EKS Training - Earn It! Keep It! Save It!

advertisement

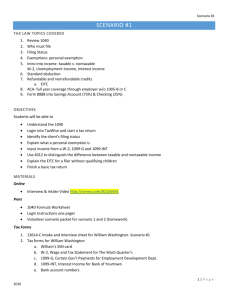

EKS Training November 22, December 6 and 13th Classroom ground rules Housekeepin g o Ask when unsure o …. Restrooms No food in lab Cell phone etiquette Intro to EKS: Let’s watch Https://www.youtube.com/watch?v=UoCP4ePRTzc In this scenario, you will learn about: 1. Who must file 2. Filing Status Scenario #1 3. Exemptions: personal exemption 4. Intro into income- taxable v. nontaxable W2, Unemployment Income, Interest income 5. Standard deduction 6. Refundable and nonrefundable credits EITC When you’re finished, you will know how to: Scenario #1 1. 2. 3. 4. 5. Login into TaxWise and start a tax return Identify the clients filing status Explain what a personal exemption is Input income from a W2, 1099-G and 1099-INT Use 4012 to distinguish the difference between taxable and nontaxable income 6. Explain the EITC for a filer without qualifying children 7. Finish a basic tax return Intake & Interview 1. As a volunteer you must check taxpayer identification and SSN/ITIN’s for everyone on return 1. Determine if the client is eligible for VITA services – see Scope of Service chart in Publication 4012, Pages 8 and 9 1. Review Intake and Interview form, making sure all information is filled out correctly Let’s review the process Taxpayer Requirements Intake & Interview Sheet 13614-C 1. Verify and confirm all information on Part I & II. 2. Ask all questions in their entirety, even if already filled out by client and confirm accuracy 3. Confirm taxpayer’s identity and SSN or ITIN with supporting documents and photo ID 4. Ensure that the documents are available for each item if taxpayer answer “Yes” in Parts IV & V 5. Review part VI regarding health coverage. Use flow charts in Section ACA 1-3 in your 4012 to determine next steps 6. Ask the client if there were any questions that they didn’t understand Make sure their client has the following- Top of 13614-C: Photo ID for all persons on the tax return Intake & Interview Sheet 13614-C cont...… Original Social Security (SSN) or Individual Taxpayer Identification Number (ITIN) documents for everyone on the tax return. Household income of $53,000 or less. Instruct volunteers to ask their site coordinator about income restrictions at your site – you may be able to help higher incomes Now… Lets look at the Job Aid in Pub 4012, pages 15-16. Let’s watch! Intake and Interview Video It’s time to start the tax return! Starting the Tax Return – Pub 4012, Tab N Using your Login Instructions: 1. Login into TaxWise 2. Input information from Part I of Intake Sheet into Main Information sheet. Refer to Pub. 4012, Tab C-10 NOTE: Taxpayers must choose a five digit PIN number and todays date- recommend using zip code. Enter 12345 for taxpayers PIN for practice. This is the client’s e-file approval signature. THREE THINGS YOU NEED TO KNOW ABOUT FILING STATUS: 1. Filing status—is based on marital status and family situation, and determines the rate at which income is taxed. 2. A taxpayer may be able to claim more than one filing status. Usually, the taxpayer will choose the filing status that results in the lowest tax. The list below is in order from the most beneficial to the least. 3. The five filing statuses are: Filing Status Pub 4012, Tab B Married filing jointly- married and filing the same return Qualifying widow(er) with dependent child- for widows/widower with dependent children. See Pub 4012, Tab B-1 Head of household (HOH)- Usually an “unmarried” person who maintains household with children. Rules are complex – See Pub 4012, Tab B-3 Single- unmarried, legally divorced or legally separated Married filing separately- legally married but filing separate returns THREE THINGS YOU NEED TO KNOW ABOUT EXEMPTIONS: Exemptions Pub 4012, Tab C 1. There are two types of exemptions: Personal and Dependency. For this scenario, we are only addressing a personal exemption. 2. This year’s exemption amount is $3,950. This amount is deducted from your taxable income for every person that is claimed on your return, thus decreases the amount of tax owed. 3. Only one exemption can be claimed per person. An exemption for a particular person cannot be claimed on more than one tax return. THREE THINGS YOU NEED TO KNOW ABOUT INCOME 1. There are two types of income: taxable and nontaxable. All income, such as wages and tips are taxable unless the law specifically excludes it. See a list of types on income in Pub. 4012, Tab D-1. 