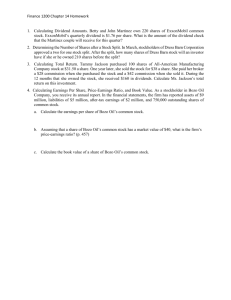

Accounting HW Chapter 15

advertisement

Chapter 15 Day 3: Page 719 – E15-1 The Oshawa Corporation was organized on January 1, 2002. During its first year, the corporation issued 2,000 no par value preferred shares and 100,000 no par value common shares. At December 31 of each year, the company declared the following cash dividends: for 2002, $6,000; for 2003, $12,000; and for 2004, $28,000. Instructions a) Show the allocation of dividends to preferred and common shareholders for each year, assuming the preferred share dividend is $4.00 and noncumulative. b) Show the allocation of dividends to preferred and common shareholders for each year, assuming the preferred share dividend is $5.00 and cumulative. c) Journalize the declaration of the cash dividend for year 2004, under each of part a) and b) Page 719 – E15-2 (1 only) On October 31, the shareholders’ equity section of Laine Company consists of common shares, $800,000 and retained earnings, $400,000. The company is considering the following two courses of action: 1) declaring a 5% stock dividend on the 80,000 no par value shares, or 2) effecting a 2-for-1 stock split. The current market price is $14 per share. Instructions Prepare a tabular summary of the effects that the alternative actions would have on the shareholders’ equity accounts, the number of shares, and the book value per share. Use the following column headings: Before Actions, After Stock Dividend, and After Stock Split. Page 719 – E15-3 On October 1, Valen Corporation’s shareholders’ equity is as follows: Valen Corporation Balance Sheet (partial) October 1, 2003 Shareholders’ equity Common shares, no par value (20,000 shares issued) Retained earnings Total shareholders’ equity $225,000 175,000 $400,000 On October 1, Valen declares and distributes a 10% stock dividend when the market value of the shares is $18 per share. Instructions a) Calculate the book value per share 1) before the stock dividend, and 2) after the stock dividend (round to two decimals.) b) Indicate the balances in the shareholders’ equity accounts after the dividend shares have been distributed. Day 4: Page 718 – BE15-4 North Vancouver-based CyPost Corp. is a hot share with a hot e-mail encryption product. On October 12, CyPost split its shares 3-for-2. Prior to the split, its share price was $12. What would you anticipate its share price ot be immediately after the split? Explain why CyPost, a relatively new company, might splits its shares. Page 719-720 – E15-5 On January 1, Tashia Corporation had 75,000 no par value common shares. During the year, the following occurred: Apr. 1 June 15 July 10 Dec 1 Dec. 15 Issued 5,000 additional common shares for $17 per share. Declared a cash dividend of $1 per share to shareholders of record on June 30. Paid the $1 cash dividend. Issued 2,000 additional common shares for $19 per share Declared a cash dividend of $1.30 per share to shareholders of record on December 31. Instructions a) Prepare the entries required to record the above transactions. b) How are dividends and dividends payable reported in the financial statements prepared at December 31, Tashia’s year end? Page 720 – E15-8 On January 1, 2003, Knowledge Corporation had an unlimited number of no par value common shares authorized, of which 150,000 had been issued for $1,500,000, and retained earnings of $750,000. The company issued 50,000 common shares at $14 on July 1, and earned net income of $400,000 for the year. Instructions a) Journalize the declaration of a 15% stock dividend on December 10, 2003, when the market value is $16 per share. b) Prepare the shareholders’ equity section at December 31, 2003, assuming that the stock dividend has not yet been distributed. Page 720 – E15-9 The following accounts appear in the ledger of Byung-yee Inc. after the books are closed at December 31: Common Shares, no par value, 400,000 shares authorized, 300,000 shares issued Common Stock Dividends Distributable 8% Preferred Shares, $5 stated value, cumulative, 40,000 shares authorized, 30,000 shares issued Retained Earnings Contributed Capital in Excess of Stated Value – Preferred Shares Instructions Prepare the shareholders’ equity section of the balance sheet at December 31, 2003 assuming $100,000 of retained earnings is restricted for a plant expansion. Page 722 – P15-2A $866,000 75,000 150,000 900,000 244,000 The shareholders’ equity accounts of Tmao, Inc. at January 1, 2003, are as follows: Tmao Inc. Balance Sheet (partial) January 1, 2003 Shareholders’ equity Preferred shares, no par value, 100,000 shares authorized, 4,000 shares issued Common shares, no par value, 500,000 shares authorized, 180,000 shares issued Retained earnings Total shareholders’ equity $400,000 900,000 500,000 $180,000,000 During 2003, the company had the following transactions and events: July 1 Declared a $0.25 cash dividend to common shareholders Aug. 1 Discovered a $72,000 overstatement of 2002 amortization. The income tax effect of this error is $22,000 Sept. 1 Paid the cash dividend declared on July 1 Dec. 1 Declared a 10% common stock dividend when the market value of the shares was $15 per share. Dec. 15 Declared a $10 per share cash dividend to preferred shareholders, payable January 31, 2004. Dec. 31 Determine that net income for the year was $350,000. Instructions Prepare a statement of retained earnings for the year ended December 31, 2003. There are no preferred dividends in arrears. Day 5: Page 721 – E15-12 At December 31, 2003, Morse Corporation has 2,000 no par value $8 cumulative preferred shares and 100,000 no par value common shares. Morse’s net income for the year is $547,000. Instructions Calculate the earnings per share for share for each of the following separate situations. ( Round to two decimals.) a) The dividend to preferred shareholders was declared b) The dividend to preferred shareholders was not declared. Page 721 – E15-13 The following financial information is available for the Bank of Montreal as at October 31, 2000, 1999,and 1998: Net Income (in millions) Number of common shares Dividends per common 2000 $1,857 1999 $1,382 1998 $1,350 265,659,000 265,862,000 262,511,000 $2.00 $1.88 $1.76 share Market price of common shares $45.88 $32.72 $36.65 Instructions Calculate the earnings per share, price-earnings ratio, payout ratio, and dividend yield for each of three years. Comment on the Bank of Montreal’s earnings and dividend performance