Chapter 4

advertisement

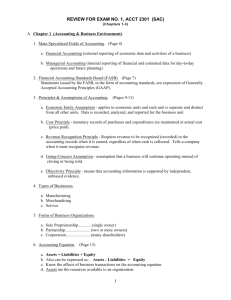

The Accounting Cycle Accruals and Deferrals Chapter 4 PowerPoint Authors: Susan Coomer Galbreath, Ph.D., CPA Charles W. Caldwell, D.B.A., CMA Jon A. Booker, Ph.D., CPA, CIA Cynthia J. Rooney, Ph.D., CPA McGraw-Hill/Irwin Copyright © 2012 The McGraw-Hill Companies, Inc.4-1 ADJUSTING ENTRIES Adjusting entries are needed whenever revenue or expenses affect more than one accounting period. Every adjusting entry involves a change in either a revenue or expense and an asset or liability. 4-2 Adjusting Entries Adjusting Entries are journal entries recorded at the end of an accounting period to adjust income and expense accounts so that they comply with the Accrual Concept of accounting. 4-3 ACCRUAL CONCEPT Business transactions are recorded when they occur. NOT when the related payments are received or made. 4-4 Accrual Concept Accrual Concept, requires that; Revenues of the business are recognised in the accounts when earned. Expenses are recognised when incurred. NOT when the money is received or paid. 4-5 Accrual Concept – Example-1 An airline company sells its tickets weeks before the flight is due. BUT It does not record the payments as revenue because the event on which the revenue is based has not occurred yet. Once the service has being provided, we can make the adjusting entry. (i.e. We can record it as received) 4-6 Accrual Concept – Example- 2 A business records its utility bills as soon as it receives them. Not when the bills are paid, because the service has already been used. 4-7 Adjusting Entries Adjusting Entries are necessary when accrual basis accounting is used. Adjusting entries allow businesses to adhere to the Matching Principle. 4-8 The MATCHING PRINCIPLE This principle, requires a company to match expenses with the related revenues in order to report the company`s profitability during the accounting period. 4-9 The Matching Principle Revenues earned this month Are offset against... Expenses incurred in earning the revenue 4-10 The Matching Principle A hospital pays £20,000 per month to 5 of its doctors. Monthly sales are £ 500,000. £100,000 (£20,000 x 5) worth of monthly salaries should be matched with £500,000 of revenue generated. Net profit for this month would be: 500,000 -100,000 ------------------£ 400,000 4-11 The Matching Principle The objective is to match the income receivable and the expenditure payable to the appropriate accounting period. 4-12 TYPES of ADJUSTING ENTRIES Prepayments Accruals 1- Prepaid Expenses 3-Accrued Revenues 2-Unearned Revenues 4-Accrued Expenses 4-13 Type 1: Prepaid Expenses Prepaid expenses are the type of expenses which are paid in cash and recorded as assets prior to being used. Prepaid expenses are also known as deferred expenses 4-14 Adjusting Entries for “Prepaid Expenses” • Let`s say you prepaid £15,000 for your property insurance on 1st September of the current year. • Make the appropriate adjustment as of the end of the accounting period. (i.e. 31/12/2012) 4-15 Adjusting Entries for “Prepaid Expenses” Original Entry: On September 1 the following entry would be recorded when the insurance was prepaid: Dec. 31 DR Prepaid Insurance CR 15,000 Cash 15,000 Prepaid Insurance Debit 15,000 Credit Cash Debit Credit 15,000 15,000 4-16 Adjusting Entries for “Prepaid Expenses” Prepaid Insurance is an asset account – it is an amount owned by the company that has economic value. We will recognise Prepaid Insurance under current assets. 4-17 Analyzing an Adjusting Entry: • Each month, a portion of the prepaid insurance expires. • At the end of the accounting period, the Prepaid Insurance and Insurance Expense accounts must be updated for the insurance that has expired (been used). 4-18 Analyzing an Adjusting Entry: (Example 1) What accounts are involved? • When something is “used up” it indicates an expense account. • In this case, we need to debit Insurance Expense for the expired insurance. • Furthermore, the asset, Prepaid Insurance, has decreased so we will credit this asset. 