Healthcare Sector Analysis

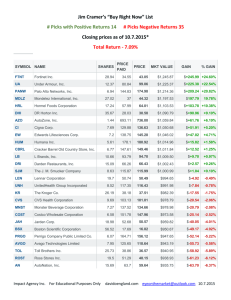

advertisement

Healthcare Sector Analysis Prepared by Ariel Imas Robert Candella Nanda Win Student Managed Investment Portfolio Class Prof. P.V. Viswanath Spring 2002 Objective • To research, evaluate, and present potential equity-investment opportunities in the U.S. healthcare sector. Research Methodology 4-fold approach: 1) Industry analysis 2) Quantitative analysis 3) Corporate analysis 4) Recommendation 1) Industry Analysis • • • • Total universe identified Elimination criteria applied Financial ratios vs. industry benchmarks evaluated Industry analysis performed Total Universe Identified • U.S. Healthcare stocks isolated using StockVal: 724 stocks in population Elimination Criteria Applied • Stocks remaining after elimination criteria applied: 246 stocks - Total assets > 200M 41 stocks – Leverage regression 18 stocks - Price/Free cash flow Financial Ratio vs. Industry Benchmarks Evaluated • • • The financial ratios were selected to complement the model inputs later required for the quantitative analysis. Financial ratios 1) Financial Strength 2) Profitability & Effectiveness 3) Growth 4) Valuation 5 stocks remained after ratios were considered Financial Ratios 1) Financial Strength – Quick Ratio • Measures firms ability to generate free cash flows – LT Debt / Common Equity • Measures effective use of long-term debt with respect to changes in the shareholder’s equity – Total Debt / Equity • Measures effective use of total debt with respect to changes in the shareholder’s equity Financial Ratios 2) Profitability & Effectiveness – EBITDA Margin • measures profitability while eliminating effects of financing and accounting methodologies between industries – Return on Equity • measures effective use of shareholder’s equity to generate net income – Return on Capital • measures effective use of capital – Net Income per Employee • measures managements ability to leverage their human resources to generate net income Financial Ratios 3) Growth – Revenue Growth LFY • measures firm’s ability to increase revenues – EPS Growth LFY • measures firm’s ability to generate income (less dividends) per unit of stock Financial Ratios 4) Valuation – Book Value / Price • measures the value of the balance sheet in the market – Price / Sales • measures the price per unit of sales the market is willing to pay for the company – Price / Free cash flow per share • measures price per unit of free cash the market will pay for the company – Price / Net Work Cap • measures price per unit of net working capital market will pay for company 1) Industry Analysis Top 5 stocks (in order of ranking): 1. Polymedica Corporation – Medical Products 2. Gentiva Health Services Inc. – Home Healthcare 3. Datascope Corporation – Medical Products 4. Mentor Corporation – Medical Products 5. Invitrogen Corporation – Biotech 1) Industry Analysis • Philosophy: If Company A is more undervalued that Company B, but Company B is in an industry with greater growth potential, Company B presents a better investment opportunity. 1) Industry Analysis • Industry view: 1. Biotech: will benefit greatly from genome research, but will not mature until patent suits and R&D investments are realized in another 4-5 years. Unfavorable. 2. Home Healthcare: benefiting from aging U.S. demographics and low-cost alternative to hospital care. Aggressive pricing will continue to drive current profitability. Favorable. 3. Medical Products & Equipment: benefiting from aggressive pricing and growing world market. Favorable. 1) Industry Analysis Final 4 stocks (in order of rank): 1. Polymedica Corporation – Medical Products & Equipment 2. Gentiva Health Services Inc. – Home Healthcare 3. Datascope Corporation – Medical Products & Equipment 4. Mentor Corporation – Medical Products & Equipment 2) Quantitative Analysis 1. Model selected: Type: Two-stage Free cash flow to equity discount model Purpose: To value the equity in a form with two stages of growth—an initial period of higher growth and subsequent period of stable growth Structure: 1) Free cash flow to equity 2) Weighted average growth rates for high-growth period 3) Discount factor 4) Stable growth period 2) Quantitative Analysis Model Value vs. Market Value Company Polymedica Corp. Datascope Corp. Gentiva Health Services Inc. Mentor Corp. Ticker PLMD DSCP GTIV MNTR Model Value $47.55 $57.35 $23.94 $36.08 Market Value $36.50 $32.98 $25.78 $38.25 Model vs. Market Differential 30% 74% -7% -6% Status Undervalued Undervalued Overvalued Overvalued 2) Quantitative Analysis Polymedica Corporation 2) Quantitative Analysis Datascope Corporation 2) Quantitative Analysis