Anik CV - cyberThink

advertisement

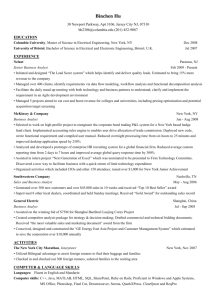

1125 US Hwy 22 STE 1 • Bridgewater, NJ 08807-9837 Sales Contact: Zamaan Rajput, (732) 481 4174 x561, (908) 429-8005 Zamaan.Rajput@cyberThink.com / zamaan.usit@gmail.com Cell: 202-627-0205 anikp1012@gmail.com Resume of AP Professional Summary AP is a Senior Consultant and Lead Business Analyst with 14+ years of total experience in Financial Services with diverse clients – Chase Bank, Ally Bank, Fidelity Investments, T Rowe Price, USAA, UBS(US and UK), Bank of New York Mellon, Credit Suisse (Switzerland), ICICI Bank (India) and VNDS Securities (Vietnam) covering Asset Management, Custody, Brokerage, Corporate Action, Securities Lending and Asset Maintenance, Wealth Management and, Banking (retail, loans and deposits) with fair understanding of Mortgage (Loan origination and servicing) and Insurance. Project Management expertise (4+ years) in managing greenfield initiatives and enhancement projects with large teams in client site in onsite/offshore model Experience on working Regulatory Compliance projects like Cost Basis, Dodd Frank, Reg CC and Basel reporting datamart for regulating bodies like SEC, FRB and BASEL Compliance for Banking Supervision. Successfully managed client expectations and executed projects worth $500K towards system implementation/enhancements. Worked on critical engagements, managed and built relationships with clients and multi vendors, displaying sound collaboration, interaction, negotiation and communication. Led matrix team comprising Jr. BAs, developers and testers on engagements ranging from data analysis, system development to enhancement. Performed functionality decomposition for one of the critical applications in area of wealth management with one of the biggest Investment firms in USA and IB in Switzerland. Experienced in various SDLC phases with proficiency in methodologies like Waterfall, RUP and Agile. Proficient in analyzing business (‘AS-IS’ and ‘TO-BE’) opportunities using GAP Analysis, Risk/Impact Assessment, Process / Project Feasibility Study to achieve end state requirements and drafting Concept/Business Case / Process Documentation. Experienced in conducting Requirement sessions, interviews, JAD, project meetings, document reviews and business walkthroughs. Extensive experience in technical documentation like Information Mapping, Use Cases, Business Requirements Document (BRD), Vision and Scope Document (VSD), Functional Requirement Specifications (FRS), UI/Screen Prototypes, Business Rules, Standard Operating Procedures (SOP), User Manuals, RTM, Test Plans, Test Scripts, UAT, Product Release Notes and Project Milestone Tracker. Experience in Process Mapping ‘AS IS’ & ‘TO BE’, Process Modelling and developing TOM models from L0 to L4 using Chevron’s Manufacturing Maintenance Model methodology. Extensive experience in reporting, data mapping using SQL across databases (Oracle and Teradata) and running ad-hoc queries. Dealt with Derivatives, Equities, Mutual Funds and Fixed Income asset classes with Reference data sources like Bloomberg, Eagle Pace, DST HiNet, Golden Source etc. Successfully managed team delivery in Onsite-Offshore models with focus on managing project, resources, risk and vendors with Client Stakeholders and Project Delivery Managers managing project budget, costing, SOW and PO for software contracts and resources furnished in onsite/offshore. Extensive practical knowledge of BABOK and Agile/Scrum principles in addition to CMMI and IEEE software standards. Major Projects CHASE Bank, Wilmington, DE Apr 2014 – Present Lead Business Analyst To met BASEL Regulatory Compliance requirements, Chase Bank has undertaken several initiaties to create datamarts for all of its diverser Lines of Business – LoB (Cards, Mortgage, Banking, Auto, Loans, Brokerage) to generate system reports that report banks exposure to risk and provide mitigation to senior management, FRB and Basel Committee. As part of this initiative, I served with Chase Cards LoB, as Lead BA, managing team of junior BAs on identifying Source of Record (SoR) used to generate current report. Process involved report analysis, SME interaction, review of code for field attributes and decomposition of business logic followed by reviews and SME Signoff to resolving IT defects. Responsibilities: Interact with Senior Management to provide estimate, status and issues on report decomposition. Onboard, train, assign and review report decompositionapproach with the team members anikp1012@gmail.com +1-202-627-0205 Page 1 of 5 1125 US Hwy 22 STE 1 • Bridgewater, NJ 08807-9837 Sales Contact: Zamaan Rajput, (732) 481 4174 x561, (908) 429-8005 Zamaan.Rajput@cyberThink.com / zamaan.usit@gmail.com Validate decomposition approach and assign report pages to team and help team members in setting client interviews, conduct requirement interviews and walkthroughs, BRD reviews and escalation. Review and analyse code across diverse systems Responsible