Internal Control and Cash

advertisement

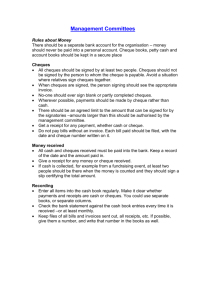

CHAPTER 6 (Full Version 8) Internal Control and Cash Chapter Outline Learning Objective 1: Define internal control. A. Internal control consists of the process designed and put in place by management to provide reasonable assurance that the organization will achieve its objectives of : 1. 2. 3. B. Reliable financial reporting, Effective and efficient operations, Compliance with applicable laws and regulation. Accounting scandals involving companies operating in the United States and Canada have resulted in the creation of the U.S. legislation: The Sarbanes-Oxley Act of 2002. The act provides tough rules and penalties related to internal controls for all companies, US or Canadian, listed on an American Stock Exchange and their auditors found in violation. Internationally, many jurisdictions, including Canada, have also responded to these accounting scandals by implementing more stringent governance requirements over public companies and the accounting profession. Learning Objective 2: List and describe the components of internal control and control procedures. A. The components of internal control include: 1. Control environment— the owner must demonstrate the importance of internal controls. 2. Risk assessment— a business must identify its risks. 3. Control procedures— procedures designed to ensure that the business’s goals are achieved. 4. Monitoring of controls— auditors ensure that assets are safeguarded from loss or theft and that accounting records are accurate. 5. Information system— the information system is critical to provide accurate information For internal controls to be effective, all of the components are required and need to work together. It is best when employees at all levels and in all areas take internal controls seriously by adopting the organization’s internal control objectives and ethical standards. (This is a considered a good control environment). B. Internal control procedures have these characteristics: 1. Competent, reliable, and ethical personnel— attract top-quality employees, train them well, and supervise them. 2. Assignment of responsibilities— each employee is assigned certain responsibilities (often defined in the organizational chart). 3. Proper authorization— an organization generally has a written set of rules that outlines approved procedures. Tasks that fall outside this set of procedures may be performed only if properly authorized. 4. Separation of duties— dividing responsibilities for transactions into the three tasks of authorization, recording, and custody limits the chances for fraud and promotes accuracy of the accounting records. Separation of duties may be divided into three parts: 2 a. b. c. C. D. Separation of operations from accounting— the entire accounting function should be completely separate from operating departments. Separation of custody of assets from accounting— accountants should not have access to assets, and those that have access to assets (such as the cashier) should not have access to the accounting records. Separation of authorization of transactions from the custody of related assets—People who authorize transactions should not handle the related asset. 5. Internal and external audits— internal and external auditors can identify weaknesses in internal control. a. Internal auditors are company employees. They examine whether company policies are being followed and if the company is complying with legislation, such as the privacy laws in Canada. b. External auditors are employed by accounting firms that are hired by a business to examine the financial statements. They gather sufficient and appropriate evidence to provide an opinion on whether or not the financial statements present fairly, in all material respects, the financial position of the company. They are not responsible for detecting fraud. 6. Documents and records— business documents provide evidence of the business transactions that have taken place and can be used to 1) check reasonableness of the accounting records – number of hotel rooms rented multiplied by the average rate should roughly equal the room revenue for the night, and 2) identify a potential error - should be pre-numbered to call attention to a missing document. 7. Electronic devices and computer controls— businesses use electronic devices to help protect assets and control operations, such as inventory sensors. 8. Other controls— businesses often use controls to protect assets such as fireproof vaults (to protect documents), burglar alarms (to protect property), point-of-sale terminals (to protect cash). a. Fidelity bonds insure the company against theft by an employee. b. Mandatory vacations and job rotation enhances morale and helps keep employees honest. Internal controls for E-commerce — Buying and selling over the Internet give rise to potential dangers. 1. Pitfalls for the consumer: a. Stolen credit-card numbers — your information must travel through cyberspace where wireless networks assist hackers. b. Computer viruses and Trojans — enter your computer without consent and cause damage to your system c. Phishing expeditions and identity theft— use of bogus websites to obtain account numbers and passwords from unsuspecting users; theft of personal data to steal assets, make purchases or obtain loans. 