International Perspectives on Public Research Organizations

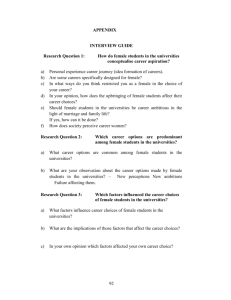

advertisement

International Perspectives on Public Research Organizations and Industry Partnerships: Laws, Models and Policy Options Guriqbal Singh Jaiya Director, SMEs Division World Intellectual Property Organization www.wipo.int/sme guriqbal.jaiya@wipo.int The Starting Point: Defining Innovation • Invention v. innovation • Sustaining v. disruptive innovation • Incremental v. radical Innovation Nature of Disruptive Technology • Less profitable in the early years • May need long periods of time before market introduction (health care) • Need mass market acceptance to achieve full value • Cheaper, smaller, simpler, more convenient The Knowledge Economy • Protected knowledge now at the core of company valuation • Intangibles are now driving market capitalization • No diminishing returns • Increasing returns possible • Network effects The Knowledge Economy • In certain industries, patents significantly raise the costs incurred by non patent-holders wishing to use the idea or invent around a patent – an estimated 40 % in the pharmaceutical sector, 30 % for major new chemicals, and are thus viewed as very important. • However, in other industries, patents have much smaller impact on the cost associated with imitation (e.g., in the 7 – 15 % range for electronics) and are considered less important for protecting investment. Source: Mansfield, Imitation costs and Patents, in The Economics of Technical Change, 1981 Knowledge Supply Chain • Universities and industry generate knowledge and transfer knowledge. • Barriers between the two cultures impact the ability to create new knowledge to satisfy society. The Knowledge Process Today • Partners need to understand how they fit in an integrated knowledge process. • Each partner is responsible to help others succeed. • Partners must be part of a continuous, free flow of information and knowledge. • • The Knowledge Process of the Future Outcomes for industry include more effective access to knowledge => reduced technology development cycles. Outcomes for universities include increased funds and capacity for pursuing relevant basic research. Technological Change –Technology Push versus Market Pull Emerging Customer Segments New Customer Needs Technological Change Entrepreneur Unsatisfied Existing Needs New Methods of Manufacture & Distribution Higher Productivity & Economic Growth Technology Push: Looking for a Problem Primary Disruptive Technologies for Next Decade • Gene Therapies • Nanotechnologies • Wireless • Other ?? Importance of radical innovation • Because it was in disruptive technologies that productivity growth was highest over the last 4 decades • Information and Communication Technologies • Biotechnology • Most of this productivity growth achieved by new players, not by existing companies • PROs well suited to drive radical innovation Impact of Open Innovation • Historically, internal R&D was a strategic asset • Nowadays, companies commercialize both their own ideas/inventions as well as those from others; for example, of other companies, public research organizations (PROs) and research universities • Industries embracing open innovation view public research organizations (PROs) and research universities as a source of graduates and applied research • Researchers in companies have shifted to advanced technologies and product development Open Innovation Interfaces and Boundaries • Cultural differences – Successful partnerships have researchers in companies working with researchers in the public research organizations (PROs) and research universities • Communication channels, working relationships – Creating a company culture where external contributions are accepted • Functional organizations with specific responsibility to manage the external technology and research function – Example of Hewlett-Packard University Relations • Work pace, expectations – Since private R & D labs work more quickly, a company may establish a small-firm channel to take advantage of the speed difference – MIT Industrial Liaison Program manages university research to meet the expectations of corporate sponsors Competing on the Global Stage • Significant attention is needed to address the issue of whether human capital will be built within the US or outside the US. • America’s information and technology workers are being forced to compete with an exploding population of lower paid, skilled workers around the globe. • US industries based on physical science and engineering face acute shortages of people and new ideas, forcing us to either import foreign researchers, or export our R&D facilities • Research conducted at foreign universities provides a source of highly talented graduates, who increasingly stay in their own countries and compete with us • To stay ahead in a skills-based economy, American companies and universities must work together to invest in developing the most skilled and flexible workforce in the world Global R&D Migration • The shift to emerging economies first occurred in textiles and other manufacturing jobs, followed by low-end services such as telemarketing and data entry. Now it is moving up the labor food chain to R&D jobs • Debate over migration of white-collar jobs