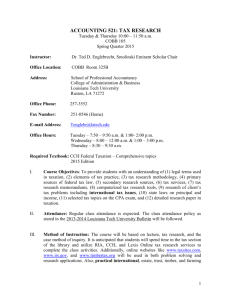

Document

advertisement

CCH Federal Taxation Basic Principles Chapter 2 Tax Research, Practice, and Procedure ©2003, CCH INCORPORATED 4025 W. Peterson Ave. Chicago, IL 60646-6085 800 248 3248 http://tax.cchgroup.com Chapter 2 Exhibits 1. 2. 3. 4. 5. 6. 7. 8. 9. Classification of Materials Judicial Authority Five-Step Research Method Research Sources for Legislative Authority Research Sources for Administrative Authority Research Sources for Judicial Authority Commercial Publishers of Comprehensive Services Commercial Publishers of Judicial Decisions Commercial Publishers of Current Developments Chapter 2, Exhibit Contents A CCH Federal Taxation Basic Principles 2 of 32 Chapter 2 Exhibits 10. Organization of the IRS 11. IRS Communications 12. Examination of Returns 13. Appeals Administrative Process 14. Taxpayer Bill of Rights 15. Choice of Tax Forum 16. Penalties Chapter 2, Exhibit Contents B CCH Federal Taxation Basic Principles 3 of 32 Classification of Materials Primary or “authoritative” Internal Revenue Code (statutory authority) Treasury Regulations (administrative authority) Internal Revenue Service Rulings (administrative authority) Judicial Authority Secondary or “reference” Looseleaf tax reference services Periodicals Textbooks Treatises Published papers from tax institutes Symposia Newsletters Chapter 2, Exhibit 1 CCH Federal Taxation Basic Principles 4 of 32 Judicial Authority The three courts of original jurisdiction are: U.S. Tax Court U.S. District Court U.S. Court of Federal Claims Chapter 2, Exhibit 2a CCH Federal Taxation Basic Principles 5 of 32 Judicial Authority The appellate courts are: U.S. Circuit Courts of Appeals U.S. Court of Appeals for the Federal Circuit U.S. Supreme court Chapter 2, Exhibit 2b CCH Federal Taxation Basic Principles 6 of 32 Five-Step Research Method 1. Gather the facts and identify the tax issues. 2. Locate and study the primary and secondary authorities relevant to the enumerated tax issues. 3. Update and evaluate the weight of the various authorities. 4. Re-examine various facets of the research. 5. Arrive at conclusions; communicate these conclusions to the client. Chapter 2, Exhibit 3 CCH Federal Taxation Basic Principles 7 of 32 Research Sources for Legislative Authority Authoritative Documents Research Source Authorship Binding 16th Amendment Constitution Congress Internal Revenue Code CCH, RIA, and West tax services Congress Chapter 2, Exhibit 4a CCH Federal Taxation Basic Principles Persuasive 8 of 32 Research Sources for Legislative Authority Authoritative Documents Research Source Tax Treaties • (to render mutual assistance between the U.S. and foreign countries in tax enforcement and to avoid double taxation.) • Chapter 2, Exhibit 4b • Tax Treaties (CCH) Worldwide Tax Treaty Library (Tax Analysts) International Tax Treaties of All Nations (Oceana Publications) Authorship Binding Persuasive Congress CCH Federal Taxation Basic Principles (overrides Code if more recent) 9 of 32 Research Sources for Legislative Authority Authoritative Documents Research Source Committee Reports Cumulative Bulletins [CB] (U.S. (useful for determining Congressional intent when Code and Regs. are unclear) Bluebook Bluebook (interprets new legislation) (a government-issued, blue-covered book) Chapter 2, Exhibit 4c Government.). Internal Revenue Bulletin [IRB] if written within 6 months Authorship Binding Persuasive House Ways and Means Committee Senate Finance Committee Joint Conference Committee Joint Committee on Taxation CCH Federal Taxation Basic Principles (no legal effect; only guidance) (no legal effect; only guidance) 10 of 32 Research Sources for Administrative Authority Authoritative Documents Research Sources Authorship Binding Final Regulations (Treasury Decisions) Federal register (U.S. Government.) Tax services (CCH, RIA and West). U.S. Treasury Department Temporary Regulations (issued without opportunity