HomeBuyer Initiated/Driven Programs

advertisement

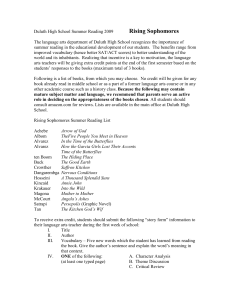

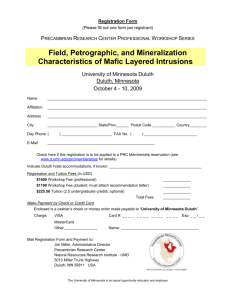

HomeBuyer Initiated/Driven Programs Jim Mischler-Philbin, Northern Communities Land Trust Duluth, MN Erika Malone Kulshan Community Land Trust Whatcom County, WA Portland, OR August 18, 2005 1 What are HomeBuyer Driven Programs? • Just like it sounds . . . • The buyers drive the process • They shop for homes on the open market like “real” buyers, except • They have financial assistance, education and hand holding from the CLT 2 Or, as Jim brilliantly states, . . . Where buyers bring homes to the CLT instead of the other way around 3 4 NCLT’s Mission Northern Communities Land Trust (NCLT) is a community-based, membership-supported nonprofit organization working to provide quality, permanently affordable homeownership opportunities for low-to-moderate income households in the city of Duluth. NCLT works with numerous housing partners, neighborhoods, and City government to help individuals and families realize the dream of homeownership otherwise unavailable to them. 5 NCLT Board of Directors To ensure community representation, NCLT members elect a board of directors that consists of: • 1/3 NCLT homeowners • 1/3 representatives of other organizations that support low income people & issues • 1/3 general community members 6 HOMELAND Home Ownership Means Equity, Legacy, Affordability, Neighbors, & Dreams • Purchase/rehab program • Started in 1999 • 65 households have purchased homes using the HOMELAND Program 7 8 KulshanCLT’s Mission Kulshan Community Land Trust strengthens community by holding land in trust for permanently affordable homeownership and other community needs, and by offering financial assistance and educational services to people of limited means. 9 KulshanCLT History • KulshanCLT incorporated in 1999 • Hired first staff is 2001 • Started HBE in 2/2002 • First HBDP acquisitions in 7/2002 • Will start first new construction this fall • First Condominium acquisition . . . . . . . . . . . . . . . . . NEXT WEEK! 10 11 Three ways to become an NCLT homeowner • New Construction -Current project is called “City Homes” • HOMELAND program - Purchase and rehab - Waiting list • Resale of existing Land Trust homes 12 2005 NCLT HOMELAND Funding (10 units) • $120,000 State Housing Finance Agency -downpayment/affordability gap grants ($80,000) -accounting, inspections, legal, emergency rehab & title insurance ($15,000) - developer fees ($25,000) • $120,000 Greater Minnesota Housing Fund (downpayment/gap) • $50,000 Federal Home Loan Bank (down payment/gap) • $220,000 HOME for Rehab (through HRA) • $15,000 CDBG for Staffing (through HRA) • $10,000 Private Foundation for marketing/staffing • $750,000 (approx) in mortgage financing. Commitments from 4 local lenders • $20,000 (in kind - HRA Rehab Administration costs) 13 2005 Income Limits (buyers’ gross annual income must be below these limits at the time of purchase) Household size 1 2 3 4 5 6 7 8 Income limit $30,600 $34,950 $39,300 $43,700 $47,150 $50,650 $54,150 $57,650 14 What is an Affordable Home? • Family does not spend more than 30% of gross income for housing costs – Housing costs include: • • • • • Principal Interest Taxes Insurance Lease Payment (if going through the Land Trust) • For example: – A family with a gross annual income of $24,000 is able to afford a house payment (including all the 15 above costs) of about $600/month Compare NCLT homeownership to conventional homeownership Same • • • • • Homeowner obtains a mortgage with a bank Homeowner accumulates equity Home can be inherited Homeowner pays property taxes Homeowner can make alterations and improvements Different • The purchase price of an NCLT home is lower–20 to 30 % below market rate–because the land is already paid for, and because of various subsidies NCLT has obtained • Homeowner leases the land for $25/month from NCLT • Home must be sold to an income-qualified buyer. Homeowner receives 100% of what they have paid off on the mortgage, 16 plus 30% of the appreciation on the home. There are currently 103 Land Trust homes in the City of Duluth. 