overseas is misguided – Proponents say it’s a win-win for America and its trading partners – Opponents say it’s a race to the bottom that will destroy America’s middle class • Jobs are flowing to Asia, Eastern Europe and elsewhere. Short of a radical change in policy – say, a complete halt to international trade – information age jobs will continue to shift overseas The IP Problem – A Relationship in Crisis • The partnership between industry and universities has been weakened over difficulties associated with negotiating IP rights in research contracts in recent times • Largely as a result of the lack of federal funding for research, American Universities have become extremely aggressive in their attempts to raise funding from large corporations • Industry feels that it takes too much time, effort, and money to negotiate an agreement • This has resulted in a perceived deterioration of trust and goodwill between industry and US universities, adversely affecting the longterm partnership between industry, universities, and government A Silent Breaking • Given that negotiations with an American university can take more than a year, the idea is often valueless before an agreement can be reached, and the company often spends more in legal expenses than it would be able to pay in royalties. • This can lead to a company just walking away from the negotiation, and declining to sponsor any further research at that university. “Typically at present, negotiating a contract to perform collaborative research with an American university takes one to two years of exchanging emails by attorneys, punctuated by long telephone conference calls involving the scientists who wish to work together. All too often, the company spends more on attorneys’ fees than the value of the contract being negotiated. This situation has driven many large companies away from working with American universities altogether, and they are looking for alternate research partners.” Stan Williams Director, HP Quantum Science Research Consequence: Global Migration of University Research • Many large companies in developed countries are finding other sources of ideas and bright young researchers in emerging countries, where they receive very favorable intellectual property agreements. “Large US based corporations have become so disheartened and disgusted with the situation [negotiating IP rights with US universities] they are now working with foreign universities, especially the elite institutions in France, Russia and China, which are more than willing to offer extremely favorable intellectual property terms.” Stan Williams Director, HP Quantum Science Research IP Relationships With Foreign PROs and Research Universities • Public Research Institutes (PROs) and Research Universities in China, India and Russia offer very attractive terms for research partnerships with US companies (research by purchase order). “Many high quality foreign universities are very eager to work with American companies, and by keeping attorneys out of the discussion completely they have streamlined processes to allow a successful negotiation to take place in literally a few minutes over the telephone. It is possible to specify what one wants to a professor at a university in China or Russia and then issue a purchase order to obtain a particular deliverable. The deliverable is received and verified to be satisfactory before the American company pays for it, and in this case the American company owns all rights to the deliverable and the process by which it was created.” Stan Williams Director, HP Quantum Science Research Move Towards Open Archiving • Cultural Differences: Defensive Publication • Open Journals: Library function • In the digital environment, increasing self publishing on the Internet • Internet, web sites, open innovation, open archiving and public disclosure Which way should Public Research Organisations (PROs, including universities) go ? – Legal basis - USA • Bayh-Dole Act P.L. 96-517 as amended • Stephenson Wydler Technology Innovation Act P.L. 96-418 Bayh-Dole Act: • Doing away with 26 different regulations used by public US research funding bodies • For the first time, a uniform policy was implemented that provided the contractor with the opportunity to elect to retain title to inventions Which way should Public Research Organisations (PROs, including universities) go ? – Legal basis - USA • If contractor retains title, obligation to exploit arises; reporting requirements • Although US university were patenting before Bayh-Dole Act, but patenting and especially licensing rose by about 20 times in the last 20 years • Government has march-in rights and may require a non-exclusive license for its own purposes • Just giving ownership to industry contractors does not necessarily stimulate use in the markets Which way should Public Research Organisations (PROs, including universities) go ? – Legal basis - USA “…to replace the existing melange of 26 different agency policies on vesting of patent rights in government funded research….with a single, uniform national policy designed to cut down on bureaucracy and encourage private industry to utilize government funded inventions through the commitment of the risk capital necessary to develop such inventions to the point of commercial