Hi - Amanda Melymuka

advertisement

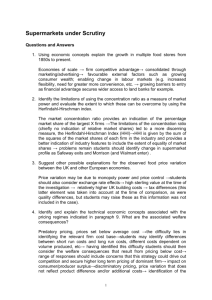

Hi- Value Supermarkets Everyday low pricing (pg.500) October 24, 2012 Dr. Aboulnasr Group 2: Amanda Melymuka Jason Stowe Elard Yong Dale Ward Case Summary: In 1975, Hi-Value Supermarkets became a division of Hall Consolidated, a privately owned wholesaler and retail food distributor. Hi-Value Supermarkets is considered to be the smallest of the three supermarkets chains owned by Hall Consolidated, with a small store distribution for its category. Hi-Value was the number one or two ranked supermarket chain in each of its trade markets (as measured by market share). Hi-Value is known as “most convenient”, having three stores in Centralia compared to its top competitors only having one each. Hi- Values three are major competitors are: Harrison’s, Grand American, and Missouri Mart. The three major competitors in Centralia contain stores all subsequently larger in size than those of HiValue. The four major supermarkets in Centralia make up 85% of all food sales, with the remaining 15% stemming from smaller, independent grocery stores and convenience stores. All 3 major competitors contain a feature attributes and a unique position in the market. Because of Hi-Value Supermarkets having three locations throughout Centralia, they provide a level of convenience that the competition simply cannot mimic without substantial investment. Although Hi-Value Supermarkets does offer the highest level of convenience, there overall prices are the highest. Residents of Centralia prefer a lower price factor mainly due to the average income, which falls between $35,000 and $74,999. Price is the most important store determinant for the residents, which poses a problem for Hi-Value. With price being the most important store determinant for the residents, the current situation poses a problem for Hi-Value. The major question described in the case is whether or not Hi-Value should implement a low-pricing strategy. With the examination of Hi-Value’s current state, it is evident that their future falls in between several courses of action that executives must examine and choose whether or not to integrate them. This process must be done in order to maintain a strong position in their served market and prosperous future. Problem Definition: The Primary Problem that Hi- Value Supermarkets face is that they are the highest priced in comparison market studies of supermarket competitors within the Centralia region. Endowed with proof in the Hi-Value Supermarket Shopper Interview Results (Exhibit 7) that when asked the question “Liked most about other regular store”, the number one answer provided was “Price”. The cause of this is their commitment and value of high quality and limited variety of merchandise particularly in grocery items and fresh produce. Symptoms of this problem can be viewed within the 3% loss revenue within the first quarter of the 2003-year. Situational Analysis: Challenge: The challenge for Hi-Value is weather or not to make the imperative decision to implement “Everyday low pricing” into their sales structure. And if implemented, decide if and how the decision will influence Hi-Value Supermarket’s brand image and positioning. Company In 1975, Hi-Value Supermarkets became a division of Hall Consolidated, a privately owned wholesaler and retail food distributor. Since then, Hi-Value has been serving trade areas in small cities and towns in the South Central United States. Hi-Value Supermarkets is considered to be the smallest of the three supermarkets chains owned by Hall Consolidated. With a small store distribution (for its category) of 20,730 square feet, Hi-Value have demonstrated an outstanding performance, achieving sales of $192.2 million in 2002 and reaching top rankings in market share scores. Strengths Hi-Value Supermarkets, in comparison to their competitors, counts with three strategically positioned locations in Centralia, Missouri, making them more accessible to their customers. This positions Hi-Value on top of the list of customer preferences regarding shopping convenience. Each one of those three stores is located in a strip shopping center owned by their mother company, Hall Consolidated. At the same time, Hall Consolidated have managed to strategically introduce drugstores, barber shops, and dry-cleaners in the same shopping centers, in order to enhance their customer’s experience and add value to their service. Hi-Value Supermarkets also counts with high scores in customer loyalty. Studies have shown that 77.9% of their customers have been loyal patrons for 3 or more years. Weaknesses Being price the most important store choice determinant, Hi-Value’s main weaknesses could be considered their highly perceived prices. After an elaborated consumer research, they concluded that consumers perceived Hi-Value Supermarket’s prices to be “above average” in comparison to their competitors. In addition to high prices, executives agreed on that Hi-Value supermarkets offer a more limited variety of merchandise than their competitors. Overall variety is also perceived as one of the weakest components of store characteristics falling 72% behind Missouri Mart. Opportunities The most important opportunity for Hi-Value Supermarkets is the growing price consciousness among Centralia shoppers. The increase on price elastic customers should be carefully taken into consideration when developing new strategies, or taking new courses of action. One of Hi-Value’s opportunities could be identified in the customer spending habits. Company records point out fresh meat, poultry, and seafood to be among the items people in Centralia spend the most money on. This representative 14.32% average plus the fact that meat quality is the second most important determinant of store choice must be seen as an