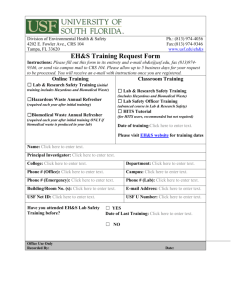

Responsible Office - College of The Arts

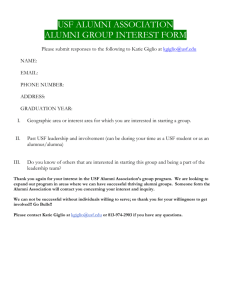

advertisement