Advertising Strategies

advertisement

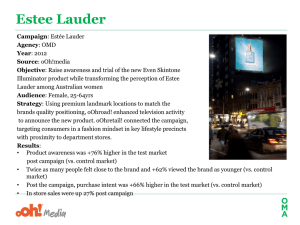

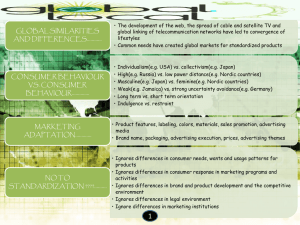

Siddiq Iddrisu Maximiliano Olivares Mariana Pinos Kadidiatou Wague Agenda Introduction Industry Analysis Advertising Strategies Raw Data Analysis Recommendations Beauty Industry • • • • Worth over 55 billion dollars Easy to enter but difficult to excel in Many players in this industry Strategic price and Brand Management is KEY Why the Beauty Industry Society stresses the importance of beauty as seen in social media Homogenization of beauty standards and the idea that this beauty is something tangible and attainable for all through cosmetics Relevant to College Students Profitable Industry Changing Demographics and Trends Because it’s the leading edge of YouTube Cosmetics “A product used for cleansing, beautifying, promoting attractiveness or altering the appearance.” Ad Comparison VS. The Beauty Industry Products: Hair Care….24% Skin Care…23.7% Cosmetics…14.6% Other…14.1% Perfume and Colognes…9.5% Deodorants, Antiperspirants and feminine products.. 8.5% Oral Hygiene…5.6% Market Share 30% 25% 20% 15% 10% 5% 0% Market Share Background Industry is heavily based on R&D • • Companies and their investors finance production and R&D costs • People of all ages use beauty products • The old generation is the age group that use the most beauty products. • Products go through R&D, manufacturing, and are sent to retail stores for consumers to purchase. • Most products are sent to Huge chain-stores for purchase such as Macy’s, Target, etc. • Trend toward direct Manufacturer to consumer purchases Research and Development L’Oréal has the largest Research and Innovation team in the cosmetics industry with 3,782 researchers and a budget representing 3.4% of its sales. The R&D budget was over $1 billion in 2014, up by 1.6% as compared to the previous year. Estee Lauder’s research and development costs totaled $157.9 million in fiscal 2014 (ended in June 2014), which reflected a 7.5% year-on-year growth. Estee Lauder employed around 700 employees for research and development activities during the same period. [5] P&G on the other hand, needs to distribute its R&D resources across its diverse product portfolio comprising of consumer goods, beauty, household goods and so on. Hence, unlike L’Oreal and Estee Lauder, beauty product innovations are not the topmost priority for the company. Competition Overall highly competitive industry Trend: number of firms has been increasing every year Rivalry is not very common in this industry in terms of (comparative) advertising. Advertising is more information geared as opposed to combative. Government regulation FD&C Act FPLA Act Distribution channels/retailers The fight for shelf-space Products are differentiated by: quality, and appearance The Beauty Industry Major Players Market Share • Procter & Gamble Company • L’Oreal USA Inc. • Estee Lauder Inc. • Unilever USA • 64% of the market is smaller beauty companies 6.30% 6.90% 10.30% 12.50% 64% Unilever USA Estee Lauder Inc. L'Oreal USA The Procter & Gamble Company Other Product Differentiation/Innovation Cosmetic companies have targeted the female audience based on the product itself. New markets for cosmetic companies are younger females and men. In 1976 Estee Lauder was the first women’s cosmetic company to create a line specifically designed for men. It was called “skin supplies for men” Each of these companies sell products through department stores, drug stores, etc. It is also important to note that most cosmetic companies are divisions of large corporations. Ex: Although P&G own Max Factor and Cover Girl, Max Factor and Cover Girl are not necessarily competing against one another. Max Factor and Cover Girl are targeted towards different audiences, allowing P&G to cash in on all markets Differentiation Based on Customer Segments Beauty brands are expected to target different groups of customers with customized product options. For example, L’Oreal’s Urban Decay or Estee Lauder’s Mac are very popular among the younger consumers. L’Oreal’s Age Perfect and Estee Lauder’s Revitalizing Supreme lotions resonate well with its mature clientele. In comparison, all P&G did was add Fresh Effects line to sell its existing Olay brand (initially targeted for mature women) to the younger clientele P&G has not evolved