Who are the competitors?

advertisement

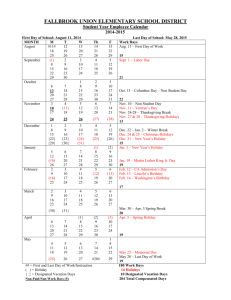

Competitor Analysis Portfolio 21128396 Paula Haddad Dr Chris Parsons 14/11/14 2 Table of Contents Introduction to the Single’s Holiday Market Who are the competitors? In-depth Analysis of Competitors Greatest Threats Emerging Competition Vulnerable Competition How are Competitors meeting Customer Needs? Conclusion and Recommendations References Appendices 2 3 3 5 6 7 7 8 9 11 1 Introduction to the Single’s Holiday Market Holidays taken by single adults have become more popular over recent years as people’s views on travelling alone are now changing. The whole singles market has been ‘reinvented’ to become more sophisticated and glamorized which is what is attracting single adults to take an interest in these holidays (Dehghan, 2012). As society is now changing their views on this niche market, the market is slowly growing as more companies begin to cater for solo travellers.. From Mintel report, Holiday Review – UK – 2014, research has shown that overall consumers took 94.1 million holidays in 2013 and the holiday market is forecasted to steadily grow over the next 5 years as consumers are regaining their confidence after the economic downturn. By 2018, the market is anticipated to grow by 8.9% and is expected to drive the market value up to £42 billion up from £36.2 million in 2013. The solo travelers market represents 31% of the whole holiday market. In comparison, the singles holiday market outperformed the overall holiday market between 2007 and 2012. Although the singles holiday market had fallen by 2.7% in 2012, the overall holiday market had fallen by 4.9%. As a result of this, the overall number of holidays taken by singles increased by some extent by 0.8% between 2007 and 2012. (Singles on Holiday, UK, Mintel, 2012). In the UK, approximately 42% of adults are single, however only 31% represent the overall holiday market. Companies are now trying to close this gap by introducing new holiday types and destinations to attract more single travelers. Around 3.5 million adults in the UK took a ‘solo’ holiday in 2012. The number of people taking a purely solo holiday outnumbered the people going on a ‘group solo’ holiday where solo travelers join a group tour on holiday. Adding group tours as an option increased the number of people going on solo holidays, as they felt safer. The main issue that solo travelers found was that holiday companies were charging for single supplements and therefore flying solo was a lot more expensive than it should be. However companies are now adjusting. Overall the singles holiday market is looking good with forecasts showing it to continue growing over the years. However for companies in this market to stay ahead they must constantly find innovative ways to attract more singles and to keep their current customers. In order to do this the companies must attempt to fulfill their needs and wants. 2 Who are the competitors? Using a competitor’s wheel (appendix 1) the competitors of Solo’s Holidays have been identified and categorized. They have been categorized into three sections to identify the level of completion they pose to Solo’s Holidays. The three sections are: Direct Competition: These companies are specialized just for single travelers, just like Solo’s Holidays. They all offer very similar products and services with very similar pricing and marketing strategies, for example Just You offers almost the same packages and holiday types as Solo’s. Indirect Competition: these companies offer a much wider range of products and services and are not specialized to any type of consumer. Within their product range they also offer holidays to single travelers but it may not be their main focus. These indirect competitors will most likely have very different pricing strategies and marketing strategies as they target different consumers however they may have some similar aims and strategies. Substitutes: these companies offer single travelling options but they use different forms of travel to Solo’s and the direct/ indirect competitors. For example, some consumers may want to travel abroad by train and therefore may use the Eurostar. In-depth Analysis of Competitors In order to analyse the competition further a strategic chart was produced to help identify who the biggest competition was (appendix 2). The strategic chart looked at the range of services against who their market is. Once the chart was complete it was able to help identify which companies should then be considered as the biggest threats and any emerging competition (Brassington and Pettitt, 2006). They competitors were also put into a cross comparison table (appendix 3) to identify any similarities they may have and what their differences are. Just You- Just You is a direct competitor to Solo’s Holidays as it is also a holiday company specializing in singles holidays. It is owned by Page & Moy travel group, who also own Travelsphere (All Leisure Group, 2014), a top contender in the escorted group tours market. This company has been chosen for further analysing, as it is a top contender in the singles holiday market and poses as a threat to Solos because of their pricing strategy. 