Lecture - Class 1

advertisement

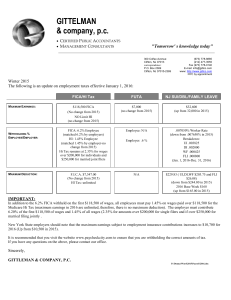

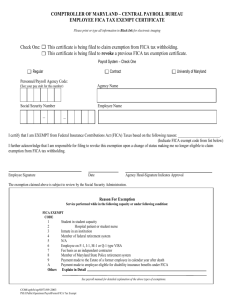

WELCOME ACC170 Payroll Tax Accounting ACC 170 – Payroll Tax Accounting Syllabus (see Syllabus Word document) Bob Bruebach – Resume Experience 1. 2. 3. ADP Paychex ADP 1. 2. ADP Corp. Office In-House Payroll ARENS CONTROLS COMPANY, L.L.C. A CURTISS-WRIGHT COMPANY Arlington Heights, IL Vice President Finance Controller Manufacturer Sales of $55+ million November 1999 to Present ROHM AND HAAS COMPANY Chicago Heights, IL Senior Financial Analyst/Plant Controller Regional Credit Manager Chemical Manufacturer Sales of $6 billion February 1995 to November 1999 August 1988 to February 1995 BUSINESS COMMUNICATIONS OF ILLINOIS, INC. Burr Ridge, IL Vice President of Finance/Controller Office Machine Dealership Sales of $5.5 million June 1987 to August 1988 SHARP ELECTRONICS CORPORATION Romeoville, IL Assistant Operations Manager Regional Credit Supervisor Electronics Manufacturer Sales of $8 billion February 1985 to June 1987 July 1983 to February 1985 Education MBA, University of Chicago CPA (Certified Public Accountant) MBA, Northern Illinois University BS, Finance, Northern Illinois University June 1999 November 1987 May 1986 May 1981 UNDERSTANDING PAY PERIODS Weekly = 52 Pay Periods per Year Example: • Annual Salary of $52,000 – what is the weekly amount? • $1,000.00 per Week ($52,000 / 52) Bi-Weekly = 26 Pay Periods per Year Example: • Annual Salary of $52,000 – what is the bi-weekly amount? • $2,000 every 2 Weeks ($52,000 / 26) Semi-Monthly = 24 Pay Periods per Year Example: • Annual Salary of $52,000 – what is the semi-monthly amount? • $2,166.66 paid on the 15th and last day of month ($52,000 / 24) UNDERSTANDING PERCENTAGES 6.2% = 0.062 Example: • What is 6.2% of $100.00? • Answer: $100.00 * 6.2% $100.00 * 0.062 = = $6.20 0.6% = 0.006 Example: • What is 0.6% of $500.00? • Answer: $500.00 * 0.6% $500.00 * 0.006 = = $3.00 FICA SOCIAL SECURITY TAXES FICA FICA (Federal Insurance Contributions Act) Two Programs • OASDI – Social Security “Old Age, Survivors and Disability Insurance” • HI – Medicare “Health Insurance” (see Soc. Sec. Benefit Stmt. pdf document) (Ratio of Taxpayers to Beneficiaries) FICA Calculation of Taxes - Employee Program: OASDI – Social Security Tax: 6.2% (0.062) of Wages up to $117,000. FYI… Wage amount has increased every year There was a 4.2% rate for 2012 and 2011. The rate reverted back to 6.2% for 2013. since 1972… except for 2010 and 2011. FYI… 2014 - $117,000 If EE changes ER during year, new 2013 - $113,700 ER required to start2012 at -$0. (EE can get $110,100 refund of overpaid OASDI on Form 1040.) 2011 - $106,800 2010 - $106,800 2009 - $106,800 2008 - $102,000 2007 - $97,500 2006 - $94,200 2005 - $90,000 <SS Wage history> FICA Calculation of Taxes – Employee (OASDI – Excess Deducted from Employee) Example Employer #1 Employee works From January 1st to June 30th and earns $125,000: FICA-OASDI deducted from Paychecks during that Time: $117,000 (maximum) * 0.062 = $7,254.00 Employer #2 Employee works from July 1st to December 31st and earns another $125,000: FICA-OASDI deducted from Paychecks during that Time: $117,000 (maximum) * 0.062 = $7,254.00 FICA Calculation of Taxes – Employee (OASDI – Excess Deducted from Employee) Example Below is the portion of the Form 1040 where excess FICA-OASDI is recorded as “additional withholding” toward federal income tax: FICA Calculation of Taxes - Employee Program: OASDI – Social Security Tax: 6.2% (0.062) of Wages up to $117,000. Wage amount has increased every year since 1972… except for 2010 and 2011. If EE changes