Italian Angel Investing Market

advertisement

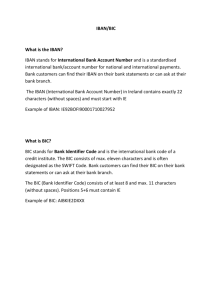

9 th ETAP Forum on Eco – Innovation Financing the eco-innovators «The Italian Angel Market & The Early Stage Investment Opportunities in Cleantech» Paolo ANSELMO IBAN President November 2010 4.4. Italian BA Profile Summary BA's personal profile from a recent Survey IBAN Association’s profile The Italian Angel Investing Market The Italian Business Angel’s profile Seed and Early stage investment opportunities in cleantech 2 4.4. Italian BA Profile IBAN Association (1) BA's personal profile from a recent Survey It is an Italian non-profit making Association – born in 1999, through a project promoted by European Commission (DG Industry) In Italy, it institutionally represents and promotes investment initiatives in the venture capital market coming from informal investors, usually called Business Angels (BA) IBAN’s President is board member of EBAN, the European Association that represents BA Networks and Seed Fund in Europe Through its birth, and a close co-operation with AIFI (the Association representing the formal venture capital in Italy), IBAN has felt up a remarkable gap in the Italian venture capital chain Today, IBAN represents a more than 500 informal investors community across all Italy 3 IBAN Association (2) Our Network to sustain Informal Venture Capital Market During last years, IBAN has created a strong “relationship network” that links Institutions and Economic Operators, Know–How and Expertise, covering all value chain in the early stage phase. In this way, IBAN can really support “start–up” entreprises in their growing process. FINANCING INSTITUTIONS SERVICES TO FIRMS IBAN TECNOLOGY CENTRES BUSINESS ANGELS NATIONAL AND INTERNATIONAL PARTNERS 4 IBAN Association (3) Our Network to sustain Informal Venture Capital Market IBAN Soci isolati, autonomi ed operativi BAN classico territoriale plurisettoriale BAN tematico, con operatività nazionale/interna zionale Club di angel investors 5 IBAN Association (4) Our Publications to sustain Informal Venture Capital culture •“Legal and Fiscal handbook for BA” - 2010, in partnership with Studio Legale Gianni, Origoni, Grippo & Partners. •“Formal Documents for Early Stage Phase” (NDA, Term Sheet, Investment Agreement) - 2010, with Studio Legale Rossotto & Partners •“Business Angels and Informal Venture Capital in Italy” - 2009, in collaboration with SDA Bocconi University – Finance Department •“Implementation of European MiFiD Directive and IBAN circuit activity”, 2008 – in collaboration with Studio Simmons & Simmons. •“Guide to setting up a business with Business Angel” - 2008, in collaboration with KPMG Italia. •“Business Angel in Italy” - 2003, in cooperation with Professors coming from II° Università di Napoli. •“Standard Behavior Handbook for BAN” in partnership with ISTUD Foundation, 2001. 6 Italian Angel Investing Market (1) Which are the data in 2009 ? A. INSTITUTIONAL SEGMENT Venture Capital (VC) and Private Equity companies have invested 2.615 ML €, with a decrease of 52% compared with 2008. Especially, for the Early Stage sector, they have closed 79 deals for an amount of 98 ML €. AMOUNT ML € N. DEALS Turnaround 416 11 Early Stage 98 79 Expansion 371 112 - - 1.688 72 TYPE OF STAGE Replacement Buy Out Sources: Aifi, 2010 7 Italian Angel Investing Market (2) Which are the data in 2009 ? B. INFORMAL VENTURE CAPITAL SEGMENT Investment amount registered by IBAN Deals Exit declared Average amount for deal Number of examinee projects EARLY STAGE SECTOR: Seed Start up Early expansion Other operations Sources: IBAN, Survey 2009 31.5 Mln € 179 33 176.000 € 1.394 32% 38% 27% 3% 8 Italian Angel Investing Market (3) Industry had a strong growth in the last years Investments Flow in Italy in Early Stage Phase: Ys 2005-2009 (in Mln €) 160 140 116 Total amount 120 98 Var ‘09/08 – 16% 100 80 66 60 40 20 0 30 28 8 2005 12 2006 20 2007 Informal 31 31.5 2008 2009 Var ‘09/08 +1.2 % Istitutional Sources: Institutional (Aifi, Pwc); Informal (Iban) 9 Italian Angel Investing Market (4) Deals in the industry follow the investments N. Deal Early Stage Phase in Italy Ys 2005-2009 300 Var ‘09/08 – 10% 250 79 200 150 88 100 50 0 88 52 56 35 2005 71 2006 N. Deal Informal 179 102 120 2007 2008 Var ’09/08 +49 % 2009 N. Deal Istitutional Sources: Institutional (Aifi – Pwc); Informal (Iban) 10 Italian BA Profile (1) BA's personal profile from a recent Survey • Man, 49 years old, top manager or entrepreneur, strong academic background (master’s degree, post-lauream) • Place of residence in the North of Italy (83%) • Range of 150-200 km to focus its investments to stress BA commitment with entrepreneur • Personal assets available around 1.000.000 € - IBAN Member • He generally allocates nearly 10% of own assets for Angel Investing • Average Investment for deal is around 176.000 € • Interesting in High Tech sector Source: Iban, Survey 2009 11 Italian BA Profile (2) BA's personal profile from a recent Survey ◆ BA's added values (over the risk capital) are: - strategies - contacts ◆ BA's best information's come from: - IBAN network - his personal network (others entrepreneurs & friends) Source: Iban, Survey 2009 12 Italian BA Profile (3) MAIN DIFFERENCES BAs IN USA AND ITALY USA ITALY 4.7 1.5 $ 50.000-100.000 (55%) $ 100.000-1.000.000 (25%) > $ 1.000.000 (20%) 45% < € 30.000 (33%) € 30-100.000 (33%) € 100-500.000(11%) > € 500.000 (11%) 76% ICT/software/internet, manufactures, Health Care/Med Tech by 250 km (28%) ICT/Software/Internet; Manufactures, Biotech/Med tech by 200 km (50%) 37% 42% Source of deal flow Formal Informal Preferred way out Trade sale/merger Trade sale/merger Average IRR registered Average holding period 27% from 3 to 6 years 22% 3.3 years