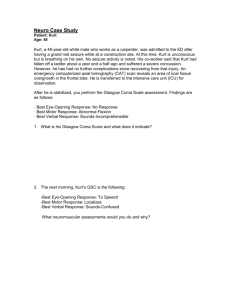

Investing & the Wealthy

advertisement

How the Affluent Manage Their Money Key Strategies That You Can Use Kurt Rosentreter, CA, CFP, CIMA, TEP, FMA, FCSI, CLU, CIM Senior Financial Advisor, Manulife Securities Incorporated Kurt Rosentreter,CA CA, CFP, CLU, TEP, FMA, CIMA, FCSI, CIM Twenty years finance industry experience; personal finance course instructor, Ontario CA Institute Specialized in wealth management Canada wide. Past co-founder of the billion dollar national wealth management practice at one of Canada’s Big 4 Accounting firms. Best selling personal finance author, seven books in stores More than 500 published articles and interviews for The Globe and Mail, National Post, CBC, Canada AM, Canadian Business and MacLean's. Senior Financial Advisor, Manulife Securities Incorporated. Certified Financial Planner, Manulife Securities Insurance Inc. Complete a Draw Ballot! Draw for four books at the end of this 45 minute presentation Draw ballots available on your chair Drop in basket at front of room Only completely filled out ballots can be winners. Defining a Wealthy Person Different Ways: As little as $500,000 of savings (excluding personal real estate) – Rather some may consider $1 Million to be wealthy… $150,000 of annual income or more Net worth of $2.5 Million or more Wealthy can be a state of mind Tax Planning of the Wealthy Focus on tax planning – see beyond your tax return – have a pro-active accountant (CA) focused on tax strategies Small businesses – tons of write offs Spousal and family income splitting yearly Using good debt and eliminating bad debt Corporations and trusts for U.S. assets, avoid Canadian probate fees on death, annual planning Investment fees not investment commissions Estate trusts for tax breaks Legitimate offshore planning Estate Planning of the Wealthy Planning done well in advance Lawyer is regular advisor and on the team Two Wills Family Trusts • Intervivos • Testamentary Family are not used as Executors or Trustees Foundations to leave a legacy Life insurance to provide liquidity in estate Pre-death planning (e.g. business succession) Investing & the Wealthy Portfolio managers, not brokers or agents Very little “do it yourself” investing Asset based fees, no commissions More Investing outside of RRSPs/RRIFs. Why? Discretionary money managers vs. nondiscretionary One to three money managers – not 12 mutual funds! More focused on preservation than growth. Tax smart investing Private equity Investing & the Wealthy Yes to stocks & bonds, pooled funds, ETFs and F class funds No to retail mutual funds, load fees of any kind No RRSP trustee fees No Labour funds No seg funds No Wrap programs Fewer hedge funds than you have been told Global diversification More real estate than their house How many clients does your advisor have? Investing & the Wealthy Pay Attention to the “Six Dimensions of Tax Smart Investing” Why? – Taxation of people matters – Taxation of assets matters – Taxation of income matters – Holding period of the asset matters – Domestic or a foreign asset matters – Legal ownership of the asset matters. Financial Advisors & the Wealthy Always have an accountant or lawyer Very wealthy use family offices Professionals, not sales people – know the diff! Specialists in high net worth issues and solutions Arms length business relationship not clouded by personalities Used to paying bigger fees for value Use of an engagement letter. What matters: expertise, experience, brand, results. Summary If you are high net worth, are you being treated that way? Are you paying lower fees because of your elite status? (should start at $250,000 of savings) Are your current advisors experts in high net worth? (broker, insurance agent, accountant) If you have a million dollars of investment money, you are high net worth. Are you being treated the way you should? About Kurt Rosentreter, CA Give Kurt your phone number or email for: – Copy of these slides – Wealth planning review in Kurt’s office – To learn about Kurt’s services as your Family CFO. – To sign up for Kurt’s popular e-newsletter on cutting edge wealth management strategies Learn more at: www.kurtismycfo.com. Questions & Answers Thank you for attending! Kurt Rosentreter, CA, CFP, CLU, TEP, FMA, CIMA, FCSI, CIM Senior Financial Advisor, Manulife Securities Incorporated Kurt.Rosentreter@ManulifeSecurities.ca Kurt’s Seven books available at www.kurtismycfo.com. Disclaimer: The opinions expressed are those of the author and may not necessarily reflect those of Manulife Securities Incorporated. Manulife Securities Incorporated is a member CIPF