3 Friendship Travel- This small company has been chosen, as it is a very innovative and forward thinking company in the singles holiday market. Their critical success (Johnson & Scholes, 2009) would be their ‘legendary house parties’ stating they are the most popular attraction amongst solo travellers. It is a very innovative company and often tries to improve the customers experience online and on holidays. They were the first company to offer double rooms to single occupants without any extra charges and first to introduce an online chat room (Friendship Travel, 2014). Thomas Cook- British Travel Company under the full name Thomas Cook Group plc, owned by shareholders and is one of two of the biggest leading travel groups in the UK (Mintel, 2013), in 2013 they had 4.3% market share, positioned 6th biggest UK airline company. Although Thomas Cook is an indirect competitor, it was chosen to be analysed further as it is a major competitor in the market. It has introduced its new Smartline services aiming to move 50% of their bookings online by early 2015 (Johnson, 2013). Explore- Explore is an indirect competitor to Solo’s holidays and is an expert in adventure and activity holidays, founded in 1981. According to the Travel Market Report, 2012, the highest demand from solo travellers is for adventure and activity holidays. Between the founder and everyone who works at Explore they have a lot of experience as they have all taken part in the adventure tours. This is a potential emerging competitor if consumers continue to demand more adventure holidays. Eurostar- Eurostar is a high-speed railway service and acts as a substitute for Solo’s holidays for consumers who may want to travel short-haul and may not want to travel by plane. Carries approximately 10.1 million passengers per year (Mintel, 2014) and has links to over 100 destinations. Using the Eurostar can be a lot cheaper than flying for customers who are going directly to France or Brussels and there is no difficulty or extra charges for travelling solo. 4 Greatest Threats One of the greatest threats to Solo’s Holidays is its direct competitor Just You. The Page and Moy group have over 50 years experience in the group tour market (Berman, 2014). Although Solos holidays has been around for longer, Just You has used their expertise of their holder brand to thrive in the growing market of solo travelling and have been able to catch-up with the big contenders such as Solos. The destinations and holiday types that both brands offer to their customers are very similar and also have very similar pricing. However the one feature that puts Just You at a competitive advantage is their ‘price match promise’. They promise that they will be able to match any low price from any of their competitors for the same holiday package. A big issue for solo travellers is often the pricing and any extra supplement charges that they are often overwhelmed with (Travel Weekly, 2013). Just You understood this and introduced their price match promise and they do not charge for any extra supplements. In order to make their customers aware of their pricing strategies, they promote it greatly. Advertising in the press is used for most of their promotion with slogans such as ‘explore the world, and not a single supplement in sight’ (see image below) (Creative club, 2014). This kind of promotion immediately attracts the target audience, as they are likely to appreciate the idea of cheaper solo flights as the extra charges are the biggest put off for solo travellers (Mintel, 2012). (Creative Club, 2014) However, their product range is not differentiated from those on the market and they are not very innovative. If Solos Holidays is able to create more holiday types/ packages to suit more customers needs and wants they may be able to avoid this threat from Just You. 5 Emerging Competition After analyzing the competition, it is clear who the emerging competitors are, or the competitors who have the potential to grow in the singles holiday market. Firstly, Explore is a strong emerging competitor and although it is an indirect