17 HOMELAND Program 2004 Homebuyer Statistics Average gross annual income = $25,308 Average percentage of median income = 59% Average mortgage = $72,500 Average monthly housing payment (includes principal, interest, property taxes, homeowners insurance and lease fee) = $560 18 HOMELAND Program Features Buyers find homes—chose from homes that are for sale ANYWHERE within the city limits of Duluth Free home inspections/property analysis $15,000—$25,000 downpayment grant Up to $22,000 grant for rehabilitation 5-6% 30-year fixed interest rate Up to $3,000 interest-free MHFA loan to cover closing costs (for qualified buyers) Buyer is required to contribute $1000 or 1% of purchase price, whichever is less 19 HOMELAND, continued • HOMELAND buyers share appreciation of their homes with future buyers, ensuring long-term affordability of homes • Compatible with other homeownership assistance providers and programs 20 HOMELAND Property Criteria Lot Requirements: Adequate space between homes for maintenance Side lot lines at least 1 foot from house Rear lot lines at least 5 feet from house Front of home cannot abut sidewalk Foundation/Structural Integrity: No evidence of substantial settlement No excessive dampness Concrete floor in basement Concrete or treated wood perimeter foundation No major structural defects Exterior: Minimum of 5 years life expectancy of current roof Serviceable siding Serviceable windows with screens 21 HOMELAND Property Criteria, cont. Interior: Separate cooking facilities Separate bathing facilities No excessive peeling of potentially lead-based paint Ventilated attics and crawl spaces Ventilated bathrooms (operable window or exhaust fan) Minimum of 6 square feet of countertop in the kitchen Adequate smoke detectors Bathroom and kitchen floors impervious to water Mechanical: Operating central heat capable of heating dwelling Permanent walls and floor in utility rooms All wells and private sewage system approved by government authority Adequately functioning plumbing Minimum of 5 years life expectancy for hot water heater and furnace Reasonably insulated Minimum of 100 amp service Grounded circuits for all appliances No hazardous wiring or fixtures 22 HOMELAND Program Application and Purchase Checklist Land Trust Orientation Land Trust Application Income Verification by Land Trust staff Homebuyer Education Class (“Homestretch” AND/OR “Home Buyers Club”) Financial Prequalification by Land Trust staff Mortgage Pre-Approval by North Shore Bank or Wells Fargo Final Interview and Approval by Board of Directors Buyers find a home Review of Land Lease with an attorney ***Before a purchase agreement can be signed, Purchase agreement*** potential homebuyers Inspection Contingency must complete a Land Financing Contingency Trust application, have Appraisal their income verified by Title Commitment showing no liens or defects in title Land Trust staff, and be mortgage pre-approved Homeowners insurance secured from a participating Rehab sign-up with HRA lender Closing, recording of documents Rehab completed and inspected 23 24 KulshanCLT Program Overview • First acquisition in July 2002 • Currently own 31 homes • Most in the City of Bellingham, 4 “in the County” • Average purchase price = $145,710 • Average square footage = 1039 sq. ft. • Average monthly cost (PITI and ground lease fee) = $720 – Maximum = $901 – Minimum = $472 25 KulshanCLT Funding sources • House Key + CLT – Washington State Housing Finance Commission secondary funding $25,000 per home (LOAN – 3% simple interest) • City of Bellingham HOME funds – $15,000, $20,000 or $25,000 depending on household income and size 26 KulshanCLT Funding sources (cont.) • Federal Home Loan Bank – $7,000 per unit – if first mortgage is through Washington Mutual (Affordable Housing Program) – $5,000 per unit – through member bank (Home$tart savings) • Washington State Housing Trust Fund – $19,000 average per unit – grant 27 Other sources of funds • Buyers Financing – Conventional first mortgage – Washington State Housing Finance Commission (House Key) • Other