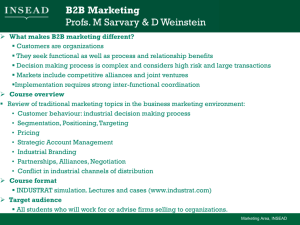

STRATEGIC ALLIANCES Şinasi

advertisement

Strategic Alliance is an agreement between companies(partners) to reach objectives of a common interest. Joint Venture: These are the results of the agreements based on which the partner companies remain independent and decide to create a new organization that is legally distinct. The share of participation can be various such as 50/50 , 49/51 , 30/70 and so on. Most joint ventures limit collaboration to specific functions. For example, only R&D, not product development and distribution. Joint ventures that cover all possible functions are rare. There are two types of joint ventures: Project-based Joint Venture: This type of alliance may commonly be used on a project by project basis. In other words, the creation of a separate entity through the alliance of two or more organizations for the purpose of carrying out a specific project. Full-blown Joint Venture: This type of alliance requires significant resource input. It is expected to remain a viable entity for a significant length of time, certainly spanning multiple projects. In a joint venture with Tepe Construction of Turkey, Turner construction provided construction management services for Türkiye IsBankası Headquaters tower. Turner International renovated six luxury hotels throughout Turkey in a joint venture with Pro^ge. An energy company of USA, EMS, a leading provider of pipeline management services has joined forces on a Joint Venture Agreement with Turkish based, VASTAŞ Company. EMS’s chief executive says that; “Turkey is geographically a prime location for providing our joint venture services throughout the Middle East, Western Asia and Eastern Europe.” Vastaş CEO says that; ”Our partnership with EMS will enable the utilization of high technology in the petroleum and natural gas infrastructure throughout the Country.” Consortia: This type of alliance involves two or more organizations. Their objective is a particular initiative or a particular project. The most significant examples are in construction such as aerospace construction. (European Airbus Consortium) Contract of Partnership in Specific Functions: One or more companies decide to collaborate in one or more functions such as marketing, R&D, production or other functions, without starting a new, legally distinct entity. Ownership of Capital: The alliance can be based on stock participation of one or more of the partners by others. Networks: These are agreements in which two or more organizations collaborate without formal relationships, but through mechanisms that provide reciprocal advantages. “Code sharing” agreements among airlines can be considered networks. These agreements through which passengers can fly with one ticket, using several airline partners. Franchising: This is an agreement in which a company (franchiser) allows another (franchisee) to sell its products or services. A franchising contract is set for a specific period of time. The franchisee pays a royalty to the franchiser for the buying rights. Franchising offers advantages to both parties. The most notable examples for franchising is Coca Cola and McDonald’s. Licensing: This is an agreement in which a company allows another (exclusive licensing) or multiple others (non-exclusive licensing) the right to use its technology, distribution network or to manufacture its products. The licensee pays a fixed amount and/or royalty or fee for the rights that are ceded to it. For an innovative company licensing offers the possibility of presence in multiple markets. The risk is that the company, ceding its own knowhow to potential competitors, therefore loses control over its core technology. The two companies made a cross-licensing alliance. Motorola ceded part of its microprocessor technology, in exchange Toshiba allowed Motorola part of its memory chip technology. Therefore, the risk of ceding technology was shared. Vertical Alliance: These are the alliances formed between entities that provide complementary services in industry. The alliance between structural steel erector and structural steel fabricator can be considered as a vertical alliance. Horizontal Alliance: These are the alliances formed between entities that compete. This type alliances are more common in the construction industry. Short-term Alliances: These alliances are characterized as primarily for operational, or project purposes. Long-term Alliances: These alliances are used for marketing purposes or offer a specific technology. Strategic alliances are based on the partnering concept. While seeking for a partner, construction firms should consider the common features of the potential partners. Each company should have complementary products based on compatible technology, should share a cooperative business philosophy and so on. Compatibility: It is easier to establish whether compatibility exists by looking at previous alliances. Capability: Generally one partner seeks in another the capabilities that contribute to strengthening an alliance. Commitment: The partner can be compatible, with complementary capabilities, but it must also believe in the alliance. In the 70’s, the main factor was the performance of the product. Alliances aimed to acquire the best raw materials. In the 80’s, the main objective became consolidation of the company’s position in the sector, using alliances. There was a true explosion of alliances. In the 90’s, collapsing barriers between many geographical markets and the blurring of borders between sectors brought the development of capabilities and competencies to the center of attention. Competitiveness within the construction industry is increasing as market borders are being expanded through use of widely available telecommunications and increasingly efficient transportation systems. In this competitive environment, firms must look to a variety of strategies. Alliance formation is one way to survive in such an environment. Access Technology 20% Share Risks 15% Secure Financing 15% Enter New Markets 15% Serve Core Customers 10% Improve Competitive Position 10% Meet Foreign Government Requirements 8% Learn Local Markets 7% Benefits of Strategic Alliances Enhance Competitive Position 20% Increase Market Share 17% Obtain New Work 15% Broaden Client Base 13% Increase Cultural Responsiveness 10% Reduce Risk 9% Increase Profits 9% Increase Labor Productivity 7% Tangible Assets: Tangible assets include resources that are easily and regularly valued and traded in the market place. Labor, equipment, financial strength and raw material are examples of such assets. Intangible Assets: Intangible assets are becoming increasingly recognized. Technology, necessity and legitimacy are the intangible assets valued by clients. Technology: Construction skill and design skill are technological assets of a construction firm. Necessity: Necessity is considered as to focus on a specific group such as socially disadvantaged groups (minority owned businesses) or other similar groups. Legitimacy: Legitimacy is considered as client’s trust, and often expressed as an organization’s reputation, image or prestige. Asset asymmetry means a firm’s assets are significantly more or less than the other venture partners. Lesser-resourced partners experiences greater return than its stronger counterparts. Positive legitimacy asymmetry within a joint venture was shown to be beneficial in gaining organizational return. Differences in National Culture: Firms have habits and values according to the place where they are located. A firms values are largely a reflection of its national culture. Differences in national culture of the firms does not have a significant effect on international joint ventures. Differences Between Host Country and Joint Venture: Differences between the national culture of the joint venture and the culture of host country does not effect performance of the joint venture significantly. Differences in Organizational Culture: Organizational culture relates primarily to shared beliefs in organizational practices and processes. Differences in organizational cultures of the firms has a positive affect on the joint venture. The possible reasons of this situation are: The culture differences may help partners learn how to operate with a foreign partner and enhance the firm’s learning capabilities. Efforts of partner companies to prevent potential miscommunications and conflicts due to cultural differences. THANKS FOR ATTENTION