attractive opportunity for Hi-Value executives to improve the quality of their butcher in order to attract more customers. Threats Some threats were identified during the customer research performed by Hall Commissioned. Hi-Value prices were perceived to be relatively higher over their competitors. This could be considered a major threat for Hi-Value in an increasing pricesensitive market like Centralia. The 2002 research results recognized Harrison’s for having the best prices, courtesy, quality of merchandize and service. A similar result was also obtained from the research studies. Considering that produce is the third most-important determinant for store patronage, Hi-Value faces another problem regarding customer perception. Customers consider Harrison’s to be the “produce store” in Centralia, and this could definitely compromise Hi-Value’s sales and customer patronage. Competition Hi-Value’s competition could be divided into two groups according 40 to competition significance. Its three 35 Hi-Value immediate competitors: Harrison’s, 30 Grand American, and Missouri Mart, Grand contribute 85% (including Hi-Value 25 American Supermarkets) of all the food sales in Missouri Centralia. The other percentage is 20 Mart primarily composed by: North 15 Fairview, West Main Street, Harrison's convenience stores, specialty food 10 stores and seasonal farmer’s markets. Others 5 Each competitor has adopted different strategies to attract and retain 0 customers and maintain business. 1996 1998 2000 2002 As we can see in the chart, HiValue Supermarkets has been recuperating from a crash in the late 90’s. This sudden gain in market share for several companies including HI-Value in the late 90’s, could be a due to a change in customer’s preference and perceptions. As we mentioned before, Centralia shoppers have became more price conscious; therefore, they go after relatively low prices. Age Distribution Customers 19 yrs & under 20-24 yrs 25-34 yrs Centralia, Missouri, the primary trade area in Central-Missouri is home for 41,000 habitants with an average income of $36,000 and an average age of 35 years. Residents of Centralia represent great opportunity for Hall Consolidated. Alternative Courses of Action: Hi- Value Supermarkets Alternative Courses of Action: 1) Implement “Everyday low-pricing” strategy to all Hi-Value Supermarket products: By choosing to implement “Everyday low-pricing” strategy to all Hi- Value Supermarket products in Centralia, Missouri, Hi- Value would begin direct competition with Harrison’s via most reasonable prices. According to the Association of Store Characteristics with Major Food Stores in Centralia’s data, Harrison’s is a market leader with 36% of customers agreeing that Harrison’s has the most reasonable prices leaving Hi- Value only valued at 7% (the least favorable in the category). With 13,500 households retaining an average income of a mere $36,000/ year, consumers of Centralia are shopping smart and becoming more money conscious. As Harrison’s is favored 29% higher, over Hi-Value on pricing, they are undoubtedly the average consumer’s penny stretching, go-to supermarkets. Because price is believed to be the most important store choice determinant for customers, this may be a strategy that Hi-Value should consider. By implementing the “Everyday low-pricing” strategy, Hi- Value Supermarkets would promise customers a low price, without the need to wait for a sale price or other comparison. It is proved that this strategy has proved to work well with a broader store positioning strategy and if it is well supported with advertising. In this case, because HiValue has 3 stores to the other retailers 1 in the Centralia area, it is positioned as the “most convenient” and uses a value approach when advertising. With the current positioning as Hi-Value= Superior Value, in convenience, service and bakery items, HiValue falls short in the pricing category and also typically spends .11% less on advertising annually than the average advertising sales (which is 1% of annual revenue). Implementing this strategy may confuse Hi-Values image and positioning. However, if it is implemented, the “Everyday low-pricing” strategy has the potential to reduce operating costs and increase profit (.9% of annual sales), which the company could then use to bolster a new advertising campaign featuring Hi-Values new “Everyday low-pricing” strategy. 2) Implement “Everyday low-pricing” strategy to Grocery and Seasonal/General merchandise only By choosing to implement “Everyday low-pricing” strategy limited to Grocery and Seasonal/ General merchandise only to Hi- Value Supermarket products in Centralia, Missouri. Hi- Value would limit the pricing strategy to all grocery (including dairy) and general merchandise (including beauty care and health care items). With these categories representing 57% of Hi-Values annual sales, this limited approach on the “Everyday lowpricing” strategy should convey the image they want to project as well as enter Hi- Value Supermarkets into a different level of competition (reasonable pricing) where they were last in the category before. This would mean more direct competition with all 3 other Supermarkets in Centralia (Grand American, Harrison’s and Missouri Mart). However, this change does alter Hi- Value’s positioning as “superior value and convenience” and may begin to confuse shoppers. Some supporting factors to this argument according to Hi- Value Supermarket Shopper Interview Results are that 77.9% of all Hi- Value customers are dedicated patrons that have stayed and shopped with Hi- Value for 3 or more years. Of these customers 51.7% purchase about half their total food needs with Hi- Value Supermarkets and of that 51.7% of food needs, 36.9% purchased grocery only and 23.4% purchased Grocery, meat and produce. Of these customers interviewed, 27% of them stated that the things they liked best about other stores were the “prices”. This information allows a conclusion to be drawn that because of the strong base of loyal customers, who mostly purchase grocery items, prefered most stores with lower pricing and shopped most regularly for other groceries at Missouri Mart (whose ad’s feature “very low prices”), that the strategy of implementing “Everyday low-pricing” limited to Grocery and Seasonal/ General merchandise only, to Hi- Value Supermarket products in Centralia, Missouri to be successful. 