2016 Industry Preview - Independent Insurance Agents of Texas

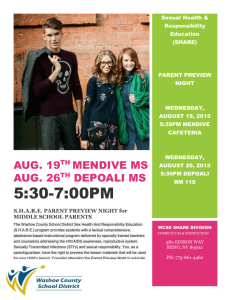

advertisement

2016 Industry Preview IIAT STAFF 2016 Industry Preview Homeowners 2016 Industry Preview Market Share Report Homeowners Year TX Premium (millions) TX Loss Ratio US Loss Ratio 2014 $7,860.7 46.2% 49.6% 2013 $7,252.3 44.8% 46.4% 2012 $6,407.2 54.4% 58.9% Written Premium Growth: 8.3% 2016 Industry Preview 2015 - Homeowners Written Premium Up 4.66% through September Rate Increases Continue for Most Companies 21 Increases in 1st Qtr. 42 Through 3 Quarters 2016 Industry Preview FAIR Plan Exposure – 9/30/2015 Policy Count Exposure Tier 1 13,236 $2.78 billion Tier 2 104,745 $16.98 billion Remainder of State 16,633 $2.72 billion 2016 Industry Preview TWIA – 9/30/2014 2015 2002 Policy Count 273,000 86,000 Exposure $85.7 billion $16.0 billion Combined Tier 1 & 2 Exposure: $106 billion CRTF: $485.5 million Cumulative Underwriting Loss: $340 million 2016 Industry Preview th 84 Session SB 900 – TWIA Changes o Funding – eff. 9/1/15 o Requires funding to the 1 - 100 yr. level (approx $4.8 bil) o Class 2 and 3 bonds responsibility of TWIA policyholders o Industry Assessment up from $800 mil to $1 bil o Change in funding order o Board Makeup – o 3 Industry, 3 Coastal, 3 Non Coastal o 2 IIAT Representatives o Depopulation PLAN o Protects Agent of Record o Requires contract or Limited Service agreement for agent 2016 Industry Preview th 84 Session SB 498–Noncompliant Properties – WPI -8 eff. Immediately o Removes 12/31/15 expiration date for noncompliant properties o 40,000 TWIA policies at risk o Retains certification requirements for: o Addition o Alteration o Remodel o repair HB 2439 – TWIA Engineer Approval eff. 9/1/15 o No TDI approval required 2016 Industry Preview Personal Lines Endorsements 2016 Industry Preview New Residency Endorsements HO 06 48 – Residence Premises Definition Residence Premises means... “That part of any other building where you reside... on the inception date of the policy... HO 06 49 – Broadened Residence Premises Definition Designed to select a period that you know the insured Is not residing in the property 2016 Industry Preview Residency Endorsements Always Use the Broadened Definition HO 06 49 Always Use the Entire Policy Period in the Box Provided Inception Date Termination Date Information required to complete this Schedule, if not shown above, will be shown in the Declarations. Effectively Changes the Definition by Eliminating the “Where you Reside” Language 2016 Industry Preview Unusual Company Endorsements Harassment, Cannabis Intimidation, or Bullying Exclusion Animal Injury Limited Animal Liability Endorsement Limited Swimming Pool or Spa (Hot Tub) Endorsement 2016 Industry Preview Homeowners Issues Slowing/Declining Real Estate Values Report Shows Houston and Austin Most Susceptible over the Next Three Years Prepare Staff to Address Questions HO 04 20 – Specified Additional Amount of Insurance for Coverage A Dwelling Automatic 25% or 50% Increase in limit 2016 Industry Preview Personal Auto 2016 Industry Preview Market Share Report Personal Auto Year TX Premium 2014 $16,314.5 TX Loss Ratio 65.6% 2013 $15,205.5 64.3% 65.6% 2012 $14,218 65.6% 66.4% (millions) US Loss Ratio 66.0% Written Premium Growth: 7.3% 7.79% Increase Through September 2016 Industry Preview Transportation Networking Companies HB 1733 – eff. 1/1/16 TNC primary from “App on” to “App off” 3 stages of operation - App On, Engaged, App Off Logged on App – $50/100/25 Limits Available, but no passenger in vehicle Engaged - $1 mil CSL Passenger in Vehicle Personal Lines carrier can endorse policy to include coverage if they choose to. 2016 Industry Preview New ISO Endorsements PP 23 40 – Public or Livery Conveyance Exclusion Specifically Excludes Liability and Physical Damage Coverage While App is On PP 23 45 – Limited Transportation Network Coverage Coverage While Logged On, but Not Engaged PP 23 41 – Transportation Network Coverage Coverage While Logged On, Engaged Until Passenger is Picked UP 2016 Industry Preview 2016 Industry Preview Delivery Services Using Personal Autos Dropoff InstaCart Favor Postmates Amazon - $25 an hour Flex – 2, 4, 8 hour shifts - $18-$25 an hour 2016 Industry Preview The Sharing Economy Ford is Testing a New Lease Option in Austin Beginning in February, 2016 Allows Up to 5 Persons To Jointly Lease One Vehicle 2016 Industry Preview Personal Auto Issues PricewaterhouseCoopers predicts the sharing economy will become a $335 billion business by 2025 — up from $15 billion a year today. 