office of the registrar

advertisement

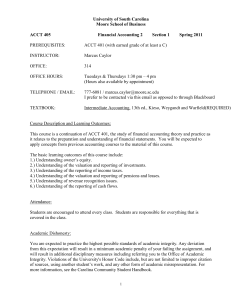

New Course Proposal ACCT 642 – Corporate Financial Reporting: Financial Transactions Kogod School of Business Note: Proposals are not necessary for a selected topics or nonrecurring topics course or project which is not a regular part of the curriculum of a department or school and is offered to a group of students on a nonrecurring or experimental basis. In essence, a selected topics course enables the faculty to offer the course on a first-time basis, or for experimentation with the curriculum. It is distinguished from an independent study project in that it is available to a group of students under the same conditions by which a they may register for a regular course. A course may be offered as a nonrecurring selected topics course at most two times. Academic Unit: Teaching Unit: Course Title: Course Number : Credit Hours: Proposed effective date: Prerequisites: Course description for University Catalog: KSB Accounting and Taxation Department Corporate Financial Reporting: Financial Transactions ACCT 642 3.0 Fall 2014 ACCT 607, Accounting Concepts and Applications. Proposed course description: ACCT-642 Corporate Financial Reporting: Financial Transactions (3) This is part of a two course series focused on financial accounting rules for corporations. Application and use of financial accounting in a decision-making framework. Emphasizes corporate financial reporting strategies, preparation of financial statements, and interpretation of financial statements by external users. Examines issues related to investments, non-current liabilities, equities, the statement of cash flows, and the accounting for changes and error corrections. The course will also explore, within these content areas, the differences between financial statements prepared in accordance with U.S. Generally Accepted Accounting Principles (GAAP) and those prepared in accordance with International Financial Reporting Standards (IFRS). Prerequisite: ACCT-607. 1 Grade type: (underline one) o A/F o Pass/Fail o A/F and Pass/Fail Expected frequency of offering: (underline one) o o o o o o o o o Underline all that apply: o o o o o o o o o o Every Fall Every Spring Every Summer Alternate Falls Alternate Springs Alternate Summers Every term Irregularly Other NONE General Education course Online course Hybrid course Rotating topics course Individually supervised course such as Internship, Independent Study, Research Course, Thesis, Dissertation Research methods course AU Abroad Program course Other study abroad course (offered directly by Academic Unit, not through AU Abroad) Please explain the main purpose of the new course, including whether it will be a requirement for an existing or proposed program or an elective, and how the new course relates to the existing courses in the program and department. Note: if a required course for an existing program, submit a corresponding Minor Change to Program proposal. 2 Currently ACCT 641, Corporate Financial Reporting, is a required Accounting Course within the Master of Science in Accounting program. The increasing complexity of financial accounting topics demands that we modify ACCT 641 (to be renamed Corporate Financial Reporting: Operations) and add a new course, ACCT 642 (Corporate Financial Reporting: Financial Transactions) to allow all key topic areas to be covered in the appropriate depth and with the appropriate level of academic rigor. Course will also allow for more in depth coverage of International Financial Reporting Standards (IFRS) within the context of the course content areas. The new course, ACCT 642, will be a required Accounting Course within the degree requirements for the Master of Science (MS) in Accounting. ACCT 642 and ACCT 641 and will constitute the two course series of Accounting Courses focused on financial accounting rules for corporations. The courses need not be taken in sequence. It is most common for MSA programs to provide this two-course sequence to cover the body of knowledge included in ACCT 641 and ACCT 642. Will the course require that students pay a special fee associated with the course? If so, please provide a justification for this additional cost to students. No. Has the course previously been offered under a rotating topics course or an experimental course number? No. Please indicate other units that offer courses or programs related to the proposed course and provide documentation of consultations with those units. N/A Estimated enrollment per semester: 20-30 3 Does your teaching unit’s classroom space allotment support the addition of this course? Yes. Are present university facilities (library, technology) adequate for the proposed course? Yes. Will the proposed course be taught by full-time or part-time faculty? Full-time faculty. We expect to have full-time faculty teach this course and will only rely on part-time faculty if appropriate. Will offering