competitor it has the potential to thrive in the singles market. Explore has over 30 years experience in adventure tours and has been welcoming single travellers from its launch, however they have now increased and there is generally a 50:50 split between singles and others (Explore, 2014). As the singles holiday market grows, according to the Travel Market Report, 2012, the highest demand from solo travellers is adventure and activity holidays. Therefore, being an expert in this market and offering over 500 different adventure holidays, Explore is at a competitive advantage. Solos must introduce more adventure/ activity holidays in order to stay ahead. Although they currently offer these kinds of holidays, they are not a big product for solos; maybe marketing towards their adventure/ activity holidays could bring in some new customers. Thomas Cook is also a strong emerging competitor in the singles holiday market. As Thomas Cook is one of two of the biggest holiday companies in the UK they have a large established customer base and its customers trust them to offer the best holiday deals. Not many of these customers may be aware of Solos holidays or any similar companies specializing in singles travel. Many customers interested in solo travelling may look straight at the bigger holiday companies, which they already know and trust. Many consumers will also most likely recognize the brand from their large marketing campaigns, although the campaigns do not focus on solo travellers, they are likely to check Thomas Cook as it is a brand they are familiar with. They have now introduced a new line of hotels which are cheaper and cater to all customers including single travellers (Thomas Cook, 2014). This competes with solos range of exclusive hotels, therefore Solos needs to make customers trust them as a brand and remember them when looking for a holiday. 6 Vulnerable Competition A vulnerable competitor in the single holiday market is Friendship Travel. Friendship Travel claims to be an innovative company with their technology by introducing features such as their online chat forum for customers to speak to each other and their phone app. However, products are not innovative or creative, and this is what customers are looking at. Their main holiday element is their ‘legendary house parties’ abroad. However, most of the reviews online in the review centre (2014) were negative comments on these parties and on the poor customer service provided on the trips from the tour guides and Friendship travel representatives. Receiving bad reviews could potentially ruin the reputation of a brand (Forbes, 2013) meaning that Friendship Travel is very vulnerable compared to its competitors and therefore does not appear to be a threat to Solos holidays. How are Competitors meeting Customer Needs? Consumers are often faced with a wide selection of choices when looking for a product or service, however when looking at their options they look at which company is able to achieve most of the needs and wants (Solomon et al, 2010). Research form Mintel (2013) shows a major factor effecting travellers decision is price. Just You, Friendship Travel and Explore are all meeting customer needs in the same way as they do not charge for any single supplements. Eurostar acts as a cheaper alternative to travel to France and Brussels from just £69 (Eurostar, 2014) therefore meeting consumers’ financial needs. Looking at the list of most preferred holidays in appendix 4, Just You and Thomas Cook are both able to offer most of these holiday types to their customers. However Thomas Cook charges extra supplements for single travellers on most of their holidays (Thomas Cook, 2014), which may put solo travellers off from using them. Reviews for Just You on Feefo, an independent review site, were amazing with 97%, out of 3113, of customers saying the service was excellent and 96% said the product was excellent (Feefo, 2014). A lot of the reviews stated they would definitely recommend Just You to others therefore Just You must be meeting a lot of their customers needs to be achieving such great responses. 