2016 Industry Preview JD Towing v. American Alternative Insurance Corp New Rule for Texas Involving Total Loss to Property Allows for Loss of Use in Total Losses Damages Must Not Be Speculative Applies to Time Reasonably Needed to Replace the Personal Property 2016 Industry Preview On-Line Shopping Latest Transunion Shopping Index Shows No Increase in the Percentage of On-line Shoppers Flat to Declining Since 2011 The Texas Percentage is 13% Higher Than the National Average Update Your TrustedChoice.com Information Studies Show Millennial Shoppers Want Agents 2016 Industry Preview Commercial Insurance 2016 Industry Preview Market Share Report Commercial Multi Peril Year TX Premium 2014 $2,601.8 TX Loss Ratio 50.0% 2013 $2,490.4 49.4% 45.4% 2012 $2,333.8 61.3% 56.7% (millions) US Loss Ratio 49.2% Written Premium Growth: 4.47% Negative Growth in 3rd Quarter (1.29%) 2016 Industry Preview Market Share Report Business Auto Year TX Premium 2014 $2,785.6 TX Loss Ratio 66.0% 2013 $2,446.4 65.7% 62.9% 2012 $2,170.5 68.9% 63.8% (millions) US Loss Ratio 64.1% Written Premium Growth: 13.9% 2016 Industry Preview Market Share Report Workers Compensation Year TX Premium 2014 $2,843.8 TX Loss Ratio 46.2% 2013 $2,673.6 47.6% 59.8% 2012 $2,445.0 47.7% 67.9% (millions) US Loss Ratio 60.5% Written Premium Growth: 6.37% Negative Growth in 3rd Quarter (6.28%) 2016 Industry Preview Drones 180,000 Registered in First Two Weeks Increasing ISO Commercial Usage Has New Endorsements Expect to See Exclusions Attached At Renewal Number of Options 2016 Industry Preview CG 21 09 – Exclusion Unmanned Aircraft “Unmanned Aircraft means an aircraft that is not 1. Designed 2. Manufactured; or 3. Modified after Manufacture To be controlled directly by a person from within or on the aircraft 2016 Industry Preview CG 21 09 – Exclusion Unmanned Aircraft Excludes BI & PD & Personal Injury (Coverage B) Excludes ownership, maintenance, use or entrustment to others Includes language excluding negligence in the supervision, hiring, employment, training or monitoring of others by that insured… 2016 Industry Preview Coverage Options CG 21 10 – Excludes BI & PD Only CG 21 11 – Excludes Personal Injury Only CG 24 50 – Limited Coverage for Designated Unmanned Aircraft 2016 Industry Preview CG 24 50 Schedule Requires Description of Unmanned Aircraft Description of Operations or Projects is Also Required Adds Additional Aggregate Limit The exclusion for Unmanned Aircraft does not apply: “…to unmanned aircraft described in the schedule but only with respect to the operations or projects described in the schedule. 2016 Industry Preview Commercial Lines Premium September 30, 2015 Third Quarter 9/30/2014 -2015 Products 10.83% 9.59% General Liability 1.70% 1.97% Commercial Fire (4.36)% (2.33)% Multi-Peril (1.29%) 1.28% Workers Comp (6.28%) 3.59% 2016 Industry Preview Surplus Lines – 2015 Totals Fire & Allied Lines (4.27%) Commercial Multi-Peril (15.51%) General Liability 5.81% Commercial Auto Liability .71% Commercial Auto Physical Damage Total Premium $5.02 billion (12.97%) (.45%) 2016 Industry Preview Headwinds Decline in Oil Prices Further Reductions in CapEx by Major Players Dallas Fed Data Shows Slowdown in General Business Activity and Projected Future Activity Less Optimism from Retailers Texas Economic Outlook Dr. Ray Perryman Monday – 10:30 2016 Industry Preview CIAB Survey Small Medium Large Avg Sept, 2015 -1.4% -3.8% -4.1% -3.1% June, 2015 -1.3% -3.5% -5.2% -3.3% March, 2015 -0.5% -2.7% -3.7% -2.3% Dec, 2014 1.1% -0.9% -2.2% -0.7% Sept, 2014 1.1% 0.3% -1.1% 0.1% 2016 Industry Preview Commercial Lines Summary Slowdown In Economic Activity Pricing Pressure Growth Will Come From New Accounts 2016 Industry Preview Legislative & Regulatory 2016 Industry Preview th 84 Session – Legislative Makeup 28 Freshmen Members of Texas House New Chair of House Insurance Committee Chairman John Frullo (R) Lubbock 9 Freshmen Member of Texas Senate New Chair of Senate Business and Commerce Senator Kevin Eltife (R) Tyler ** 2016 Industry Preview th 84 Session Legislative Statistics 6276 Bills Filed 4207 - House Bills 2069 - Senate Bills 1323 Bills Passed 819 – House Bills 504 – Senate Bills (approx. 