per day) Total Revenue, Total Cost, and Economic Profit Revenue and Cost 300 225 183 100 0 4 9 12 Quantity (sweaters per day) Total revenue & total cost (dollars per day) Total Revenue, Total Cost, and Economic Profit TR 300 225 183 100 0 4 9 12 Quantity (sweaters per day) Revenue and Cost Total revenue & total cost (dollars per day) Total Revenue, Total Cost, and Economic Profit TC TR 300 225 183 100 0 4 9 12 Quantity (sweaters per day) Revenue and Cost Total revenue & total cost (dollars per day) Total Revenue, Total Cost, and Economic Profit TC TR 300 225 Economic profit = TR - TC 183 100 Economic loss 0 4 9 12 Quantity (sweaters per day) Revenue and Cost Profit/loss (dollars per day) Total Revenue, Total Cost, and Economic Profit Economic profit/loss 42 20 0 -20 -40 4 9 12 Profit/ loss Quantity (sweaters per day) Profit/loss (dollars per day) Total Revenue, Total Cost, and Economic Profit Economic profit/loss 42 20 0 4 -20 -40 Economic profit Economic loss Profit maximizing quantity 9 12 Profit/ loss Quantity (sweaters per day) Profit/loss (dollars per day) Total Revenue, Total Cost, and Economic Profit MR=MC MR>MC MR<MC 42 20 0 4 -20 -40 Profit maximizing quantity 9 12 Profit/ loss Quantity (sweaters per day) Break-even Output An output at which total cost equals total revenue is called a break-even point. Even though economic profit is zero at break-even output, the firm still earns a normal profit. Remember, normal profit is part of total (opportunity) cost. Total revenue & total cost (dollars per day) Total Revenue, Total Cost, and Economic Profit TC TR 300 225 Breakeven Points 183 100 0 4 9 12 Quantity (sweaters per day) Profit/loss (dollars per day) Total Revenue, Total Cost, and Economic Profit Breakeven Point Breakeven Point 42 20 0 4 -20 -40 Profit maximizing quantity 9 12 Profit/ loss Quantity (sweaters per day) Marginal Analysis Using marginal analysis, a comparison is made between a units marginal revenue and marginal cost. Marginal Analysis If MR > MC, the extra revenue from selling one more unit exceeds the extra cost. The firm should increase output to increase profit If MR < MC, the extra revenue from selling one more unit is less than the extra cost. The firm should decrease output to increase profit If MR = MC economic profit is maximized. Profit-Maximizing Output Quantity Total Marginal revenue (MR) (Q) revenue (dollars per (sweaters (TR) additional per day) (dollars) 7 8 9 10 11 175 200 225 250 275 sweater) - Total Marginal cost (MC) cost (TC) (dollars per additional (dollars sweater) 141 160 183 210 245 - Economic profit (TR – TC) (dollars) 34 40 42 40 30 Profit-Maximizing Output Quantity Total Marginal revenue (MR) (Q) revenue (dollars per (sweaters (TR) additional per day) (dollars) 7 8 9 10 11 175 200 225 250 275 sweater) 25 Total Marginal cost (MC) cost (TC) (dollars per additional (dollars sweater) 141 160 183 210 245 - Economic profit (TR – TC) (dollars) 34 40 42 40 30 Profit-Maximizing Output Quantity Total Marginal revenue (MR) (Q) revenue (dollars per (sweaters (TR) additional per day) (dollars) 7 8 9 10 11 175 200 225 250 275 sweater) 25 Total Marginal cost (MC) cost (TC) (dollars per additional (dollars sweater) 141 160 183 210 245 19 Economic profit (TR – TC) (dollars) 34 40 42 40 30 Profit-Maximizing Output Quantity Total Marginal revenue (MR) (Q) revenue (dollars per (sweaters (TR) additional per day) (dollars) 7 8 9 10 11 175 200 225 250 275 sweater) 25 25 Total Marginal cost (MC) cost (TC) (dollars per additional (dollars sweater) 141 160 183 210 245 19 Economic profit (TR – TC) (dollars) 34 40 42 40 30 Profit-Maximizing Output Quantity Total Marginal revenue (MR) (Q) revenue (dollars per (sweaters (TR) additional per day) (dollars) 7 8 9 10 11 175 200 225 250 275 sweater) 25 25 Total Marginal cost (MC) cost (TC) (dollars per additional (dollars sweater) 141 160 183 210 245 19 23 Economic profit (TR – TC) (dollars) 34 40 42 40 30 Profit-Maximizing Output Quantity Total Marginal revenue (MR) (Q) revenue (dollars per (sweaters (TR) additional per day) (dollars) 7 8 9 10 11 175 200 225 250 275 sweater) 25 25 25 Total Marginal cost (MC) cost (TC) (dollars per additional (dollars sweater) 141 160 183 210 245 19 23 Economic profit (TR – TC) (dollars) 34 40 42 40 30 Profit-Maximizing Output Quantity Total Marginal revenue (MR) (Q) revenue (dollars per (sweaters (TR) additional per day) (dollars) 7 8 9 10 11 175 200 225 250 275 sweater) 25 25 25 Total Marginal cost (MC) cost (TC) (dollars per additional (dollars sweater) 141 160 183 210 245 19 23 27 Economic profit (TR – TC) (dollars) 34 40 42 40 30 Profit-Maximizing Output Quantity Total Marginal revenue (MR) (Q) revenue (dollars per (sweaters (TR) additional per day) (dollars) 7 8 9 10 11 175 200 225 250 275 sweater) 25 25 25 25 Total Marginal cost (MC) cost (TC) (dollars per additional (dollars sweater) 141 160 183 210 245 19 23 27 Economic profit (TR – TC) (dollars) 34 40 42 40 30 Profit-Maximizing Output Quantity Total Marginal revenue (MR) (Q) revenue (dollars per (sweaters (TR) additional per day) (dollars) 7 8 9 10 11 175 200 225 250 275 sweater) 25 25 25 25 Total Marginal cost (MC) cost (TC) (dollars per additional (dollars sweater) 141 160 183 210 245 19 23 27 35 Economic profit (TR – TC) (dollars) 34 40 42 40 30 Profit-Maximizing Output Quantity Total Marginal revenue (MR) (Q) revenue (dollars per (sweaters (TR) additional per day) (dollars) 7 8 9 10 11 175 200 225 250 275 sweater) 25 25 25 25 Total Marginal cost (MC) cost (TC) (dollars per additional (dollars sweater) 141 160 183 210 245 19 23 27 35 Economic profit (TR – TC) (dollars) 34 40 42 40 30 Marginal revenue & marginal cost (dollars per day) Profit-Maximizing Output 30 25 20 10 8 9 10 Quantity (sweaters per day) Marginal revenue & marginal cost (dollars per day) Profit-Maximizing Output 30 25 MR = AR = P 20 10 8 9 10 Quantity (sweaters per day) Marginal revenue & marginal cost (dollars per day) Profit-Maximizing Output MC 30 25 MR = AR = P 20 10 8 9 10 Quantity (sweaters per day) Marginal revenue & marginal cost (dollars per day) Profit-Maximizing Output 30 Profitmaximization point Loss from 10th sweater MR = AR = P 25 20 MC Profit from 9th sweater 10 8 9 10 Quantity (sweaters per day) Economic Profit in the Short Run Maximizing economic profit does not guarantee that profits will be positive. Economic profit can be positive, negative or zero. To calculate total profit, we must subtract total cost from total revenue. Price, Average Total Cost, and Profit Price is total revenue per unit, or average revenue (P=AR=TR/Q) Average total cost is total cost per unit (ATC=TC/Q). Profit = TR - TC Profit per unit=(TR-TC)/Q=TR/Q-TC/Q = (P - ATC) That means we can calculate total profit as (P - ATC)xQ. Profits and Losses in the Short-Run As we indicated, at short-run equilibrium firms may: Earn a profit Break even Incur an economic loss. Profits and Losses in the Short-Run If price equals average total cost (P=ATC), a firm breaks even. If price exceeds average total cost (P>ATC), a firm makes an economic profit. If price is less than average total cost (P<ATC), a firm incurs an economic loss. Price (dollars per chip) Three Possible Profit Outcomes in the Short-Run 30.00 MC 25.00 Possible ATC Outcome One P=ATC 20.00 15.00 8 10 Quantity (millions of chips per year) Price (dollars per chip) Three Possible Profit Outcomes in the Short-Run 30.00 Break-even point 25.00 20.00 MC Possible ATC Outcome One P=ATC Profits=(P-ATC)xQ =(20-20)x8 = 0 AR = MR = P 15.00 8 10 Quantity (millions of chips per year) Price (dollars per chip) Three Possible Profit Outcomes in the Short-Run 30.00 MC ATC Possible Outcome Two P>ATC 25.00 20.00 15.00 8 10 Quantity (millions of chips per year) Price (dollars per chip) Three Possible Profit Outcomes in the Short-Run 30.00 MC ATC Possible Outcome Two P>ATC 25.00 AR = MR = P 20.33 15.00 Profits =(P-ATC)xQ =(25-20.33)x9 =4.67x9=42 9 10 Quantity (millions of chips per year) Price (dollars per chip) Three Possible Profit Outcomes in the Short-Run 30.00 MC ATC Possible Outcome Two P>ATC 25.00 Economic Profit 20.33 15.00 AR = MR = P Profits =(P-ATC)xQ =(25-20.33)x9 =4.67x9=42 9 10 Quantity (millions of chips per year) Price (dollars per chip) Three Possible Profit Outcomes in the Short-Run 30.00 MC ATC Possible Outcome Three P<ATC 25.00 20.00 15.00 9 10 Quantity (millions of chips per year) Price (dollars per chip) Three Possible Profit Outcomes in the Short-Run 30.00 MC ATC Possible Outcome Three P<ATC 25.00 Profits =(P-ATC)xQ =(17-20.14)x7 =-22 20.14 17.00 AR = MR = P 7 10 Quantity (millions of chips per year) Price (dollars per chip) Three Possible Profit Outcomes in the Short-Run 30.00 MC ATC Possible Outcome Three P<ATC 