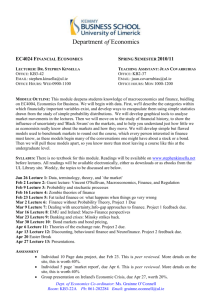

Unit 3 Acc 2013 Course outline

advertisement

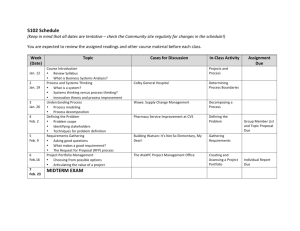

UNIT COURSE OUTLINE ACCOUNTING UNIT 3 Term I & II Week Area of study/key knowledge Term 1 Area of Study 1: ‘Recording financial data’ Week 1 30 Jan. – 1 Feb. Relevant accounting principles, qualitative characteristics, accounting elements, twofold effect on the accounting equation and the Balance Sheet Week 2 Double-entry accounting, General Ledger, source documents, GST (including calculating GST and the GST Clearing account) 4–8 Feb. School-assessed coursework Week 3 11–15 Feb. Week 4 18–22 Feb. Accounting for Stock—stock cards, FIFO, advertising use, drawings of stock Outcome 1 assessment task A: Folio of exercises Week 5 25 Feb. – 1 Mar. Week 6 4–8 Mar. Special journals—sales, purchases, cash receipts, cash payments, control accounts, Subsidiary Ledgers, debtors and creditors schedules Week 7 11–15 Mar. Week 8 18–22 Mar. The General Journal—format, establishing a double-entry system, correction of errors, contribution of non-current assets by the owner, including the distinction between historical cost and agreed value, withdrawals of stock by the owner, bad debts. Distinguishing between historical cost and agreed value in relation on-current assets Outcome 1 assessment task B: Folio of exercises Week 9 25–28 Mar. 29 Mar. – 14 Apr. Mid-semester break Term 2 The process of posting to the General Ledger from the General Journal and special journals on a monthly basis and balancing the general ledger and subsidiary ledger accounts for the next reporting period Week 10 15–19 Apr. Week 11 22–26 Apr. Control accounts—debtors, creditors and stock. Subsidiary ledgers and schedules for debtors and creditors, subsidiary records for stock internal control procedures and Preadjustment Trial Balance Outcome 1 assessment task C: Folio of exercises Week 12 29 Apr. – 3 May Week 13 6–10 May Area of Study 2: ‘Balance day adjustments and reporting and interpreting accounting information’ Balance day adjustments—straight-line method of depreciation, stock loss or gain, prepaid expenses, accrued expenses Payment of accrued expenses in a subsequent period UNIT COURSE OUTLINE ACCOUNTING UNIT 3 Term I & II Week Area of study/key knowledge Week 14 Closing entries for revenue and expenses, Profit and Loss Summary account, transfer of drawings to the capital account, post-adjustment trial balance 13–17 May School-assessed coursework Week 15 20–24 May Week 16 27–31 May Classified accounting reports—Cash Flow Statement, Income Statement and Balance Sheet, effect of transactions on the accounting equation and the accounting reports, distinction between cash and profit Outcome 2: Test Week 17 3–7 June Week 18 10–14 June GAT week: Wednesday 12 June Revision of semester’s work 17–21 June Begin Unit 4: Control and Analysis of Business Performance Sales returns and purchase returns, prepaid revenue, accrued revenue Week 20 Stock valuation Week 19 24–28 June