4-19 Analyzing an Adjusting Entry: £15,000 for 12 months = £1,250/month Policy purchased on Sept 1. (£15,000/12 ) Months that have expired between purchase and fiscal year-end 4 months (Sept, Oct, Nov, Dec) Amount of adjustment =(£1,250/month X 4 months) £ 5,000 4-20 Let’s record the adjusting entry; Dec. 31 DR Insurance Expense CR 15,000 £10,000 £5,000 Prepaid Insurance Prepaid Insurance Debit £5,000 Credit 5,000 Insurance Expense Debit Credit 5,000 £5,000 4-21 The Concept of Depreciation (Example 2) Depreciation is the systematic allocation of the cost of a depreciable asset to expense. Fixed Asset (debit) On date when initial payment is made . . . Cash (credit) The asset’s usefulness is partially consumed during the period. Depreciation Expense (debit) At end of period . . . Accumulated Depreciation (credit) 4-22 Depreciation Is Only an Estimate On May 2, 2011, JJ’s Lawn Care Service purchased a lawn mower with a useful life of 50 months for $2,500 cash. Using the straight-line method, calculate the monthly depreciation expense. Depreciation Cost of the asset expense (per = Estimated useful life period) $50 = $2,500 50 4-23 Depreciation Is Only an Estimate JJ’s Lawn Care Service would make the following adjusting entry. GENERAL JOURNAL Date Account Titles and Explanation May 31 Depreciation Expense: Equipment Accumulated Depreciation: Equipment Debit Credit 50 50 To record one month's depreciation. Contra-asset 4-24 Depreciation Is Only an Estimate JJ’s $15,000 truck is depreciated over 60 months. Calculate monthly depreciation and make the journal entry. GENERAL JOURNAL Date Account Titles and Explanation May 31 Depreciation Expense: Truck Debit Credit 250 Accumulated Depreciation: Truck 250 To record one month's depreciation. $15,00060 months = $250 per month 4-25 Depreciation Is Only an Estimate JJ's Lawn Care Service Partial Balance Sheet Accumulated depreciation would May 31, 2001 appear on theAssets balance sheet as L Cash $ 3,925 N follows: Accounts receivable 75 A Equipment $ 2,500 Less: Accum. depr. 50 2,450 Truck $ 15,000 Ow Less: Accum. depr. 250 14,750 J To Cost - Accumulated Depreciation = Book Value 4-26 Adjusted Trial Balance JJ's Lawn Care Service Adjusted Trial Balance May 31, 2011 Cash $ 3,925 Accounts receivable 75 Tools & equipment 2,650 Accum. depreciation: tools & eq. $ 50 Truck 15,000 Accum. depreciation: truck 250 Notes payable 13,000 Accounts payable 150 Capital stock 8,000 Dividends 200 Sales revenue 750 Gasoline expense 50 Depreciation exp.: tools & eq. 50 Depreciation exp.: truck 250 Total $ 22,200 $ 22,200 All balances are taken from the ledger accounts on May 31 after preparing the two depreciation adjusting entries. 4-27 TYPES of ADJUSTING ENTRIES Prepayments Accruals 1- Prepaid Expenses 3-Accrued Revenues 2-Unearned Revenues 4-Accrued Expenses 4-28 Type 2: Unearned Revenues Unearned Revenues are payments for future services to be performed or goods to be delivered. At the end of each accounting period, adjusting entries must be made to recognize the portion of unearned revenues that have been earned during the period. 4-29 Adjusting Entries for “Unearned Revenues” Suppose that you are the owner of an Insurance company and on November 30th a customer pays £1,800 for an insurance policy to protect her delivery vehicles for six months. Make the appropriate adjustment as of the end of the accounting period. (i.e. 31/12/2012) 4-30 Adjusting Entries for “Unearned Revenues” Initially, the insurance company records this transaction by; increasing an asset account (cash) with a debit increasing a liability account (unearned revenue) with a credit. 4-31 Adjusting Entries for “Unearned Revenues” Adjusting Entry: Nov. 30 DR Cash £1,800 Unearned Insurance CR Cash Debit £ 1,800 Unearned Insurance Credit Debit Credit 1,800 1,800 £ 1,800 £ 1,800 4-32 Adjusting Entries for “Unearned Revenues” After one month on 31 December 2012, the insurance company makes an adjusting entry; To decrease (debit) unearned revenue To increase (credit) revenue by an amount equal to one sixth of the initial payment. 4-33 Adjusting Entries for “Unearned Revenues” (£1,800 / 6months)= 300 per Adjusting Entry: month Dec. 31 DR CR Vehicle Insurance Revenue Vehicle Insurance Revenue Debit £ 300 Unearned Insurance Credit Unearned Insurance Debit 300 300 $300 £ 300 Credit 1,800 $1,500 4-34 Adjusting Entries for “Unearned Revenues” If we do not include adjusting entries to show the earning of previously unearned revenues ; We overstate total liabilities and understate total revenues and net income. 4-35 TYPES of ADJUSTING ENTRIES Prepayments Accruals 1- Prepaid Expenses 3-Accrued Revenues 2-Unearned Revenues 4-Accrued Expenses 4-36 Type 3: Accrued Revenues An asset class for goods or services that have been sold or completed but that have not yet been billed and/or paid for. Accrued revenue is income that has been incurred but not received Accrued revenue is also called accrued assets. 