the new course involve any substantial changes to the scheduling of existing courses? No. What are the learning outcomes including the competencies that students are expected to demonstrate for the course and how are those outcomes assessed? This course, ACCT 642, Corporate Financial Reporting: Financial Transactions, is a required accounting course in the Master of Science in Accounting (MSA) program. The goal of the MSA program is to produce graduates who are prepared for professional careers in accounting. Specifically, students will Demonstrate competency in the functional areas of accounting (audit, financial, managerial, and tax) [Functional Competencies] Develop competency in applying quantitative information and professional judgment in solving business problems [Analytical Problem Solving] Demonstrate proficiency in the use of research databases (e.g., GAAP, GAAS, tax code) to provide well-reasoned conclusions on accounting issues. [Research] Demonstrate professional competence in oral, written, and interpersonal skills. Communicate information to decision makers in an effective and professional manner. [Communication] Understand the role of the accounting profession and the important professional, legal, and ethical obligations of accounting professionals. [Professionalism] 4 Understand how the global business environment impacts accounting. [Global Perspective] ACCT 642, Corporate Financial Reporting: Financial Transactions, will focus on accounting standards governing the form and content of the major financial statements, the measurement, recordation, and reporting of liabilities and equities, and the statement of cash flows. The course will also explore the accounting and reporting requirements of International Financial Reporting Standards. Throughout the course, we will emphasize the application and use of financial accounting in a decision making framework. Students will focus on the preparation of financial statements by internal management as well as the interpretation of financial statements by external users. This course offers several opportunities for experiential learning via assignments. The course focuses on accounting regulation and therefore, examines the interplay between public and private organizations. The course objectives include obtaining and demonstrating a mastery of the following accounting and financial reporting topics: Time value of money Investments Bonds and long-term notes Leases Accounting for income taxes Pensions and other post-retirement benefits Shareholders’ equity Share-based compensation Earnings per share Accounting changes and error corrections Statement of Cash Flows International Financial Reporting Standards Learning outcomes will be assessed through a variety of methods, including examinations, and some or all of the following: regular homework assignments, quizzes, case studies, research of accounting issues and rules through the FASB Accounting Standards Codification, accounting topic assignments, classroom discussions, and individual or team classroom presentations. Please attach a draft syllabus. – See attached. 5 Proposed Syllabus: ACCT 642 - Corporate Financial Reporting: Financial Transactions FALL 2014 Course: Time & Location: Instructor: E-mail: Office Hours: Corporate Financial Reporting: Financial Transactions Office: Phone: COURSE DESCRIPTION & OBJECTIVES: This course is part of a two course series focused on financial accounting rules for corporations. Corporate Financial Reporting: Financial Transactions will focus on accounting standards governing the form and content of the major financial statements and the measurement of assets, liabilities, equities and income. Throughout the course, we will emphasize the application and use of financial accounting in a decision making framework. Students will focus on the preparation of financial statements by internal management as well as the interpretation of financial statements by external users. This course examines issues related to investments, non-current liabilities, equities, the statement of cash flows, and the accounting for changes and error corrections. The course will also explore, within these content areas, he differences between financial statements prepared in accordance with U.S. Generally Accepted Accounting Principles (GAAP) and those prepared in accordance with International Financial Reporting Standards (IFRS). PREREQUISITE: ACCT 607, Accounting Concepts and Applications. MSA (MASTER OF SCIENCE IN ACCOUNTING) LEARNING OBJECTIVES: The goal of the MSA program is to produce graduates who are prepared for professional careers in accounting. Specifically, students will Demonstrate competency in the functional areas of accounting (audit, financial, managerial, and tax) [Functional Competencies] Develop competency in applying quantitative information and professional judgment in solving business problems [Analytical Problem Solving] Demonstrate