Chapter 9 Developing a Product: Writing a Financial Plan

advertisement

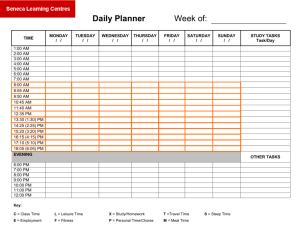

Chapter 9 Developing a Product: Writing a Financial Plan The Process of Financial Planning: Developing a Financial Plan Lytton, Grable & Klock 2006 Writing Style & Voice Writing style: Consistently used, distinctive, personal approach to communicating in writing Should reflect awareness of the primary information processing styles: • • • Visual Auditory Kinesthetic Information Processing Style Guidelines Visual (eyes) • Pictures, graphs, charts, and other visual aids Auditory (ears) • Discuss, talk, review Kinesthetic, experiential (actions) • Engage the content through webbased calculators, software simulations, “to do” list Writing Style & Voice Voice conveys an image of the writer and the message through • Author’s point of view • Author’s choice and use of pronouns • Author’s choice of active or passive verb tense What Voice to Use? A knowledgeable expert with technical expertise; An objective professional serving as a fiduciary; A trusted confidante and friend; A counselor, coach, referee, challenger, or educator; A business person or service provider with good customer relationship skills; A trusted family friend; or A motivator and “voice of reason” for financial issues. Exploring Voice 1. Point of view • Impersonal – factual message • Personal – personalized message 2. “Person” • First person: I, me, my, we • Second person: you, your • Third person: she, he, her, him, his, they, • them, their “One” – impersonal and gender neutral Objective, Subjective & Possessive Case Usage Case Subject or Subjective First Person Second Person Third Person Object or Objective First Person Second Person Third Person Possessive First Person Second Person Third Person Singular Usage Plural Usage I You She or He We You They Me You Her or Him Us You Them My Your Her or His Our Your Their Exploring Voice (cont’d) 3. Verb form • Active verb tense: Shorter, direct more forceful and personal sentences. • “Yogini purchased a $1M term policy.” • Passive verb tense: More impersonal, detached sentences. • “A $1M term policy was purchased by Yogini.” As a Trusted Coach & Educator To be more objective: To be more informal, but personal: Use a consistent voice, but don’t jolt the client between educator and coach • Plural possessive and use of “one” • More passive sentences • Pronouns and client’s first name • More active sentences Plan Style & Format Remember, anything that can assist a client in accessing and interpreting a plan will enhance the probability that a client will buy into the ideas presented and, most importantly, ultimately implement the recommendations. Rules for the Plan Functional format with easy to read fonts, that are repeated throughout the plan Consistency in the formatting, writing style, and voice from one plan section to another Format to maximize the mix and impact between color and black and white Use a plan cover that sends the right message Check and recheck for errors, omissions, and grammar Rules for the Plan (cont’d) Each core content section within a comprehensive plan should be comprehensive Write well, but clearly – and provide resources Make sure the plan follows the process Use a combination of pre-scripted and client specific information – set in the current context Document, document, document! A Well-Written Financial Plan Is: Integrative Realistic Synergistic A Well-Written Financial Plan Is: Integrative: The sections link together, as do the recommendations Realistic: Goals, analysis, and recommendations match the client –including assumptions and marketplace. Can be implemented with or without the advisor. Synergistic: Comprehensive financial life roadmap – the “whole is worth more than the sum of the parts” Components of a Plan Plans vary with the business model of the advisor and the services, products delivered Sequencing may vary, but all good plans include these “bones” I. The Cover Page Should include: • • • • • • • The firm’s name and address The planner’s name A brief firm or planner vision statement A phrase such as “A Comprehensive Financial Plan Prepared for [Client’s Name]” The term “confidential” clearly indicated Any applicable disclosure statements as required The date of the plan II. Letter to the Client Informational message that varies with the business model of the advisor, the services/products delivered, and the client relationship. Letter may include some or all of the following: • • • A personal, friendly overview An outline for the future relationship Statement of compliance and legal disclosures Signed and dated by the advisor Personal, Friendly Overview Reintroduce the planner/firm to the client Restatement of commitment to goal accomplishment Review of the planning process Review of the planner/firm’s core values Statement of commitment to an on-going client relationship Outline For The Future Relationship Timing of periodic reviews; Expected client preparation for review meetings (e.g., updating client information by mail or online); Provision of quarterly reports or other client updates; Availability of the planner or other staff for client assistance; Mailing of newsletters; or Access to the firm’s other services Statement Of Compliance & Legal Disclosures* Confidentiality of client data – privacy statement Confidentiality of planning relationship