for team deliverables Collaborate with IT team to resolve queries, defects and escalations. Coordinate with various stakeholders globally for additional documents pertaining to system access, reporting logic, requirement gathering and document review for the reports being submitted by Chief Risk Officer (CRO) to the board of Basel Committee on Banking Supervision (BCBS). Environment: Oracle EssBase, Business Objects, SAS and other internal SoR. ALLY Bank, Charlotte, NC Jun 2013 – Nov 2013 Lead Business Analyst ALLY Bank is an Internet only bank, and part of GM. To enhance its market position and retain competitiveness, ALLY has been constantly upgrading its core banking and service delivery platforms through vendor allies. I worked on building UC and requirement documentation for Mobile Application Enhancement for next generation Mobile Banking covering functions like deposits, positions, transfers and bill-pay. Responsibilities: Interact with Marketing and other Business stakeholders to understand Voice of Customer (VoC) and identify customer requirements that can enhance ALLY’s market position Conducted JAD sessions for project feasibility and business requirements Document Use Cases (UC), System Specifications, Navigation flows and co-ordinate with UX team for UI design Coordinated with various BUs and stakeholders for system requirements, product integration documentation, testing and implementation of the systems. Validate metrics and evaluate release candidates based on Testing and Development release cycles. Analyzed, researched and recommended well articulated feasible solutions for implementing new designs and suggested underlying dependencies to mitigate risk. Environment: Clarity, SharePoint, MS Visio, Azure UBS Investments, Stamford, CT Nov 2012 – Mar 2013 Senior Business Analyst Dodd Frank act in modified form from CFTC mandates all investment firms to report their business entity dealings on the following four areas – Commodity Pool/Trade Operators (CPO/CTA), FATCA, EMIR and Volcker. My role in the project was to analyze each business entity from the CPO-Fatca-EMIR and Volcker perspective, and recommend additional deep-dive for the entities that satisfied minimum requirements under the proposed rule. Responsibilities: Read the rules and analyze to create template for analysis of 4000+ business entities Coordinate with various BUs and various stakeholders globally for additional documents pertaining to incorporation, activities, purpose, trading products list, investor list and constitutional references for shell, standalone and subsidiary entities to extract records of investors, products and positions Validate data against business entities and updated management with deliverables post analysis of BU’s located globally. Validate records and transactions from Legal Structure Database (LSDB) on business entity setup services offered by UBS. Achievements: Documented Standard Operating Processes (SOP) that outlines the methodology towards assessing BU’s for Dodd Frank compliance. Environment: LSDB, SharePoint Fidelity Investments, Merrimack, NH May 2012 – Oct 2012 Lead Business System Analyst Risk Model project aims to address customer complaints arising from the current 4-day hold on deposited funds. Delivery of risk model will implement a process that will accelerate funds availability for Personal Investing (PI) deposits (for non-On Us checks, EFT, etc). An accelerated hold period value is derived based on the account’s risk tier (assets + tenure), deposit instrument (check, EFT, etc.), deposit channel (mail, branch, mobile, home scan, EFT) and deposit amount to be utilized by the current nightly transaction aging process. Deposit outcome from Rules Management was displayed to customers via Web/Mobile application. This project was part of Compliance to Reg CC by FRB and dealt with AML and Fraud Management arising from householding risk. Responsibilities: anikp1012@gmail.com +1-202-627-0205 Page 2 of 5 1125 US Hwy 22 STE 1 • Bridgewater, NJ 08807-9837 Sales Contact: Zamaan Rajput, (732) 481 4174 x561, (908) 429-8005 Zamaan.Rajput@cyberThink.com / zamaan.usit@gmail.com Elicit business objectives and requirements, and communicate/document them in a clear, concise way. Lead systems design approach and collaborate with technical teams to recommend solutions; ensuring all interfaces are identified and understood with respect to documented business processes and system workflows Follow FSDM delivery methodology for documentation, provide estimate analysis, establish milestones and manage scope Tools: Visio, SharePoint; Dev Environment – DB2, GRE T Rowe Price (TRP), Baltimore, MD May 2011 – Mar 2012 Lead Business Analyst / PM TRP is a major brokerage firm in US that serves and advises private wealth management clients. As Lead BA/PM, I worked on documenting requirements, development, UAT and delivery of Research Management System (RMS) providing flexibility to compose and publish research report and circulate