3) Do not implement the “Everyday low-pricing” strategy whatsoever By choosing not to implement the “Everyday low-pricing” strategy whatsoever to HiValue Supermarket products in Centralia, Missouri would allow Hi- Value Supermarkets to maintain their prided image and positioning as the “greatest convenience for shoppers”. Their 3:1 ratio of stores located throughout Centralia gives them a competitive edge against the other leading stores in the area. Hi-Values W. Prospect store, being the only Supermarket in that section of town is a definite advantage for the organization. By choosing to focus directly on their existing positioning they will be sure to not confuse customers, also with their large base (77.9% of loyal 3+ year customers) they are not to worry about switching. It should however, be a concern that most customers stated they liked other stores prices better. But if Hi-Value was to change their positioning, it may change the way they are overall perceived. Higher prices indicate higher value and superior service. This is a trend seen worldwide. These categories of high value and service are what Hi- Value (hence the name) Supermarkets was built upon. The option of lowering price tends to contradict these written values. In a well-defined market area, for “Everyday low pricing” to work, you do not have to be the lowest priced supermarket in the trade area. This allows the option to always be considered to only slightly lower prices. With Hi-Value’s pricing to be 7-10% higher than its competitors, if Hi-Value lowers prices by a mere 2-3% they can still be positioned as the most convenient and superior value supermarket, while satisfying their customers price concerns. Recommendation: The more appropriate and responsible course of action Hi-Value Supermarkets should take, given the market’s standing at this point in time would be to not implement the “Everyday pricing strategy” whatsoever. By choosing not to implement the “Everyday low-pricing” strategy whatsoever to Hi- Value Supermarket products in all 3 stores located in Centralia, Missouri would allow Hi- Value Supermarkets to focus on the already respected positioning as the “greatest convenience for shoppers”. Because of their 3:1 ratio of supermarkets located throughout Centralia, Hi-Value gains well-recognized competitive edge against the other leading stores in the area (especially having direct store competition at the N. Fairview and W. Main Street locations and having a complete territory sectioned and conquered with the S. Prospect location). Deciding to solely focus HI-Value’s existing positioning they can be confident that customer confusion will not occur. Hi-Value Supermarkets cannot be “everything to everyone”, they should focus on their strength and satisfy disputes with marginal tweaks. With that being said, because of Hi-Values large base (77.9% of loyal 3+ year customers) there is no doubt the trend will alter as Hi-Value maintains their image. The largest concern with this recommendation would be that most customers surveyed stated they “liked” other stores prices better. Because of the somewhat struggling market of Centralia, this should be a point of concern for Hi- Value Supermarkets who are already down 3% of their first quarter sales in 2008. However, if Hi-Value was to change their positioning, and introduce the “Everyday low pricing strategy” it may change the way they are overall perceived. The higher prices shown in their products available to consumers indicate higher value and superior service. This strategy is a trend that can be viewed in products from handbags to cheese. The categories of high value and service that Hi- Value has chosen to associate them with are the values Hi- Value (hence the name) Supermarkets were built upon. Meaning, the option of lowering prices tend to contradict these written values. The following statement can effectively prove the chosen alternative. “If a low-price strategy is implemented it has to be used by all stores in a trade area. Otherwise, the store's positioning and image may become confused”. Although the other 3 main competitors have ideally lower prices, they are not all on board with the “Everyday low pricing” strategy. It is proved that “In a well defined market area, for “Everyday low pricing” to work, you do not have to be the lowest priced supermarket in the trade area”. This allows Hi-Value to consider only slightly lowering all product prices. In the case of Hi-Value’s pricing to be 7-10% higher than its competitors, for HiValue to lower product prices by a mere 2-3% it allows them to continue to be positioned as the most convenient and superior value supermarket, while satisfying their customers price concerns. This being done, and also increasing the advertising to 1% of annual revenue, creating awareness about price drops (whatever the percentage) will satisfy the large base of loyal consumers with economical driven price concerns, yet maintain the “High-Value” image and convenience advantage. Case Questions: 1-How would you characterize the supermarket competitive environment in Centralia? The competitive environment for supermarkets in Centralia is mostly based upon four major grocery chain stores that accounted for 85% of all food sales in 2002. The