silent seconds – Home$tart (FHLB) – HomeChoice (WSHFC) – or specialty product – Habitat for Humanity – Employer contributions – have yet to do 28 KulshanCLT’s HBDP Funding Breakdown Total cost Total Average Percentage of total acquisition Buyer’s 1st HOME 2nd HTF Grant Other $4.64 million $3.02 million $520,140 $826,340 $217,390 $149,670 $97,290 $16,780 $26,650 $7,001 100% 66% 11% 18% 5% 29 KulshanCLT Outreach, Intake and Education • How do people know about us? – Coverage in the media (newspaper articles, TV public service announcements) – Free advertising (Community Calendars, etc.) – Word of mouth • HomeBuyer Education – Free and open to the community – 6 hours, sponsored by the WSHFC – Eligibility requirement to participate in the program • HomeOwnership Services – Credit and budgeting for hopefuls – Home Repair classes for HomeOwners 30 Roll Film 31 KulshanCLT’s Application Process • Apply – application attempts to get borrower ready to go to the bank • Check eligibility and “bankability” • Letter obligating subsidy to borrower • Send them to the bank • Pre-approval for a loan – shopping price • Shop with a real estate agent • Purchase and Sale agreement • Inspection • Seller’s work orders and repairs • Close and split title 32 33 Key Components of the Land Lease • • • • 99-year renewable land lease Homes must be owner-occupied You pay all taxes and assessments You receive credit at resale for any improvements you do to the home (if documented and appraisal obtained) • Home can only be sold to another low-tomoderate income homebuyer at the price determined by the Resale Formula 34 HOMELAND Program Statistics, Round 1 (location, household size, gross annual income, % of median income, mortgage amt) HOMELAND Round One (2000) West Duluth (4) $14,117 = 31% $39,500 West Duluth (1) $17,682 = 56% $47,900 East Hillside (3) $17,199 = 42% $51,900 Duluth Hts (1) $19,240 = 61% $51,200 Observ. Hill (2) $26,241 = 73% $41,150 Lincoln Park (1) $20,390 = 65% $73,000 East Hillside (1) $12,261 = 39% $22,600 West Duluth (1) $16,041 = 51% $52,500 West Duluth (3) $25,584 = 64% $39,675 Riverside (1) $14,000 = 45% $51,000 Underserved populations: Single female head of household: 1 Household of color: 0 Average Median Income: 53% Average purchase price: $58,555 (High $73,000, Low: $37,000) Average mortgage $45,842 Average gross income: $18,275 35 HOMELAND Program Statistics, Round 2 (location, household size, gross annual income, % of median income, mortgage amt) HOMELAND Round Two (2001) Lakeside (1) $20,176 = 58% Lakeside (1) $24,648 = 71% Central Hillside (4) $34,680 = 70% Denfeld (2) $25,100 = 63% Central Hillside (1) $25,200 = 72% Gary/New Duluth (4) $28,036 = 56% West Duluth (2) $23,556 = 59% Morley Heights (3) $26,208 = 59% East Hillside (1) $24,445 = 70% Lakeside (2) $23,740 = 60% $65,750 $53,065 $45,000 $48,000 $31,650 $70,217 $40,000 $86,250 $61,000 $66,500 Underserved populations: Single female head of household: 2 Households of Color: 1 Average Median Income: 64% Average purchase price: $73,650 (High: $101,800, Low: $48,500) Average mortgage: $56,750 Average gross income: $25,870 36 HOMELAND Program Statistics, Round 3 (location, household size, gross annual income, percentage of median income, mortgage amt) HOMELAND Round 3 (2002) East Hillside (1) $15,314 = 43% West Duluth (2) $18,720 = 46% East Hillside (1) $19,348 = 55% Gary/New Duluth (1) $22,619 = 64% West Duluth (2) $30,222 = 74% Lincoln Park (1) $21,200 = 60% West Duluth (1) $23,478 = 66% Duluth Heights (1) $23,920 = 67% West Duluth (2) $11,376 = 35% East Hillside (2) $22,177 = 55% West Duluth (2) $24,200 = 60% Lincoln Park (1) $26,726 = 77% Endion (2) $18,093 = 45% West Duluth (2) $16,640 = 41% Lakeside (1) $27,822 = 80% $71,300 $52,900 $58,000 $71,200 $71,000 $43,840 $51,000 $60,000 $37,650 $43,840 $63,000 $61,900 $71,635 $58,900 $49,600 Underserved Populations: Single female head of household: 5 Household with disabled member: 1 Average Median Income: 58% Average purchase price: $72,450 (High: $86,500, Low: $58,000) Average mortgage: $55,475 Average gross income $21,450 37 How a purchase with