7 Conclusion and Recommendations After identifying and thoroughly evaluating the competitors it is evident that solos is a leader in the market and a top competitor. However in order to avoid the competition threats and emerging competition, Solos must stay ahead of them. Firstly, solos must create more marketing for their brand. Currently they only advertise in press and direct mail, which may be working to bring in a small number of customers. However if solos considers using online advertising it may drive more traffic to their website. Their competitors Just You and Thomas Cook both promote their brands well and seeing as Just You is a major threat to solos and Thomas Cook is an emerging competitor in this market, solos must do all they can to promote themselves for customers to choose them over their competitors. With their new line of solos exclusive hotels coming in 2015, they have an opportunity to create a campaign promoting these along with the solos brand. Moreover, as the adventure/ activity holidays are a growing demand amongst solo travellers, solos should increase their holiday types by adding more adventure tours. Explore is doing currently well, although their turnover is has decreased (Mintel, 2014) they still continue to make a high profit, however solos can take this opportunity and use Explores decrease in turnover and try attract some new customers by creating new holidays. Many reviews on Solo’s Holidays claim that their pricing is very expensive and the holidays are not worth the price (Review Centre, 2014). Therefore solos must try and change this by introducing different and cheaper options to their different kinds of customers as not everyone may be willing to pay a large price for a solo holiday. 8 References All leisure group, (2014). All Leisure Holiday Companies. [Online] Available at: http://www.allleisuregroup.com/history.html[Accessed 11 Nov. 2014]. Berman, C. (2012). Page and Moy bought by All Leisure Group. [Online] travel weekly. Available at: http://www.travelweekly.co.uk/articles/2012/05/16/40496/page-and-moy-bought-by-all-leisuregroup.html [Accessed 12 Nov. 2014]. Brassington, F. and Pettitt, S. (2006). Principles of marketing. Harlow: Financial Times Prentice Hall. Creative club, (2014). Jut You. [Online] Available at: http://creativeclub.co.uk[Accessed 12 Nov. 2014]. Dehghan, S. (2012). How singles holidays are getting hipper. [online] The Guardian. Available at: http://www.theguardian.com/travel/2012/aug/03/singles-holidays-rome-italy-solotraveller[Accessed 11 Nov. 2014]. Eurostar, (2014). Eurostar Train - About Eurostar. [online] Available at: http://www.eurostar.com/uk-en/about-eurostar [Accessed 10 Nov. 2014]. Eurostar, (2014). Eurostar Deals & Offers. [online] Available at: http://www.eurostar.com/uken/eurostar-deals [Accessed 12 Nov. 2014]. Explore, (2014). About Us. [online] Available at: https://www.explore.co.uk/about-us/meet-theteam[Accessed 11 Nov. 2014]. Forbes, (2013). The Dark Side Of Reputation Management: How It Affects Your Business. [online] Available at: http://www.forbes.com/sites/cherylsnappconner/2013/05/09/the-dark-side-ofreputation-management-how-it-affects-your-business/ [Accessed 12 Nov. 2014]. Friendship Travel, (2014). Home. [online] Available at: http://www.friendshiptravel.com/ [Accessed 11 Nov. 2014]. Johnson, B. (2013). Thomas Cooks £10m campaign guns for families and independent travellers. [Online] Marketing Week. Available at: http://www.marketingweek.com/2013/12/20/thomascooks-10m-campaign-guns-for-families-and-independent-travellers/ [Accessed 11 Nov. 2014]. Just you, (2014). Customer support; booking conditions | Just You. [online] Available at: http://www.justyou.co.uk/customer-support/booking-conditions/[Accessed 12 Nov. 2014]. Mintel, (2013). Singles on Holiday - UK - March 2013. [online] Available at: 9 http://academic.mintel.com/display/638005/[Accessed 12 Nov. 2014]. Mintel, (2014). Rail Travel - UK - July 2014. [online] Available at: http://academic.mintel.com/display/679737/[Accessed 10 Nov. 2014]. Mintel, (2014). Holiday Review - UK - January 2014. [online] Available at: http://academic.mintel.com/display/679605/[Accessed 11 Nov. 2014]. Mintel, (2014). Group Holidays - UK - 2014. [online] Available at: http://academic.mintel.com/display/701062/[Accessed 13 Nov. 2014]. Review Centre, (2014). Friendship Travel www.friendshiptravel.com. [online] Available at: http://www.reviewcentre.com/reviews204522.html[Accessed 11 Nov. 2014]. Review Centre, (2014). Solo's Holidays www.solosholidays.co.uk. [online] Available at: http://www.reviewcentre.com/reviews101424.html[Accessed 13 Nov. 2014]. Solomon, M. (2010). Consumer behaviour. Harlow, England: Prentice Hall/Financial Times. Thomas cook, (2014). Pricing Terms and Conditions. [online] Available at: http://www.thomascook.com/pricing-terms-conditions/[Accessed 11 Nov. 2014]. Travel Market Report, (2014). Solo Travel Is Booming, and Suppliers Are Responding. [online] Available at: http://www.travelmarketreport.com/content/publiccontent.aspx?pageID=1365&articleID=6512&LP =1[Accessed 11 Nov. 2014]. Travel Weekly, (2013). Traveling solo. [online] Available at: http://www.travelweekly.com/TravelNews/Tour-Operators/Traveling-solo/[Accessed 12 Nov. 2014]. 