for public comment because timing is critical) Federal Register (U.S. Government) Cumulative Bulletin (U.S. Government) Tax services (CCH, RIA, and West). U.S. Treasury Department (binding if < 3 years old) Proposed Regulations Federal Register (U.S. Government) Cumulative Bulletin (U.S. Government) Tax services (CCH, RIA, and West). U.S. Treasury Department Chapter 2, Exhibit 5a CCH Federal Taxation Basic Principles Persuasive (nonbinding if over 3 years old) (nonbinding preview or final Regs.) 11 of 32 Research Sources for Administrative Authority Authoritative Documents Research Sources Revenue Rulings Cumulative Bulletins (interprets tax laws) (U.S. Government) Revenue Procedures Cumulative Bulletins (addresses internal (U.S. Government) Authorship (explains how IRS will treat a proposed transaction for tax purposes; issued to taxpayers) Chapter 2, Exhibit 5b IRS Letters Rulings Reports (CCH) Private Letter Rulings (RIA) Daily Tax Reports (BNA) Tax Analysts & Advocates, TAX NOTES Persuasive National office of IRS National office of IRS National office of IRS procedures of IRS) Letter Rulings Binding CCH Federal Taxation Basic Principles (not approved by the Treasury) (not approved by the Treasury) (only precedent value is for the taxpayer addressed in letter) 12 of 32 Research Sources for Administrative Authority Authoritative Documents Research Sources Authorship Technical Advice Memoranda [TAMs] IRS Position Reporter (CCH) Tax Notes (Tax Analysts) Internal Memoranda of the IRS (RIA) National office of IRS Not published, but available by IRS for public inspection District Director of IRS (addresses how IRS will treat a completed transaction for tax purposes; issued to District Office, hence “memorandum”) Determination Letters (mainly deal with pension plans and tax-exempt organizations) Chapter 2, Exhibit 5c CCH Federal Taxation Basic Principles Binding Persuasive (only precedent value is for the taxpayer addressed in memo) (only precedent value is for the taxpayer addressed in letter) 13 of 32 Research Sources for Judicial Authority Authority U.S. Supreme Court Research Source USTC (CCH) (4 of 9 justices needed to AFTR (RIA) grant certiorari – often granted only when there is S.Ct. Series (West) L.Ed. conflict among the appellate courts or where (Lawyer’s Co-op) the tax issue is extremely U.S. Series important) (U.S. Government) Chapter 2, Exhibit 6a Binding Persuasive (highest judicial body) CCH Federal Taxation Basic Principles 14 of 32 Research Sources for Judicial Authority Authority U.S. Court of Appeal decisions (hears appeals from any of the three lower courts; the Federal Circuit Appellate Court hears all appeals from the Court of Federal Claims) U.S. Tax Court decisions – regular (deals with novel issues not previously resolved by TC; advance payment of tax not allowed) Chapter 2, Exhibit 6b Research Source Binding USTC (CCH) AFTR (RIA) Federal 3d (West) CCH services RIA services U.S. Government Printing Office Persuasive (binding to lower courts in same circuit) (binding to other tax courts in same circuit) CCH Federal Taxation Basic Principles 15 of 32 Research Sources for Judicial Authority Authority U.S. Tax Court decisions— Memorandum Research Source Binding TCM (CCH) T.C. Memo (RIA) (deals with factual issues necessitating application of established principles of tax law; advance payment of tax not allowed) Small Cases Division of Tax Court Persuasive (binding to other tax courts in same circuit) Not published No precedent authority (informal hearing for disputes of $50,000 or less; appeals process not available) Chapter 2, Exhibit 6c CCH Federal Taxation Basic Principles 16 of 32 Research Sources for Judicial Authority Authority Research Source U.S. District Court against U.S. that is based on the Constitution, an Act of Congress, or a Regulation of any executive department) Chapter 2, Exhibit 6d USTC (CCH) AFTR (RIA) Federal Claims Reporter (West) Persuasive (jury trial available for factual issues but not for legal issues) U.S. Court of Federal Claims (hears any claims USTC (CCH) AFTR (RIA) F. Supp. Series (West) Binding (binding to courts in same district) (binding to same court) CCH Federal Taxation Basic Principles 17 of 32 Commercial Publishers of Comprehensive Services Service Description Standard Federal Tax Reporter (“Standard”), CCH Comprehensive, self-contained reference service. 