Investment performance disclaimers Disclaimers for confirming advice, working with other professionals *May be on a separate disclaimers page in the Introductory Materials Section III. Copy of the Original Client Engagement Letter Contractual letter signed by the client outlining responsibilities of the advisor and client If signed earlier, then a copy rather than another original may be included in the plan May appear at the end of the plan as confirmation for the advisor to proceed with implementation Messages in the Engagement Letter Explain the scope of the engagement and expectations for client and advisor: • • • Plan only, and perhaps an overview of components or scope of review If implementation, then how, by whom, and when Retainer or concierge services Messages in the Engagement Letter (cont’d) Disclaimers Plan, analysis limited to client provided information • Investment disclaimers • Tax and other legal services disclaimers IV. Table of Contents A navigational tool that explains: • • • Plan organization and contents Availability of supporting documents (analytical or educational) Page numbers Color coding (page numbers, tabs, etc.) if used, should improve, not hinder the navigation V. Other Introductory Materials Designed to foster client confidence, planner credibility and client commitment. May have been in other marketing materials, so may be omitted or summarized in the plan. • • • • • Mission/vision statement Statement of principles or core values Ethics statement Privacy statement Investment policy statement Mission/Vision Statement Mission: Focuses on market segment and the strengths, weaknesses of the firm to serve that target market Vision: More global statement of the firm’s aspirations and the principles and values that govern the firm’s operation Mission/Vision Should “Speak” to the Firm’s Potential Clients We strive to bring our clients financial peace of mind. Our goal is to identify optimal recommendations to help guide our clients in reaching their financial goals and objectives. We do this by building trusting, longlasting client relationships that always focus on the best interests of our client—not our own. It is our goal to give the best guidance and advice to help our clients consistently make sound financial decisions in pursuit of their hopes and dreams. Statement Of Principles Or Core Values What does this planner/firm stand for? • Customer service • Teamwork • Professional expertise We expect a high level of customer service and satisfaction from our staff. We believe that planning through teamwork provides better service. Ethics Statement CFP Board of Standards, Inc. Code of Ethics • • • • • • • Integrity Competence Objectivity Fairness Confidentiality Diligence Professionalism Professional association code Privacy Statement Likely provided with initial client information, may be included in the plan May be required by law – at initiation of the business relationship and with annual updates States policies on how data will be used, shared with other professionals with disclosure and consent, and confidentiality maintained Investment Policy Statement Signed by planner and client to establish guidelines for the appropriate and mutually agreed upon management of the client’s funds Provides a transparent set of investment policy parameters that provide discipline for the planner and the client VI. Client Profile, Summary of Goals, Assumptions Establishes the foundation, or grounding, for the plan development Sets the parameters, or constraints, on the planning process • Resources • Goals • Assumptions One last opportunity for client validation Client Profile Full demographic profile, and final check for accuracy • Names, address • Employment • Ages, health status • Other pertinent information Summary of Goals Clearly defined and perhaps ranked, mutually agreed upon goals • Specific • Measurable • Attainable • Realistic • Trackable Guide the plan and the implementation Assumptions Summary of all assumptions, although they may be repeated in respective sections. • Factual information about the household or other planning issues • Assumed information about the household or other planning issues VII. Executive Summary or Observations & Recommendations Purpose of the Plan • Key goals and objectives Methods Used to Analyze the Situation • Assumptions used Results of the Analysis Recommendation(s) • Projected financial outcomes Implementation Strategies for Action Timeline for Implementation How Much of the Story to Tell? May be general or detailed – which impacts the remainder of the plan May be organized by goals or core content planning areas Keep a balance between the summary and the core content planning sections “Title” of the summary and the approach should reflect the voice of the firm and the clients served VIII. Individual Core Content Planning Sections Each core content planning section should be consistently similar –establishes a “routine” for the client and the firm Assume the client has limited knowledge, unless confirmed otherwise Educate and motivate – don’t overwhelm! Use text and graphics + appendices VIII. Core Content Planning Sections (cont’d) Cash Flow Analysis Net Worth Analysis Tax Analysis VIII. Core Content Planning Sections (cont’d) Insurance/Risk Management Analysis • Life insurance • Health and disability insurance • Long term care insurance • Property