application.” Source: House Committee on the Judiciary, 1980 Which way should Public Research Organisations (PROs, including universities) go ? – Legal Basis • In the EU, concern that different national laws regarding the ownership and exploitation of IP from PROs, especially at universities, may create barriers to international collaborative research • Austria, Denmark, Germany and Norway have recently introduced new legislation to grant universities title to IP resulting from publicly funded research • In Finland, proposals to the same effect • In Japan and Korea, recent reforms in funding regulations to this effect • These policy trends echo the landmark US Bayh-Dole Act of 1980 Source: OECD, Turning Science into Business, 2003 Which way should Public Research Organisations (PROs, including universities) go ? – Legal Basis Internationally • Either there is employer-employee law defining ownership (Germany, Austria) • Or there is just common law/case law/individual agreements (US) • Or there is some regulation in patent law defining rights of the employee (UK, France) • And then there are research sponsorship agreements (do not affect employer-employee relation but define ownership and exploitation framework in projects funded with certain - public – funds) • On the European level (research framework programmes) such sponsorship agreements can become extremely complex as these are generally consortium deals involving numerous partners Which way should Public Research Organisations (PROs, including universities) go ? – Some aggregate US Data • • • • • • • Gross license income: 1.337 billion $ 10,866 licenses yielding income Invention disclosures: 15,573 Total US applications filed: 12,929 New US applications filed: 7,741 US Patents issued: 3,673 Start-up companies formed since 1980: 4,320; still operational: 2,741 Source: AUTM Licensing Survey 2002 Which way should Public Research Organisations PROs (incl. universities) go ? – Some Data on the US • • • • • • University of Florida 369.25 M $ sponsored research 207 US patents filed in FY 2002 59 new licenses / options executed 31.6 M $ gross license income 62 US patents issued in 2002 5 start-up companies formed in 2002 Source: AUTM Licensing Survey 2002 Which way should Public Research Organisations PROs (incl. universities) go ? – Some Data on the US • • • • • • • Columbia University Research budget : 200-400 M $ 407.4 M $ sponsored research 191 US patents filed in FY 2002 55 new licenses / options in FY 2002 155.6 M $ gross license income 60 US patents issued 8 start-up companies formed Source: AUTM Licensing Survey 2002 Intellectual Property Licensing by PROs in Germany • Fraunhofer, and to a lesser extent Helmholtz and the universities, focus heavily on collaborative R&D • IP positions regularly compromised as a consequence • Only Max-Planck (Garching Innovation GmbH) and Fraunhofer Patent Center achieved maturity (major revenues, involvement in litigation, management of big portfolios) in IP licensing • After abolishing the Professor´s privilege in 2002, 18 regional IP licensing companies formed with federal sponsorship • Each of these companies works with a number of universities in the respective region • These programmes have remained marginal so far • Both industry as well as some public research organisations are trying to undermine these activities by the universities Patent applications of German PROs 2000 Universities Max Planck Society Helmholtz Association Fraunhofer Society 1800 1600 number 1400 1200 1000 800 600 400 200 0 70 72 74 76 78 80 82 84 86 88 90 92 94 96 98 00 year Source: Turning Science into Business, OECD, 2003 Which way should Public Research Organisations PROs (incl. universities) go ? • No University licensing data available in Germany • Reason: Up to 2002, licensing was mainly done by the individual inventors because of the Professor´s privilege • However, a 1996 study for the Federal Ministry of Science showed that 60 % of the inventions were assigned to industry partners – in most cases without or with minimal compensation Source: Becher, Gering, Lang, Schmoch: Patentwesen an Hochschulen, BMBF 1996 Which way should Public Research Organisations PROs (incl. universities) go ? - UK • Commercialisation activities in the university sector have substantially increased in the last five years • Many universities created technology transfer offices only in the late 1990s • Staff numbers are still rising by almost 25 % per annum • Internationally, the UK lags behind the US in its expertise in technology transfer, although the UK is ahead of much of the rest of Europe • Lack of clarity over IP in research collaborations • A minimum of annual investment in research needed in order to justify a technology transfer office; only 25 % of UK universities seem to have such critical mass, yet 80% are now running their own offices • Still struggling with restructuring after BTG disappeared as the sole solution in 1985 Source: The Lambert Review of Business-University Interaction, December 2003 Which way should Public Research Organisations PROs (incl. universities) go ? – Other notable models • • • • Chalmers University in Gothenburg, Sweden Privatized the whole university; now operates as an AB Technology transfer is a huge operation being responsible