ER during year, new ER required to start at $0. (EE can get refund of overpaid OASDI on Form 1040.) FYI… Social Security site http://www.ssa.gov/ Program: HI – Medicare Tax: 1.45% (0.0145) of Wages – no Maximum. Plus, 0.9% for Wages over $200,000. FICA FICA Taxes - EE Examples Example 1 If John has cumulative wages of $50,000 and his next paycheck was $5,000, calculate: $5,000 * 0.062 = $310.00 a) the SS (OASDI) part of FICA: ____________________ $5,000 * 0.0145 = $72.50 b) the Medicare (HI) part of FICA: ___________________ FICA FICA Taxes - EE Examples (cont.) Example 2 If Mary has $109,600 of cumulative earnings and her next paycheck was $8,000, calculate: First Check to see if maximum reached: $109,600 + $8,000 = $117,600, which exceeds $117,000 maximum. Second Calculate the amount wages subject to the tax: $117,000 - $109,600 = $7,400 So, only $7,400 of the $8,000 paid is subject to the tax. $7,400 * 0.062 = $458.80 a) the SS (OASDI) part of FICA: ________________________ $8,000 * 0.0145 = $116.00 b) the Medicare (HI) part of FICA: _______________________ FICA FICA Taxes - EE Examples Example 3 The Johnson Company pays their employees on a monthly basis. Sam is paid $20,000 per month. What are the amounts for FICA-SS and FICA-HI that are withheld for Sam’s June 30th paycheck: First, what will be Sam’s cumulative earnings including the June 30th paycheck: • 6 * $20,000 = $120,000 exceeds $117,000 So, need to calculate cumulative earnings PRIOR TO June 30th paycheck: • 5 * $20,000 = $100,000 Since the maximum wages for FICA-SS are $117,000, then only $17,000 of the $20,000 of the June 30th paycheck are subject to FICA-SS tax: $17,000 * 0.062 = $1,054.00 FICA-HI: ______________________ $20,000 * 0.0145 = $290.00 FICA-SS: $______________________ FICA Calculation of Taxes – Employer Portion Program: OASDI – Social Security Tax: 6.2% (0.062) of Total “OASDI” Wages. Use wages only subject to OASDI Tax. Program: HI – Medicare Tax: 1.45% (0.0145) of Total “HI” Wages. (Employer does not pay 0.9% additional tax for Wages over $200,000.) FICA FICA Taxes - ER Examples Example 4 Calculate Employees’ and Employer’s Share of FICA taxes: Employee Joe Sue Doug Totals Bi-Weekly Wages $2,000 $3,000 $2,000 ---------$7,000 FICA OASDI Tax $124.00 $186.00 $124.00 ----------$434.00 $7,000 * 0.062 Employer OASDI: $434.00 FICA HI Tax $29.00 $43.50 $29.00 ----------$101.50 $7,000 * 0.0145 Employer HI: $101.50 FICA FICA Taxes - ER Examples (cont.) Example 5 Calculate Employees’ and Employer’s Share of FICA taxes: Cumulative Employee Earnings Tom $62,000 Diane $114,600 Jenny $50,000 Totals: Weekly Wages $1,000 $4,000 $3,000 ---------$8,000 OASDI Taxable Wages $1,000 $2,400 $3,000 ----------$6,400 $6,400 * 0.062 Employer OASDI: $396.80 FICA OASDI Tax__ $ 62.00 $148.80 $186.00 ----------$396.80 HI FICA Taxable HI Wages_ Tax_ $1,000 $14.50 $4,000 $58.00 $3,000 $43.50 ----------- ----------$8,000 $116.00 $8,000 * 0.0145 Employer HI: $116.00 FICA History Review History… <SS Wage history> <SS Rate history> <SS Total history> 941 Taxes Tax Deposit Requirements Total of FICA taxes and withheld FIT • New Employers Monthly Depositor until (Federal Income Taxes) lookback is established. (If $100,000 or more, then pay next business day and become a semiweekly depositor.) • (lookback period = 4 calendar quarters beginning July 1st of 2nd preceding year and ending June 30th of the previous year.) 941 Taxes Tax Deposit Requirements (cont.) Deposit Status QUARTERLY MONTHLY SEMI-WEEKLY NEXT BUSINESS DAY Qualification Deposit Due End of the following month Less than $2,500 at the end (as a deposit or when filing of the calendar