Gentiva Health Services Inc. 2) Quantitative Analysis Mentor Corporation 2) Quantitative Analysis Subjective variables considerations 1. High-growth rate weights: • • • 2. Historical growth rates Outside prediction of growth rate Fundamental prediction of growth rate High-growth rate growth estimates: • • • • 3. Growth rate in capital spending Growth rate in depreciation Growth rate in revenues Outside estimates (5-yr growth rate) Stable-growth estimates: • • Stable growth rate Stable growth beta 2) Quantitative Analysis Subjective variables justifications 1. High-growth rate weights: • 2. Fundamental growth rates were more heavily weighted to the extent that the model value was deemed reasonable. This was because greater “historical” and “outside” weighting significantly inflated the model’s stock price and concurrently diminished the significance of the group’s fundamental research. High-growth rate growth estimates: • 3. Parity was maintained between growth rates in capital spending and depreciation and the growth rates that would be required to promote significant revenue growth rates in a high-growth period. Stable-growth estimates: • • Stable growth rates were kept within reasonable economic limits. Current, high-growth betas were applied in the stable-growth period to encourage conservative model values. This is because industry average betas (the beta that a company’s beta will approach in a stable-growth period) tend to fall below 1 in the healthcare sector, which significantly overstate prices in the FCFE model. 3) Corporate Analysis Considerations: • Management review • Insider activity • Institutional activity • SWOT analysis • Corporate Overview Management Review • Of all stocks, Mentor Corp. ranked #1 • Of undervalued stocks, Polymedica ranked #1 Title Age Tenure (years) Salary Bonus Other Compensation All Other Compensation Other Compensation Polymedica Corp. Datascope Corp. Gentiva Health Services Inc. PLMD DSCP GTIV CEO CEO CEO 54 73 48 12 N/A 3 Mentor Corp. MNTR CEO 62 34 $397,460 $1,160,000 $0 $6,550 $1,564,010 $1,000,000 $1,175,000 $281,305 $17,590 $2,473,895 $458,654 $650,000 $7,777 $3,758,078 $4,874,509 $390,000 $0 $0 $4,552 $394,552 Net Income Salary as a % of Net Income Mean % from average Score $22,734,000 7% 10% -29% 2 $34,243,000 7% 10% -25% 3 $20,988,000 23% 10% 141% 4 $32,078,000 1% 10% -87% 1 Exercised Stock Options Exercisable Stock Options Unexercised Stock Options Total Stock Options 37,024 347,881 66,542 451,447 325,000 215,000 0 540,000 0 727,073 90,000 817,073 100,000 260,500 183,500 544,000 8% 22% -62% 2 60% 22% 177% 4 0% 22% -100% 1 18% 22% -15% 3 4 2 12 3 4 2 3 1 % Exercised Mean % from average Score Product Rank Insider Activity • Of all stocks, Mentor Corp. exhibited an insider buying trend • Of undervalued stocks, Polymedica Corp. exhibited an insider buying trend Institutional Ownership # of Institutions Current Activity Polymedica Corp. Datascope Corp. Gentiva Health Services Inc. Mentor Corp. PLMD DSCP GTIV MNTR 95.0% 71.6% 69.9% 82.1% 283 238 168 285 Buying Selling Selling Buying Institutional Activity • Of all stocks, Mentor Corp. exhibited the most significant positive change in institutional ownership • Datascope Corp. exhibited the most significant positive change in ownership amongst undervalued companies # Institutions Total Shares Held % Shares Owned 3 Mo. Shares Purchased 3 Mo. Shares Sold 3 Mo. Net Change % Change # Buyers # Sellers Total # Net Buyers Trend Polymedica Corp. Datascope Corp. Gentiva Health Services Inc. Mentor Corp. PLMD DSCP GTIV MNTR 113 101 86 133 12,287,280 10,508,648 15,802,032 18,868,990 102% 71% 61% 81% 1,545,967 (1,817,093) (271,126) -8% 1,004,944 (872,439) 132,505 7% 4,789,582 (5,053,975) (264,393) -3% 4,987,289 (2,447,674) 2,539,615 34% 50 55 105 -5 39 57 96 -18 53 31 84 22 67 59 126 8 Selling Buying Selling Buying Corporate Overview Polymedica Corporation: With formidable growth for years to come, Polymedica Corp offers direct-to-customer relief medical products and equipment to patients with diabetic, respiratory, urology, urinary tract, and menopause problems. Their core business consists of diabetic and respiratory products, both of which have shown significant growth. Currently, only consuming 8% of the diabetic market, Polymedica has great potential to gain market share and achieve even more growth. Favored by today’s demographics, Polymedica Corp relies on government programs to receive most of their profits. Corporate Overview Datascope Corporation: With over 6 long established product lines consisting of products for clinical health care markets in interventional cardiology, critical care and cardiovascular and