Lifetime Value Calculation

advertisement

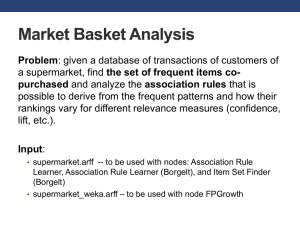

Why Start with a Customer For a company to be successful, it must : • Understand the customer – All customers are not alike! • Identify their preferences – Customers have different needs! • Deliver value - Today,s customer is in the driver’s seat ! If you don’t know where you are going you probably aren't going to get there The fundamental principle of Marketing is: To target a specific niche market as your point of attack and focus all your resources on achieving the dominant leadership position in that segment High risk low data decision The market we will enter will not have experienced our type of product before. We are in high risk low data state. Lack of Data The only proper response to this situation is to acknowledge the lack of data as a condition of the process. To be sure, you can fight back against this ignorance by gathering highly focused data yourself. You can not expect to transform a low data situation to high data situation quickly. Memorable Images Only work with memorable images. Please note that we are not focusing on target market characterization. But target customer. Let Them Guide Us Markets are impersonal abstract things like the PC market Neither the names nor the descriptions of markets evoke any memorable images. We need something that feels a lot more like real people. We are just going to have to make them up. We can let them guide us to developing a truly responsive approach to their needs. Target Customer Characterization A formal process for making up these images, getting them out of individual heads and in front of a marketing decision making group. Target Customer Characterization Create as many characterizations as possible Built a basic library of possible target customer profiles Apply techniques to reduce these data into a prioritized list of desirable target market segment opportunities. Sample Scenario for a Pen based Laptop Customer Personal profile and job description Technical resources (environment) A day in life (before) The problem your product solves A day in life (after) We are still operating in a low data situation We just have a better set of material to work with. Value Triad Customer Value Proposition Product Application Market Assumption: People will respond better to promotions,products tailored to their needs Segmented Market Objective: Find homogenous groups of people -so each group can be sent a different promotion -tailored to its needs. Segmentation Techniques Behavioral Enterprise Value Lifecycle Other Other Segmentation Segmentation Segmentation Segmentation Segmentations Segmentations RFM Geographic Demographic Psychographics (AOI) Customers How valuable expectations and the customers Are and can be to the needs change over the course Company LTV Of the Lifecycle Segmentation Key principles of segmentation Once a customer has purchased a product or service he or she is likely to purchase again from the same source. Assuming the customer had a good experience Segment customers from non customers • Than focus resources on repeat sales to the same customers. By learning more about the best customers marketer can maximize profits. All customers do not purchase the same product for the same reason. Seniors and kids purchase aspirin for different reasons Lifetime Value The Criterion of Strategy The Loyalty Effect Accountants have developed sophisticated techniques for appraising capital assets and their depreciation; They have learned how to monitor the constantly changing value of work-in-progress; but they have not yet devised a way to track the value of a company's customer inventory. Accountants They make no distinction between the sales revenue from brand new customers and sales revenue from long term, loyal customers, because they don’t know or care it costs much more to serve new customers than an old one. Worse accountant treat investment in customer acquisition as one more current expense instead of assigning it to specific customer accounts and amortizing it over the life of the customer relationship. Why Lifetime Value Analysis? • We need to know the value of our customers, so as to properly target our sales and retention efforts. • We need to discriminate among our customers to acquire and retain the best. The Importance of Measurements • Measures determine vision and strategy deciding what to measure and how to link measures to incentives are the most important DBM decisions. • NPV of customer base should be at the top of the measurement hierarchy. LTV Analysis Goal: Determine… • • • • Where to put your retention dollars The value of each retention strategy Where to put your acquisition dollars How much to spend on acquisition What is Life Time Value • NPV of the profit to be realized on the average new customer during a given number of years. • Life time value is goodwill • To compute it you must be able to track customers from year to year • Main use: To evaluate strategy Birthday Club Strategy We will examine Ridgeway Fashions before and after it adopted the new strategy of writing letters to husbands before their wives birthdays. While this is a retail example the principles apply to any kind of industry. Financial,Telecommunications, B2B Variable Costs Include any variable cost. Do not include fix costs rent long term debt overhead. These costs do not vary with number of customers. The costs of servicing a customer tend to decrease with the number of years that the customer has been buying from you. Acquisition Cost Marketing + Sales Money you spend during the year. Than Marketing+Sales/the number of new customers who actually make purchases from you each year. The Discount Rate The profits you receive from your customers come