for all contract research, an incubator, a technology park, etc. But Sweden lived under a Professor´s privilege system which is still very much defining the mindset Private IP exploitation company in the incubator University of Twente, the Netherlands • Probably the European University concentrating most on spin-off creation very early on (1980s) • But again, Intellectual Property Management on behalf of the University is not at the centre stage in this effort How to position a PRO in the market • What is the customer base? • Are the customers prepared, able and willing to do R&D collaborations? • Does this apply to all technology sectors the PRO represents? • Or do you have to use a custom approach in different technological fields? Local, Regional Customer Base • Mainly SMEs ? High Tech ? • Multinationals ? • Incentives available ? • Government co-financing ? • Taxes ? Local, Regional Customer Base • What do you do if there is no such thing ? • Multinationals ? • Engage in company formation and business development ? • But that changes the requirements completely ! Requirements • What is it? Technology Transfer or commercialization is a parallel process of radical and incremental innovation, the determination of technical and business feasibility, the creation of intellectual assets, and the development of a plan to enter the market. • Why do it? To build sustainable companies Requirements • You will only be able to attract investors if your Intellectual Property Management (IPM) approach is effective • IP in general, trade secrets and confidential knowhow are the building blocks for such an IPM program • That makes the national legal system regarding ownership and exploitation of PRO results so important. If you cannot manage your IP assets effectively for the sake of the investor you will have no business ! Key Findings 1. Technology Transfer, IP management and licensing by PROs should be seen in the broader perspective of how the individual, national research and innovation system is structured. 2. More collaborative research and research funding by industry will make it more difficult to maintain freedom to operate. 3. If freedom to operate exists for PROs, mature programmes require significant lead time and professionalism. 4. OECD 2003 (Turning Science into Business): On average, PROs engaged in Intellectual Property Asset Management need more than seven years to break even. 5. US-Policy considerations: Jobs created (more than 300000), 3 billion in taxes generated (1 billion royalties). Source:AUTM Setting a Mission • • • • Transfer of technology for society’s use and benefit To generate income; net return on investment Regional economic development and job creation To recruit, reward, and retain faculty and/or researchers • To develop relationships with Industry • To facilitate formation of Start-up/Spin-out firms Intellectual Property Management in Public Research Organizations (PROs): Objectives • Maximizing Public Good (social return) or maximizing financial (private) return • Internationally, even the leaders in technology transfer have managed to create revenues of up to 5 % of their research expenditures • Social returns must be given due weight in the overall analysis Methods of Technology Transfer • • • • • • Graduated Students/ Ph.D. Students Publications Conferences Visiting Scholars/Industry Visitor Programs Industrial Affiliates Programs Research Sponsorship, Contract Research and Faculty Consulting • Licensing to Established Companies and to StartUp/Spin-off Companies Inventor’s Role in Tech Transfer • Disclose Inventions • Identify Potential Licensing Prospects • Participate in Patent Preparation and Prosecution • Host Visits by Potential Licensees • Provide input into the licensing strategy • Consultant (optional) to Licensee(s) Major Issues for TLOs • • • • Organizational Issues Scope of Service Issues Policy Issues Empowerment Issues Key Organizational Issues • Government IPR Policy Framework: S & T, Innovation • Legal and Regulatory Framework: National, Institutional • Organizational Structure or Form of TLO: – Part of PRO or University – One-to-one or One-to-many – Separate from PRO or University (for example: Foundation, Trust, Company, etc) – Reports to whom • Service Model: Legal, Administrative or Marketing • Location: Distance between TLO and Institution • Funding of TLO: Financial support; self-supporting Scope of Service Issues • Invention Evaluation, Patenting, Marketing, and Licensing (Basic Functions) • Advisor and Educator on Intellectual Property • Negotiate/Sign Industry Research Agreements • Negotiate/Sign Material Transfer Agreements • Actively Assist in Start-Up Company Formation Competitive Strategy: Every Institution Develops and/or Acquires Tools and Technology Expensive And Risky Make Buy Develop License Quick And Less Costly Market Validation Study & Identify Potential Licensees • Identify viable commercial partner – Identify key markets – Identify potential licensees • Resources used to identify partner – Researchers/Technologists – San Diego State University – Entrepreneurial Management Center (EMC) – TechLink – Business network • Have expanded program to work with government technologist and companies across the country Market Analysis with Licensee • EMC performs