2. Some security measures, but not an exclusive list, that companies can implement to help protect the consumer: a. Encryption rearranges messages using a mathematical process b. Firewalls limit access to a local network There are some limitations of internal control. An internal control system can only provide reasonable assurance not absolute assurance that errors or fraud will be detected and corrected. There are many reasons why, for example: 3 a. b. Internal control systems can be circumvented by collusion between two or more people working together to defraud the firm. Internal controls will be implemented based on risk and the costs and benefits of an internal control. Thus, there will not be an internal control procedure for every potential risk. Learning Objective 3: Prepare a bank reconciliation and the related journal entries. A. The bank account is a control device because banks have established practices for safeguarding cash. Banks provide depositors with detailed records of cash transactions. (Exhibit 8-4 illustrates the Cash account.) The documents used to control a bank account include: 1. 2. 3. 4. 5. B. C. A signature card, to ensure that only an authorized person has access to the account. Deposit slips, to maintain a record of amounts deposited. Cheques, to maintain a record of monies withdrawn from the bank; includes the date of t he cheque, the name of the payee, and the signature of the maker. (Exhibit 8-2 shows a cheque drawn on a bank.) Bank statements, to show the monthly activity in an account. (Exhibit 8-3 is an example of a bank statement.) Included with bank statements are cancelled cheques that have been cashed by the payee or copies of these cheques. Electronic funds transfers (EFT) are paperless transactions that move cash to or from a bank account. The bank statement lists EFT transactions. There are two records kept of a company’s cash transactions, the cash account in the general ledger and the cash account at the bank. Due to timing differences, the ending balances in these two cash accounts rarely agree. The bank reconciliation, a document prepared by the company, that explains the differences, accounts for all the cash transactions, and establishes that the balances are accurate. Examples of items that would cause timing differences and would be included on a bank reconciliation are (see Exhibit 8-5): 1. Items recorded by the company but not yet recorded by the bank include: i. Deposits in transit—Money that has been deposited by the company but not yet recorded by the bank. ii. Outstanding cheques—cheques that have been issued by the company but not yet paid by the bank. iii. Bank errors – may need to be added or subtracted from the bank balance 2. Items recorded by the bank but not yet recorded by the company include: i. Bank collections—Money collected by the bank on behalf of its customers. Some companies use a lock-box system where customers make payments directly to the bank to reduce theft. ii. Electronic funds transfers— the bank statement may include EFTs that the company has not yet recorded. iii. Service charges— fees that the bank charges for certain services. iv. Interest revenue earned on the chequing account— the amount of interest earned may not be known until the bank statement is received. v. Nonsufficient funds cheques (NSF)— NSF cheques received from customers and returned to the payee; they are sometimes included in the bank statement. vi. The cost of printed cheques— a fee that the bank charges for printing cheques. vii. Book errors – may need to be added or subtracted from the book balance The steps in preparing the bank reconciliation are as follows and address the items listed in Exhibit 8‒5: 4 1. After setting up your bank reconciliation form, start with two figures, the balance in the business’s Cash account in the general ledger (balance per books) and the balance shown on the bank statement (balance per bank) on the same date. 2. Add to, or subtract from, the bank balance those items that appear correctly on the books but not on the bank statement. For example, add deposits in transit and subtract outstanding cheques. 3. Add to, or subtract from, the book balance those items that appear on the bank statement but not on the company books. For example, add EFT cash receipts and interest revenue and subtract service charges. 4. Compute the adjusted bank balance and adjusted book balance. The two adjusted balances should be equal. 5. Journalize each item in step 3, that is, each item listed on the book portion of the bank reconciliation. These items must be recorded on the business’s books because they are cash amounts that have increased or decreased the cash in the bank account, but they have not been recorded in the accounting records. 6. Correct all book errors, and notify the bank of any errors the bank has made. D. Journalizing transactions from the reconciliation is required for every adjustment to the book’s balance. For example, the journal entry for an NSF cheque is: Accounts Receivable XX Cash XX E. Owners and managers of small businesses with very few employees or one do not have the luxury of separation of duties. The bank reconciliation can be used to help control cash either by having the owner periodically check it or having the owner be responsible for preparing it. Learning Objective 4: Apply internal controls to cash receipts A. Internal control over cash receipts ensures that all cash is deposited and that the accounting records are correct. 