SUPPLY CHAIN MANAGEMENT Online/Distance Learning Course

advertisement

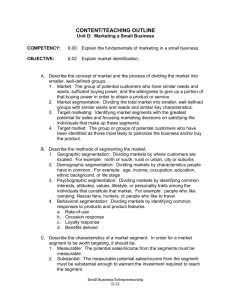

SUPPLY CHAIN MANAGEMENT: An Organizational Competency INTRODUCTION TO THE COURSE http://awhitebread.ba.ttu.edu alan.whitebread@ttu.edu ALAN L. WHITEBREAD IB 3353 • Learning and doing in a business environment – always prepared! • 4 TESTS • EXERCISES / HOMEWORK • No make-up tests! No extra credit! COURSE STRUCTURE • • • • Business environment Read ahead to prepare for class everyday Attend class AND take good notes Analyze, create, learn, understand, and apply [versus memorize] • Form opinions based on facts and analysis • Participate – Some in-class activities – Your comments and questions KEY LEARNING OUTCOMES • Understand the four major basic parts of supply chain management. – understanding markets and supply chains, – supplier management and supplier relationships, – the role of the focal firm, its strategy and systems, and – marketing channels of distribution and channel relationships . • There are many concepts and theories that are relatively easy to understand at a high level but are very complex and difficult to implement. • New product development [NPD] is critical to the continuing success of the firm and the role SCM has in the NPD cycle. YOUR CAREER SUCCESS DEPENDS ON being • • • • • INDIVIDUAL & TEAM SUCCESS ON TIME UNDER BUDGET ABOVE PLAN NO EXCUSES • EVERY TIME! LEARNING OUTCOMES AND YOUR CAREER SUCCESS • Begin to understand the many forces that cause changes to marketing programs around the world. – Culture – Business practices and legal systems – Governmental issues and procedures SUPPLY CHAIN MANAGEMENT SECTION 1 Understanding the Market – Supply Chain Relationship 1 – UNDERSTANDING AND CREATING VALUE ALAN L. WHITEBREAD KEY LEARNING OUTCOMES • Understand the four major basic parts of supply chain management. – understanding markets and supply chains, – supplier management and supplier relationships, – the role of the focal firm, its strategy and systems, and – marketing channels of distribution and channel relationships . • There are many concepts and theories that are relatively easy to understand at a high level but are very complex and difficult to implement. • New product development [NPD] is critical to the continuing success of the firm and the role SCM has in the NPD cycle. WHAT IS SCM TODAY? It is the seamless end-to-end management of a complex set of decisions requiring the exchange and flow of information, products, services, and money. Simply put, BUSINESS ENVIRONMENT Regulatory compliance and corporate governance Ethical, government Risk Management Customer, planning, quality, research, supplier, systems Human Resource Development Staffing and compensation Education and skill development: change, education, professional development, team Information Technology Knowledge Management, MRP/ERP, JIT Sourcing Inventory & Logistics Customer Relationships Supplier Relationships Payments Order fulfillment Procurement FIRMS USING SUPPLY CHAIN MANAGEMENT The Aromatics (Thailand) Public Co. Ltd. plus every other company, governmental agency, and organization. SUPPLY CHAIN MANAGEMENT Mining companies – Manufacturers – Suppliers – Assemblers – Services MARKETS Consumers: Customers Prospects Suspects FOCAL FIRM NEW PRODUCT DEVELOPMENT Resellers of all kinds or final purchasers Final purchasers of Resellers SUPPLY CHAINS ARE INTERDEPENDENT MARKET Consumers: Customers Prospects Suspects CUSTOMERS SUPPLIERS’ SUPPLIERS If you change one thing in a supply chain, you know that one or more other things will be affected. So you must make decisions for the good of the entire supply chain, not for a specific area. For instance, the system losses in all other areas may greatly exceed the benefit to the one area. This causes the supply chain to lose efficiency. MAJOR BENEFITS OF SCM • is due to the timely flow of information, products and services, and money. • is driven by the focal firm’s specifications, and requirements for their suppliers. • is a result from the close working relationships between your suppliers, your customers, and the focal firm. • results from the improved customer and supplier responsiveness and faster NPD. MAJOR BENEFITS OF SCM • are driven throughout the system with critical systems like Total Quality Management [TQM]. • is required to minimize delays, inventory levels, and total cost structures. • as you build closer and more effective relationships. • From here on, the term products will mean products, and/or services, or any combination of products and services. SUPPLY CHAIN SUCCESS: Some hard questions • Who are we? • How do or should we … – – – – Fit competitively? Understand customer behavior at all levels? Understand customer needs and wants? Understand which competencies, technologies, and processes are required? – Understand the role of power in the supply chain? – Gain a detailed understanding of costs from a simple operation through to total system cost? FILLING THE GAPS • • – – – – – When? Where? How many? In what mix? Delivered how? – – – – – When is it made? Where? How many? How is it scheduled? How is it delivered? DEMAND PULLS ALL PRODUCT! B2C B2B Suppliers Manufacturers B2C is business-to-consumer. B2B is business-to-business. Warehouses or Distribution Centers Resellers B2B or B2C Consumers Planning and forecasting accuracy are critical as any delay in the system has a ripple effect! That ripple effect costs members time, money, and damaged relationships. EMPOWERED CUSTOMERS • Customers have quick access to extensive product and pricing information. • Consumers are increasingly demanding – • Consumers are demanding more and better services. • CREATING CUSTOMER VALUE These are some of the tools available to you to create and increase customer value. A great SCM system will strive to add value throughout the supply chain with everything it does. Benefits Quality Innovation Cost Delivery Flexibility • Benefits are the reason we buy everything! • Benefits – May be – Must be – Must always • Delivering meaningful benefits and exceeding customer expectations are the keys to customer satisfaction in every step of the supply chain. QUALITY TO THE END-USER • David Garvin identifies the following factors that comprise quality. 