21% pass rate) 2016 Industry Preview th 84 Session Agent Issues SB 876 – Omnibus Licensing bill eff. 9/1/15 TDI initiated this legislation due to overwhelming number of license requests and delays in issuing. Future license to correspond with birthdate Common Expiration date of multiple licenses CE changes from 30 – 24 hours over 2 year cycle In line with other states (Eff. 1-1-16) Must complete CE and pay fine Major change over current requirements (Eff. 11-1-15) 2016 Industry Preview th 84 Session SB 7 /SJR 1– Tax Changes eff. 1/1/16 Margins Tax reduced 25% Many other alternative discussed Some believe this is the beginning of the end of the margins tax Property Tax exemption raised From $15K to $25K Also discussed reduction of state Sales Tax 2016 Industry Preview th 84 Session Personal Lines SB 188 & 189 -Policyholder Inquiry eff. 9/1/15 Inquiry may not be used for underwriting or pricing Not sure this was a big problem??? HB 2779 – Claims Free Discount eff. 9/1/15 Company may give discount first year Not allowed before, but CLUE reports will now suffice 2016 Industry Preview th 84 Session SB 956 - Delivery of Personal policies eff. 9/1/15 New policies delivered within 30 days Delivery to insured or insurers agent Renewal or amended policy within 15 days of request Request may be made to insurer or insurers agent in writing 2016 Industry Preview th 84 Session Commercial Lines SB 1081 - OCIP Disclosure eff. 9/1/15 Must provide subs with certain information within 10 days of contract Contact information Policy Forms, Limits, Endorsements How to exclude or include cost into bid Audit procedures at completion of job Failure to furnish allows Opt out 2016 Industry Preview HB 1295 New Texas Ethics Commission Requirement Applies to Public Entities Applies to Contracts that require a vote or are in excess of $1 million Form 1295 must be filed with Texas Ethics Commission Discuss with Entity the necessity to file 2016 Industry Preview Questions to Ask Is a Vote Required Before the Bid is Accepted and the Coverage is Bound? Do Your Consider This Transaction a Contract That Requires Notification to the Ethics Commission? Can An Insurer Bind Coverage When the Bid is Awarded? Who is Required to File? Who is the “Interested Party”? Agent, Agency, or Insurer? 2016 Industry Preview Future Legislative and Regulatory Issues Hail Litigation Catastrophe Claims Process vs Tort Reform issue Surplus Lines Placement – “Diligent Effort” Proportionate Responsibility for Auto Property Damage Claims Uncooperative Zenefits Insureds – Notice of Cancellation – Level Playing Field TWIA Depopulation 2016 Industry Preview Life & Health Preview 2016 Industry Preview Are you? 2016 Industry Preview You aren't alone. 2016 Industry Preview Trends with Employer Based Coverage 2016 Industry Preview What about Taxes and Fees? 2016 Industry Preview 2016 Industry Preview 2016 Industry Preview Employer Reporting When are the forms due, now? 2016 Industry Preview 1094-C & 1095-C Who files? When are they due? Third party solutions? Do your homework! 2016 Industry Preview What’s Next for Brokers? Commissions going down on individual and small group But volume is going UP! 2016 Industry Preview 2016 Industry Preview 2-3 hour classes for you and your clients! Look for the Employee Benefits Academy in May. 2016 Industry Preview Jim Gavin jgavin@iiat.org Questions? Lee Loftis lloft @iiat.org Misty Baker mbake@iiat.org 2016 Industry Preview Next Welcome Reception 5:30 – 7:00 2016 Industry Preview