1. Cash receipts over the counter a. Use a point-of-sale terminal (cash register) with a drawer that only opens when a transaction is recorded and a receipt issued. b. The register should be positioned so that the customer can see the amounts entered. c. At the end or several times a day, depending on volume of business, an employee with cash handling responsibilities should deposit cash in the bank with the machine tape going to accounting, serving as the basis for the journal entry to record sales revenue. 2. Cash receipts by mail (Exhibit 8-8.) a. All incoming mail should be handled by a mailroom employee who sends the customer cheque to the treasurer for deposit and who sends the remittance advice to accounting for the cash receipt to be recorded. b. The bank reconciliation done by a third person compares the banks’ records to the cash account in the general ledger. c. Many companies use a lock-box system to separate the physical custody of cash from recording the cash. Customers send their cheques to a lock-box at the bank, and the bank directly deposits the cash into the company’s bank account. 5 3. Cash Short and Over is an account used to record small differences when the amount of cash recorded does not agree with the amount received. It should net to zero in the long term with small errors going either under (short) and over. Exhibit 8-9 provides a summary of the internal controls over cash receipts. Learning Objective 5: Apply internal controls to cash payments Internal control over cash payments is at least as important as controlling cash receipts. A. Control over payments by cheque 1. Cheques are an important control because a cheque acts as a source document and requires an authorized signature. 2. Controls over purchase and payment, outlined in Exhibit 8-10, require the following steps. a. The company sends a purchase order (this document is the authorization to purchase) to the supplier. b. The supplier fills the order, ships the goods, and mails an invoice to the purchaser. c. When the goods arrive, the receiving department checks the goods for damage and prepares a receiving report. d. The accounting department combines the three documents, purchase order, invoice, and receiving report into a payment packet (Exhibit 8-11), then checks that the documents match. Matching the documents ensures that the goods authorized to be purchased have been received by the company. If they match, then the payment is made. Many companies have a requirement for large purchases to be reviewed a second time by the appropriate officer before payment is made. 3. Streamlined procedures have been made possible with technology. a. Evaluated receipts settlement (ERS) requires only the electronic comparison of the receiving report with the purchase order. This increases the importance of the receiving report. b. Electronic data interchange (EDI) enables the purchaser to send automatic purchase orders to supplies such as Proctor & Gamble when inventory reaches pre-determined lows. Also, it enables EFT payments when the inventory has been received. Exhibit 8-12 provides a summary of internal controls over cash payments. B. Controlling petty cash payments 1. Establishing a petty cash fund allows control over expenditures too small to pay by cheque. 2. The following controls should be established over the petty cash fund. a. Designate a custodian of the fund. b. Keep a specific amount on hand (an imprest system). c. Support all fund disbursements with a petty cash ticket or voucher. 3. The entry to establish the fund is: Petty Cash XX Cash in Bank XX A petty cash ticket is prepared like the one illustrated in Exhibit 8-13 whenever a disbursement is made from petty cash. No journal entry is made at this time. 4. 6 5. C. Replenish the petty cash fund through normal cash disbursement procedures by bringing the cash on hand up to the fund balance and preparing a summary entry such as the one illustrated below: Office Supplies XX Postage Expense XX Delivery Expense XX Cash Short and Over XX Cash in Bank XX The petty cash fund must be replenished on the balance sheet date; otherwise, expenses on the income statement will be understated. Cash should be the first asset reported on the balance sheet as it is the most “liquid.” The cash balance reported on the balance sheet will equal the total balance of all of the companies’ cash accounts which can include term deposits and certificates of deposit – in this case called “Cash equivalents Learning Objective 6: Make ethical business judgments A. Most large companies have a code of ethics designed to encourage employees to act ethically. B. Accountants who are members of a professional accounting body (such as CAs, CGAs, and CMAs) must also abide by the Code of Professional Ethics of their respective professional organization. C. Ethical issues in accounting require the accountant to make a choice. In illegal situations, the choice is easy. However, in cases where no law is being violated, the accountant is forced to make a choice that could have serious implications for his/her reputation in the profession. As it can be a difficult choice, a framework for making ethical judgments is provided Learning Objective 7: Assess the impact on cash of international financial reporting standards (IFRS). A. There is very little difference in the way cash is valued. B. The presentation of cash on the balance sheet can be different under IFRS. Under ASPE, cash is presented as the first asset. Under IFRS, companies have several choices, thus cash may be presented as the last asset item rather than the first asset. C. Canadian companies reporting under IFRS can choose either of the presentations.