reports to subscribers using business rules based upon portfolio, fund, author, asset class etc. Responsibilities: Documented requirements by performing GAP analysis and suggested alternate solutions As PM managed – scope identification, deliverables, deviations and Impact Analysis to ensure that there is no scope creep Conducted stakeholders meeting and JAD sessions for Process Documentation and created Process models in Visio Coordinated between Product Owner, Development & Testing teams and resolved Project/Operational risks and issues. Used Agile/Scrum methodologies and conducted Scrum meetings. Access data from Reference data sources like Eagle Pace, DST HiNet & Bloomberg for Equities and FI asset classes. Tools: Visio, Balsamiq Mockups, Dream Weaver, Blue Print, IBM Websphere Process Modeler Dev Environment: .Net, Oracle 10G, Alfresco Document Management Systems Reference Data Sources: Charles River, Eagle Pace, DST HiNet, Bloomberg Capital One Bank, Richmond, VA Nov 2010 – Apr 2011 Lead Business Systems Analyst Served as Lead BSA on Enterprise Data-Warehouse (EDW) platform of CapOne where I analysed data, documented business requirements and data mappings for Mortgage DW by interacting with SMEs. Also supported data modelers, testers and developers in chalking out requirements and assisted PM in creating stories and milestones for AGILE methodology. Responsibilities: Conducted user interviews and requirements gathering sessions Documented and published BRD, FRD, Use Cases, Activity Diagrams, Sequence Diagrams, OOD (Object oriented Design) using UML and Visio. Environment: Teradata, SQL, Rational ReqPro, HP Quality Center United Services Automobile Association (USAA) Jan 2010 – Nov 2010 Lead Business Systems Analyst / PM USAA offers banking, investing, and insurance to people and families that serve, or served, in the United States military. As Lead Business Analyst (Team Lead), my role was to manage team of BAs, QA and Dev team including aligning with client businesses on future projects. Trust - Order Management System PoC for Trust, USAA Aug 2010 – Nov 2010 Supported initial planning, vendor identification, integration and pre-implementation study for Charles River Development (CRD) Investment Management and Compliance Solution (IMS) for the Trust BU of USAA as a Business System Analyst where facilitated walkthrough, process study and requirement sessions between business and CRD team. Cost Basis Compliance (EES Act, 2008), USAA April 2010 – Nov 2010 As PM, managed team, scope and deliverables while as Lead BA documented requirements that confirms IRS guidelines through effective disclosure of Cost Basis via channels (mobile, .com, and portal) to end users and by integrating solutions from Scivantage MaxitTM (Record keeper) and Sungard’s Wall Street Concepts (1099-B reporting) through USAA channels. Online Retirement Center (ORC) for USAA Jan 2010 – May 2010 Engagement objective was to revamp the design, content, calculators for the Online Retirement Center Portal and .com which included rules management to display contents based on consumer/customer demographics over the Web/Mobile channels. Deutsche Bank AG, India BA QA Lead anikp1012@gmail.com +1-202-627-0205 Dec 2008 – Dec 2009 Page 3 of 5 1125 US Hwy 22 STE 1 • Bridgewater, NJ 08807-9837 Sales Contact: Zamaan Rajput, (732) 481 4174 x561, (908) 429-8005 Zamaan.Rajput@cyberThink.com / zamaan.usit@gmail.com Served with Trust and Securities Servicing (TSS) IT as a Lead BA/QA leading team of testers for an invoicing and billing application. Prior engagement included working with ‘Domain Consulting Group’ (DCG) to understand and explore DB’s Investment Banking and Asset Management landscape to position for additional business growth based on capabilities. Trust and Securities Servicing, Lead BA-QA-Testing July 2009 – Sep 2009 Trust and Securities Servicing (TSS) IT, identifies needs and requirements of business groups to manage streaming operations across trust and securities landscape of Deutsche Bank ensuring management of processes/applications for business continuity. o Lead the Software Testing Team (8 members) to execute unit and SIT and documented errors/bugs in IBM Synergy o Responsible for test delivery including work allocation, resource management, test release management and status reports to senior management using ‘PM Smart’, a CMMi compliant proprietary tool. Environment: IBM Synergy Domain Competency Group (DCG) - Lead Business Analyst Dec 2008 – Jun 2009 Project involves working with the delivery team in technology projects to increase domain knowledge of team members and also to enhance business opportunities based on domain presence and gaps. o Process and application landscapes for Deutsche bank’s AM, IB and PCB business units. o Created process landscapes and process models for Investment Bank, Asset Management and Pvt Commercial Bank using BPM tool (IBM System Architect) covering asset classes like Equity, FI, FX and OTC derivatives