proficiency in the use of research databases (e.g., GAAP, GAAS, tax code) to provide well-reasoned conclusions on accounting issues. [Research] Demonstrate professional competence in oral, written, and interpersonal skills. Communicate information to decision makers in an effective and professional manner. [Communication] Understand the role of the accounting profession and the important professional, legal, and ethical obligations of accounting professionals. [Professionalism] Understand how the global business environment impacts accounting. [Global Perspective] 6 DETAILED COURSE OBJECTIVES: Corporate Financial Reporting: Financial Transactions is considered a core accounting course within the MSA program. The course addresses all of the MSA learning objectives to some degree, and is especially focused on developing Functional and Analytical Problem Solving Competencies. The course provides in depth coverage of financial accounting and reporting rules related to the following topic areas: Conceptual Framework and Qualitative Characteristics of Accounting under US Generally Accepted Accounting Principles (GAAP) and under International Financial Reporting Standards (IFRS) and Status of Convergence Project Efforts Accounting Processing Cycle (from Transaction Analysis to the Closing Process) Time Value of Money Concepts Basic Concepts Time Value of Money Valuing a Single Cash Flow Amount Preview of Accounting Applications of Present Value Techniques—Single Cash Amount Expected Cash Flow Approach Basic Annuities Future Value of an Annuity Present Value of an Annuity Financial Calculators and Excel Solving for Unknown Values in Present Value Situations Preview of Accounting Applications of Present Value Techniques—Annuities Time Value of Money Concepts Investments Investor Lacks Significant Influence Securities to Be Held to Maturity Trading Securities Securities Available-for-Sale Transfers between Reporting Categories Impairment of Investments Financial Statement Presentation and Disclosure 7 Investor Has Significant Influence How the Equity Method Relates to Consolidated Financial Statements What Is Significant Influence? A Single Entity Concept Further Adjustments Reporting the Investment What If Conditions Change? Financial Instruments and Investment Derivatives Bonds and Long-Term Notes The Nature of Long-Term Debt The Bond Indenture Recording Bonds at Issuance Determining Interest—Effective Interest Method The Straight-Line Method—A Practical Expediency Debt Issue Costs Long-Term Notes Note Issued for Cash Note Exchanged for Assets or Services Installment Notes Financial Statement Disclosures Debt Retired Early, Convertible Into Stock, or Providing an Option to Buy Stock Early Extinguishment of Debt Convertible Bonds Bonds with Detachable Warrants Option to Report Liabilities at Fair Value Leases Accounting by the Lessor and Lessee Capital Leases and Installment Notes Compared 8 Lease Classification Operating Leases Capital Leases—Lessee and Lessor Sales-Type Leases Bargain Purchase Options and Residual Value Bargain Purchase Options Residual Value Other Lease Accounting Issues Executory Costs Discount Rate Contingent Rentals Lease Disclosures Special Leasing Arrangements Sale-Leaseback Arrangements Real Estate Leases Detailed Discussion of accounting treatment for leases under International Financial Reporting Standards (IFRS) and US GAAP changes proposed by FASB Impacts to business and financial reporting Accounting for Income Taxes Deferred Tax Assets and Deferred Tax Liabilities Conceptual Underpinning Temporary Differences Deferred Tax Liabilities Deferred Tax Assets Valuation Allowance Permanent Differences Other Tax Accounting Issues Tax Rate Considerations Multiple Temporary Differences 9 Net Operating Losses Financial Statement Presentation Coping with Uncertainty in Income Taxes Intraperiod Tax Allocation Pensions and Other Postretirement Benefits The Nature of Pension Plans Defined Contribution Pension Plans Defined Benefit Pension Plans Pension Expense—An Overview The Pension Obligation and Plan Assets The Pension Obligation Pension Plan Assets Determining Pension Expense The Relationship between Pension Expense and Changes in the PBO and Plan Assets Reporting Issues Recording Gains and Losses Recording the Pension Expense Recording the Funding of Plan Assets Comprehensive Income Income Tax Considerations Putting the Pieces Together Settlement or Curtailment of Pension Plans Postretirement Benefits Other Than Pensions What Is a Postretirement Benefit Plan? Postretirement Benefit Obligation Accounting for Postretirement Benefit Plans Other Than Pensions 10 Shareholders' Equity The Nature of Shareholders' Equity Financial Reporting Overview The Corporate Organization Paid-In Capital Fundamental Share Rights Distinguishing Classes of Shares The Concept of Par Value Accounting for the Issuance of Shares Retained Earnings Characteristics of Retained Earnings Dividends