2. Employers report wage, salary and tip income on Form W2, Wage and Tax Statement. Other documents you may see are: 1099 INT/DIV, 1099-G, 1099-MISC, etc. 3. Income is reported on lines 7-21 on the 1040 Income Pub 4012, Tab D THREE THINGS YOU NEED TO KNOW ABOUT DEDUCTIONS Deductions Pub 4012, Tab F A deduction is a set amount (based on your filing status) that decreases your taxable income, thus decreasing the amount of tax you owe. Tax filers have the choice to take the standard deduction or itemize their deductions. For this scenario we are only going to focus on the standard deduction. Your standard deduction increases if you are 65 or over and/or blind. See Publication 4012, Tab F-1 for deduction amounts. TaxWise populates this automatically. Now lets review the federal tax return so far! You’ll notice the amount on line 66: Reviewing the Federal Tax Return Earned Income Tax Credit This credit is called the "earned income" credit because to qualify, you must work and have earned income and meet certain eligibility requirements. Earned Income includes wages, salaries, and tips that are includible in gross income and net earnings from self-employment earnings. THINGS YOU NEED TO KNOW ABOUT THE CA STATE RETURN: Completing the CA return 1. Get the red out! Most information will automatically populate from the federal return 2. If you have entered more than one W-2 on the 1040, you will have to manually add the additional W-2’s. The first W-2 will carry over, but the rest won’t. 3. Make sure to complete the direct deposit or balance due portion of the return 4. Complete the CA Renters Credit Wkt when applicable. Finishing the return Pub 4012, Tab K THINGS YOU NEED TO KNOW ABOUT FINISHING A RETURN 1. All returns will be e-filed (unless otherwise specified) 2. Bank account information needed for direct deposit- refer to Part VII of the Intake Sheet 3. Identity Protection PIN- if client checked the “yes” in box 12 of the Intake Sheet, refer to Pub. 4012, Tab P-1 REFUNDS 1. 2. Refunds & Balance Due Using the filers bank account and routing number, enter it into TW on Main Info Sheet and Page 2 of the 1040. Always double check account numbers! BALANCE DUE 1. 2. 3. Balances must be paid by the filing deadline (April 15th) to avoid penalties and interest charges. There are separate penalties to paying and filing late. Pay as much as you can before the deadline! Filers will send in their own payments or have it directly debited from their bank account. See Publication 4012, K-3 for instructions If the filer chooses to send their payment via mail, show them the 1040V Payment Voucher and instruct them to send it with their payment What is something you always ask for during the intake and interview process? Identification Where in our resource material can you find information on the intake and interview process? Knowledge Check! Publication 4012, Page 15 How many 5 filing statuses are there? Can you name them? 5: Single, Married Jointly, Married Separately, Qualified Widower with Dependent Child, and Head of Household Where can I find this info in our resource material? Pub 4012, Tab B-1 Name the two types of exemptions and identify which one Olivia is getting. Personal and dependency; Personal Knowledge Check cont... Where in our resource material can you find information on exemptions? Amounts are in Pub 4012, Tab C-1 Where can I find info on a filers exemptions in Taxwise? Main Info, number 6 and line 42 on the 1040 What types of taxable income does Olivia have? Wages/W2, Interest income/1099-INT, and Unemployment Compensation/1099-G Where in our resource material can you find information on income? Publication 4012, Tab D What tab in the 4012 specifies the line number for most income documents? Pub 4012, Tab D-3 Knowledge Check cont... Where in our resource material can I find information on how to finish a return? Pub 4012, Tab K What form do you use for splitting a refund? 8888 What form does the taxpayer send in with their balance due? 1040V Payment Voucher