A. What is Money?

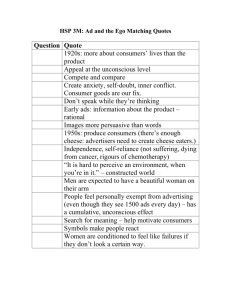

advertisement

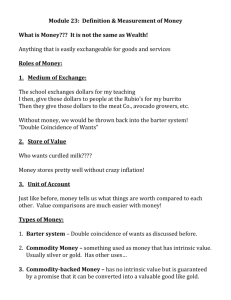

Name ______________________ Unit 5: Financial Sector Module 23: Definition and Measurement of Money Lecture Notes Pump Primer Define money and explain its function. The purpose of this module is to clarify what economists mean when they use the term money. A clear definition and measurement of money allows us to better understand monetary policy. Student learning objectives: The definition and functions of money. The various functions money plays and the many forms it takes in the economy. How the amount of money in the economy is measured. Key Economic Concepts For This Module: Money is not the same as wealth. Money is essentially anything that is easily exchangeable for goods and services. Many things have been used as money by different human civilizations. All successful forms of money must serve as a medium of exchange, a store of value, and a unit of account. Two aggregate measures of the money supply are defined by the Federal Reserve and discussed at the principles level. M1, the narrowest definition, contains only currency in circulation (also known as cash), traveler’s checks, and checkable bank deposits. M2 starts with M1 and adds several other kinds of assets, often referred to as near-moneys— financial assets that aren’t directly usable as a medium of exchange but can be readily converted into cash or checkable bank deposits, such as savings accounts. I. The Meaning of Money ____________ and ___________ are often confused. This section of the module provides a very easy way to separate money from other assets that have value. A. What is Money? What makes the $20 in your pocket different from your laptop computer or your cell phone? All three are assets, but only the $20 will be accepted by the gas station as payment for your gasoline and big gulp. 1 M-23 Money is essentially _______________ that is easily exchangeable for goods and services. Of course you could sell your laptop and cell phone, because they have value, and someone would give you money in exchange, and then you could buy gasoline and other items with that money. Or, you could give the gas station your laptop in _______________ for the gasoline in your car, but then we are talking about barter, the exchange of goods for goods. As we will see, using money helps to eliminate the need for _____________. B. Roles of Money While it seems that everything relies on money, money really only has three main roles in any modern economy: it is a _______________ of exchange, a store of _________, and a unit of _______________. 1. ________________________________________ Your employer exchanges dollars for an hour of your labor. You exchange those dollars for a grocer’s pound of apples. The grocer exchanges those dollars for an orchard’s apple crop, and on and on. Without money, we would make such exchanges in a _______________ system. If I were a cheese maker and I wanted apples, I would need to find an orchard that also needed cheese, and this would be a supremely difficult way to do my shopping. “Double coincidence of ________.” 2. ______________________________________ So long as prices are not rapidly increasing, money is a decent way to store value. You can put money under your mattress or in a checking account and it is still useful, with essentially the same value, a week or a month later. If I were the town cheese maker, I must quickly find merchants with whom to exchange my cheese, because if I wait too long, moldy cheese loses its value. 2 M-23 3. ________________________________________ Units of currency (dollars, euro, yen, etc) measure the relative worth of goods and services just as inches and meters measure relative distance between two points. In the barter system, all goods are measured in terms of other goods. Prices in a Barter Economy: A lb of cheese= dozen eggs = ½ lb of sausage = 3 pints of ale….. With money, the value of cheese, and all other goods and services, is measured in terms of a _______________ unit like dollars. C. Types of Money Throughout human history, people have understood the important roles that money plays, but have chosen to use different types of money within their societies. _______________ money: something used as money, normally gold or silver, that has _______________ value in other uses. If you didn’t want to use your gold or silver to purchase a covered wagon, you could have it melted and shaped into a piece of jewelry or a serving platter. _______________-____________ money: a medium of exchange with no intrinsic value whose ultimate value was guaranteed by a _______________ that it could always be _______________ into valuable goods on demand. This form of money appeared similar to ______ current paper currency and was used to make ___________________________. However, if you wanted, you could try to take the paper currency to a bank and exchange it for an equivalent amount of gold or silver. 3 M-23 U.S. bill: Is this commodity money? _______________. If I take this to the local bank, will they give me the equivalent amount of gold for this money? __________________________________________ Is it money at all? ________ Says who? __________________________ If you mow my lawn, and I give you some money for your labor, why should you accept it? Wouldn’t you rather have something useful like a block of cheese? So, what is so useful about this money? ___________________________ ___________________________________________________________ What if that store didn’t accept it? _______________________________ ___________________________________________________________ o Now show the class the small print on the front, bottom left, corner of the bill. It reads “This note is legal tender for all debts, public and private.” o This is a declaration from the U.S. government that you can use this money to pay your taxes (a public debt) or buy a slurpee (a private debt). ________ money: money whose value derives entirely from its official status as a means of exchange. This is our paper and metal money today. It is our money because the government has _______________ it to be our money. Everyone accepts it as payment for nearly anything, so it serves the purposes of __________. D. Measuring the Money Supply How much money is out there? It depends on what we define as money. The Federal Reserve, our central bank, has two aggregate measures of the money supply. First, we add up the money that is most easily used to make transactions (the most liquid). ______ = currency and coin in circulation + checking deposits + traveler’s checks Then, the Fed expands the definition to include “______ __________” or forms of money that can fairly easily be converted to cash (slightly 4 M-23 less liquid than M1). Near monies pay _______________ while few items in M1 pay interest. _____ = M1 + savings accounts + short-term CDs + money market accounts (Note: In future modules about monetary policy, an increase in the money supply is really just adding to M1 and M2.) Common Student Difficulties: There aren’t too many difficulties in this material, but some students do forget that M2 already includes M1. So if Steve moves $10 from his checking account to his savings account, M1 falls but M2 remains the same. 5