Stock Dividends and Splits Share-Based Compensation and Earnings Per Share Share-Based Compensation Stock Award Plans Stock Option Plans Employee Share Purchase Plans Earnings Per Share Basic Earnings Per Share Diluted Earnings Per Share Antidilutive Securities Additional EPS Issues Accounting Changes and Error Corrections Accounting Changes Change in Accounting Principle Change in Accounting Estimate Change in Reporting Entity 11 Error Correction Correction of Accounting Errors Prior Period Adjustments Error Correction Illustrated The Statement of Cash Flows Revisited The Content and Value of the Statement of Cash Flows (SCF) Cash Inflows and Outflows Role of the Statement of Cash Flows Preparation of the Statement of Cash Flows Preparing the SCF: Direct Method of Reporting Cash Flows from Operating Activities Using a Spreadsheet Preparing the SCF: Indirect Method of Reporting Cash Flows from Operating Activities Components of Net Income That Do Not Increase or Decrease Cash Components of Net Income That Do Increase or Decrease Cash Comparison with the Direct Method Reconciliation of Net Income to Cash Flows from Operating Activities VISION: Our vision for transforming the Kogod School of Business is built upon a commitment to the idea that profit and purpose are not at odds. Pursuit of a profitable enterprise does not require that one abandon all other values, and there are many opportunities to earn a reasonable return while serving broader objectives. We believe that a business mindset provides critical thinking and problem solving skills needed across all industries and interests, and that a rigorous framework of business education and research that focuses on traditional business organizations is also relevant for organizations outside the business sector. We believe that businesses cannot ignore their broader impact on individuals and society, and that tomorrow’s successful business leaders need to be able to think constructively about the sustainability and impact of their company’s operations. We will build our students’ education on strong business fundamentals, both quantitative and qualitative, and enhance that education by: (a) making experiential learning in real organizations our first priority; (b) creating deeper understanding of the roles public, private and non- governmental organizations (NGOs) play and their connectedness to one another; and (c) helping our students develop a global perspective through their coursework and our relationships with international organizations and academic institutions. This course primarily deals with the “profit” angle and offers several opportunities for experiential learning via assignments. The course focuses on accounting regulation and therefore, examines the interplay between public and private organizations. 12 REQUIRED MATERIALS: Intermediate Accounting with Connect Plus Accounting, Seventh Edition, by David Spiceland, James Sepe, Mark Nelson and Lawrence Tomassini, McGraw-Hill, 2013. ISBN: 978-0-07-802532-7. A simple calculator is required for certain chapters in this course. Calculators that store text material (i.e., calculators that include keys for the full alphabet) are not permitted unless memory is cleared before exams. Cell phones are not permitted to be used during exams for this course. We will be using the Connect Accounting, an on-line tool that coordinates with the text for homework. If you purchased a new textbook at the AU campus store, it will come with a registration code to enable access for Connect Accounting for free. If you purchased a used book or the electronic version of the text, you can purchase access to Connect Accounting via the publisher's website. GRADING: Grades will be based upon the professional judgment of the professor based on the following requirements (note that the particular instructor may adjust specific requirements and weightings of assessments): Exam 1 Exam 2 Final Exam Quizzes Homework Project Participation Total 20% 20% 30% 10% 10% 5% 5% 100% Letter Grades: As a general guideline, the following are the cut-off points for the letter grades: ABCD = = = = 90-94 80-84 70-74 60-69 A B C F = = = = 95-100 85-87 75-77 Below 60 B+ C+ = = 88-89 78-79 Exam and assignment grades will be posted to the course Blackboard (Bb) site throughout the semester. It is the student’s responsibility to review his/her grade information periodically and to meet with the Professor to discuss any question regarding a specific grade or concern about the student’s overall course grade. This type of dialogue as the course progresses is essential to any corrective action. The Professor welcomes dialogue with students on study and learning strategies to improve the student’s ability to be successful in this course. Below is a discussion of specific course requirements. These are subject to change based on unexpected circumstances and the professional judgment of the Professor. Any such change, if deemed