25.00 20.14 Economic Loss 17.00 Profits =(P-ATC)xQ =(17-20.14)x7 =-22 AR = MR = P 7 10 Quantity (millions of chips per year) Three Possible Profit Outcomes in the Short-run The Firm’s Short-Run Supply Curve Fixed costs must be paid in the short-run. Variable-costs can be avoided by laying off workers and shutting down. Firms shut down if price falls below the minimum of average variable cost. Marginal revenue & marginal cost (dollars per day) A Firm’s Supply Curve 31 25 17 7 9 10 Quantity (sweaters per day) Marginal revenue & marginal cost (dollars per day) A Firm’s Supply Curve 31 ATC 25 AVC 17 7 9 10 Quantity (sweaters per day) Marginal revenue & marginal cost (dollars per day) A Firm’s Supply Curve MC 31 ATC 25 AVC 17 7 9 10 Quantity (sweaters per day) Marginal revenue & marginal cost (dollars per day) A Firm’s Supply Curve MC 31 25 MR1=P1=25 AVC 17 7 9 10 Quantity (sweaters per day) Marginal revenue & marginal cost (dollars per day) A Firm’s Supply Curve MC 31 MR2=P2=31 25 AVC 17 7 9 10 Quantity (sweaters per day) Marginal revenue & marginal cost (dollars per day) A Firm’s Supply Curve MC 31 25 Shutdown point s 17 AVC MR0=P0=17 7 9 10 Quantity (sweaters per day) Marginal revenue & marginal cost (dollars per day) A Firm’s Supply Curve MC = Supply 31 MR2=P2=31 25 MR1=P1=25 AVC s 17 MR0=P0=17 7 9 10 Quantity (sweaters per day) Marginal revenue & marginal cost (dollars per day) A Firm’s Supply Curve S = MC 31 25 AVC s 17 7 9 10 Quantity (sweaters per day) Marginal revenue & marginal cost (dollars per day) A Firm’s Supply Curve S = MC 31 25 AVC s 17 7 9 10 Quantity (sweaters per day) Marginal revenue & marginal cost (dollars per day) A Firm’s Supply Curve S = MC 31 25 s 17 7 9 10 Quantity (sweaters per day) The Firm’s Short-Run Supply Curve A perfectly competitive firm’s short-run supply curve shows how its profitmaximizing output varies as market price changes. Since price must equal marginal cost, the marginal cost curve is also the supply curve. However, only the portion of the marginal cost curve above the minimum average variable cost curve is relevant. Temporary Plant Shutdown A firm cannot avoid incurring its fixed costs but it can avoid variable costs. A firm that shuts down and produces no output incurs a loss equal to its total fixed cost. A firm’s shutdown point is the level of output and price where the firm is just covering its total variable cost. In other words, if its losses are bigger than its fixed costs, the firm will shut down. Production Decisions When price is below the minimum point of the AVC curve, the firm will shut down and supply zero output. When price is above the lowest point of the AVC curve, the firm will produce the level of output where price equals marginal cost. The short-run supply curve is therefore the MC curve above the AVC curve. Output, Price, and Profit in the Long Run In short-run equilibrium, a firm might make an economic profit, incur an economic loss, or break even (make a normal profit). Only one of these situations is a long-run equilibrium. In the long run either the number of firms in an industry changes or firms change the scale of their plants. Economic Profit and Economic Loss as Signals If an industry is earning above normal profits (positive economic profits), firms will enter the industry and begin producing output. This will shift the industry supply curve out, lowering price and profit. Economic Loss as a Signal If an industry is earning below normal profits (negative economic profits), some of the weaker firms will leave the industry. This shifts the industry supply curve in, raising price and profit. Long-Run Adjustments Forces in a competitive industry ensure only one of these situations is possible in the long-run. Competitive industries adjust in two ways: Entry and exit Changes in plant size Entry and Exit The prospect of persistent profit or loss causes firms to enter or exit an industry. If firms are making economic profits, other firms enter the industry. If firms are making economic losses, some of the existing firms exit the industry. Entry and Exit This entry and exit of firms influence price, quantity, and economic profit. Let’s investigate the effects of firms entering or exiting an industry. Price (dollars per sweater) Entry S1 23 20 17 D1 6 7 8 9 10 Quantity (thousands of sweaters per day) Price (dollars per