in over several years. Money received in future years is not worth as much as money received today. We must discount it by a certain percentage so we can equate it to the present money. Use the market rate of interest to discount the future revenue And include the risk factor How to figure the Discount Rate Market Rate of Interest...8% Assume Risk (Double rate)...16% Years = n Interest = i Formula: D = (1 + i)n Calculation of rate after 2 years: D = (1 + .16)2 = (1.16)2 = 1.35 Profits NPV Profits : Gross Profits / Discount rate Cumulative NPV profits NPV year 1 + NPV year 2 + NPV year 3 LTV LTV : Cumulative NPV profits in each year / original group of customers Calculating LTV In other words, lifetime value is the value of a newly acquired customer. The LTV of the average new customer for Ridgeway in the 3rd year is 60.05 1,201,057 / 20,000 = $60.05 LTV Table’s Significance Typically, the lifetime value numbers in and of themselves have no particular significance. What makes them important is when they are used in comparison with other numbers to evaluate the effect of proposed strategies. What Life Time Value table shows is that if the new strategies were to be adopted….. Ridgeway Fashions Assumption: The birthday club will be successful and there will be a 5 % referral rate. Assumptions 5 percent of her customers will recommend Ridgeway to their friends or relatives. As a result we will have 5 percent more customers in year 2 than we otherwise would have had. Assumptions Spending rate, Loyal customers will buy more than new customers. As customers drop out, those who are left are the more loyal customers. To set the club up in the 1st year will cost $15 per customer. This includes training of the clerks to ask people to join the club and giving the clerks a commission of $5/customer sign up in addition: • Getting the survey data • Entering the data, • Putting it into the database • Creating the birthday club software • Writing one letter to each members husband at birthday time. In years 2 and 3 the costs are set at $3 per year. You will note that she is sending out birthday letters to all club members, even though many have already stopped buying in the store. Gains from Birthday Club Year 1 Year 2 Year 3 Old LTV $20.00 $47.59 $60.05 New LTV $17.00 $58.94 $86.00 Change ($3.00) $11.35 $25.95 With 200,000 Customers ($600,000) $2,270,690 $5,189,801 Event driven communication: Ridgeway Fashions Leesburg, VA 22069 Dear Mr. Hughes: I would like to remind you that your wife Helena’s birthday is coming up in two weeks on November 5th. We have the perfect gift for her in stock. As you know, she loves Liz Claiborne clothing. We have an absolutely beautiful new suit in blue, her favorite color, in a fourteen, her size, priced at $232.00. If you like, I can gift it to you next week, so her birthday. Or, I can Please call me at (703) wrap the suit at no extra charge and deliver that you will have it in plenty of time for put it aside so you can come in to pick it up. 754-4470 to let me know which you’d prefer. Sincerely yours, Robin Baumgartner Robin Baumgartner, Store Manager Recency, Frequency, Monetary Analysis RFM Direct Marketers have been using RFM Analysis to predict customer behavior for more than 50 years. It is the basis for any model of customer behavior You only need your Customer database with purchase history. You don’t need to hire a statistician. RFM The predictor of future behavior is past behavior RFM is pure behavior, it only works with customer files It requires knowledge of the customer purchase history. It works with any industry. How to code your customers by Recency 03/20/2001 You need the most recent purchase date. Divide the database into 5 exactly equal parts. Number 5 ( the most recent ) Down to 1 ( the most ancient ) 5 4 3 2 1 11/20/1998 Response by Recency Quintile The customers were offered a video package that cost them about $100 including S&H charges.The graph represents the responses to a test mailing to 30 000 of 2.1 million names. How to code your customers by Frequency You need the total number of times that the customer has made a purchase from you. 3.254 5 4 Average products purchased per month 1 3 2 1 Frequency Average number of telephone calls made per month Total number of checks and deposits made during a month This is a measure of how important is doing business with you is in the minds of your customers. Response by Frequency Quintile Lowest quintile contains an abnormal number of recent buyers. Joined yesterday.This customer did not have the chance to become a frequent buyer yet Frequency is also a good predictor of behavior but much less so than Recency. How to code your customers by Monetary We need the total amount spent on our products or services,per month,per year or in some other way. $12,456 Average amount purchased per month $10 5 4 3 2 1 Response by Monetary Quintile Monetary response to $100 product 1.61% Monetary response to $5000 product Monetary coding is far less predictive of behavior than either recency or frequency. Putting It All Together RFM Code Construction R 5 F 35 4 34 3 33 2 32 31 1 Database One Sort Five Sorts M 335 334 333 332 331 Twentyfive sorts Creating an Nth 300 000 Records Results of test mailing $100 offer to 30 000 customers 34 of 125 cells better than breakeven RFM Cell X axis represents the RFM cell codes and Y axis represents The breakeven index of each cell. Cost per price / net profit from a single sale Profit=$40 each successful sale Cost= $0.55 The rate needed for each RFM cell was %1.35 Profit from Test Mailing For a net cost of $420 the company learned how 30,000 customer, an Nth of it s 2.1 million customer database would respond to this offer. Test Full File & RFM Selects Compared Test v.s. Response Rates