Electronic Lodgement FAQs [MS Word]

advertisement

![Electronic Lodgement FAQs [MS Word]](http://s3.studylib.net/store/data/009461137_1-e84e3e8c57d511f57549f4d027bade7d-768x994.png)

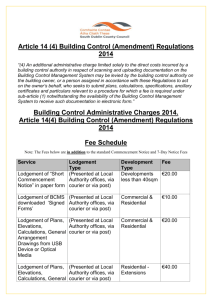

FAQ - Electronic Lodgement Q: How do I determine what the correct Lodgment Category is? A: If you are unsure as to the lodgement category you need to select, the Help Text within Duties Online Electronic Lodgement Module (ELM), provides you with a brief description of the transactions and sections of the legislation applicable to that category. Help Text exist for both Transfer of Land and Declaration of Trusts. Examples of other methods that can be used to identify the correct lodgement category are: Covering letter – A lodgement generally contains a covering letter that specifies the nature of the transfer and the transaction type. Forms - Some SRO Forms are specific to a Lodgement Category. Example - 1: Form 61, 53D, 4A and /or 8F. A property transaction between related parties may include any of the above forms. This may be an indication that the Lodgement category should be Related or Associated Party Transfers with Concessions. Example - 2: Forms 12, 13, 56. A lodgement containing any of these forms indicates that the land being transferred is a farming property. As such the lodgement category would be Primary Production. Statutory Declaration constructed and declared by parties to the transaction A Statutory Declaration may indicate that the transfer relates to a trust(s) on which the duty determination is pursuant to a specific section(s) of the legislation. The applicable Lodgement Category is Trust Exemptions & Concessions. Q: What If I have selected an incorrect Lodgment Category prior to submitting my lodgement? A: Prior to submitting the Lodgment Category specified in the ‘Lodgement Summary’ page, the category can be changed to reflect the correct one. Q: What happens to the data I have entered when I change the Lodgement Category? A: By clicking the ‘Save’ button prior to and after changing the lodgement category will ensure that the data entered is retained. FAQ - Electronic Lodgement Q: What do I do if I have a Share Transfer Document or a Form 50 Land Use Entitlement? A. To lodge Share Transfers or Form 50 Land Use Entitlement transaction, you will need to select Lodgement Category “Conversion of Land Use Entitlements” and in Step 2 select the applicable Property Type and enter the address of the property. There is no need to enter a ‘Land Identifier’ e.g Vol/folio. Q: What do I do if I have a Form 14 Change of Beneficial Ownership or An Assignment of Possessory Rights? A. Data entry relating to Form 14 Change of Beneficial Ownership is treated as the same as if there was a Transfer of Land involved. Q: Do I need to scan all the pages of a document? A: Generally you are required to scan the complete document, in particular for a Declaration of Trust or a lodgement requiring you to submit a copy of a Trust. Q: What if I have accidently uploaded the wrong document? A: Prior to submitting the lodgement, incorrectly uploaded documents may be removed by using the ‘remove’ option in the Uploaded Documents section. Q: What if the physical documents in my possession do not match with the document list populated for that category? A. There are two possibilities; 1. You may have selected the wrong category; or 2. You may have additional documents outside the prescribed list. Q: What do I do if I have additional documents that are not specifically listed in the ‘Document Type’ drop down list? A: Additional documents can be uploaded by selecting ‘Other (refer to ERM)’ in the ‘Document Type drop down list. Q: How long do I have to submit my lodgement? A. There is no set timeframe for the submission of a lodgement however keep in mind that lodgements not submitted within 30 days from date of settlement may be subject to interest. Further, documents uploaded to a lodgement and not submitted within 30 days will need to be re-uploaded before proceeding. FAQ - Electronic Lodgement Q: I have made a mistake in the data I have entered. Can I change it? A. Amendments to any of the data entered can only be completed prior to the lodgement being submitted. Once submitted for duty determination, changes can only be completed by an SRO Officer. Q: How do I know what is happening to my lodgement? A. You will be able to track the progress of your