necessary, will be communicated in writing to all students via the course Blackboard (Bb) site. EXAMS: The exams will be in closed-book format, and will consist of problems, computational and conceptual multiple choice questions, and short essays related to the material covered in the course. A short paper on a topical article will be a take-home component of one of the two midterm exams. Each 13 student will write a short paper on a topic covered in the course and discussed in a recent article in popular press (Wall Street Journal, Barrons, New York Times, and Washington Post). The recommended length of this paper will be two pages (single-spaced) and will be structured as follows: (a) what is the topic/issue you are writing about? (b) how does this topic relate to the course? and (c) major points or findings from the article. The article will also be the subject of an in-class discussion. QUIZZES: Short quizzes will be administered after all or most chapters to enable students are able to assess their on-going progress with respect to master of course concepts. The questions will be both conceptual and computational and may be in multiple choice or short essay format. Quizzes may be inclass or completed through the Connect Accounting in-line tool that is used for homework submission. HOMEWORK: Homework assignments and their due dates are listed in the Assignment Schedule. You will need to complete and submit homework assignments for grading through the online Connect Accounting tool before the beginning of class each week. Late homework submissions will not be accepted It is vital to your success in the course that you attempt all assignments by the due dates. This schedule of assignments is subject to change as deemed necessary by the Professor. PROJECT: There will be a group project that will allow students to demonstrate an understanding of the differences between statements prepared in accordance with U.S. Generally Accepted Accounting Principles and those prepared in accordance with International Financial Reporting Standards, within the context of the content areas presented in this course. Students will present their group projects on the last day of class. PARTICPATION: Active learning is critical to performing well in this course. Students are expected to attend each class. Class effectiveness depends heavily on student participation in class discussion. If only a few people are continually involved in the discussion, the class is denied a wealth of ideas, concepts, backgrounds, etc. from which it would most assuredly benefit. For this reason, a portion of the course grade will be based on informed class participation. Both the quantity and the quality of your participation will influence your participation grade. Note: you will not earn participation points for attending classes. You need to speak up to earn points. NO-CELL PHONE POLICY: You may not use your cell phone (including texting) during class unless you get permission from me first. ACADEMIC INTEGRITY CODE: Academic integrity is paramount in higher education and essential to effective teaching and learning. As a professional school, the Kogod School of Business is committed to preparing our students and graduates to value the notion of integrity. In fact, no issue at American University is more serious or addressed with greater severity than a breach of academic integrity. Standards of academic conduct are governed by the University’s Academic Integrity Code. By enrolling in the School and registering for this course, you acknowledge your familiarity with the Code and pledge to abide by it. All suspected violations of the Code will be immediately referred to the Office of the Dean. Disciplinary action, including failure for the course, suspension, or dismissal, may result. Additional information about the Code (i.e. acceptable forms of collaboration, definitions of plagiarism, use of sources including the Internet, and the adjudication process) can be found in a number of places including the University’s Academic Regulations, Student Handbook, and website at http://www.american.edu/academics/integrity. If you have any questions about academic integrity or standards of conduct in this course, please discuss them with your instructor. 