NCLT compares after 10 years for a home originally worth $75,000 Approx. Income Needed to Buy Original Purchase Price Value at Original Purchase Value at Resale Amount of Appreciation Owner’s Share Amount Originally Borrowed Amount Still Owed Sale Price of Home Pay Remaining Loan Amount End up with Interest Paid Principal Paid Approx. Income Next Buyer With NCLT $19,827 (6.5% interest) $60,000 (home only) $66,000 (home only) $126,237 (home only) $60,237 (home only) $18,071 (30%) $60,000 $50,247 $78,071 $50,247 $27,824 $35,756 $9,752 $24,911 (6.5% interest) $28,097 (8% interest) Conventional $27,985 (8%) $75,000 $75,000 $143,451 $68,451 $68,451 (100%) $71,750 $62,525 $143,451 $62,525 $80,926 $53,534 $9,244 $48,143 (8%) 38 How a purchase with NCLT compares after 10 years, cont. Assumptions: 1. The home is owned for 10 years. 2. Property values appreciate. 3. Taxes and insurance do not appreciate. 4. Initial HOMELAND Grant was $15,000 to first buyer. 5. Interest rates of resale are identical to original sale. Notes: 1. If property values go down or remain constant, NCLT Leaseholders are not guaranteed a profit, and could take a loss, just like non-NCLT Leaseholders. 2. This example assumes no capital improvements take place. 3. While the return in cash from a sale after 10 years is much lower with the NCLT purchase, it is important to remember the NCLT buyer paid $166/month less for a house payment during the 10 years. $166 x 12 months x 10 years = $19,920. $19,920 (without figuring possible interest if the money was invested) added to the $27,824 is a total of $47,744—a bit closer to the return of $80,926 of the conventional deal. 4. It is also important to remember that $3750 of the $80,054 return is money paid as downpayment at the beginning of the 10 years while there was no downpayment needed for the NCLT transaction. 39 HOMELAND homes Endion Lincoln Park 40 HOMELAND homes 41 HOMELAND homes West Duluth Lakeside 42 43 Kulshan CLT’s Resale Formula Mortgage amount + downpayment = X Resale price = X + 1.5% of X Compounded annually THE FINE PRINT (plus the monetary value of approved improvements and minus the monetary value of any excess damage) 44 Kulshan CLT: Housing Example 1 45 Kulshan CLT: Housing Cost Example 1 House profile Financing Purchase price $132,400 First mortgage $78,500 Square footage: 831 Buyer’s cash out of pocket: $1,324 Bedrooms: 2 Total subsidy: $56,439 Bathrooms: 1 Owner’s monthly payment (including $35 ground lease fee) $580 Household at 52% of AMI With the CLT model if home is sold in 10 years the sales prices will be The homeowners equity at the time of sale through the CLT is $92,639 $28,076 If home is sold in 10 years (based on conservative estimate of market trends – increase of 4% per year) on the open market the sales price would be $195,984 46 Another Kulshan CLT Example (2) 47 Example 2 House profile Financing Purchase price $119,900 First mortgage $95,920 Square footage: 778 Buyer’s cash out of pocket: $1,295 Bedrooms: 2 Total subsidy: $26,552 Bathrooms: 1 Owner’s monthly payment (including $35 ground lease fee) $701 Household at 78% of AMI With the CLT model if home is sold in 10 years the sales prices will be The homeowners equity at the time of sale through the CLT is $112,822 $33,093 If home is sold in 10 years (based on conservative estimate of market trends – increase of 4% per year) on the open market the sales price would be $177,481 48 And. . . Still another (3) 49 Example 3 House profile Financing Purchase price $154,375 First mortgage $102,600 Square footage: 1,268 Buyer’s cash out of pocket: $5,044 Bedrooms: 3 Total subsidy: $54,756 Bathrooms: 2 Owner’s monthly payment (including $35 ground lease fee) $781 Household at 67% of AMI With the CLT model if home is sold in 10 years the sales prices will be The homeowners equity at the time of sale through the CLT is $124,925 $39,352 If home is sold in 10 years (based on conservative estimate of market trends – increase of 4% per year) on the open market the sales price would be $228,513 50 Thank you! No applause Just throw money No, really . . . . ANY QUESTIONS?? 51