analysis for specific markets discovered • Outside expert consultants used where possible • SSC SD funds scientist labor and travel to work with licensee • Market analysis provides independent information to help company with decision to proceed with licensing of technology Key Policy Issues • Ownership of Intellectual Property – Patents and Know-how/Trade secrets – Copyright, Industrial Design & Trademark – Plant Breeder’s rights • Incentives to Disclose Inventions – Royalty Sharing; Consulting; Research Funding • Conflict of Interest & Conflict of Commitment – Institutional – Individual University/Industry Partnership Lesson “Of 3200 universities, perhaps 6 have made significant amounts of money from their intellectual property rights. IP rights should be pursued as a means for interaction with industry rather than as a means for raising revenue from commercialization.” John C. Hurt National Science Foundation Sharing of Licensing Income (After patent expenses are reimbursed) Inventor/ Creator Inventor’s Lab Inventor’s Dept Inventor’s School Tech Promotion Fund Tech Research Fund U Central: First $100K per year 50% 10% 0% 30% 10% 0% U Central: Above $100K per year 40% 10% 10% 25% 5% 10% VUMC: First $100K per year 50% 0% 20% 20% 10% 0% VUMC: Above $100K per year 40% 0% 25% 20% 5% 10% Revenue Sharing From IP Exploitation Cumulative net income Invent or Department R&D Directorate Trust First £50 000 50% 10% 20% 20% Next £100 000 40% 10% 25% 25% Next £100 000 30% 10% 30% 30% Over £250 000 25% 10% 32.5% 32.5% Note In practice, Trusts are recommended to consider sharing the revenue of their associated University as the basis for their own policy. By doing so, the potential for conflict within inter NHS/University groups is reduced. Issues to be Considered in Negotiations • Which party initiated the idea? • Who is contributing financially: Money, Equipment, Feedstock, Supplies ? • Who is contributing technically? • Cost of the overall development program? • Cost to bring it to market? • Risks: Who pays for the failures? Who is Best Suited to File for Patents? Industry – Full time experienced staff – Focused on market segments – Can select the proper foreign filing – Works with the people who are developing the use and market – Knows where the technology can be applied to similar opportunities. University – Has experienced staff but is spread thinly – Communications between the scientists and IP personnel is more distant – Scientist is not connected to the market – Do not foreign file due to costs, limited protection – Their market is industry Industry thinks it is best suited. Five Types of IP Arrangements 1) Industry owns the IP generated as a result of the collaborative research. 2)Industry owns the IP but allows the University to continue with development for research purposes only. 3) The University owns the IP but industry has exclusive rights. 4) The University owns the IP but the business has exclusive rights in a narrow field of use. 5) the University owns the IP but offers the technology non-exclusive, royalty free. The Industrial Model Intellectual property Proprietary position Competitive advantage Acceptance in the Market place Unique product Innovation Equity Participation Model Investor A for 33% with $2MM Investment Investor B for 33% with $10MM Investment License Agreement from University •54% Tech Founder ($3.24mm) •100% Tech Founder No Valuation •80% Tech Founder •20% University Value of Technology •13% University ($.78mm) •33% Investor A ($1.98mm) ~$6MM Valuation •36% Tech Founder ($10.8mm) •9% University ($2.7mm) •22% Investor A ($6.6mm) •33% Investor B ($10mm) ~$30MM Valuation IPO raising $30MM •28% Tech Founder ($42mm) •7% University ($10.5mm) •17% Investor A ($25.5mm) •28% Investor B ($42mm) •20% Public Market ($30mm) ~$150MM Valuation **Every investment accepted by the company in exchange for equity serves to establish the valuation of the company. Empowerment Issues • • • • Signature Authority for License Agreements Review Committee: Is it needed? Legal Review: When is it needed? Authority of Licensing Officers/Associates – – – – Evaluation Patenting Marketing Negotiating terms of the License Intellectual Property Management by PROs Link to Venture Capital Technology Pool Cooperative R&D mature companies Licensing Non-exclusive Who owns what? Start-Up Companies Exclusive Joint Venture Quasi-exclusive Field of Use Equity Commercialization Through Licensing • License • Technology • Potentially people Licensor Licensee Sales Product / Service Development • Lump sum License Fee • Royalty Market Revenue Which way should Public Research Organisations (PROs, including universities) go ? • Historically, in the US little co-operative R&D • More focus on licensing and start-ups (beginning in about the mid 1980s); an effect of Bayh-Dole Act in the US • In Europe, much more interest in project based co-operation with the private sector: one example is the European Framework Research Programmes (FP 6) • Limited IP and licensing infrastructure at most European PROs • In recent years, both sides trying to adopt some of the features of the other model Which way should Public Research Organisations (PROs, including universities) go ? • Historically, little co-operative R&D in the US • “Throughout most of the 1960s and 