with reviews from SME’s, Domain Architects and clients to baseline the understanding. Bank of New York Mellon (BNYM), Pittsburgh, PA & India (Onsite – Offshore) May 2008 to Nov 2008 Sr Business Analyst BNYM provides fund accounting services to various clients through SunGard’s InvestOne application. Engagement included adopting SDLC practices and implementing newer enhancements along with production support. Documented system enhancement requirements and CR’s for Portfolio and Pricing data to calculate NAV Collate pricing information for securities from data providers when the price has staled due to error in batch jobs and updated GL / Holding statements based on client request Served as Production Support BA for InvestOneTM, wherein ran ad-hoc SQL queries to determine daily health checks for Apollo (GUI of InvestOne) application Communicated with SMEs and Project Architects in solution definition, BR prioritization, estimation, requirements, test cases, UAT, rollout plans and documenting Product Data Management (PDM) and User Manuals Environment: ReqPro, QMF and InvestOneTM. UBS, Stamford, US and London, UK (Onsite) Jul 2006 - Sep 2006 & Feb 2008 - Mar 2008 Lead Process Analyst Business Analyst to study Processes for – SecLending, Collateral Management, Corporate Actions and Class Actions for US operations while in UK documented processes for Equity Derivatives Confirmations & Settlement. Responsible for Process Mapping, SOP and Risk analysis documentation based upon risk assessment with stakeholders. Tools: Visio Credit Suisse, Zurich, Switzerland & India (Onsite – Offshore) Aug 2007 to Jan 2008 Sr Business Analyst / Onsite Associate PM As part of decommissioning of GlobalOneTM (a Securities Lending application from SunGard stable), the bank wanted to develop similar reports into their proprietary system incorporating changed business logic to suit future business needs. My role involved client interaction, onsite BA and Tester, work allocation to offshore teams etc. Environment: Visio, GlobalOneTM, Site-Minder, Crystal Reports, Sybase, SQL State Street, Boston, MA & India (Onsite – Offshore) Nov 2006 to Aug 2007 Business Analyst As part of a technology upgrade, State Street had identified critical apps developed in COBOL, C, Access and VB to be migrated to Java/J2EE framework. My role was to understand the applications, document system requirements and create test cases to ensure replication of business functionality on the new architecture. Environment: Web based application built on Java/J2EE. ICICI Securities Ltd, Mumbai, India Business Analyst anikp1012@gmail.com +1-202-627-0205 Apr 2003 – May 2006 Page 4 of 5 1125 US Hwy 22 STE 1 • Bridgewater, NJ 08807-9837 Sales Contact: Zamaan Rajput, (732) 481 4174 x561, (908) 429-8005 Zamaan.Rajput@cyberThink.com / zamaan.usit@gmail.com Project with ICICI Securities involved backend reconciliation automation of the securities order by running daily overnight batch jobs and creating reports on holdings, margins etc. Deliverables included business requirements, data mappings and rules for automation. Ran adhoc SQL queries during Testing and UAT phases to validate requirement confirmations and generated reports that ensured overnight GL updates to bank’s balancesheet (Collections & Disbursements). Tusy Infotech – ERP Implementation Jun 2000 – Mar 2003 Associate Analyst Tusy had its own ERP Product that was implemented across multiple clients in various industries. Role involved accumulating client requirements and documtation for implementing ERP modules – General Ledger, Payables, Receivables, Bill of Materials, and Payroll. Environment: Client Server architecture with VB and .Net with SQL database. Trainings/Certifications Domain: Derivatives and Mutual Fund Processing Modules from National Stock Exchange of India Ltd (NSEIL), India (2006). BA Certifications: Agile 101 and Agile 102 Certifications from CapitalOne Academy, 2011. Training on UML from Westminster Univ, London (UK), March 2008 Specialist in Requirement Management using Use Cases (2008) and in ‘Rational Unified Process’ (2009) from IBM. Education: Post Graduate program in Management and Business Administration (MBA), from BGIMS Mumbai, India (1999). Bachelors in Commerce from Mumbai University, India (1997). Technical Knowledge BA Tools SDLC Methodologies Testing Tools Business Modeling Tools Languages Web Technologies Database : : : : : : : Rational ReqPro, BluePrint, MS Office, Balsamic Mockups, Pencil(OSS), RUP, Agile, Scrum, Waterfall HP Application Lifecycle Management (ALM), IBM Synergy MS Visio, Rational Rose, Business Modeler UML, BPML, HTML, XML MS FrontPage, Dreamweaver Oracle, Teradata, Sybase, mySQL Accomplishments/Activities Won Western Region Semifinals in Management Games, 1999 organized by All India Management Association (AIMA), Mumbai Chapter. Won 1st prize in ‘Effective Portfolio Management’ in the National Level Event ‘Trishna-1998’. anikp1012@gmail.com +1-202-627-0205 Page 5 of 5