1. of the products 2. of the products - 3. of the products 4. Conformance to standards and specifications 5. Durability of the products 6. Serviceability of the products - 7. Aesthetics of the products - 8. Perceived quality of the products ADDITIONAL ASPECTS OF QUALITY • • • • Service level • • Product Flexibility • Delivery • QUALITY: MANUFACTURING • Productivity – Improve current processes – Develop innovative processes • Strategic locations – If you had a product that would be sold frequently to most adults in the U.S., how would you get enough inventory in the right places to service customer needs? – How do the differences between a sophisticated and an unsophisticated product affect service levels of the locations? • Supply chain management in place QUALITY: DESIGN AND SPECIFICATIONS • • • • Design to meet Design to meet Design for Exceed standards organizations specifications QUALITY: PROCESSES • Works right the first time and every time! • – A batch lot sampling approach to quality [percent defective] – At a customer specified level – Standards might include • Mil-Std-105E; ANSI/ASQC Z1.4-1993 and 2003; ISO 28591 [1999] – It is frequently found in • food, pharmaceutical, medical device, communications, apparel, software, and many more industries. QUALITY: PROCESSES • are used when a process variable is counted rather than measured. Here’s how its done. – Calculate the mean [average] for the variable. – Calculate the standard deviation [σ ]for the variable. – The control chart limits for an acceptable product = Mean ±σ QUALITY: PROCESSES • – A statistical approach to quality – It is frequently found in • communications, financial services, healthcare, many manufacturing firms, and others. • Supplier rating / categorization – Suppliers are rated / categorized and each supplier level has its minimum requirements – Ship-to-stock is generally the highest level of supplier. They will ship products in your packaging directly into your inventory for shipment to your customers. QUALITY: SERVICE • Exceeding service expectations is the key to value realization. Value realization is the customer perception of your worth versus your cost. – You purchased something for its perceived benefits. – It performed better than expected. – It was a better value than you initially thought. – What are you likely to do? • Service must be seamless for the customer! QUALITY: COST • Continuous improvement drives process efficiency! • The International Metric is Landed cost [LC] LC = Standard Cost + Transportation1 + Insurance + Duties + Other Fees 1 Inland location to outbound port + port fees + transportation to inbound port + port fees QUALITY: FLEXIBILITY • The outstanding firm has these characteristics. – Change is embraced and indigenous to all processes. • Any process can always be improved. – It can easily handle shorter lead times, special requests, unexpected events, and varying quality specifications. – It employs sophisticated information systems and highly developed processes are in place. – The thrust of the organization is to QUALITY: DELIVERY • • Correct products shipped • Correct quantities [exact amounts, no partial orders unless requested by the customer] • Correct • Correct order • An automotive supplier may be required to provide parts for the truck in the order they need to go to the assembly line. QUALITY: INNOVATION • – Suppliers can provide excellent advice. Get them involved early and you may get a nice surprise. • Joint teams with hand-picked members from each entity address – – Design • – Process improvement – Cost reduction – Major opportunities or problems CUSTOMER SATISFACTION … 1. is based on the perceived benefits, the performance of the product and/or service, and the quality of the organization[s] that support it relative to customer expectations; and 2. It depends on understanding customer needs and wants then providing solutions with meaningful benefits, and 3. It must become deeply ingrained into the corporate culture. CUSTOMER SATISFACTION AND EXPECTATIONS • Customer expectations must be managed so benefits always exceed them! Overcommitting only leads to disappointment and customer dissatisfaction. • Customer expectations are the bases for customers measuring their satisfaction. • Increased customer satisfaction leads to increased brand loyalty. THE VALUE OF CUSTOMER SATISFACTION • SCENARIO 1 – Benefits greatly exceed expectations = Very satisfied customer • Customer is loyalty and recommending • SCENARIO 2 – Benefits exceed expectations = Satisfied customer • Customer is less loyal, provides a weak if any recommendation THE VALUE OF CUSTOMER SATISFACTION • SCENARIO 3 – Benefits meet expectations = customer is indifferent • Customer is neutral, not recommending you • SCENARIO 4 – Benefits are below expectations = Dissatisfied customer • Customer is not loyal, not recommending you • SCENARIO 5 – Benefits are far below expectations = Very dissatisfied • Customer will not purchase from you again. Customer shares their bad experience others. CUSTOMER SATISFACTION • Metrics – ways to measure customer satisfaction – Percent on-time delivery – Percent of order complete – Percent defective products – Speed of response • Product / service gaps – What products / services are we missing? CUSTOMER-CENTRIC STRATEGY • All supply chain activities are a result of a customer buying or wanting to buy a product and/or service. • A customer-centric strategy asks – What are the real needs of our • customers? • customer’s customers? • ultimate end-use customers? – What • information must be shared, and • capabilities developed, through the supply chain to meet these needs? – How can we improve the overall supply chain’s customer fulfillment capabilities? CUSTOMER-CENTRIC STRATEGY • A firm likely has different customer segments with different service expectations within a target market segment. • In addition to customer segments, very large accounts are likely to have specific individual service requirements. MARKET SEGMENTATION AND CUSTOMER-CENTRIC STRATEGY • Market segmentation is the identification of unique groups or sets of customers and prospects who possess similar characteristics or needs. • Market segmentation is the basis for – understanding the needs of market segments, – – developing market segment profiles, – – determining an effective marketing mix, and – CUSTOMER ANALYSIS • To complete a thorough customer analysis, you need to be able to answer these questions. – What do each of our tiers of customers need to succeed? • • • … • CUSTOMER SEGMENTATION • Your customer analysis by tiers from the previous slide may provide some interesting insights. • You may also need to analyze customer types within tier – For example, if a tier is B2B distributors it would be best to understand their needs by type of business they are in like electrical, MRO, medical, etc. They are likely to have some important differences. CUSTOMER SEGMENTATION • Types of customers within tiers – • “20% of your customers provide 80% of your sales” – but you have the ability to manage the mix. • – “A” customers are the largest and should receive the best service. – “B” customers are the next largest and should receive sufficient service to grow. – “C” customers are the smallest and should be serviced with a minimum of resources [transactional accounts]. Possible candidates for direct marketing activities. – Just make sure your customers are never told they are a “B” or a “C” customer! CUSTOMER SEGMENTATION • As you do your customer segmentation make sure you also define expected service levels. – Examples of things to consider could include • • • • – ? Communications: frequency, levels, … Role of teams Information systems Processes EVALUATING CUSTOMERS • What are the best measures for evaluating customers for our firm? – Net sales, profits, growth prospects, …, ? • What tools can we use to measure this? – • Ties specific costs directly to the customers that create them. • Used to identify the profitability of a business relationship. – Customer Relationship Management [CRM] • Used to create customer profiles that capture buying habits and determine customer profitability. • Many firms have a lot of work to do to incorporate relationships and tie this to an efficient direct marketing campaign. – These must be balanced with customer opportunity for growth in revenue and profit! CUSTOMER SERVICE GAPS • Our customers continually evaluate us and we must exceed their expectations in all areas to not suffer from a customer service gap. • Customer service gaps can exist in – – – – – Speed of response Quality of response Not delivering as promised Poor or untimely information flow ? MARKETING DEGREE: Emphasis in Supply Chain Management • • • • • MKT 3353 Supply Chain Management MKT 4358 International Marketing MKT 4370 Logistics Management MKT 4371 Logistics Analytical Methods IB 4361 International Commerce See my website for the brochure or your advisor for degree plan information. http://awhitebread.ba.ttu.edu SUPPLY CHAIN MANAGEMENT Online/Distance Learning Course SECTION 1 Understanding the Market – Supply Chain Relationship 2 – THE SUPPLY CHAIN: AN OVERVIEW ALAN L. WHITEBREAD THE FIRM’S ENVIRONMENTS - Competitive -Corporate culture - Cultural - Functional and crossfunctional relationships - Economic - Legal - Political - Reward systems - Strategic priorities - Comparative advantages -Core competencies - Overall competitiveness [key success factors] SUPPLY CHAIN MANAGEMENT FIRM’S ENVIRONMENT MARKET POSITION STRUCTURE & OPERATIONS [SCM] THE PROCESS IS SOUND. THAT IS WHY WE USE CONTINGENCY THEORY. CONTINGENCY THEORY • Contingency theory sets the framework to evaluate alternatives using scenario planning. • Every good executive and manager is continually aligning the firm’s resources to take advantage of opportunities in the marketplace. • The central question a supply chain manager must continually answer is … – TREE DIAGRAM What will they do? ? Underdeveloped Nations: Rapid increase in population Poorly educated What will they buy? Lack of water ? Lack of food Very poor infrastructure … Normal increase in population SUPPLY CHAIN MANAGEMENT • requires – a common understanding by all entities [levels or tiers] of supply chain objectives; – an understanding of all individual entity roles; – the ability to