25 coordinated and cross-referenced loose-leaf volumes that provide comprehensive coverage of the income tax law. Compiles legislative, administrative, and judicial aspects of the income tax law, arranged in Code section order. Also contains weekly supplements concerning current legislative, administrative, or judicial changes in tax law. United States Tax Reporter, RIA Comprehensive, self-contained reference service. 18 coordinated loose-leaf volumes organized by Code sections and updated weekly. Similar to CCH. RIA is known for its willingness to take a stand on controversial issues not covered by legislation or tax law. Federal Tax Service, CCH Contains several volumes of compilation material organized by topic. The Code, Regulations, and Committee Reports are contained in separate volumes. The chapters are prepared by over 250 practitioners. Chapter 2, Exhibit 7a CCH Federal Taxation Basic Principles 18 of 32 Commercial Publishers of Comprehensive Services Service Description Federal Tax Coordinator, RIA 26-volume service organized by topic, rather than Code sections. Popular features include editorial explanations, illustrations, planning ideas, and warnings of potential tax traps. Merten’s, Law of Useful complement to traditional reference services. In-depth discussions of general concepts of tax law. Often quoted in judicial decisions. Sometimes difficult reading due to its legalistic style. Also, updating is less frequent than most other services and not as accessible. Federal Income Taxation, Clark, Boardman Callaghan & Co. Tax Management Portfolios, BNA Chapter 2, Exhibit 7b Useful complement to traditional reference services. Each booklet ranges in length from 50 to 200 pages and deals exclusively with a special tax topic covering Code, Regulations, reference to primary authorities, and extensive editorial discussion, including numerous tax planning ideas. Problems of inconvenience may develop when there is no one portfolio squarely on point and the research effort requires reference to many portfolios. Updates are convenient though not extensive. CCH Federal Taxation Basic Principles 19 of 32 Commercial Publishers of Comprehensive Services Service Description CCH ONLINE An electronic research service. Incorporates practitioner-oriented access methods to successfully located the desired tax information and to retrieve documents of special interest. Available in many different “libraries” addressing tax and nontax topics. LEXIS/NEXIS, Reed Elsevier, Inc. An electronic research service. LEXIS accesses federal statutes, regulations, IRS rulings, and judicial decisions. NEXIS contains the full text of over 500 publications. WESTLAW, West Publishing Co. An electronic research service. Provides much of the same data as Lexis. Available online or CD-ROM. Chapter 2, Exhibit 7c CCH Federal Taxation Basic Principles 20 of 32 Commercial Publishers of Judicial Decisions Service Description CCH Citator, CCH Two-volume, loose-leaf reference service. Contains alphabetical listing of Tax Court (formerly Board of Tax Appeals, “BTA”) and federal court decisions since 1913. Indicates a paragraph reference where each case is digested in the Compilation Volumes of the Standard Federal Tax Reporter. Each listing outlines the judicial history of a selected case beginning with the highest court to have ruled on that issue. Chapter 2, Exhibit 8a CCH Federal Taxation Basic Principles 21 of 32 Commercial Publishers of Judicial Decisions Service Description Federal Tax Citator, RIA Seven-volume