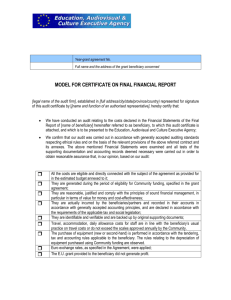

Report of Factual Findings on the Final Financial - EACEA

advertisement