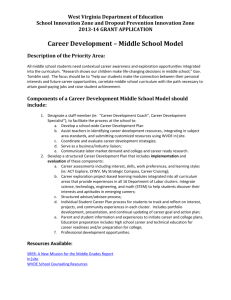

NetWorth - West Virginia Department of Education

advertisement

NetWorth: Personal Finance Education in Your Classroom LINKing Up for a Student’s Future Oct. 1, 2009 Glade Springs Oct. 9, 2009 Charleston Oct. 15, 2009 Morgantown What is NetWorth? An integration of personal finance knowledge and skills into the core curriculum The application of basic skills to real-world situations for grades K-12 An element of the 21st Century Learning Skills Answers the questions: “Why do I have to know this?” and “How will I ever use this?” What NetWorth is not… It is not one more subject to be added to the daily schedule. It is not a personal finance class It is not just a unit in the 12th grade Civics class It is not delivered by volunteers It is not just pre-packaged curriculum created by a wide-range of providers History of NetWorth 2006 WV Legislature mandated personal finance education in high school 2007 – State Treasurer and State Superintendent addressed State Board of Education 2008 – Legislature provided seed money for program development 2009 – Additional funding for pilot program 2009-2010 Pilot Program 78 teachers in 35 counties Pre- and post-test teachers and their students Implement a minimum of one instructional guide Develop additional guides/PBLs Reflect on “what works” Compile research results The three components of NetWorth Core Curriculum – – – Math Social Studies Language Arts Developmental Guidance Parental Involvement Integration into Core Curriculum Instructional Guides – – – – Instructional Resources – Developed by classroom teachers Correlated to standards Peer reviewed Accessible on Teach 21 Link to lesson plans, activities, free resources Vertical spiraling of skills Addressed in statewide assessment measures http://wvde.state.wv.us/instructionalguides/ Developmental Guidance Developed by school counselors Minimum of four lessons per grade level K12 Delivered by school counselors OR advisors in middle/high school advisor/advisee program – 30-45 minutes each Addresses academic, career, and personal/social counseling standards http://wvde.state.wv.us/counselors/networth-lessons.html LINKS Learning Individualized Needs Knowledge and Skills Development of Lessons Format (same as LINKS) Show template for Lesson plan and handouts http://wvde.state.wv.us Go to: Go to: Go to: Go to: Go to: Other WVDE sites LINKS Program Counselors LINKS Networth Curriculum Networth Lesson Plans Creating the Lesson Lessons were developed by counselors Lessons are written thoroughly Additional Resources given for each lesson Parent or Extended type of activity Interactive and Engaging Instructs what, when and how Lessons are stand alone however the lessons in each grade are complimentary of each other Sample Lesson Plan for Elementary NetWorth LINKS Lessons K.1 & K.3 http://wvde.state.wv.us Go to: Other WVDE sites Go to: School Counseling Go to : School Counselors Go to: Networth Curriculum Go to : Networth Lessons Sample Lesson Plan for Middle School NetWorth LINKS Lesson 6.3 http://wvde.state.wv.us Go to: Other WVDE sites Go to: LINKS Program Go to: Advisors Go to: LINKS Curriculum Go to: Lesson Plans Sample Lesson Plan for High School NetWorth LINKS Lesson 10.4 http://wvde.state.wv.us Go to: Other WVDE sites Go to: LINKS Program Go to: Advisors Go to: LINKS Curriculum Go to: Lesson Plans The role of the counselor Deliver four 30-45 minute lessons to each class/grade level annually Collaborate with classroom teachers and administrators to develop parent involvement activity At middle and high school, coordinate with Advisor/Advisee Program Addresses state and national counseling standards and 21st Century Partnership Parent Involvement Culminating activity for each grade level Developed by team of educators Planned and delivered by teachers, counselors, school administrators Can be during school hours or after school – approximate 1 ½ - 2 hours Parents and students participate together Special Projects Stock Market simulation Principles of investing First Steps to NetWorth Advanced credential Finance University Community engagement The Partners West Virginia State Treasurer’s Office West Virginia Department of Education West Virginia State Auditor’s Office AND – – – – – WV Attorney General First Lady Government agencies Non-Profits Financial Institutions Why NetWorth? Provide students with money management, investing, budgeting and saving skills Allow students to plan for their future beyond high school Prevent students from falling into the “debt” pit before they have an income Instill importance of personal finance knowledge and skills http://wvde.state.wv.us/instructional guides/ http://wvde.state.wv.us/counselors/ networth-lessons.html Lynn Bennett NetWorth Program Manager lynn.bennett@wvsto.com 304-842-4166 Cell – 304-282-2427 John D. Perdue, West Virginia State Treasurer West Virginia State Treasurer’s Office 1900 Kanawha Boulevard East Charleston WV 25305-0860 800-422-7498 NetWorth@wvsto.com