quarter. Form 941). $50,000 or LESS “lookback” period. in the By the 15th of the following month. More than $50,000 in the “lookback” period. If Payday: • W,R,F following W • Sa,Su,M,T following F $100,000 (accumulated) or more By close of Next Business on any day. Day. 941 Taxes FYI… Tax Deposit Requirements (cont.) Deposit Status Qualification QUARTERLY Less than $2,500 at the end of the calendar quarter. MONTHLY $50,000 or LESS in the “lookback” period. SEMI-WEEKLY NEXT BUSINESS DAY More than $50,000 “lookback” period. $100,000 any day. (accumulated) in the or more on 941 Taxes FYI… Tax Deposit Requirements (cont.) Deposit Status QUARTERLY MONTHLY SEMI-WEEKLY NEXT BUSINESS DAY Firm Size Firm Salaries, assuming total ER & EE FICA taxes (15.3%) and FIT rate of 15% Qualification Less than $2,500 at the end of the FYI… calendar quarter. The 15.3% is based on: FICA-SS-EE: 6.20% FICA-SS-ER: 6.20% $50,000 or LESS in the “lookback” FICA-HI-EE: 1.45% period. FICA-HI-ER: 1.45% 15.30% More than $50,000 “lookback” period. $100,000 any day. (accumulated) in the or more on 941 Taxes FYI… Tax Deposit Requirements (cont.) Deposit Status QUARTERLY Firm Size Firm Salaries, assuming total ER & EE FICA taxes (15.3%) and FIT rate of 15% Qualification Less than $2,500 at the end of the calendar quarter. $8,250 per Quarter or $33,000 per Year MONTHLY SEMI-WEEKLY NEXT BUSINESS DAY $50,000 or LESS in the “lookback” period. More than $50,000 “lookback” period. $100,000 any day. (accumulated) in the or more on 941 Taxes FYI… Tax Deposit Requirements (cont.) Deposit Status QUARTERLY Firm Size Firm Salaries, assuming total ER & EE FICA taxes (15.3%) and FIT rate of 15% Qualification Less than $2,500 at the end of the calendar quarter. $8,250 per Quarter or $33,000 per Year MONTHLY $50,000 or LESS in the “lookback” period. $165,000 per Year SEMI-WEEKLY NEXT BUSINESS DAY More than $50,000 “lookback” period. $100,000 any day. (accumulated) in the or more on 941 Taxes FYI… Tax Deposit Requirements (cont.) Deposit Status QUARTERLY Firm Size Firm Salaries, assuming total ER & EE FICA taxes (15.3%) and FIT rate of 15% Qualification Less than $2,500 at the end of the calendar quarter. $8,250 per Quarter or $33,000 per Year MONTHLY $50,000 or LESS in the “lookback” period. $165,000 per Year SEMI-WEEKLY More than $50,000 “lookback” period. in the $330,000 per Payroll NEXT BUSINESS DAY $100,000 any day. (accumulated) or more on 941 Taxes Tax Deposit Requirements (cont.) If $200,000 or more in a calendar year – must FILE (deposit) ELECTRONICALLY. The amount includes all taxes, not just P/R taxes. You will be notified when you are required to file electronically. Penalty of 10% if not followed. Once EFT is required, then EFT every year. Beginning in 2011 – Payroll Taxes (as well as ALL federal tax deposits) must be deposited electronically. 941 Taxes Form 8109 Coupon (see Form 8109 pdf document) Beginning in 2011, Form 8109 cannot be used since all taxes are now deposited electronically! 941 Taxes Form 941 Quarterly report of Total FICA Taxes and Withheld FIT (aka “941” Taxes). Due date is the last day of following month - (10 additional days allowed if timely deposits have been made). (see Form 941 pdf document) 941 Taxes fyi… Penalties Failure to Pay ½% for each month, to a maximum of 25%. Failure to File 5% for each month, to a maximum of 25%. Failure to Make Timely Deposits 2-15% of undeposited taxes, based on days late, or amount of days after IRS notice. May include CRIMINAL CHARGES, as well. FICA Coverage FICA cover most employees. Examples of workers who are not covered include: Medical Interns & Student Nurses Household