work together across entities, functions, and levels of responsibility; – the flexibility to adapt in a timely manner to various or unpredictable situations, and, – the desire to create and deliver products and services that provide excellent customer value. SUPPLY CHAIN MANAGEMENT MARKETS Consumers: Customers Prospects Suspects CUSTOMERS SUPPLY CHAIN MANAGEMENT Entities and their Roles PLUS – Information Requirements – Flows and Processes – Repelling Competitive Thrusts – Building Relationships SUPPLIER’S SUPPLIERS SUPPLIERS FOCAL FIRM CUSTOMERS CUSTOMER’S CUSTOMERS THE SUPPLY CHAIN AT WORK: A product flow view DEALERS STEEL UPSTREAM DIRECT FORD, GM RENTAL CONSUMERS BUSINESSES COMPANY SUPPLIER SUPPLIER CHRYSLER AGENCIES CONSUMERS 3RD TIER 2ND TIER 1ST TIER FOCAL FIRM Manage all other tiers. STEEL FASTENERS RADIATORS VEHICLES FLEETS SPECIAL VEHICLES SCM: • INFORMATION – – – – Market research Supplier research Process or system research Technology research SCM: PULL AND PUSH INFORMATION FOCAL FIRM CUSTOMERS SUPPLIERS Suppliers accessing Wal-Mart’s store data. RESELLERS SUPPLIERS FOCAL FIRM CUSTOMERS Toyota suppliers advising deliveries will be short due to the earthquake. SCM: FLOWS AND PROCESSES • FLOWS AND PROCESSES – FLOWS • – PROCESS INTEGRATION • Suppliers – Upstream • Focal firm – Internal Integration • Customers – Downstream • Complete – End-to-End Integration SCM: FLOWS AND PROCESSES – MAJOR PROCESSES [SYSTEMS] • Suppliers – Supplier relationship management • Focal firm – Demand management – Manufacturing flow » » – Order fulfillment » – Product development and commercialization – • Customers – – Customer service » SUPPLY CHAINS VS. VALUE CHAINS: AN HISTORICAL PERSPECTIVE SUPPLY CHAIN LOGISTICS The connected set of all value-added business entities and flows that perform or support the logistics function required for production. All discrete and Interrelated activities [regardless of ownership] that seek to enhance firm performance Focus on upstream supplier and producer processes, efficiency, and waste reduction. VALUE CREATION in every single event, process, and/or system from raw materials through customer satisfaction. Focus on downstream value creation for the customer SUPPLY [VALUE] CHAIN SUPPORT ACTIVITIES • Infrastructure • Human resources • Materials Management – Purchasing or procurement function • Technology development SUPPLY [VALUE] CHAIN: DIRECT ACTIVITIES • Inbound logistics • Operations • Outbound logistics • Marketing and Sales • Customer Services SUPPLY [VALUE] CHAIN GOAL • To combine the support and direct activities to create the greatest value as perceived by the target market[s] segment[s]. EXTERNAL SUPPLY [VALUE] CHAINS • CUSTOMERS • SUPPLIERS • MARKETS • STAKEHOLDERS SUPPLY CHAIN PRINCIPLES: • MAXIMIZE VALUE AT EVERY OPPORTUNITY FOR ALL YOUR STAKEHOLDERS [PUBLICS]. EMPLOYEES VENDORS SHAREHOLDERS CUSTOMERS INTERESTED PARTIES WHO ELSE? A SUPPLY CHAIN • REPELLING COMPETITIVE THRUSTS – Market [segment] share – Large customers – – – SUPPLY CHAIN PRINCIPLES: • Builds relationships – Suppliers – Focal firm stakeholders • • • • • • Customers Employees Shareholders Suppliers Special interest groups … SUPPLY CHAIN MANAGEMENT Online/Distance Learning Course SECTION 1 Understanding the Market – Supply Chain Relationship 3 – INFORMATION [research for the supply chain] ALAN L. WHITEBREAD WHAT ARE THE COMMON GOALS OF SUPPLY CHAIN MANAGERS? • In rank order – – – – – – – Increase sales Get more value from current investments Reduce the amount of direct labor and material Migrate to a higher percentage of variable cost through outsourcing SCM MANAGEMENT PROCESSES 1. 2. 3. 4. 5. 6. 7. Customer relationship management [CRM] Customer service Demand forecasting Inventory control Order fulfillment Manufacturing flow and scheduling New product development & commercialization 8. Procurement 9. Returns – Rework – Replace - Disposal 10. Supplier interfaces THE RESEARCH PROCESS Present the findings Collect data Develop the research plan Analyze the data INFORMATION • What information do we need about our external environment? – Competitive • Actions, new developments, new products, new entrants, … – Legal • New laws, regulations, and procedures – Cultural • How do we appear to be native to this culture? – Economic • How well do we understand the impacts of economic trends and cycles on our business[es]? – Political INFORMATION • What information do we need about consumers [markets]? – Strategy analysis – Market research • What are their needs? – New / existing business analysis – Market segmentation / share – How do markets view our competitors and their offerings? – ? INFORMATION • What information do we need about suppliers? – Capabilities • Facilities, output, technological prowess, … ? – Financial status and prospects [10K and 10Q] – Management team and style – How well do they comply with security needs? – How well do they meet standards and compliance needs? – What are there systems, processes, process flows, … –? INFORMATION • What information do we need about our organization? – Competitively speaking, how do we fare technologically? – Are processes and procedures as efficient as they can be? • Inventory management and live inventory – Do we have an above average supplier management program? – Do we have exceptional • market segmentation? • customer classifications? – Have we implemented best practices throughout the organization? – How do we expand and streamline global operations? – ? INFORMATION • What information do we need about our