with the changing times, as compared to the core beauty players, and hence is getting left behind. Organization Monopolistic competition Large number of firms with a few major competitors that dominate the market. All have slightly differentiated products Major firms have strong control over pricing Global Industry Global Distribution With tight margins and strong US competition, manufacturers are looking outside the US for growth opportunities. Most international companies are looking at developing countries such as China for significant growth opportunities. Rising income levels in developing countries create more consumers willing to spend on personal care products, an "affordable luxury Estee Lauder • Limited distribution channels to maintain the high-quality reputation. • Targets upscale retailers, authorized online retailers and specialty shops such as fragrance boutiques, on-board cruise shops and duty free stores. • The market share Estee Lauder is 6.9% • Brands under Estee Lauder are Clinique, Origins, Aveda, M*A*C, Bumble and bumble. Procter and Gamble • Has over 20 different brands under it. • It makes 25 % of its annual sales in 2014 in Beauty Products. • 12.5% of the market. • Brands that under P&G are Head & Shoulders, Olay, Pantene, Herbal Essences, CoverGirl, Old Spice. L’Oreal • Canada and the United States account for 25.0% of the company's global cosmetic sales and 22.4% of the company's cosmetics manufacturing, with seven major industrial sites located within the United States. • The company employs more than 72,600 people worldwide, • With about 22.3% of these employees located in the United States. • Brands under them are Maybelline and L’Oreal, Lancome . Product Packaging Products and their packaging are increasingly designed to minimize waste and environmental alterations. Recycled paper is now used to box many cosmetics. Major player Procter & Gamble introduced an ecofriendly initiative in 2010 which spans all major aspects of production, including packaging and plant emissions. While the Food and Drug Administration does not have a definition for organic cosmetics or beauty products, brands market their products as such. Product Quality High-quality items (or those perceived as such) carry a price premium, which boosts company revenue and profit. Premium packaging, such as metallization (i.e. metal packaging that is considered luxurious), is an indicator of product quality. Link-Selling This includes the use advertisements to show the benefit of purchasing a combination of makeup products instead of a single item. Experience Goods Giving consumers free samples of new products lets them experience the products firsthand. When creating a makeup advertisement, companies use words or phrases that will cause a consumer to favor a product. These keywords describe features or benefits of makeup that consumers seek, which may not be apparent with just a picture of a model. Consumer First Sales per customer were far greater when the brand’s messaging focused on what the woman wanted to hear. Instead, brands have to use data they gather from consumers to target them uniquely. Targeted emails Lack of control over data. Loyalty Programs Paths to Purchase Omni-channel approach to both commerce and marketing Website Redesign Online Shopping Widgets Millennial Brand Loyalty “It is important for me to find brands that I am loyal to” Blue- Disagree Black- Neither Grey-Agree Celebrity Endorsement There are two main ways that celebrities can positively affect a brand’s image. Creating “borrowed equity” Celebrities as Spokespeople Celebrities personify products to sway consumers into choosing one product over another. Celebrity Endorsement Ex. Kate Moss Endorsed Rimmel Make-up When she was found to be a drug user many companies reviewed their contracts with the star.. Chanel decided not to renew Kate Moss's £750,000-a-year contract as the face of Coco Mademoiselle perfume Digital Advertising – YouTube Study The beauty industry leads in social video sharing, content creation, engagement, and curation. The Youtube audience is looking for a different brand experience. Brands and their agencies are failing to understand this medium. Why should modern marketers care about YouTube and the beauty industry? Because it is revealing the future of marketing. Data-driven video, video marketing, and