Employees who receive less than $1,900 from one employer in one year. Partners in a Partnership Federal & State EE’s covered by a retirement system – HI only. Ministers – may elect not to be covered. Independent Contractors FICA Determination of Independent Contractor (SECA) vs. Employee (FICA) IRS historically used 20-point test to determine “common law relationship” - examples from list include: » » » » How many companies does person work for Control work/schedule/where performed Who provides tools Can person incur profit or loss 3 Categories of evidence » Behavioral Control » Financial Control » Type of Relationship Can file SS-8 with IRS if uncertain what to do!! Access http://www.irs.gov/formspubs/ FICA Specifically Covered (in addition to common law) • Full time life insurance salespeople • Full time traveling salespeople • Agent- and commission-drivers of food/beverages FICA What are Taxable Wages? Wages, Salaries, Vacation Pay, Bonuses, Commissions. Moving Expense Reimbursement (non-qualified) Cash Tips over $20 in a Calendar Month Non-Cash Compensation (“fringe benefits”): Personal Use of a Company Car Employer paid premiums for Group Term Life Insurance in excess of $50,000 Non-Cash Awards & Prizes FICA Self Employed Contributions Act (SECA) FICA taxes are due on Self-Employed Income (from Schedule C) Same wage base for OASDI $117,000 FICA-OASDI: 12.4% FICA-HI: 2.9% …plus, 0.9% for Wages over $200,000. Use Schedule SE to calculate/report FICA taxes The tax ultimately gets “located” on 1040 form (line 56). Deduction for 50% of the Self-Employment Tax (SECA) is on the 1040 form (line 27). HISTORY INCOME TAX ACT • 1913 – 16th Amendment In 1913, the 16th Amendment to the Constitution made the income tax a permanent fixture in the U.S. tax system. The amendment gave Congress legal authority to tax income and resulted in a revenue law that taxed incomes of both individuals and corporations. • 1943 – Withholding Tax Act On the eve of WWII, few Americans paid income taxes. Those that owed taxes paid them in one lump sum on March 15 (later changed to April 15). To pay for the war, the Revenue Act of 1942 lowered exemptions and raised income tax rates. The Current Tax Payment Act of 1943 required employers to collect the tax by deducting it from the employee's paycheck—just like the Social Security tax that began in 1935. Although the withholding tax was sold as a wartime emergency, like most expansions of government instituted during wartime, it has been a way of life for most Americans ever since. HISTORY FEDERAL INSURANCE CONTRIBUTION ACT (FICA) • 1935 • OASDI FDR – Franklin Delano Roosevelt Elected President in 1932 …in 1965 • HI – Medicare added HISTORY SELF-EMPLOYED CONTRIBUTION ACT (SECA) • 1951 • Tax upon the earnings of the Self- Employed HISTORY UNEMPLOYMENT TAX ACTS • 1935 HISTORY UNEMPLOYMENT TAX ACTS (cont.) • 1935 • FUTA – Federal Unemployment Tax Act • SUTA – State Unemployment Tax Act HISTORY FAIR LABOR STANDARDS ACT (FLSA) • 1938 The Fair Labor Standards Act was passed by Congress on 25th June, 1938. The main objective of the act was to eliminate "labor conditions detrimental to the maintenance of the minimum standards of living necessary for health, efficiency and well-being of workers". The act established maximum working hours of 44 a week for the first year, 42 for the second, and 40 thereafter. Minimum wages of 25 cents an hour were established for the first year, 30 cents for the second, and 40 cents over a period of the next six years. The Fair Labor Standards Act also prohibited child labor in all industries engaged in producing goods in inter-state commerce. HISTORY