organization? – Are we prepared to handle emerging key issues? • The rapidly rising cost of transportation • The falling or rising value of the dollar • Technology challenges – • The challenge of energy efficiency? • The challenge of becoming ecology friendly? • ? INFORMATION • What information do we need about our – – – – – How do they want to purchase? What are they really good at? How good is our reseller selection process? What do they need to become better? ? INFORMATION • What information do we need about our – – – – – How do they use our products? What are their attitudes about …? What do they like most about us? Where do they perceive product and/or service gaps? ? SUPPLY CHAIN MANAGEMENT SECTION 1 Understanding the Market – Supply Chain Relationship 4 – MARKET DEFINITION, SEGMENTATION, AND TARGET MARKETING ALAN L. WHITEBREAD MARKET SEGMENTATION • This is a multi-step process that must be done in a sequence of six steps. • It groups people or entities by their most important attributes. • It should determine unique [preferably] or nearly unique segments where each segment will have its own behavior pattern. MARKET SEGMENTATION - A SIX-STEP PROCESS MARKET SEGMENTATION What are the attributes with minimal overlap? MARKET TARGETING Which segments do we want to pursue? MARKET POSITIONING How do we want to be perceived? 1-Identify the bases for selection. [Why are you splitting it this way?] 2-Develop a detailed market segment profile for each one. [Clearly identify attributes of each segment.] 3-Select and develop measures of target market attractiveness. 4-Select the best target market segments to pursue. 5-Develop a market position for every target market segment. 6-Develop the marketing mix for every target market segment. MARKET SEGMENTATION: BASES MARKET SEGMENT AND TARGET MARKET 1+ CHILDREN HISPANIC TARGET AGES 25-34 HOUSEHOLD INCOME OVER $50,000 In this example, the key attributes are Hispanic, ages 25-34, with household income over $50,000 per year having one or more children. The target market segment is the intersection of all four attributes. It is the small colored area named TARGET. [Oxford - MacDonald - video] MARKET SEGMENTATION - DEVELOP ATTRACTIVENESS MEASURES • WHY IS MARKET SEGMENTATION WORTH DOING? – It provides for very targeted communications. – It helps you provide products that fulfill needs and wants. – It allows you to respond to changing markets and conditions. – It makes your marketing more efficient. • BUT, IF THE MARKET SEGMENTATION IS WRONG, LITTLE SEEMS TO WORK WELL AFTERWARD! MARKET SEGMENTATION • Multiple market segments When a firm uses the market segment approach it usually has between three and eight market segments. Market segments that are not nearly unique result in lack of brand loyalty and consumers being less brand loyal [cannibalization]. Venn diagram explanation. • From 2009 to 2011 P&G is reducing the number of detergent segments in the U.S. from 13 to 6. Remember - the number of market segments is a function of your market segmentation, not some arbitrary range. The more segments you have the more complex and expensive the marketing effort is likely to be. CONSUMER MARKET SEGMENTATION METHODS – DEMOGRAPHIC [1] REGION Great Lakes, Southwest, Mountain States, … CITY SIZE Major metropolitan areas [SMSA], small cities [<100,000], … DENSITY OF AREA Urban, suburban, exurban, rural CLIMATE Temperate, hot, humid, rainy “Lubbock’s leading radio station” CONSUMER MARKET SEGMENTATION METHODS – DEMOGRAPHIC [2] CULTURE American, Italian, Chinese, Mexican, … RELIGION Catholic, Protestant, Jewish, Moslem, … SUBCULTURE / RACE / ETHNICITY African-American, Caucasian, Asian, Hispanic, … FAMILY LIFE CYCLE Bachelors, young married, empty nesters, … GENDER Male, female CONSUMER MARKET SEGMENTATION METHODS – DEMOGRAPHIC [3] AGE Various age groups that match the Census Bureau categories MARITAL STATUS Single, married, divorced, living together, widowed INCOME Under $25,000, $25,000-$34,999, $35,000-$49,999, $50,000-$74,999, $75,000-$99,000, $100,000 and over - Census Bureau has more detail - EDUCATION Some high school, high school graduate, some college, college graduate, postgraduate OCCUPATION Professional, blue-collar, white-collar, agricultural, military [Be careful, subjective definitions like blue-collar can lead to problems.] CONSUMER MARKET SEGMENTATION METHODS – PSYCHOGRAPHIC [1] NEEDS-MOTIVATION Shelter, safety, security, affection, sense of self-worth PERSONALITY Extroverts, novelty seeker, aggressives, low dogmatics PERCEPTION Low-risk, moderate-risk, high-risk LEARNINGINVOLVEMENT Low-involvement, high-involvement ATTITUDES Positive attitude, negative attitude SOCIAL CLASS Lower, middle, upper, … CONSUMER MARKET SEGMENTATION METHODS – PSYCHOGRAPHIC [2] LIFESTYLE SEGMENTATION Economy-minded, couch potatoes, outdoors enthusiasts, status seekers, … ATTITUDES, INTERESTS, & OPINIONS [AIO] for instance: Spends 1+ hours per day on the Internet, heavy e-mail user Buys on the Internet, goes to stores only as required Professional, income above $75,000 per year Belongs to multiple frequent traveler programs The market profile should provide almost everyone that reads it a very similar picture of the people in this target market segment! CONSUMER MARKET SEGMENTATION METHODS - BEHAVIORAL USAGE, LOYALTY, INNOVATIVENESS Frequent flyer programs OCCASION Hallmark U.S. CONSUMER COMMUNICATIONS MARKET SEGMENT PROFILES 1. Older [define age range [45+]], low communicator [define [<1 hour per day on the phone]], low income [define range or