remaining 15% is shared by two other small independent grocery stores, as well as several convenience stores and specialty stores. Hi-Value's main competition stems from Harrison's, Grand American, and Missouri Mart. Harrison's is believed to have captured most of its business from the middle and upperincome groups in Centralia whose incomes are in excess of $40,000. The store is clean, orderly, and attractive with a warm decor and friendly staff. Harrison's has a very favorable image in the mind of consumers, and the store has a well-balanced variety of meats, produce, and groceries. Harrison's focuses on a low priced strategy as described by their slogan, "Save on the Total." Grand American is a new store in Centralia, and is one of 148 Grand American supermarkets. The store is the most modern store in the city, with the finest fixtures and decor, as well as wide aisles, but Hall officials to be a secondary competitor regard the store. It's variety of meats, groceries, and produce is modest but the dairy department is highly regarded by Centralia shoppers. Grand American's price strategy is also one of low-cost, but does this by highlighting the competitor's prices in their advertisements. Customers of this store also come from residential areas, but have lower incomes in the range of $20,000-$35,000. Missouri Mart is regarded as Centralia's food sales volume leader, and is Hi-Value's main competition. Almost 32% of Hi-Value customers also shop at Missouri Mart on a regular basis. The store's main clientele is middle-aged and older families with incomes in excess of $30,000. Missouri Mart's main merchandising strength is in groceries and special purchase displays. A manager from one of the three Hi-Value stores in Centralia is quoted as saying that " orderliness and cleanliness are sacrificed for production, and the store lacks the quality and freshness present in the other supermarkets in Centralia." 2-How would you characterize Hi-Value Supermarkets' competitive positioning in Centralia? Hi-Value Supermarkets in Centralia were believed to offer a more limited variety of merchandise than the major competitors, but carried more high-quality merchandise, particularly grocery and produce items. Hi-Value trailed both Missouri Mart and Harrison's in terms of overall advertising exposure. No advertising in Centralia was done on television. Instead, newspapers, circulars, radio, and outdoor advertising was used. The highest-priced food stores in Centralia were those of Hi-Value Supermarkets, but nevertheless, Hi-Value advertises high-volume items at deeply discounted prices and features "loss-leaders." The North Fairview store is the oldest of the three stores in Centralia, and is located about two blocks from Missouri Mart. About twenty percent of the North Fairview store's customers come from outside of Centralia. The West Main Street store opened in 1977 and had substantial renovations done in 1992 and 2000. The deli prepares items for sale at this location, as well as the other two HiValue stores in Centralia. Harrison's and Grand American stores are both located across the street, but most of the customers of the West Main Street store come from the area south of the store, where Harrison's and Grand American draw fewer customers. The South Prospect store, built in 1982, was substantially remodeled in 2000. This store has no immediate competition in the vicinity, and 23% of the store's sales come from people living outside of Centralia. This store features an on-premise "scratch" bakery, which offers high quality items, but less variety than other retail bakery shops in the area. 3-How might everyday low pricing affect Hi-Value Supermarkets' competitive situation in Centralia? In a time of growing price consciousness in Centralia, a low pricing strategy could potentially increase sales and the market share of Hi-Value Supermarkets. In the first quarter of 2003, sales of Hi-Value were already down 3%. By switching to a low cost strategy, Hi-Value could possibly reverse this effect, and prevent any loss to its market share. 4-What are the pros and cons of an everyday low pricing strategy for Hi-Value Supermarkets in Centralia? The controller for Hi-Value Supermarkets pointed out that by implementing a low pricing strategy, Hi-Value could potentially lower its operating costs by two ways. It could reduce handling and inventory costs due to a more steady and predictable demand. Secondly, labor costs could also be reduced by less frequently changing temporary price reductions. Both savings could be added to the company's gross profit margin. The savings could also be used to fund a new advertising budget featuring the new low pricing strategy. If a low-price strategy is implemented it has to be used by all stores in a trade area. Otherwise, the store's positioning and image may become confused. Strengths Hi-Value Supermarkets counts with three strategically positioned locations in Centralia, Missouri. Hi-Value on top of the list of customer preferences when it comes to shopping convenience. Stores are located in a strip shopping center owned by their mother company, Hall Consolidated. HiSupermarkets Weaknesses Hi-Value’s main weaknesses could be their highly perceived prices. More limited variety of products than their competitors. Hi-Value Supermarkets counts with a very strong customer loyalty. Research has shown that 77.9% of their customers remain loyal patrons for 3 or more years. Opportunities The most important opportunity for Hi-Value Supermarkets is the growing price consciousness among Centralia shoppers. Research has shown that quality of meat is the second-most important determinants of store choice and patronage. Threats Harrison’s is perceived as having the best overall prices. Customers perceived Harrison’s to be the “produce store” in Centralia.