FAIR LABOR STANDARDS ACT (cont.) (FLSA) • 1938 • Minimum Wages, Equal Pay, Overtime, Recordkeeping • Enterprise Coverage / Employee Coverage Enterprise: (includes all employees if…) $500K+ in sales Interstate commerce Many family establishments are exempted Individual/Employee Employee whose company may not meet enterprise coverage, but is involved in interstate commerce • Example: a driver for fleet that transports goods, but enterprise annual revenues are $225,000 HISTORY What the FLSA Does Not Cover No requirement for employers to: Pay extra for weekend/holiday work Pay for holidays, vacation or sick time Grant vacation time HISTORY FAIR EMPLOYMENT LAWS • Civil Rights Act (1964) • EEO (Equal Employment Opportunity) • Cannot discriminate – color, race, religion, gender, national origin. • Exemptions exist – ex., private membership clubs. (In 1974 the Western Open found an annual home at the Butler National Golf Club in Oak Brook, Illinois. It stayed this way until shortly after the 1990 tournament, when the PGA Tour adopted a policy of holding events only at clubs which allowed minorities and women to be members. This resulted in Butler National being replaced by the Cog Hill Golf & Country Club in Lemont, Illinois. The Dubsdread Course at Cog Hill played host to the Western Open from 1991 to 2006.) HISTORY FAIR EMPLOYMENT LAWS • Civil Rights Act (1964) • Executive Order 11246 • Major anti-discrimination regulation for government contractors with contracts > $10,000 • For those exemptions under Civil Rights Act, prevents discrimination in organizations that contract with the Federal Government. • Requires written plan that shows how underrepresented groups are recruited and hired. HISTORY FAIR EMPLOYMENT LAWS • Civil Rights Act (1964) • Executive Order 11246 • Age Discrimination in Employment Act (ADEA) (1967) • Added age protection for all workers over 40. • Applies to employers with 20+ employees. HISTORY FAIR EMPLOYMENT LAWS • Civil Rights Act (1964) • Executive Order 11246 • Age Discrimination in Employment Act (ADEA) (1967) • Americans with Disabilities Act (ADA) (1990) • Applies to employers with 15+ employees • Reasonable accommodations must be provided (vague) • Many companies needed to rewrite job descriptions to specify physical requirements for jobs HISTORY IMMIGRATION REFORM & CONTROL ACT (IRCA) • 1986 • Proof of Citizenship • Requires employer to verify citizenship • I-9 Form needs to be completed within 3 days of employment • Penalties for noncompliance HISTORY Family Medical Leave Act (FMLA) • 1993 • Covers companies with 50+ employees within 75 mile radius • EE guaranteed 12 weeks unpaid leave for: • Birth, adoption, critical care • Can use for child, spouse or parent • Leave may be used all at once or at separate times – but must be within 12 months of qualifying event • ER continues health care coverage • Right to return to same/comparable job and continue health coverage in absence HISTORY Employee Retirement Income Security Act (ERISA) • Trustees must monitor pension plans • Vested 100% in 3-6 years Years of % Vested in Example of a vesting plan: Service Pension Plan 2 50% 4 75% 5 100% • Provides for PBGC Pension Benefit Guaranty Corporation - a federal agency which guarantees benefits to employees • Stringent recordkeeping requirements FIDUCIARY Fiduciary Responsibility Amounts Withheld from Employees’ Wages for Income Taxes and Social Security to be Paid to the Government You cannot use these funds for any other purpose (see Fiduciary Liability from Scarinci & Hollenbeck “pdf” document) (see IRS Cases “pdf” document) (see more recent IRS Cases “docx” document)