9 Appendices Appendix 1: Competitor Identification and Analysis for Solo’s Holidays Travel Company Cruises Train and Silversea / Ferry Coach Trips Eurostar P&O Leger Specialized Holidays ACE Cultural and NCL Tours Adventure Archers TUI UK Noble Holidays PEAK Direct Adventure Caledonia Thomas Cook Dunabe Travel Travel Express Solitair Holidays Redpoint Fred Republic Holidays Olsen Shearings Thompson Cold STA Travels Skiworld Fusion Solo’s Norwegian Andante Door to Spice chalets Cruise Line Holidays Just You door coach Exodus Expedia holidays Go Learn to Royal Easyjet One Grand UK Caribbean Traveller Friendship Contiki Interational Saga Holidays Travel Explore Eurotunnel Travelsphere Companies offering single trips Other National Car rental DIRECT COMPETITORS Companies offering same specialized holiday trips as Solo Holidays, aimed at single travellers. INDIRECT COMPETITORS Companies that offer similar services as Solo Holiday’s within the companies varied range of options and packages aimed at a wider range of travellers. SUBSTITUTES Companies that offer singles holidays using other forms of travel. Wild Frontiers GAD adventures Budget Car rental Park Holidays 10 Appendix 2: Strategic Groups Nonspecialized Thomas Cook P&O TUI Eurostar Travelsphere Explore MARKET Exodus STA Travels Friendship Travel Specialized Just You Saga Solos Holidays Solitair Holidays HIGH LOW RANGE OF PRODCUTS/ SERVICES 11 Appendix 3: Cross Comparison of Competitors Competitors Friendship Travel Solo’s Holidays Just You Background Formed in 1982, it was the first company to specialize in holidays for single travelers. Licensed to carry 10,341 ATOL protected annual customers. Was part of the Page & Moy Travel Group and sister company to tour operator Travelsphere. They are both now owned by All Leisure Group. Specialist singles holiday group tour operator, which was founded in 1999. The company is now licensed to carry 2,490 ATOL protected customers annually. Who are their Customers? Customers are usually around the age of 35, where 65% of them are women. What do they offer? They offer both short and long haul group holidays with a range of different holiday types. For example they offer sun holidays, discovery tours and cruises. They Regular customers are in age range of 4570’s, ABC1 Empty nesters. Under half of the customer profiles are retired, two thirds of the consumers are women and either divorced or widowed. Just You describe their consumers as ‘onlinesavvy’. Offer escorted group tours to over 40 countries. They also offer ‘stay-put’ resort holidays, cruises, rail holidays and short breaks (city breaks 35-50 year olds ‘Single and happy’ Enjoy being single Friendship Travel describes their group holidays as laid back with a sense of ‘house party’. It offers resort holidays, cruises, beach holidays, skiing resorts, and city Thomas Cook Explore Eurostar In 2007 Thomas Cook AG and My Travel Group plc merged to form Thomas Cook, one of the two biggest leading travel groups in the UK. They carry 3.4 million ATOL protected customers annually. Thomas cook has a wide range of customers such as families, couples, groups and singles. This could be because of the smaller subbrands which Thomas cook owns. An adventure holiday tour operator, founded in 1981. Licensed to carry 18,466 ATOL protected passengers annually. In 2012, Explore launched a brand aimed at young professionals called Edge Adventures. Varied clientele of, families, couples and singles. Explore has identified that generally a 50/50 split between single travelers and other. High-speed railway service going through the channel tunnel connecting London, Paris and Brussels. Eurostar services began in 1994. Thomas Cook is able to offer a wide range of holiday types to appeal to all its customers using its partner brands. They offer package Offers 500 adventure and activity holidays for single travelers and small groups to 135 countries. Range of waling & trekking, cycling, Offers trips to Paris, Brussels, Disneyland Paris, Lille, Avignon, Bruges, Amsterdam, Germany, Geneva and Skiing to the French and Swiss alps. Research shows Eurostar’s customers are roughly 64% male and 36% female. The dominant age groups of travelers are 16-24 and 25-34. Most travelers use Eurostar for leisure and a very small group use it for business. 