maximum [$15,000-30,000 per year] 2. Middle-aged, higher income, empty nester [no children at home], who talks a lot on the phone 3. Technology interested [extensive user of several communications modes], well educated, high discretionary income You must define every term so there is a clear understanding of the profile! B2C EXPECTED BUYER BEHAVIOR • Exercise: – Describe the expected buyer behavior profile of the market for any current product. – Use key items like demographics, psychographics, purchasing patterns, quantity, the marketing mix, classification of your product, and other relevant items to generally describe how consumers would purchase this item. • ON YOUR OWN: Develop a buyer behavior profile for college students purchasing pens for class use. MARKET SEGMENTATION: FILLING THE GAPS CHANNELS OF DISTRIBUTION 3 4 2 MARKETS / SEGMENTS PRODUCTS SERVICES APPLICATIONS TWO LARGEST TARGET MARKET SEGMENTS In this example, you have to decide which target market segments are good for your firm. #1 needs a channel of distribution you are either not in or have a very weak position. That is very hard to do. #2 and #4 are nice size. A large firm will attack #2, but #1, #3, and #4 may be too small to be of interest. #3 is the hardest of all because it has channel and product mix issues. B2C TARGET MARKET SEGMENT CRITERIA: Kotler’s 5 tests • MEASURABLE • Can I quantify the size of the market [segment]? • ACCESSIBLE • Can I access the market [segment] with my current channels of distribution? • SUBSTANTIAL • Is the market [segment] large enough to be worthwhile? • DIFFERENTIABLE • Can our products be clearly differentiated? • ACTIONABLE • Does my company have the necessary staying power? YOU ALWAYS NEED TO IDENTIFY A UNIQUE OR NEARLY UNIQUE RESPONSE / BEHAVIOR PATTERN FOR EVERY SEGMENT! LEVELS OF MARKET SEGMENTATION UNDIFFERENTIATED [MASS] MARKETING The firm decides to ignore market segment differences. One marketing mix Same product to all segments Salt Sugar Early Ford DIFFERENTIATED [SEGMENTED] MARKETING The firm decides to target several [large] market [s] segment[s] Each market or segment has a marketing mix Different products for each market segment Proctor & Gamble detergents Current auto manufacturers LEVELS OF MARKET SEGMENTATION CONCENTRATED [NICHE] MARKETING The firm decides to pursue a larger market share of selected [smaller] market segments, sub-segments, or niches Different products to the [sub-]segments Different marketing mix for each segment or sub-segment SUV’s standard to family to luxury MICROMARKETING Specialized products for individuals and locations LOCAL MARKETING [Brands, promotions] Local chain grocery stores INDIVIDUAL MARKETING [1:1 marketing] Amazon, Dell #2 – DIFFERENTIATED MARKETING • A different marketing mix for each large segment. – Marriott International [circa 2000] • • • • Marriott Suites…………...Permanent vacationers Fairfield Inn……………..……...Economy Lodging Residence Inn………….……….....Extended Stay Courtyard By Marriott………..Business Travelers TRANSITIONED TO CONCENTRATED [NICHE] MARKETING [beginning in 2008 -13 brands] MARKET TARGETING: CHOOSING A MARKET-COVERAGE STRATEGY • Some questions about key factors to consider when deciding on a market-coverage strategy include the following. – – – – – What are the available company resources? How much market variability exists? What is the product’s life cycle stage? How much product variability exists? What is the typical behavior of the competition and their actions/strategies? CHARACTERISTICS OF BUSINESS VERSUS CONSUMER MARKETS BUSINESS MARKETS CONSUMER MARKETS Market Structure Geographically concentrated Many types of markets [segments] Fewer very-high volume buyers Fluctuating, derived demand Geographically dispersed Mass markets Small volumes Primary demand Products Standard / complex / custom Service[s] etc. are critical Business applications Engineering / Quality / Testing involvement Standard Service etc. of some note Personal use No formal evaluation Buyer Behavior Professionally trained Multiple levels involved Performance hurdles Individuals purchasing Some family influence Social / psychological drives Buyer-Seller Relationships Technical expertise Amateur Close interpersonal relationships Impersonal Long-term focus Immediate / Short-term May be very dependent on each other CHARACTERISTICS OF BUSINESS VERSUS CONSUMER MARKETS BUSINESS MARKETS CONSUMER MARKETS Supply Chains / Channels of distribution Predominant Often shorter [more direct] Not seen by consumer Usually indirect Promotion Often technical Personal selling Often involves resellers Simple Advertising Price Professional negotiating / purchasing Volume sensitive Complex formalized process Competitive bid / Many strategies Individuals limited purchasing skill Little, if any, leverage Simple process N/A Demand Fluctuating, derived demand Inelastic in the short-run Volatile and discontinuous Direct Elastic Limited volatility THE ECONOMY AND NAICS Every economy has a similar economic organizational structure. GROW, BUILD, OR MAKE Agriculture GOV’T SERVICE Wholesale Information Finance Mining Retail Real Estate Professional Utilities Transportation Construction Manufacturing SELL Management Administration Entertainment Education Health Accommodation Other Public Administration BUSINESS CLASSIFICATION You can find NAICS details at www.census.gov • NORTH AMERICAN INDUSTRIAL CLASSFICATION SYSTEM [NAICS] – SUPPLY-ORIENTED SYSTEM – 20 SECTORS: 1,065 INDUSTRIES [in 2012] – Compatible with • NAFTA: 5 DIGITS + 6TH FOR