1970s, the business community was the source of 3% of total research performed in universities.” • “By the mid 1980s this had risen to 6 % and in the 1990s to 7 %. Source: Wendy H. Schacht, CRS Report for Congress; R&D Partnerships and IP, Implications for US Policy, December 2000 Which way should Public Research Organisations (PROs including universities) go ? “The preferred mechanism of German industrial support for academic research is a research contract with clearly defined deliverables. In the US, most industrial funding of academic R&D takes the form of grants, more open-ended arrangements without specifically defined research deliverables……..” Source: Technology Transfer Systems in the United States and Germany, Lessons and Perspectives, German American Academic Council Foundation, National Academy of Sciences 1997 Which way should Public Research Organisations (PROs, including universities) go ? “….the panel judges university-industry research interaction in Germany to be more heavily oriented toward short-term, incremental problem solving than university-industry linkages in the United States.” Source: Technology Transfer Systems in the United States and Germany, Lessons and Perspectives, German American Academic Council Foundation, National Academy of Sciences 1997 Which way should Public Research Organisations (PROs, including universities) go ? • Some European Research Universities now receive up to 40 percent of their research budgets from private sources on a project contract basis Private Funds • Example: RWTH Aachen • Total budget (excl. hospital): 367 Mio € • Research Budget: 142,5 Mio € Source: RWTH Drittmittelreport 2003 Government EU German Science Foundation Critical Ingredients for a Thriving Environment • • • • • • Strong, diverse research programs Technology Transfer Business start-up facilities Research Parks Access to capital Management Major Findings from the DEST Report - I • Australian universities: significantly strengthened their research commercialisation capabilities, performance. • Scale is crucial: – effective research commercialisation requires sufficient portfolio of research, – Commercialisation function: requires breadth and depth of capacity. – a significant challenge to smaller and regional universities. • Access to pre-seed capital - the most common financial need for universities in research commercialisation Major Findings from the DEST Report - II • Licensing of IP: the most common form of research commercialisation – generates most revenue, well done, lower risk. • Australian industry: – fragmented, small size and low R&D investment – poor capacity to absorb university-generated technology – linkages have to be established with overseas firms. • Creation of spin-off firms an important commercialisation mechanism – holds and develops IP with high return potential – Common in the biosciences and IT fields. – Spin-offs that generate a huge growth in value, are rare. • Commercialisation hubs: – key role in transforming knowledge into economic value Australia: What is ATP Innovations? • A commercialisation hub: – commercialisation of innovative Australian technologies – focussed on technology business development – A hub for the innovation & commercialisation community • Technology convergence encouraged: – Information & Communications Technology – Life Sciences: Biotechnology & Biomedical – Micro & optical electronics • Provides time intensive resources that start-ups may not always be able to access from their technology commercialisation office • A resource to be utilised • A partner in business development ATP Innovations addresses the needs of start-up ventures • • • • • • Sydney metropolitan location, regional outreach Owned by 4 major universities Clients: public and private sectors Currently 25 clients, 11 anchor tenants Full facilities, 7000 m2 space, 85- 95% occupancy Full business support program suite – bizStart, bizConnect, bizNetClub, bizCapital. CEO: Mark Bradley Dir. Business Programs: Charles • Operates to world best practice Lindop • Connected technology community Dir. Biobusiness Programs: Paul Field CFO: Charles Summers ATPi Commercialisation Process Applicants accepted Graduate Realistic Business Plan Market Validation Customer Management Business Expansion • After ~ 3 years • Space >125m2 • >20 staff • Proven/strong / credentialed Professional development, forums, workshops, Networking events ATPi - University Technology Commercialisation Partnership: a Model University Commercialisation Office Researchers create IP Consultation with Commercialisation Office Company Graduates Assessment Made IP Abandoned Go/No Go License Agreement IP Protected Commercialisation Process ATPi Joins Project team Start-up Moves to ATPi business precinct Decision to create Start-up Start-up Company Created ATPi: Start-up Seed Capital provided ATPi: Start-up Rent Relief provided What is TrusTECH? o o o TrusTECH is a DTI Biotechnology Exploitation Platform (BEP) Challenge Programme, funded for 4 years TrusTECH is a partnership between Central Manchester & Manchester Children’s University Hospitals NHS Trust The Royal Liverpool & Broadgreen University Hospitals NHS Trust The University of Central Lancashire (UCLAN) TrusTECH provides a service to the NHS Trusts and Universities in the