Scenario Planning Presentation (2008)

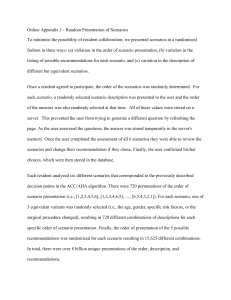

advertisement