4-37 Adjusting Entries for “Accrued Revenues” ABC Ltd. sold £1,000 of products to a customer who is not required to pay for 60 days. The sale is recorded by ABC Ltd. on the income statement as revenue and on the balance sheet as a current asset Even though no money will be received until later. (The sale process is occurred) 4-38 Adjustıng Entries for “accrued revenues” Initial Entry: Dec. 31 DR Receivables (Current Asset) CR Revenue £ 1,000 Receivables Debit 1,000 £ 1,000 Credit Revenue Debit Credit 1,000 1,000 4-39 Adjusting Entries for “accrued revenues” The concept of accrued revenue is needed in order to properly match revenues with expenses. The absence of accrued revenue would tend to show excessively low initial revenue levels. Thus, low profits for a business 4-40 Adjusting Entries for “Accrued Revenues” For example; Muffin Ltd. rented its office to Cookie Ltd. for £500 a month. Muffin Ltd. has not received December rent of £500 from Cookie Ltd. What figure of rent receivable should be shown as income for Muffin Ltd. for the year ended 31/12/2012 4-41 Adjusting Entries for “Accrued Revenues” Adjusting Entry: The adjusting entry at the end of December is to debit rent receivable and credit rental revenue by £500. Dec. 31 DR Rent Receivable (Current Asset) CR Rental Revenue Rent Receivable Debit 500 £500 Credit £500 Rental Revenue Debit Credit 500 500 4-42 Adjusting Entries for “Accrued Revenues” After one month, on January 2013 Muffin Ltd. received the rental income of £500 form Cookie Ltd. What To would be the double entry? increase (debit) as cash is received. To decrease (credit) as rent is paid by Cookie Ltd. 4-43 Adjusting Entries for “Accrued Revenues” Adjusting Entry: The adjusting entry on January 2013 is to debit Cash / Bank and credit Receivable`s account for £500. Jan. 31 DR Cash or Bank CR £500 Rent Receivable Rent Receivable Debit 500 - £500 Credit Cash / Bank Debit Credit 500 500 - 500 4-44 TYPES of ADJUSTING ENTRIES Prepayments Accruals 1- Prepaid Expenses 3-Accrued Revenues 2-Unearned Revenues 4-Accrued Expenses 4-45 Type 4: Accrued Expenses Accrued Expense is an expense incurred but not yet paid. A journal entry is created to record the expense, as well as an offsetting liability (which is usually classified as a current liability in the balance sheet). The absence of a journal entry result in reported profits being too high in that period. (as expense will not be reported in the FS) 4-46 Adjusting Entries for “Accrued Expenses” Examples of expenses that are commonly accrued include: Interest on loans, for which no lender invoice has yet been received Goods received and consumed or sold, for which no supplier invoice has yet been received Services received, for which no supplier invoice has yet been received Wages incurred, for which payment to employees has not yet been made 4-47 Adjusting Entries for “Accrued Expenses” For example; Green Ltd. enters into a rental agreement to use the trucks of Car & Cars Ltd. The term states that Green Ltd. will pay monthly rentals of £2,000 at the end of each month. The lease started on July 1st, 2012. On July 31, the rent for the month has not yet been paid and no record for rent expense was made. 4-48 Adjusting Entries for “Accrued Expenses” What would be the necessary adjusting entry for rent expense? In this case, Green Ltd. has already incurred (consumed/used) the expense. Even if it has not yet been paid, it should be recorded as an expense. 4-49 Adjusting Entries for “Accrued Expenses” Adjusting Entry: The adjusting entry at the end of July is to debit rent expense and credit rent payable for £2,000. July. 31 DR Rent Expense CR 2,000 £ 2,000 Rent Payable Rent Expense Debit £ 2,000 Credit Rent Payable Debit Credit 2,000 2,000 4-50 Adjusting Entries for “Accrued Expenses” Expense recognition principle, requires expenses to be recognized when incurred regardless of when paid. 4-51 SUMMARY Prepaid expenses Debit Expense Credit Asset (Prepaid) Depreciation Debit Depreciation Expense Credit Accumulated Depreciation Accrued revenues Debit Receivable Credit Revenue 4-52 SUMMARY Accrued expenses Debit Expense Credit Liability Unearned revenues Debit Liability (Unearned) Credit Revenue 4-53 End of Chapter 4 4-54