12 What is their Pricing Policy? How do they Promote themselves? also offer specialized activity holidays such as tennis, ski, golf and walking & trekking. Solo’s also offers a ‘solo’s for one’ range for customers who do not want to travel in a group. Solo’s holidays offers extra features, such as insurance, airport parking, airport hotels, lounge passes and discounts on trains to the airport. and weekend breaks). The main focus of their product range is tours with a cultural element. Just you can offer airport lounge passes, no single supplement charges, individual rooms and a tour manager. For customers who have never travelled alone before Just You offers Discovery weekends in UK hotels as a taster. No single supplement charges. If customer’s ticket fares drop after ticket has been purchased, they will receive the lower price. Solos holiday’s uses press and direct mail for promotion. They also have active social sites of Facebook, YouTube and twitter. No single supplement charges. Prices vary depending on holiday type and package. Just You offers ‘price match’ of competition. In 2012 approx. £3 million was spent on above-the-line advertising, using press and direct mail. They have an active Facebook page where they encourage potential customers to speak to previous travelers on the ‘your breaks. They offer both long haul and short haul holidays and tours worldwide. Their package holidays come with tour manager; double rooms for single occupants (no other company does this) and most holidays are supplement free. A loyalty scheme is available and complimentary gifts for repeat clients. The company uses YouTube as a main channel to promote their holidays covering 75% of their resorts. Over £30,000 was spent on above -the-line advertising mainly press and direct mail; in 2014 they started using online advertising as well. holidays, villa holidays, history tours and luxury holidays, wildlife discovery. activity holidays and cruises. Thomas Cook’s cruises are able to cater towards single travelers however only double occupancy cabins are available. For most of its holidays it charges a singles supplement. However they also provide a price match promise. In 2012 they spent £5 million on their first integrated campaign using TV, radio, online, press and in-store promotion. They now continue to use large integrated campaigns. They are very active on social sites, Facebook, twitter, They spent approx. £175,000 on abovethe-line advertising in 2012. Very active on social sites Facebook, Twitter, Google+, YouTube and Pinterest. Facebook is the main social channel with over 14,000 likes on the page. Eurostar offers links to over 100 destinations across Europe through Paris, Lille and Brussels. They have loyalty programs to encourage customers to collect points to use in the future. Eurostar also gives their customers the option of booking a hotel through their website, or hiring a car at their destination while also offering insurance. Cheapest trips are from £69. They use Facebook and Twitter where they have very high follower numbers on each. They also have newsletters that customers can sign up to and have sent by email. 12 community’ forum. What are their Strengths? What are their Weaknesses? Solos holiday’s was the first company specializing in singles holidays therefore have the most experience in the market and understand what their customers need and want. They also fly to more destinations than other companies in the niche market. Not very innovative, do not offer anything different to others in the market. YouTube and Google+. Top contender in the market. Good use of technology, using online forum to create community between old customers and new customers. Offer price match on competitor’s prices, no one else offers this. Innovative company always bringing in new ideas for their customers. Won two awards, for ‘best small holiday company- singles’ and ‘best small holiday company to Caribbean and Bermuda’ both in 2013. One of the two biggest leading travel groups in the UK. As it isn’t specialized to just single’s holidays it offers more destinations, holiday types and packages for all different customers. Travels to 135 countries, experts in adventure and activity holidays. Leaders in their holiday market. They have also won 6 awards over 2 years for their tours. Cheaper and easier alternative for solo travelers who want to travel to Paris or Brussels. They do not offer anything different from competitors, standard products and offers. Do not fly to as many destinations as their competitors. Charges single supplements for most of its singles holidays. Most competitors do not charge extra supplements for single travelers. Only do adventure holidays, therefore it won’t appeal to all consumers who are looking for something different. Limited number of destinations, it does not have a large variety like its competitors. 12 Appendix 4: Preferred Holidays by Single Travellers in UK (Mintel, 2013) 13