COUNTRY CODE • ISIC Rev. 3 [UN] READING NAICS TABLES - PAGERS • 51 Economic sector » Information • 511 Economic sub-sector » Broadcasting and Telecommunications • 5111 Industry group » Telecommunications • 51111 Industry group » Wireless Telecommunications Carriers • 511111 U. S. Industry specialized identification » Paging TYPES OF MARKETS • HORIZONTAL MARKET – Numerous NAICS codes define it. • B2C – Inexpensive pens, pencils, pads of paper, … • B2B – floor sweeping compound • VERTICAL MARKET – One or a few NAICS codes define it. – May be very profitable [niche] • B2C – $1,000 fountain pen • B2B – CT scanner BUSINESS SEGMENTATION VARIABLES Organizational Characteristics -Industry -Size -Channel -Operating characteristics Product[s] or Process[es] or Technology[ies] -Level of technology -Configuration -Design Buying Approach -Centralization -Functional involvement -Partnering Application[s] of Products / Services -What are they used for? -How they are used? BUSINESS MARKET SEGMENTATION • ORGANIZATIONAL CHARACTERISTICS – GEOGRAPHIC • How can I sell my new pen to ALL 400,000 businesses in the Chicago area? – DEMOGRAPHIC • How do I get my resume to all firms with 500 or more employees? BUSINESS MARKET SEGMENTATION MATRIX MARKET (SEGMENT) NAME Brief verbal description INDUSTRY / INDUSTRY / INDUSTRY / INDUSTRY / SEGMENT NAME SEGMENT NAME SEGMENT NAME SEGMENT NAME DESCRIPTION DESCRIPTION DESCRIPTION DESCRIPTION NAIC(S) NAIC(S) NAIC(S) NAIC(S) APPLICATION 1 PRODUCT 1 PRODUCT 2 APPLICATION 1 PRODUCT 1 PRODUCT 1 APPLICATION 1 APPLICATION 2 APPLICATION 3 You get the same result using products within applications or applications within products. B2B TARGET MARKET SEGMENT CRITERIA 1. MEASURABLE – The degree to which you can measure buyer characteristics 2. ACCESSIBLE – The ability to focus on target market segments 3. SUBSTANTIAL – The degree to which target market segments are large enough and potentially profitable enough to pursue B2B TARGET MARKET SEGMENT CRITERIA 4. COMPATIBLE -The extent to which marketing and business strengths compare to current and expected competitive and technology states 5. RESPONSIVE -The extent to which target market segments respond to elements of the marketing mix POSITIONING: ESTABLISHING CUSTOMER VALUE • POINTS OF PARITY [POP] AND POINTS OF DIFFERENCE [POD] – RELEVANCE • It must be relevant and important. – DISTINCTIVENESS • It must be distinctive – superior [actual or perceived] is nice. – BELIEVABILITY • It must be believable and credible. STARBUCKS POP AND POD COMPETITOR POParity PODifference Fast food chains / convenience stores Convenience Value Quality Image Experience Variety Supermarket brands for home Convenience Value Quality Image Experience Variety Freshness Local café Quality Experience Price Community Convenience POSITIONING: ESTABLISHING CUSTOMER VALUE • POINTS OF CONTENTION [POC] – Elements where there is disagreement as to how its performance or functionality compares to the next best alternative. – Seen in comparison or negative advertising • COMPETITIVE FRAME OF REFERENCE – Comparative advertising – Negative advertising COMMUNICATIONS MARKET EXERCISE POINTS OF …Parity …Difference Must be relevant and distinctive and believable …Contention ANDROID IPHONE SUPPLY CHAIN MANAGEMENT Online/Distance Learning Course SECTION 1 Understanding the Market – Supply Chain Relationship 5 – SYSTEMS THINKING AND SUPPLY CHAINS ALAN L. WHITEBREAD FUNCTIONAL ORGANIZATION THINKING AND GOALS PURCHASING PRODUCTION Metrics: Standard cost [SC], PPV Metrics: SC / volume / automation MARKETING LOGISTICS Metrics: Average unit price [AUP] Metrics: Inventory & transportation SUPPLY CHAIN MANAGEMENT: PROCESS THINKING AND GOALS • – aligns decisions with corporate strategy, and – coordinates actions across • SCM is the maximization of value at every opportunity from supplier’s supplier to the customer’s customer. • SCM requires a process thinking approach that consists of sets of value-added flows and activities in three areas. – – – SYSTEMS THINKING • • Systems thinking is the holistic process of simultaneously considering both the immediate outcomes and the longer-term system-wide ramifications of decisions. • It requires: – – – – Information Availability and Accuracy Teamwork Metrics Systems Thinking INFORMATION – – – – – Bar Codes Radio Frequency Identification [RFID] Data Warehousing Data-Mining Materials Requirements Planning [MRP] or Enterprise Resource Planning [ERP] TEAMWORK • Hand-pick teams to accomplish specific objectives. – Process improvement – – Cost improvement – • They may be – – – METRICS • With a systems thinking approach we must be able to quantitatively measure changes in processes as well as the impact of any single change or set of changes on the total system. SYSTEMS THINKING • Requires all firms and employees anywhere in the supply chain to understand their place in the larger chain. • All entities must participate in – – – – – – Establishing the core goal[s] Defining systems and their boundaries Determining the nature of the interrelationships Determining the information requirements Performing trade-off analysis Evaluating and implementing system constraints THE FIRM AS A VALUE-ADDED SYSTEM • Everything the firm does must be focused on 1. 2. 