lodgement. As the status of the lodgement changes, it will be reflected in the ‘Status’ field within the Search functionality. Q: What does the status of my Lodgement mean? A. The following ‘statuses’ are applicable to Lodgements in ELM: In Progress: The data has been entered in relation to the lodgement, however it has not been submitted to SRO for duty calculation. Submitted: The lodgement has been submitted to SRO for duty calculation. Allocated: The lodgement has been assigned to an SRO assessor Returned: The lodgement has been returned with a request for additional documentation Ready to Pay: You have been notified that a duty calculation has been completed by the SRO and therefore the lodgement is ready to be finalised. Review: The lodgement has been ‘taken back’ by the SRO Assessor for further processing Manually Assessed: The lodgement has been formally assessed by the SRO Impounded: The SRO has impounded your lodgement Cancelled: The lodgement has been cancelled by the SRO Finalised: You have committed to pay and finalised your lodgement Completed: Payment has been received and allocated against your lodgement Overdue: Monies have not been received and/or allocated to your lodgement Q: What do I do if my lodgement has been returned? A. Generally if a lodgement has been returned, it means that additional documentation has been requested. An explanation email will be sent detailing what is required. Simply upload the additional documents and resubmit the lodgement. Q: What if I don’t want to go ahead with my lodgement? Can I cancel the lodgment? A. Prior to submitting for assessing, you may cancel a lodgement at any time. If a lodgement has been submitted but not assessed then you will need to send an email to the Duties Online email address requesting that the lodgement is cancelled and the reason(s) why. FAQ - Electronic Lodgement Q. Will I be notified when my lodgement has been assessed? A. Yes. Upon logging into Duties Online, a message stating that “There are assessed lodgements which need you attention” will appear. Clicking on the words “assessed lodgement” will direct you to the lodgement(s) that require attention. The ‘Last Modified’ date is the date the duty calculation was issued. Q. What if I don’t agree with my assessment and no longer wish to proceed? A. Your first point of call is to contact the assessor to request an explanation. If after obtaining an explanation, you still do not agree and do not wish to finalise your lodgement by committing to pay, you will be issued with a formal assessment and you may then object. You cannot legally object until such time that an Assessment has been issued i.e. you have committed to pay your lodgement or a manual assessment issued and payment falls due. Q. How do I finalise my lodgement? A. A lodgement will have a status of ‘finalised’ once it has been committed for payment. In the ‘Approve’ tab, simply tick the lodgement or lodgements you wish to finalise and click on ‘Commit to Pay Selected’. Q. How long do I have to finalise my lodgement? What happens if I forget to ‘Commit to pay’ my lodgement? A. You have 7 business days from the ‘Last modified’ date to finalise your lodgement. Failure to do will result in a formal assessment being issued, interest being accrued and access to Duties Online being restricted or removed. Failure to pay will result in possible recovery action. Q. “Commit to Pay Selected” is grey and I can’t finalise my lodgement. What do I do? A. Generally this means that a payment method hasn’t been assigned to the lodgement. In the ‘Approve’ Tab, select the lodgement by ticking the box and click on ‘Change’. This will allow you to choose the method of payment and finalise the lodgement. Q. If my lodgement contains more than one transaction, can I commit or pay each transaction separately? A. No. You are required to commit or pay the lodgement in its entirety. FAQ - Electronic Lodgement Q. Do I need to keep the original documents? A. As per the Terms and Conditions of Duties Online, you are required to have ACCESS to original documentation should we request them. Q. If my lodgement contains a transaction that has a consideration greater than $2.5m, do I need to submit the documents again to HVCTransactions@sro.vic.gov.au? A. No. Only documents pertaining to transactions completed via the DOL Duty Determination menu will be required to be submitted to HVCTransactions@sro.vic.go.au