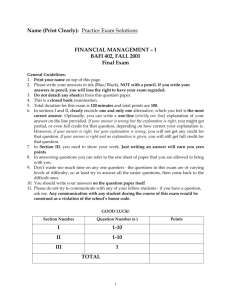

2_capstructureNriskadjustedBeta

advertisement

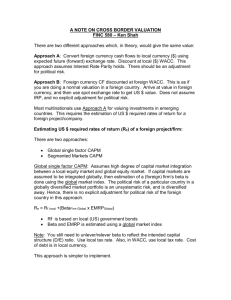

Capital Structure, Risk Adjusted Beta and WACC By Binam Ghimire 1 MV of a company: Meaning Market Value of a Company: Future CashFlows/ WACC If we can decrease WACC by changing the gearing then we can add value to the shareholders wealth 2 Impact of Gearing Should decrease WACC because Debt is cheaper Should increase WACC because more Debt means more risk to shareholder so increases cost of equity Traditional theory says WACC is U shaped so find optimal point at bottom and keep gearing at that level M&M theory (no tax) says Debt is cheaper but cost of equity rises so WACC is constant. Gearing is irrelevant M&M (with tax) debt is cheaper and greater than the related cost of equity rises. So WACC falls. Get as much debt as possible 3 CAPM in Project Appraisal: Ungeared company (all equity firm) and CAPM 4 CAPM in Project Appraisal: Example 1 Toshack plc is an all equity company and has a cost of capital of 17% p.a. A new project has arisen with an estimated beta of 1.3, Rf = 10% and Rm = 20%. Required: What is the required return of the project What relationship does this have to the cost of capital of the company 5 CAPM in Project Appraisal: Example 2 Johnson plc is an all equity company with a beta of 0.6. It is considering a single year project which requires an outlay now of $2,000 and will generate cash in one year with an expected value of $ 2,500. The project has a beta of 1.3, Rf = 10% and Rm = 18% Required: What is the Johnson’s cost of equity capital? What is the required rate of return of the project? Is the project worthwhile? 6 CAPM in Project Appraisal: Example 3 Mears Ltd is an all equity company with a beta of 0.9. It is considering a project which has a beta of 1.2. Rf = 7% and equity risk premium = 6%. Calculate the project specific cost of capital. 7 CAPM in Project Appraisal: Geared company (all equity firm) and CAPM 8 Introducing Debt finance into CAPM : CAPM can be extended to take gearing When a company is planning to diversify into a different sector The risk of the new sector will be different The job is to calculate the cost of capital which can reflect the risk of the new sector 9 Betas: In an ungeared company it simply represents the business risk. This is Beta of Asset In a geared company Beta represents both business and other risk associated with debt. This is called Beta of Equity (Business and finance risk) The beta of debt is generally very small so we may ignore it 10 Choosing a Beta (Converting the Beta of the company into Beta of the proposed investing sector) : 2 Steps: Get an appropriate Asset Beta (same as a company in that business) Adjust it to your gearing levels. Make it an equity beta 11 Formula: The assets beta equals weighted average of the betas of the various methods of financing, according to the importance of each source of finance in the capital structure Ve a e x Ve Vd (1 t ) Vd (1 t ) d x Ve Vd (1 t ) Given the beta of debt is 0 (The debt beta is usually given as nil), the formula (when debt beta not given) can be: Ve a e x Ve Vd (1 t ) 12 Formula: The beta of equity: [V V (1 t )] x V e e d a e 13 Example 1: A Ltd is planning to diversify by investing into a different market sector. The market sector has an average geared beta of 1.8 and a debt to equity ratio of 2:3. A Ltd. has a geared beta of 1.4 and a debt equity ratio of 1:3. Tax rate is 30%. Calculate the geared beta that A ltd should use when calculating the cost of capital for this project. 14 Example 2: Confectionary Co. (CC) is considering to move into Theme Park (TP) Business. What is suitable cost of capital? CC: Equity:Debt ratio= 5:2. The debt is risk free and yields 11%. Beta = 1.1. Average Return on Stock Market = 16%. Tax is 30% TP Ltd. Equity: Debt = 2:1, Beta = 1.59 15 Solution (Example 2): Degear the Equity Beta of the co. doing same business 1.59 * [2/ (2+1*(1-0.3)] = 1.18 Regear your Asset Beta 1.18 = ? X 5/ (5+1.4) =1.51 Cost of Equity: Risk Free + Beta x Market premium or : 11% + 1.51 (16-11) = 18.55% Cost of Debt = 11 * 70% = 7.7% WACC = 18.55% x 5/7 + 7.7 % x 2/7=15.45 % Ve a e x Ve Vd (1 t ) 16 CAPM in Project Appraisal: Example 1 Toshack plc is an all equity company and has a cost of capital of 17% p.a. A new project has arisen with an estimated beta of 1.3, Rf = 10% and Rm = 20%. Required: What is the required return of the project What relationship does this have to the cost of capital of the company Required rate of return: Ks = Rf + b (Rm-Rf) = 10% + 1.3 x (20 - 10)% = 10% + 1.3 x 10% = 10% + 11.3 % = 21.3% (This has no relationship with the cost of capital (17%) of the company) 17 CAPM in Project Appraisal: Example 2 Johnson plc is an all equity company with a beta of 0.6. It is considering a single year project which requires an outlay now of $2,000 and will generate cash in one year with an expected value of $ 2,500. The project has a beta of 1.3, Rf = 10% and Rm = 18% Required: What is the Johnson’s cost of equity capital? What is the required rate of return of the project? Is the project worthwhile? Johnson’s Ks= 10% + 0.6 x (18-10)% = 10% + 0.6 x 8% =10% + 4.8% = 14.8% 18 CAPM in Project Appraisal: Example 2 The required rate of return of the project? Ks= 10% + 1.3 x (18-10)% = 10% + 1.3 x 8% =10% + 10.4% = 20.4% The return = 100 * [2500 – 2000)/ 2000] = 25% The project is attractive because return (25%)>Cost (20.4%) 19 CAPM in Project Appraisal: Example 3 Mears Ltd is an all equity company with a beta of 0.9. It is considering a project which has a beta of 1.2. Rf = 7% and equity risk premium = 6%. Calculate the project specific cost of capital. Ks = 7% + 1.2 x 6% = 7%+7.2% = 14.2% 20