vascular surgery, this company is here to stay for years to come. 2 new products shall propel growth rates even higher. Their brand new launch of top-of-the-line next generation intra-aortic balloon sets a new standard with the Fidelity 8 Fr. This product will propel their Cardiac Assist unit to levels of great proportions. In the pipeline, upgraded VasoSeal (R) arterial puncture sealing devices shall reap positive rewards for their Collagen Products / Vascular Graft Segment. Having undergone a big restructuring with in the company, DSCP looks to benefit over 10 Million annually. Corporate Overview Gentiva Health Services: With a positive earnings surprise of 6 cents or 33% in the fourth quarter, and a positive earnings surprise for the past four quarters, GTIV is doing something right. Currently, this company provides specialty pharmaceutical services through 40 pharmacies across U.S.A., along with specialty home health care services. With their sale of the Specialty Pharmaceutical assets to Accredo, GTIV is focusing on their Home Health Care Services. Currently, GTIV holds the number one spot in Home Care with a 2-3% market share. Their 275 locations enable delivery of wide range of services though their nursing and care centers. GTIV is actively pursuing relationships with managed care organizations. Cigna Health Care represents the largest managed care organization in which they have direct business with; in 2001 Cigna represented 19% of revenues for GTIV. Recently, both Cigna and GTIV renewed their contracts for the seventh consecutive time. Corporate Overview Mentor Corporation: Mentor Corporation develops, manufactures, and markets a broad range of products for the medical specialties of plastic, reconstructive, general surgery, and urology. The Company's products include a line of implants, incontinence products, catheters, impotence products, and cancer diagnosis and treatment products. Mentor markets its products in the United States and in more than 60 companies. Mentor continues to post consistent revenue growth earning it the distinction of being one of Forbes 200 Best Small Companies. Recently divesting its ophthalmology business, Mentor focus now is on its core businesses--urology and cosmetic surgery markets. The urology segment of its core business addresses a large underserved population with devices for the management and treatment of urologic disorders common in the aging population. The cosmetic surgery segment, one of fastest growing fields in medical practice today, experiences annual growth rate of 10-12 percent. This well managed company will most definitely translate these market opportunities into significant earnings growth. SWOT Analysis Polymedica Corporation: Strengths: • Have a good stranglehold of the Diabetic market • Direct mail delivery along with sophisticated software and advanced order fulfillment system provides products and support quickly and efficiently • Building brand name and loyalty with their customers due to customers recurring orders • Headed in the right direction with marketing to the right customers Weaknesses: • A change in Medicare and governmental policies will severely alter PLMD’s revenues • Revenues depend on recurring orders from customers; if customers do not place any extra orders other than their first, PLMD incurs a loss • Low-medium barriers of entry Opportunities: • With an only 8% market share in Diabetic products and supplies, there is plenty of room to achieve greater success • Once business is completely established, PLMD can expand internationally • Can increase revenue growth by selling other products to existing patients in database • Increase relations with merchandisers to generate extra growth. Threats: • With an advance in technology, elimination of consumable testing supplies for glucose monitoring is inevitable. This line consists of a major portion of Chronic care sales • Reorders by patients are questionable due to customer preference, competitive pricing pressures, customer transitions to extended care facilities and mortality rate • Competition with in this market is fierce. Price pressures and market share are difficult to achieve • Government controls companies destiny; limited budgeted expenses towards healthcare SWOT Analysis Datascope Corporation: Strengths: • Many lines of products that make money • Pioneer in development of Cardiac Assist products • Restructuring will save over $10 M year over year • Newly implemented direct sales strategy prove to be effective • Experiencing great growth in Patient Monitoring Labs Weaknesses: • Experienced distribution problems • Weak dollar hurts international sales • Involved in too