social video as part of an integrated marketing strategy tie into a very different—yet highly targeted— advertising economy YouTube YouTube Emotional Advertising Recent studies show that both the emotional and utility aspect of cosmetic brands have a significant impact on consumer satisfaction, but that the emotional component has a greater effect Some of the main positive emotions aroused by beauty products include “the sensation of well-being gained from eliminating or reducing feelings of worry and guilt, which is the factor with the greatest impact. The results showed that “consumer satisfaction is greatest when the cosmetics brand helps to strengthen positive emotions through the perception of ‘caring for oneself’ and removing feelings of worry and guilt about not taking care of one’s appearance Targeting Ads – Emotional Advertising Marketing firms have encourage a strategy that crosses the line from merely targeted to outright predatory, explicitly advising brands to seize on the times of the day and week when women feel the most insecure about their bodies and overall appearance in order to sell beauty products and other goods Targeting Male Adoption As indicated by Estee Lauder's recent decision to establish a business segment dedicated to men's skin care, the male consumer will likely continue to be an important market focus for industry manufacturers during the five years to 2020. Picking Up Market Cues Over 40% of Estee Lauder’s revenues comes from the skincare segment. In Q1 2015, the company witnessed a decline in skincare growth in its most important region, the U.S. A major reason for this was that the US consumers expect innovative products, across newer skincare categories. Estee Lauder realized that innovation must be extended beyond the traditional skincare formulations like moisturizers and serums to newer concoctions such as masks and oils “No Make-up Look” Beauty trendsetters are pushing a very particular look for spring: the bare face. And much to makeup companies’ relief, it takes new products to achieve it. Social media helped spread that look, with product-laden video tutorials on YouTube drawing millions of views. Cosmetics brands are responding with lighter foundations, sheerer lip glosses and new products to accentuate cheekbones and brows, two features that are especially important with the bare look. Brand Equity – Estee Lauder Total assets WACC ESTEE LAUDER FINANCIALS (in '000 of $) 2010 2011 $3,121,000 $3,686,500 10% $312,100 $368,650 Net income Economic Value Added EVA) RBI (Brand Earnings) Discount rate Discount factor 40% 2013 $4,297,200 $429,720 2014 $4,825,200 $482,520 $482,400 $703,800 $856,500 $1,019,800 $1,204,100 $170,300 $68,120.00 $335,150 $134,060.00 $470,990 $188,396.00 $590,080 $236,032.00 $721,580 $288,632.00 1.08 1.1664 1.259712 1.36048896 1.469328077 $63,074 $114,935 $149,555 $173,491 $196,438 8% Discounted Earnings Value until the year 2014 Terminal value (growth rate=2%) = (Discounted earnings in 2014)/(discount rate - growth rate) $3,273,968 Net present value of the Brand $3,971,461 Value of the ESTEE LAUDER brand: ~ 3.97 billion dollars 2012 $3,855,100 $385,510 $697,492 Total assets WACC Brand Equity – L’Oreal L'Oreal FINANCIALS (in '000 of $) 2010 $6,673,900 10% $667,390 2011 $7,842,300 $784,230 2012 $8,626,700 $862,670 2013 $9,216,200 $921,620 2014 $10,522,000 $1,052,200 Net income $1,794,900 $2,242,000 $2,440,900 $2,870,400 $2,961,400 Economic Value Added EVA) RBI (Brand Earnings) $1,127,510 $451,004 $1,457,770 $583,108 $1,578,230 $631,292 $1,948,780 $779,512 $1,909,200 $763,680 1.08 1.1664 1.259712 $417,596.30 $499,921 $501,140 Discount rate Discount factor 40% 8% Discounted Earnings Value until the year 2014 Terminal value (growth rate=2%) = (Discounted earnings in 2014)/(discount rate - growth rate) Net present value of the Brand Value of the L'Oreal brand: ~ 11.17 billion dollars $2,511,370 $8,662,463 $11,173,833 1.36048896 1.469328077 $572,965 $519,747.78 Total assets WACC Brand Equity – P&G P&G FINANCIALS (in '000 of $) 2010 $18,782,000 10% $1,878,200 2011 $21,970,000 $2,197,000 2012 $21,910,000 $2,191,000 2013 $23,990,000 $2,399,000 2014 $31,617,000 $3,161,700 Net income $12,736,000 $11,797,000 $9,317,000 $11,402,000 $11,785,000 Economic Value Added EVA) RBI (Brand Earnings) $10,857,800 $4,343,120 $9,600,000 $3,840,000 $7,126,000 $2,850,400 $9,003,000 $3,601,200 $8,623,300 $3,449,320 1.08 1.1664 1.259712 1.36048896 1.469328077 $4,021,407.41 $3,292,181 $2,262,739 $2,646,990 $2,347,549.23 Discount rate Discount factor 40% 8% Discounted Earnings Value until the year 2014 Terminal value (growth rate=2%) = (Discounted earnings in 2014)/(discount rate - growth rate) $14,570,867 Net present value of the Brand $53,696,687 Value of the P&G brand: ~ 53.7 billion dollars $39,125,821 Number of Ads per Brand 700 629 576 Number of Advertisements 600 500 453 400 346 300 200 100 53 77 0 Estee Lauder Clinique Covergirl Brand L'Oreal Maybelline Olay Advertisement Expenditure $37,737,100 Expenditure Amount $28,101,600 $28,230,100 $24,529,400 $6,756,200 Estee Lauder $7,821,700 Clinique Covergirl Brand L'Oreal Maybelline Olay Average expenditure per ad Average Expenditure Amount $140,000.00 $127,475.47 $120,000.00 $101,580.52 $100,000.00 $80,000.00 $60,000.00 $70,894.22 $59,995.39 $62,034.44 $49,010.59 $40,000.00 $20,000.00 $Maybelline Olay L'Oreal Brand Covergirl Clinique Estee Lauder Average Advertisement Time Average Advertisement Time (seconds) 35 30 30 30 25 20.462 20 16.6145 17.6269 18.3865 15 10 5 0 Maybelline L'Oreal Olay Brand Covergirl Estee Lauder Clinique Average Expenditure per Second Average Expenditure per Second $4,500.00 $4,249.18 $4,000.00 $3,500.00 $3,000.00 $3,263.01 $3,386.02 $3,464.68 $3,519.30 $2,949.87 $2,500.00 $2,000.00 $1,500.00 $1,000.00 $500.00 $Maybelline Olay Clinique Brand Covergirl L'Oreal Estee Lauder “Love the Skin you’re in”- Olay • • • • • • Your best beautiful Taking care of what you’ve been given Glow from the inside Sharktank, NCIS, Hell’s Kitchen, Dateline Bachelor- women compete for the love of a man For busy women who need a simple beauty regimen “Easy, breezy, beautiful”Covergirl • • • • • • • #GirlsCan for women’s empowerment Youthful Challenging/Rebelling Katy Perry ANTM, Originals, Supernatural, Beauty and the Beast ANTM- Young people compete for a modelling contract Beauty portrayed as an asset that is tangible “You’re worth it”-L’oreal • • • • • • • Established in France Halo Emphasis on richness of products perfection America’s Got Talent, Bachelor, Vampire Diaries, Revenge Vampire Diaries- Teenage girl stuck in a love triangle Beauty brings infatuation and love “Maybe she’s born with it”Maybelline Unique formula Full effect Bringing out natural beauty American Idol, America’s Got Talent, ANTM, Arrow, Originals, Vampire Diaries • American Idol- Showcases amazing voices • Natural talent comes from within, but can be enhanced • • • • “Bringing the best to everything we touch”-Estee Lauder • • • • • • • • Kendall Jenner Supreme Experts/ Breakthroughs Look younger Elitism American Idol, Glee, Voice Voice- judges ONLY turn around for phenomenal voices Only provide the best “Allergy tested, 100% fragrance free”-Clinique • • • • • Smart Repair Breakthrough Elitism Chicago Fire, Unforgettable, Voice “Makeup for all. All ages, all races, all sexes”-M*A*C • • • • Party Fun Active Standing Out Videos Recommendation (Entire Industry) Utilize the consumers watching tutorials on YouTube in the morning by having advertisements on YouTube in the morning, go to where the consumers are (internet) Have advertisements on the internet where consumers go and watch their shows (i.e. scandal, empire, how to get away with murder. Having more advertisements for men. Estee Laude are the only ones using this. Recommendation P&G Use more money on R&D. They have low-quality products so spending money on R&D could benefit their products quality in the long run. Estee Laude Spend money on other innovative ways to attract consumers to spend money on skin care. Utilizing their money; their spending their money irrationally Be more of a presence on social media (i.e. YouTube twitter, instagram) L’OREAL They should utilize more celebrity advertisements. Currently, there in the middle of the pack so getting more notable faces would help greatly uplift their band name Recommendation Advertising Strategy Having more advertisements throughout the morning and late at night. Woman are feeling least attractive around 5am-7am so utilizing that by having advertisements pertaining to how beautiful they can become with a companies product. Being to advertise more on Sunday and Monday where woman feel the least attractive during the week. Questions?