USA (data 2009) – ITALY (data 2009) Average amount of deals per BA Average amount of investment per deal % Investments in seed and start-up phase Sectors of investment Geographic Area of investment % of potential BAs with no geographical restrictions Italian Angel Investing Market 2009, % Investments by sector Software and services 18% Handicraft manufacturing 17% Internet 1% ICT 13% Financial/ Insurance 4% Entertainment 8% Energy 7% Consumer & Distribution 3% Biotechnology & Med Tech 27% Agrofood 2% 0% Source: Iban, Survey 2009 5% 10% 15% 20% 25% 30% 14 What is Cleantech? Former Energy sector …… “The US Cleantech Group” provides a comprehensive definition: A “new, innovative technology to create products and services that compete favorably on price and performance while reducing humankind's impact on the environment” & “offering a cleaner or less wasteful alternative to traditional products and services” 15 The huge scope for cleantech investments Source: “The Cleantech Group” • Energy Generation: wind, solar, hydro/marine, biofuels, geothermal, other; • Energy Storage: fuel cells, advanced batteries, hybrid systems; • Energy Infrastructure: management, transmission; • Energy Efficiency: lighting, buildings, glass, other; • Transportation: vehicles, logistics, structures, fuels; • Water & Wastewater: water treatment, water conservation, wastewater treatment; • Air & Environment: cleanup/safety, emissions control, monitoring/compliance, trading & offsets; • Materials: bio, chemical, other; • Manufacturing/Industrial: advanced packaging, monitoring & control, smart production; • Agriculture: natural pesticides, land management, aquaculture; • Recycling & Waste: recycling, waste treatment. 16 Do these cleantech investments “compete favorably on price and performance”? Cleantech “alternative” Cleantech “alternative” The “traditional product” 17 Trends in cleantech investments Source: “The Cleantech Group” 18 Trends in cleantech investments Source: “PwC/NVCA MoneyTree report” 19 Is the Venture Capital business model broken? 20 The investment opportunity for seedstage investors • In order to be sustainable in the long-term and avoid dotcom-like bubbles cleantech investments have to be capital-efficient; • Cleantech is not only about renewable energies (i.e., PV, wind, biomasses.); there is a great deal of less capital-intensive investment opportunities in cleantech: suitable for seed-stage and less risk-averse investors; • Cleantech is also about seed- and early-stage investments: less capital intensive, better valuations, greater value-adding potential, but higher risk; fixing the big IRR issue of traditional venture capital investing. 21 How is IBAN going to address these challenges/opportunities? The forthcoming “Italian Cleantech Club” (1) • An investment club, operating through syndication, focussed on cleantech investment opportunities backed by an independent committee of cleantech specialists to source, and select the best deals; • Cleantech is a global opportunity; joint-marketplaces to exchange investment opportunities with some of the world's most successful cleantech clusters (Sweden, Israel, and other European countries); • Partnership with online content providers (i.e. www.energiaspiegata.it) to source the best cleantech technology transfer investment opportunities coming from the top Italian Universities. 22 How is IBAN going to address these challenges/opportunities? The forthcoming “Italian Cleantech Club” (2) • Incubators, Technology Parks, University technology transfer Offices and IBAN network will be the main deal flow sources • Seed and Early Stage investments in Italy and abroad between 50k and 500k euro, with possible co-investment with other Angel groups and Seed funds; • The Club will be managed by a specific Advisory Board (5 members) in charge of scouting and coaching business opportunities, also thanks to IBAN Association support; • 3 Investment Forum per year with 6 pitching companies each time; • Focus on 3-4 years exit time and trade sale way-out (M&A); • Per each deal a “champion” will manage the due diligence and the investment process; • Each ICA members (forecast 15-20) must fill a specific form in with his/her financial and managerial commitment. 23 How is IBAN going to address these challenges/opportunities? The forthcoming “Italian Cleantech Club” (3) Entrepreneur Business Angel Contact with IBAN Identification Executive Summary validation Drafting of Executive Summary Preparation of Elevator Pitch Confronting offer and demand Identification of investment priorities Circulation of Executive Summary MATCHING BA added to database Participation in investment forum/club 24 A first step has just been done : “The Green Technologies Investment Forum” • The GREEN TECHNOLOGIES INVESTMENT FORUM (GTIF), organized in February 2010 by IBAN Association (Italian Business Angels Network) and the Swedish Business Region Goteborg AB provided a unique chance during which investors and entrepreneurs coming from Italy and Sweden matched. • Eleven Italian and Swedish “green” companies, selected by a panel of experts, pitched their activities to qualified investors, Business Angels, Seed, Venture Capital Funds and Trade operators. • During the event two break-outs had been forecasted in which an Italian and Swedish keynote speakers presented strengths, weaknesses and opportunities of today clean-tech market. • All companies had a marketplace area where they could meet investors during and after the event • To cross experiences, best practices, business and trade opportunities 25 and networking have been the key words of the initiative www.iban.it Via Borgonuovo, 5 20121 Milan – Italy TEL.+39.02.89011207 FAX +39.02.89011299 segreteria@iban.it Member of: 26