sweater) Entry S1 S0 23 20 17 D1 6 7 8 9 10 Quantity (thousands of sweaters per day) Price (dollars per sweater) Exit S2 23 20 17 D1 6 7 8 9 10 Quantity (thousands of sweaters per day) Price (dollars per sweater) Exit S0 S2 23 20 17 D1 6 7 8 9 10 Quantity (thousands of sweaters per day) Price (dollars per sweater) Entry and Exit S1 S0 S2 23 20 17 D1 6 7 8 9 10 Quantity (thousands of sweaters per day) Entry and Exit Important Points As new firms enter an industry, the price falls and the economic profit of each existing firm decreases. As firms leave an industry, the price rises and the economic loss of each remaining firm decreases. Long-Run Equilibrium Long-run equilibrium occurs in a competitive industry when firms are earning normal profit and economic profit is zero. Economic profits draw in firms and cause existing firms to expand. Economic losses cause firms to leave and cause existing firms to scale back. Long-Run Equilibrium So in long-run equilibrium in a competitive industry, firms neither enter nor exit the industry and firms neither expand their scale of operation nor downsize. Long-Run Equilibrium In long-run equilibrium, firms will be earning only a normal profit. Economic profits will be zero. Firms will neither enter nor exit the industry. In long run equilibrium, P=MC and P=ATC. Thus, P=MC=ATC. Because MC=ATC, ATC must be at its minimum. Changing Tastes and Advancing Technology What happens in a competitive industry when a permanent change in demand occurs? A Decrease in Demand Firm 0 Price and Cost Price Industry Quantity Quantity A Decrease in Demand Industry Firm MC Price and Cost Price S0 P0 ATC MR0 P0 D0 0 Q0 Quantity q0 Quantity A Decrease in Demand Industry Firm MC Price and Cost Price S0 P0 P0 P1 P1 ATC MR0 MR1 D0 D1 0 Q1 Q0 Quantity q1 q0 Quantity A Decrease in Demand Firm Price S0 P1 MC Price and Cost Industry ATC MR1 P1 D1 0 Q1 Quantity q1 Quantity Industry S1 S0 Firm MC Price and Cost Price A Decrease in Demand P0 P0 P1 P1 ATC MR0 MR1 D1 0 Q2 Q1 Quantity q1 q0 Quantity A Decrease in Demand P0 Firm MC Price and Cost Price Industry S1 S0 ATC MR0 P0 MR1 D1 0 Q2 Quantity q0 Quantity Industry S1 S0 Summary Firm MC Price and Cost Price A Decrease in Demand P0 P0 P1 P1 ATC MR0 MR1 D0 D1 0 Q2 Q1 Q0 Quantity q1 q0 Quantity Changing Tastes and Advancing Technology Technological change New technology allows firms to produce at lower costs. • This causes their cost curves to shift downward. Firms adopting the new technology make an economic profit. • This draws in new technology firms Old technology firms disappear, the price falls, and the quantity produced increases. Changing Tastes and Advancing Technology A competitive industry is rarely in a long-run equilibrium. What happens in a competitive industry when there is a permanent increase or decrease in the demand for its product? What happens in a competitive industry when technological change lowers its production costs? A Permanent Change in Demand A permanent decrease in demand will cause the short-run equilibrium price and quantity to fall. In the long run, firms will leave the industry (because economic profits are negative), raising price enough to restore a normal level of profit. The difference is the number of firms in the industry. A Permanent Increase in Demand The increase in demand causes industry price and profits to rise. Firms enter the industry, increasing market supply and eventually lowering price to its original level. However there are now more firms in the industry. Technological Change Technological improvements lower average cost of production. Most technological improvements cannot be implemented without investment in new plant and equipment. This means it takes time for a technological advance to spread through an industry. Technological Change and Equilibrium Price A technological improvement that affects all firms will shift the industry supply curve down and to the right. Firms now earn economic profits and new firms enter the industry. This this drives down equilibrium price and raises industry output. Technological Change and Equilibrium Profit Implementing a technological improvement causes the marginal cost curve for each firm to shift down and to the right. Economic profits are not affected in the long run. The firms that survive in the long run are those that adopted the new technology early.