Northwest TrusTECH provides help and advice in the identification, protection and exploitation of intellectual property TrusTECH provides access to the expertise of associated organisations e.g. manIP, Technology Transfer companies, patent agents The TrusTECH Team Technology Exploitation Managers Responsible for visiting NHS Trusts and Technology Auditing o Dr Lynsey Grieveson – based in Preston lynseygrieveson@trustech.org.uk 01772 892787 o Dr Ruth Hale – based in Manchester Ruthhale@trustech.org.uk 0161 276 5786 o Dr Sonja Jonas – based in Liverpool sjonas@merseybio.com 0151 794 4487 Innovation Unit Manager • Responsible for managing the work of the Innovation Unit and visiting NHS Trusts Dr Richard Deed, richarddeed@trustech.org.uk 0161 276 5763 Project Coordinator Responsible for the day-to-day administration of the Unit Bridget Liddle, bridgetliddle@trustech.org.uk 0161 276 5764 TrusTECH Services NHS Trust agrees to pay a service fee of 0.5% of its R&D budget; in return the Trust can expect the following Support for IP management and policy development Technology/innovation auditing Opportunities for collaborative research projects Pooling of IP in portfolios Links to external funding opportunities Assistance with development and exploitation of innovation and IP (Costs are not included in the service fee) IP training for Trust personnel (Costs are not included in the service fee) Membership of a region wide network of NHS Trusts developing IP All IP discovered remains the property of your organization Technology/Innovation Auditing • Introductory Meeting with R&D Manager and/or designated contact · A systematic review of the research in progress at your Trust · Identification of research projects and groups or staff involved in innovation · Follow-up visits to relevant personnel · Preparation of audit reports · Identification of innovations of commercial value · Advice on exploitation and protection of IP Fundamental Barriers to Success (DCW View) • Fundamental, endemic differences between industry and university mission and world view (culture) • Industry and University “wants” in contract negotiations are often poles apart, especially in IP. Federal and state laws, which were meant to help, actually hurt collaboration. • Fundamental shift since WW II in engineering department’s emphasis, reward system and training of students and faculty is unfavorable to fostering type of collaboration industry needs • Large disconnect between industry and academe in what constitutes “Effective Technology Transfer” • Few plans or programs to remedy the situation Areas of Tough Contract Negotiation • Intellectual Property Rights • Publication Rights • Royalties & Licensing Fees • Proprietary Information • Patents • Warranty and Indemnification • Selection of Student Participants These issues must be resolved in win-win situation for both Industry and the University “Intellectual Property Rights” is the Toughest Challenge Faced Before Contract Is Signed Technology Transfer from Academe to Industry • To succeed, technology must - “Arrive in time” to be used - “Get incorporated” into the product (e.g. via the design / analysis system, etc.) - “Give Competitive Advantage” to GEAE in the marketplace • May need change / modification of university culture - What constitutes “acceptable” thesis project - Return to what “engineering really is” - Does university really want to work “our problems” Effective Technology Transfer is the Toughest Single Challenge Faced After Contract Is Signed Effective Technology Transfer DESIGN and/or ANALYSIS SYSTEM University Technology How best to transfer university technology to Company • Identify “Sockets” into which technology can fit (The “LEGOTM model”) • Identify CTQ’s (critical to quality) for “sockets” • Present results (transfer technology) in format that fits sockets & satisfies CTQ’s • Make sure results are accepted by the Industry Steps for Effective Technology Transfer to GEAE 1. Conduct a “Customer Value Chain Analysis” (CVCA) • Identifies the parties involved and shows their relationships • Shows flow of information, complaints, money, decisions, results, etc. 2. Capture the “Voice of the Customer” (VOC) • Identify what the critical customers really want (lightweight, reliable, safe, etc.) • Identify Critical to Quality (CTQ) items 3. Establish “Engineering Metrics” (EM) from VOC • Characterize performance with measurable quantities (max temp, MHz, MPG) 4. Use the “LEGOTM model” concept for packaging technology to fit GEAE design and analysis system • Present technology using EM’s to fit GEAE system like a LEGOTM block 5. Use Project FMEA to manage program • Risk assessment and abatement • Critical path scheduling One Starting Point to Developing Effective Industry / University Research Partnerships Universities focus on High-impact Technologies 1. Those that reduce cost pain (IFSD, Aborted Take-off, unscheduled engine removal, delays and cancellations, manu. errors) 2. Those that industry sees as needed to improve their product (business) - future advanced propulsion systems - component improvements At Issue: Universities often do not see these types of “practical” problems as scientific enough for Ph.D. thesis University Strategic Alliances University of Cincinnati • Acoustics • Aerodynamics