citator service organized in a manner consistent with CCH Citator. Provides an alphabetical list of court cases followed by a descriptive legislative history of each case. U.S. Tax Cases (USTC), CCH Series of volumes that cover Supreme Court, Courts of Appeals, District Courts, and Court of Federal Claims cases since 1913. Chapter 2, Exhibit 8b CCH Federal Taxation Basic Principles 22 of 32 Commercial Publishers of Judicial Decisions Service Description American Federal Tax Reports (AFTR), RIA Comparable to USTC above. Tax Court Memorandum Decisions (TCM), CCH Publishes memorandum decisions of the Tax Court. TC Memorandum Decisions (TC Memo), RIA Similar to TCM above. Chapter 2, Exhibit 8c CCH Federal Taxation Basic Principles 23 of 32 Commercial Publishers of Current Developments Service Description Standard Federal Tax Reports, CCH Weekly highlights of latest tax developments Weekly Alert, RIA Weekly highlights of latest tax developments Tax Notes, Tax Analysts Weekly digests of new tax decisions. Journal of Taxation Monthly tax journal. Tax Adviser Monthly tax journal published by the AICPA. Chapter 2, Exhibit 9 CCH Federal Taxation Basic Principles 24 of 32 Organization of the IRS The four Operating Divisions include: Wage and Investment Income Division Small Business and Self-Employed Division Large and Mid-Size Businesses Division Tax-Exempt Organizations and Governmental Entities Division Chapter 2, Exhibit 10a CCH Federal Taxation Basic Principles 25 of 32 Organization of the IRS Other units include: Criminal Investigation IRS Appeals Office National Taxpayer Advocate Office of Chief Counsel Chapter 2, Exhibit 10b CCH Federal Taxation Basic Principles 26 of 32 IRS Communications The IRS issues communications to individual taxpayers and IRS personnel in three primary ways: Letter rulings Determination letters Technical advice memoranda IRS Publications also address a variety of general and special topics of concern to taxpayers. Chapter 2, Exhibit 11 CCH Federal Taxation Basic Principles 27 of 32 Examination of Returns Correspondence Examinations—These involve relatively simple problems that can generally be resolved by mail. District Office Examinations—These are conducted by a tax auditor either by correspondence or by interview. Field Examinations—These are conducted by revenue agents and involve more complex issues. Chapter 2, Exhibit 12 CCH Federal Taxation Basic Principles 28 of 32 Appeals Administrative Process If the taxpayer and the agent do not agree, the taxpayer has several options: Request a conference in the IRS Appeals Office File a petition in the Tax Court Wait for the 90-day period to expire, pay the assessment, and start a refund suit in the District Court or the Court of Federal Claims Chapter 2, Exhibit 13 CCH Federal Taxation Basic Principles 29 of 32 Taxpayer Bill of Rights The Taxpayer Bill of Rights is divided into four major categories: Taxpayer rights and IRS obligations Levy and lien provisions Proceedings by taxpayers Authority of the Tax Court Chapter 2, Exhibit 14 CCH Federal Taxation Basic Principles 30 of 32 Choice of Tax Forum Factors to consider in deciding whether to litigate a case and where to litigate: Jurisdiction Payment of tax Jury trial Rules of evidence Expertise of judges Chapter 2, Exhibit 15 Publicity Legal precedent Factual precedent Statute of limitations Discovery CCH Federal Taxation Basic Principles 31 of 32 Penalties Delinquency penalties Accuracy-related and fraud penalties Negligence penalty Substantial understatement of tax liability Substantial valuation misstatement penalty Substantial overstatement of pension liabilities Chapter 2, Exhibit 16 Estate of gift tax valuation understatements Penalty for aiding understatement of tax liability Civil fraud penalty Criminal fraud penalty Estimated taxes and underpayment penalties Failure to make deposits of taxes Tax preparer penalties CCH Federal Taxation Basic Principles 32 of 32