14 ACADEMIC SUPPORT SERVICES: If you experience difficulty in this course for any reason, please don’t hesitate to consult with me. In addition to the resources of the department, a wide range of services is available to support you in your efforts to meet the course requirements. Academic Support Center (x3360, MGC 243) offers study skills workshops, individual instruction, tutor referrals, and services for students with learning disabilities. Writing support is available in the ASC Writing Lab or in the Writing Center, Battelle 228. Counseling Center (x3500, MGC 214) offers counseling and consultations regarding personal concerns, self-help information, and connections to off-campus mental health resources. Disability Support Services (x3315, MGC 206) offers technical and practical support and assistance with accommodations for students with physical, medical, or psychological disabilities. If you qualify for accommodations because of a disability, please notify me in a timely manner with a letter from the Academic Support Center or Disability Support Services so that we can make arrangements to address your needs. Kogod Center for Business Communications (x1920, KSB 101) To improve your writing, public speaking, and team assignments for this class, contact the Kogod Center for Business Communications. You can get advice for any written or oral assignment or for any type of business communication, including memos, reports, individual and group presentations, and PowerPoint slides. Hours are flexible and include evenings. Go to http://www.kogod.american.edu/cbc and click on "make an appointment," visit KSB 101, or email cbc@american.edu. You may also call x1920. Financial Services and Information Technology Lab (FSIT) (x1904, KSB T51) to excel in your course work and to maximize your business information literacy in preparation for your chosen career paths, we strongly recommend to take advantage of all software applications, databases and workshops in the FSIT Lab. The FSIT Lab promotes action-based learning through the use of real time market data and analytical tools used by business professionals in the market place. These include Bloomberg, Thomson Reuters, Argus Commercial Real Estate, Compustat, CRSP, @Risk etc. For more information, please check out the website at Kogod.american.edu/fsit/ or send an email to fsitlab@american.edu. EMERGENCY PREPAREDNESS FOR DISRUPTION OF CLASSES: In the event of an emergency, American University will implement a plan for meeting the needs of all members of the university community. Should the university be required to close for a period of time, we are committed to ensuring that all aspects of our educational programs will be delivered to our students. These may include altering and extending the duration of the traditional term schedule to complete essential instruction in the traditional format and/or use of distance instructional methods. Specific strategies will vary from class to class, depending on the format of the course and the timing of the emergency. Faculty will communicate class-specific information to students via AU e-mail and Blackboard, while students must inform their faculty immediately of any absence. Students are responsible for checking their AU e-mail regularly and keeping themselves informed of emergencies. In the event of an emergency, students should refer to the AU Student Portal, the AU Web site (www. prepared. american.edu) and the AU information line at (202) 8851100 for general university-wide information, as well as contact their faculty and/or respective dean’s office for course and school/ college-specific information. 15 TENTATIVE ASSIGNMENT SCHEDULE Date Class 1 Topic and Assignment Intro & Syllabus Conceptual Framework of Accounting, Qualitative Characteristics of Financial Reporting Information, Key Assumptions and Principles, Differences between US GAAP and IFRS, Convergence Project Status, and the Accounting Processing Cycle (from Transaction Analysis to the Closing Process). CH 6: Time Value of Money; Present Value and Future Value Computations and Applications to Financial Accounting Homework (HW): P6-3, Other problems TBD Class 2 Quiz CH 6 CH 12. Investments HW: Problems TBD Class 3 Quiz CH 12 CH 14: Bonds and Long Term Notes HW: P14-5, P14-10, P14-12, Other problems TBD Class 4 Quiz CH 14 CH 15: Leases HW: P15-1, P15-3, P15-11, Other problems TBD Class 5 CH 15: Special Leasing Arrangements Sale-Leaseback Arrangements Real Estate Leases Detailed Discussion of accounting treatment for leases under International Financial Reporting Standards (IFRS) and US GAAP changes proposed by FASB HW: Problems TBD Quiz CH 15 (no Quiz or In-class Quiz) Class 6 Exam on Chapters 6, Chapters 12, 14-156, 12, 14-15 Review1 for Exam 1 on 16 Class 7 CH 16: Accounting for Income Taxes HW: E16-3, E16-9, E16-10; E16-11; E16-13, Other problems TBD Class 8 Quiz CH 16 CH 17: Pensions and other postretirement benefits HW: E17-1, E17-3. E17-16, E17-17, P17-10, Other problems TBD Class 9 Quiz CH 17 HW: Pension Problem Set Due CH 18: Shareholders’ Equity (Parts A & B) HW 10: E18-20, P18-1, P18-4, Other problems TBD Quiz CH 18 (no Quiz or In-class Quiz) Review for Exam 2 on Chapters 16-18 Class 10 Exam 2 on Chapters 16-18 Class 11 CH 19: Share-Based Compensation and Earnings Per Share HW: P19-1, P19-12, P19-19, Other problems TBD Class 12 Quiz CH 19 CH 20: Accounting Changes and Error Corrections HW: Problems TBD Class 13 Quiz CH 20 CH 21: Statement of Cash Flows Revisited HW: P21-1,P21-3, P21-7, Other problems TBD Quiz CH 21 Class 14 Group Project Due and Class Presentations COMPREHENSIVE FINAL EXAM: TBA 17