Ohio State University • Full scale turbine testing at engine conditions • Aeromechanics Aachen RWTH, Germany • Centrifugal Compressors • Compressor CFD GEAE MIT • Compressor Duke University • Aeromechanics RHEINISCH WESTFÄLISCHE TECHNISCHE HOCHSCHULE AACHEN Eidgenössische Technische Hochschule Zürich Stanford University • Turbine Cooling & Heat Transfer • Design for Six Sigma - Manufacturing Georgia Tech • Probabilistic Design Methodology • New Propulsion Technologies Swiss Federal Institute of Technology, Zurich • CFD Turbine & Compressor GEAE Concentrating Academic Expertise on Critical Technology Needs Bay Area Science and Innovation Consortium(BASIC) IP Project • • • • • BASIC is a collaboration of the Silicon Valley region’s major research universities (Stanford, UC Berkeley, UCSF, …), businesses (IBM, Genencor, HP, Lockheed, SIA, …), and national labs (Lawrence Livermore, NASA Ames, Sandia, …) BASIC is dedicated to developing programs that take advantage of the unique capabilities at Bay Area R&D institutions to provide solutions for critical national and regional challenges Goal of the IP Project is to achieve a shared understanding of general principles that will more effectively advance the IP interests of public and private research institutions Motivation is driven by recognition that a problem exists and is becoming more contentious and complex over time IP Project Desired Impact and Outputs – A set of general principles – Achieve social / culture change in the total IP system – Enhance economic and business development – create a virtuous cycle/environment rather than a vicious cycle Gelato Federation • HP encourages collaborations with and among universities worldwide, exemplified by the Gelato Federation • The Gelato Federation is a world-wide consortium of research organizations dedicated to enabling scalable, open source Linux-based Itanium computing solutions to address real world problems in academic, government, and industrial research www.gelato.org The Gelato Federation NCSA University UIUC of Waterloo Purdue PNNL NCAR Hewlett-Packard (sponsor) UCSD/ SDSC BP KTH Stockholm OSC PSC GaTech Uni Houston Univ Copenhagen Russian Academy Univ Karlsruhe Groupe of Science CERN ESIEE Fudan University INRIA Tsinghua University Zeijang University UPRM BII Singapore iHPC University of New South Wales PUCRS www.gelato.org The Partnership Continuum • An increasing level of trust is developed in the partnership. • The relationship becomes a holistic engagement in the strategic partnership phase. New Relationship Models • • • • “Dedicated to the Public Domain” Model Some university faculty put the results of their research directly into the public domain and do not try to obtain a patent This strategy has been quite successful, since many companies would rather just give money to a university in return for access to students than waste time, money and energy in futile licensing negotiations In this approach, all companies have equal access to the ideas, and those who push the hardest (and hire the students who worked on them) will bring them to market Neither the university nor faculty receive royalty income, but those who adopt this strategy have found that the increase in direct research support more than outweighs the potential (but seldom realized) income New Relationship Models • • • • “Research Commons” Model Proposed by Bob Miller, Vice Chancellor of Research, UC Santa Cruz Multiple companies and universities interact on research activities in the research commons IP is freely available to the companies and universities participating in the commons Under discussion at the UC System New Relationship Models • • • • “Second Generation Technology Transfer” Model Proposed by Gerald Barnett, UC Santa Cruz Technology Transfer Office Current approach of patenting and licensing university inventions to generate royalties is flawed because it concentrates resources on trying to find a few winners, rather than using university technologies to build relationships with companies that might actually use those ideas Barnett advocates using intellectual property as a tool for working with industry more, not less Awards nonexclusive licenses to industrial sponsors of research New Relationship Models • • • • “Privatization” Model Proposed by Mike Uretsky, NYU Stern School of Business His thesis is that universities are the wrong place to do technology development, since universities can’t move fast enough and don’t understand the marketplace The challenge is dealing with economic realities that keep this from being successful Uretsky proposes the formation of a middle operation between universities and industry to focus on development, prototyping, testing, refining, and commercialization of technologies Conclusions • Focus on Building long-term Strategic Partnerships that help each other to be successful: – – – – – – – – • Build trust and mutual respect Maximize the creation and transfer of knowledge Publish and use public domain where appropriate Emphasize total revenue to the university (focus on research funding) Favored vendor status Access to government resources Accreditation & learning science and teaching Technology program portfolio/balance science & engineering We believe this leads to win-win collaborations.