3. increasing building strengthening THE FIRM AS A VALUE-ADDED SYSTEM – Core Competency • – • The skills and processes that together seek to deliver customer value at least equal to the most direct competitor. – • The total value that the firm promises to deliver to the customer. STRATEGIC DIRECTION OF THE FIRM [“THE CORE COMPETENCE OF THE CORPORATION” ARTICLE] • CORE COMPETENCY – The foundations [ ] upon which you build your business over a very long time. You need to compare your core competencies with those of your competitors. • THREE CORE COMPETENCY TESTS • – • – • – KEY SUCCESS FACTORS • NOT CORE COMPETENCIES • YOU MUST DO BETTER ALL THE TIME TO • Take a few moments now and apply the core competency tests to the following and see why they usually fail one or more of the tests. – Customer services – Design SWOT ANALYSIS Your firm and your major competitors IP Low cost structure Market position STRENGTHS OPPORTUNITIES BUILD EXPLOIT Take advantage of the firm’s strengths LEVERAGE CONSTRAINTS Use the firm’s strengths to offset competitive threats New markets, channels Acquisitions VULNERABILITIES Breadth of offering WEAKNESSES THREATS CORRECT AVOID Lack of management talent Offset the firm’s weaknesses Weak finances NPD PROBLEMS Counter threats Rapidly changing market New entrants Government regulations SWOT: EXAMPLE QUESTIONS • STRENGTH – What do we do better than others? • WEAKNESS – Where has performance declined? • OPPORTUNITY – What new trends [short-term and long-term] are emerging? • THREAT – Is a major technology change underway or expected in the industry? COMPETITIVE ADVANTAGE OF THE FIRM: PORTER’S THREE GENERIC STRATEGIES Customer Perceived Uniqueness Focus on perceived value. Examples = ? Low Cost Position OVERALL COST LEADERSHIP STRATEGY Hard to maintain long term. Examples = ? Understanding and focus. No direct battles with major competitors. Examples = ? STRATEGY AND SYSTEMS FIRM’S GOAL → INNOVATION • Short conceptto-market cycle time [autos] • Technological sophistication for advanced products [lasers] • Unique service options DELIVERY FLEXIBILITY QUALITY • On-time, exact quantity delivery • Availability [inventory] • High-quality products and/or services • Customer responsiveness COST LEADERSHIP • • Optimize the cost–service level Beware of “the low cost producer” versus “among the lowest cost producers” position STRATEGY AND SYSTEMS FIRM’S GOAL → INNOVATION Identify and develop suppliers who will provide: • Design expertise • Technological support • Flexibility to changes in specifications • Ample process capabilities DELIVERY FLEXIBILITY QUALITY Identify and develop suppliers who will provide: • Rapid, consistent delivery • Certified quality • Full line availability • Responsiveness COST LEADERSHIP • • • • • Identify and develop suppliers who will provide: Productivity Low prices [quantity price discounts] Learning curve efficiencies Scale / scope economies STRATEGY AND SYSTEMS FIRM’S GOAL → INNOVATION • Work closely with R&D [concurrent engineering] • Support process engineering DELIVERY FLEXIBILITY QUALITY COST LEADERSHIP • Shop floor control — • due-date performance • Shorten cycle times • • Cross-train workers • • Extensive process control • Reduce inventories • • Reduce inventories Increase repetitiveness Increase part commonality [modularity] Utilize low-cost labor Increase worker productivity STRATEGY AND SYSTEMS FIRM’S GOAL → INNOVATION • Utilize technology [bar codes, GPS; EDI, …] • Automated picking/packing for customized services DELIVERY FLEXIBILITY QUALITY • Use private fleet • and/or dedicated contract carrier for ontime delivery • Use IT to increase responsiveness [MRP • or ERP] • Implement • comprehensive quality approach [AQL, Six Sigma, …] COST LEADERSHIP Negotiate lowcost transport [utilization, multiple car rates] Minimize inventory Centralize and/or coordinate decision making PROCESS ENGINEERING • is the design of business processes using a methodology to optimize each specific process. PROCESS REENGINEERING • is the of business processes using DECISION MAKING AND UNCERTAINTY • Economic Value Analysis – Requires you to have outcome steps and a probability estimate for each outcome step. – The Expected Value [EV] is the sum of the probability of an outcome [Pn] times the value [Vn] of that outcome. EXPECTED VALUE EXAMPLE You are deciding between two alternatives with the following payoffs, states of nature, and probabilities. Which alternative should you choose? Alternative Poor Market Good Market Great Market EV 1 (.25)(10,0 00) (.55)(17,5 00) (.20)(28,5 00) 1 10,000 17,500 28,500 EV 1 17,825 2 -10,000 15,000 47,500 EV 2 (.25)(-10,000) (.55)(15,0 00) (.20)(47,5 00) Probability 25% 55% 20% EV 2 15,250 DECISION TREE EXAMPLE SUBSIDIARY PIECE PART PURCHASE OPTIONS Buy from U.S. 100% 10.00 / 100% = 10.00 [10.00 landed cost] Subsidiary purchases Buy from qualified local supplier Net cost 96% Net cost 9.80 / .96 = 10.21 [9.80 delivered cost] Manufacture the product [9.60 cost] 90% Net cost 9.60 / .9 = 10.67 PROCESS MAPS • A process is any activity that transforms an input set into an output set. • A process map is a visual representation that shows all steps in the correct sequence that is required to transform an input set into an output set. • A process map should show • PROCESS MAP PROBLEM Procurement Input Process Output [materials] [manufacture] [finished goods] Output Movement Delay Movement [customer receives finished goods] [to customer] [warehouse inventory] [to warehouse] Process mapping has its own set of diagram symbols. SUPPLY CHAIN MAPS • Help to identify major linkages and bottleneck areas with customers and key suppliers. • Tools like a pipeline map may identify unnecessary complexity or steps, thereby leading to improvements in efficiency of the supply chain. PIPELINE MAP EXAMPLE