many projects resulting in higher costs Opportunities: • Potential to gain on the Inter Vascular market of $130 M in U.S. • New line of Fidelity 8 Fr. Can significantly increase growth • VasoSeal ® new pipelines can significantly increase growth • Expand to Asian and other European markets Threats: • Foreign Rate Fluctuations can impact earnings • Costs with in company can increase • Lower R&D investment can weigh negatively on the company • Competition is strong, can force profits to dwindle SWOT Analysis Gentiva Health Services: Strengths: • Home Care services prove to be effective and strong with 275 locations of deliveries of wide range of services • New trademarks are developing, making GTIV a known source • More focus on Home Care services with the sale of Specialty Pharmaceuticals Weaknesses: • Due to the Budgeted Balance of 1997, there is a 15% reduction in home health care payout limit • Depended on Government regulations Opportunities: • Actively pursuing relationships with managed care organization • With more focus paid on Home Care services GTIV can effectively distribute their products through nursing and care centers • Can gain market share through brand name and various projects Threats: • Outside competition can hurt earnings with price pressures • Government regulations can hurt earnings SWOT Analysis Mentor Corporation: Strengths: • 25-year track record in growing world breast augmentation market • Competes primarily with one other company in the domestic breast implant market, McGhan Medical Corporation • Competes with only one other company in the inflatable penile implant market, American Medical Systems, Inc • The Company believes that it has second largest market share for both Iodine and Palladium (brachytherapy seeds for the treatment of prostate cancer) seeds, and its recent acquisition of South Bay Medical's automated workstation will provide the Company with a strong competitive advantage • Dominant catheters and other disposable incontinence products position in the European market Weaknesses: • Limited global reach • Recently emerged from FDA consent decree • 1,622 employees - 382 in sales and marketing Opportunities: • Innovative ultrasound liposuction technique under FDA review • Clear exit strategy—to be acquired • Viagra introduction and concurrent advertising campaign generated an unprecedented amount of interest in impotence causes and treatments Threats: • FDA regulation • Failure to develop existing distribution channels • Government and market cost containment measures • Strong dollar SWOT Overview • Polymedica Corporation • Potential for former venture capital fund manager CEO to further capitalize on diabetic and Senior demographic trends outweigh price pressures and regulatory concerns. • Datascope Corporation • Innovative, but aging management, recent restructuring enables company to have productive sales--no longterm debt and significant foreign currency exposure--make company’s growth potential questionable but reasonable. With two bran new products and international exposure company can see formidable growth for years to come. • Gentiva Health Services • Company dominates Home Care and will benefit from demographic trends and growth in industry, but insider selling at $24, stock at 52-week high (as of April 22nd) confirms that stock is overvalued. • Mentor Corporation • Company will benefit from favorable demographic changes and growth trends in core businesses, but 34-year CEO tenure, recent emergence from FDA consent decree, and significant earnings increases realized through cost savings and a recent acquisition leave make current management's ability to grow company questionable. 4) Recommendation (A) • Polymedica Corporation – Access to capital: • CEO former venture capital fund manager – Solid technology investments: • Co. leverages database of over 5% of all diabetes patients in U.S., free shipping, reoccurring order processing and automatic billing to retain customers and develop new product lines and services – Regulatory concerns marginal: • Emerged from SEC investigation unscathed – Strong market demographics • Market share growth initiatives will be complimented by favorable demographic trends Recommendation (B) Datascope Corporation • • • • Solid Future With two bran new products Datacope will greatly increase their revenue stream. Cost Cutting Management is doing the right thing in curbing costs during recessionary times. Strong Market Demographics Just like Polymedica Corp, Datascope will accrue greater sales as the baby boom population ages. Good take-over candidate with only a $400 M market capital, while penetrating the international markets.