and liability insurance • Umbrella insurance • Other insurance needs VIII. Core Content Planning Sections (cont’d) Investment Analysis Retirement Analysis Estate Planning Analysis VIII. Core Content Planning Sections (cont’d) Specialized Analyses • • Educational funding Planning for special needs • • Refinancing scenarios Saving for special objectives • Charitable giving • Trust management • Long-term care planning • Family business continuation Core Content Planning Section: An Outline I. Overview of core content area and definitions II. Restatement of planner-client assumptions III. Review of the analysis of client’s current situation • • • Observations about the current situation Assessment of the planning needs Assessment of the current planning efforts Core Content Planning Section: An Outline (cont’d) IV. State financial planning recommendations that are actionable and answer: • Who? • What? • When? • Where? • Why? • How? • How much? Example Recommendation In order to reach your goal of accumulating an emergency fund equal to 4 months of current living expenses in your XYZ money market account, you need to automatically transfer, via bank draft, $150 from your checking account for the next 15 months. Cecillia, please initiate the request by calling XYZ, Inc. within the next 30 days. Example Recommendation In order to reach your goal of accumulating an emergency fund equal to 4 months of current living expenses in your XYZ money market account, you need to automatically transfer, via bank draft, $150 from your checking account for the next 15 months. Cecillia, please initiate the request by calling XYZ, Inc. within the next 30 days. Core Content Planning Section: An Outline (cont’d) V. Compare projected recommendation outcome(s) to current situation • • • Document the method used Apply mutually agreed upon assumptions Conduct a fair comparison – legitimate and conservative VI. Suggest alternative recommendations and outcome(s) where appropriate • Use the options to inform and expand the options, but don’t overwhelm Graphic Comparison of Projected Outcomes Thousands College Funding Projections $100 $80 $60 $40 $20 $0 ($20) 10.5 ($40) 12.5 14.5 16.5 18.5 20 Child's Age College Tuition Expense Proposed Account Balance Projection Original Account Balance Projection 22 Core Content Planning Section: An Outline (cont’d) VII. Provide implementation and monitoring plan • • • Explain the source of the cash flow or assets to be used to fund the recommendation Give specific implementation advice and establish responsibility Tables, “to do” lists, or a timeline can be helpful to inform and motivate the client IX. Implementation & Monitoring Summarizes, integrates and prioritizes all of the strategies and actions required to implement the plan May include narrative, tables, charts, graphs, or “to do” lists Goals of this section: • • To rank and fund the recommendations To ensure that action occurs Example Implementation Table What Contribute the $4,000 annual maximum to a Roth IRA. Who When How Strategy Doug and Nancy Before the end of 2006 Contact your broker to open the Roth IRA accounts, or our firm will be glad to assist with opening these accounts. Funding will come from both your excess discretionary cash flow and money in your money market account. Saving for retirement by using a tax-advantaged investment account that offers the added benefit of tax- and penalty-free withdrawals under certain circumstances. Effect on Annual DCF Post-tax-$8,000 Net Effect of Retirement Planning Recommendations -$9,200 Discretionary Cash Flow (DCF) After Implementing Recommendations $7,345 Implementation & Monitoring Sets the Stage For…. Implement the plan in a timely manner Guide future monitoring meetings Guide future progress assessments Guide future needed changes in response to changes in the client’s situation, goals, or the economic/legal marketplace X. Client Acceptance Letter or Client Engagement Letter Depending on the business model, the client engagement letter may • • • • Formalize the business agreement May be included as a record of the earlier transaction May be used alone or in conjunction with a client acceptance letter May appear only at the beginning of the plan The Client Acceptance Letter Informational or contractual message that varies with the business model of the advisor, the services/products delivered, and the client relationship Sometimes called “acknowledgement of delivery” Signed and dated by the client Reiterates that the plan reflects the information provided by the client XI. Appendices Supplements to educate the client • Supporting calculations, spreadsheets, analysis • Informs the client of the mathematical framework • Increases transparency of the analysis • Protects against claims of unsuitability, errors, or omissions if the analysis matches the assumptions • Educational articles • Glossary of key terms (optional) • Document – with page references, footnotes, etc. To Write Good Plans… Practice the craft of planning and writing – get client feedback. Check and recheck…. • Use Figure 9.5 Financial Plan Review Checklist Summary Good plans • capture the interest, trust, respect, and • • • commitment of the client. integrate the client with a realistic plan for financial well-being. provide a synergistic financial road map to the future. standardize the internal processes for working with clients.