File - Ms. Nancy Ware's Economics Classes

advertisement

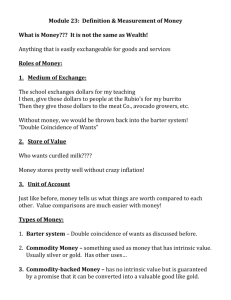

Section 5 The Financial Sector Modules 22-29 AP Macro Nancy K. Ware Instructor Gainesville High School Module 23 The Definition and Measurement of Money Module 23 Essential Questions 1. What is money? 2. What are the functions of money? 3. What are the various roles money plays? 4. What are the many forms money takes in the economy? 5. How is the amount of money in the economy measured? Start Up In the United States, the dollar is A. Backed by silver B. backed by gold & silver C. commodity backed money D. commodity money E. fiat money What is Money? Terms to Understand Money Currency in Circulation Checkable Bank Deposits Money Supply Money v. Barter What is Money? Terms to Understand Money: An asset that can be easily used to purchase a good or a service Currency in Circulation: Cash held by the public Checkable Bank Deposits: Bank accounts out of which people can write checks Money Supply: total value of financial assets in the economy that are considered money Money v. Barter: Money is more widely accepted. Barter is exchanged one good of value for another good of value. Bartering deals with the problem of “double coincidence of wants” What is Money? 1. What makes the $20 in your pocket different from your laptop computer or your cell phone? 2. Money is essentially anything that is easily e______________ for goods and services. 3. How could you turn your laptop & cell phone into $? 4. What else could you do with your laptop and cell phone? As we will see, using money helps to e___________ the need for barter. What is Money? 1. What makes the $20 in your pocket different from your laptop computer or your cell phone? All three are assets, but only the $20 will be accepted by the gas station as payment for your gasoline and Coke Zero 2. Money is essentially anything that is easily exchangeable for goods and services. 3. How could you turn your laptop & cell phone into $? You could sell your laptop and cell phone, because they have value, and someone would give you money in exchange, and then you could buy whatever you wanted with that money. 4. What else could you do with your laptop and cell phone? Or you could give the gas station your laptop in exchange for the gasoline, but that is a barter, or the exchange of goods for goods. (is that a good exchange for you or them?) As we will see, using money helps to eliminate the need for barter. 3 Main Roles of Money Functions of Money Medium of Exchange Store of Value Unit of Account How it Works 3 Main Roles of Money Functions of Money Medium of Exchange: asset used to trade for goods & services Store of Value: holds purchasing power over time Unit of Account: measurement used to set prices/make comparisons How it Works 1. Medium of Exchange An employer exchanges dollars for an hour of labor. You exchange those dollars for a grocer’s pound of apples. The grocer exchanges those dollars for an orchard’s apple crop, and on and on. Without money, we would have to make exchanges in a barter system. PROBLEM: “Double coincidence of wants.” You must find someone who wanted what you had to offer. If there was no one, how would you get what you needed to survive? This is a supremely difficult way to obtain wants & needs. 2. Store of Value So long as prices are not rapidly increasing, money is a decent way to store value. You can put money under your mattress or in a checking account and it is still useful, with essentially the same value, a week or a month later. Problem with Barter: If you have an item to barter with that is perishable, you have to find people to exchange with FAST because if you wait too long, your item will go bad & lose its value. Is money perishable? 3. Unit of Account http://www.automotoportal.com/article/Top_10_most_expensive_cars_in_the_world Units of currency (dollars, euro, yen, etc) measure the relative worth of goods and services just as inches and meters measure relative distance between two points. In the barter system, all goods are measured in terms of other goods. Prices in a Barter Economy: A lb of cheese = dozen eggs = ½ lb of sausage = 3 gallons of milk …..How do you know what the worth REALLY is?? With money, the value of cheese, and all other goods and services, is measured in terms of a monetary unit like dollars. Types of Money •Commodity Money •Commodity-backed Money •Fiat Money 1. Commodity Money Throughout history people have understood the important roles that money plays, but have chosen to use different types of money within their societies. Commodity money: something used as money, normally gold or silver, that has intrinsic value in other uses. If you didn’t want to use your gold or silver to purchase something, you could have it melted and shaped into a piece of jewelry or a serving platter. 2. Commodity-backed Money Commodity - backed money: a medium of exchange with no intrinsic value whose ultimate value was guaranteed by a promise that it could always be converted into valuable goods on demand. This form of money appeared similar to our current paper currency and was used to make transactions. However, if you wanted, you could take the paper currency to a bank and exchange it for an equivalent amount of gold or silver. 3. Fiat Money Fiat money: money whose value derives entirely from its official status as a means of exchange. This is our paper and metal money today. It is our money because the government has decreed it to be our money. Everyone accepts it as payment for nearly anything, so it serves the purposes of money. Interesting Thought…. Measuring the Money Supply 1. 2. 3. 4. How much money is out there? It depends on what we define as money. The Federal Reserve, our central bank, has two aggregate measures of the money supply, _____& ____. First, we add up the money that is most easily used to make transactions (the most liquid). M1 = c_________and c______in circulation + c__________d_________ + t___________’s checks Then, the Fed expands the definition to include “near monies” or forms of money that can fairly easily be converted to cash (slightly less liquid than M1). Near monies pay i________ while few items in ______pay interest. M2 = M1 + s________accounts + short-term __________ + m___________m___________ a__________. Measuring the Money Supply 1. 2. 3. 4. How much money is out there? It depends on what we define as money. The Federal Reserve, our central bank, has two aggregate measures of the money supply, M1 & M2. First, we add up the money that is most easily used to make transactions (the most liquid). M1 = currency and coin in circulation + checking deposits + traveler’s checks Then, the Fed expands the definition to include “near monies” or forms of money that can fairly easily be converted to cash (slightly less liquid than M1). Near monies pay interest while few items in M1 pay interest. M2 = M1 + savings accounts + short-term CDs + money market accounts Thar’s N’More Gold!! Inquiry When did the United States come off the “gold” standard for good? Under whose administration did it happen and why? Thar’s N’More Gold!! Inquiry When did the United States come off the “gold” standard for good? Under whose administration did it happen and why? Caused by inflation, the oil embargo against the US, and high levels of spending on the Vietnam War, during Richard Nixon’s presidency in 1971, the cancellation of the gold standard was implemented. The United States dollar could no longer be converted to gold. Module 23 Review Questions p. 235-236 Read Module 24 The Time Value of Money