Title (up to 2 lines. Keep title in white space, do not write in coloured

advertisement

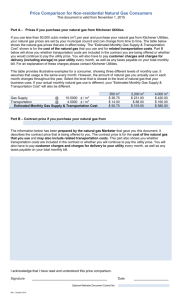

OECD Presentation Resources and Transfer Pricing: A Canadian Perspective San Jose 31 March – 4 April 2014 Overview Transfer pricing and resource economics Audit considerations The Canadian resource tax environment Case studies • Commodity marketing transactions • Business restructures and expansion • Intangibles in the mining sector 2 Transfer Pricing and Resource Economics Renewable v non-renewable resources • Expectations of scarcity affect supply and demand dynamics and therefore price Demand and supply realities • World v regional markets; resource type Market structure • Levels of competition and market consolidation The Paradox of Value 3 Consideration for Extractive Industries Facts and circumstances • All mines are unique – geography; risk; ore quality Capital intensity • Significant sunk cost investment required Continued investment • Need for continual, often significant, injections of capital over life of project 4 Consideration for Extractive Industries (cont’d) High cost of knowledge • Decisions based on expectations – in order to obtain full data on a mine it must be operated Commodity price cycles • Market prices are volatile – affects decision making over the life of the mine – impact from a myriad of economic factors on various stages of value chain 5 Consideration for Extractive Industries (cont’d) How do such factors affect the market, investment decisions, inter-company pricing and taxation? 6 Mineral Extraction: Stages and Functions Exploratio n and Feasibility Planning and Constructi Operations Closure Exploration: - reconnaisance; locate mineral anomalies - discovery, sampling Feasibility: - decision about economic fesability of mining Planning: - mine planning - environmental/social planning - closure plan - environmental assessment - evironmental and other permits Construction: - clearing, stripping, blasting, infrastructure - ore extraction - crushing, grinding, concentrating - waste rock and tailings management - wastewater management - progressive reclamation - site clean- upl reclamaton; rehabilitation - maintenance; environemtnal monitoring 7 Price Determination In the short-run, price of an intermediate natural resource is a function of the price of the final product Price differences exist between stages of extraction, processing and distribution For certain resources market prices exist for the intermediate product – oil quoted as $ / barrel Crucial to understate stage of pricing in the value chain • Microeconomic and macroeconomic, endogenous and exogenous, factors impact expected market pricing 8 Price Determination (cont’d) Price is influenced by: • Demand for minerals and resources • Increasing industrialization of China and India • Regional and global economic activity • Demand for substitutes • Mine production and processing output • Political issues; project costs; technological advances • Supply chain challenges • Production Processing Distribution 9 Source of Price Changes Final product price fluctuations The price of inputs remain unchanged (inelastic) Cost of labor and industrial inputs Transportation costs – may be affected by market changes Distribution and marketing costs Technology and machinery - efficiency and availability 10 Level of Market and Pricing Issue Resource Demand Resource Price Resource Supply Recycling Processing Processing Demand for Concentrate Captive mine Mine Processing Price of Concentrate Supply of Concentrate Mine Mine Mine 11 Level of Market and Price Issue (cont’d) Identify and understand potential difference in price at various stages of the value chain Stage of value chain impacts: • Function, asset and risk contribution • Comparability • Market prices and benchmarking Look to market for reasonable arm’s length pricing and transaction models 12 Resource Value Chain and Transfer Pricing Mining Oil and Gas Exploration Upstream Production Production Transportation Processing Midstream Refining Transportation Downstream Marketing Marketing 13 Economic Rent Typical v atypical returns – excess returns above normal levels Economic rent as the returns realized after paying for all factors of production, including funds committed to the project Not uncommon for resource sectors to accrue economic rent • Commodity boom – periods of ‘excessive’ returns 14 Economic Rent (cont’d) Economic rent in resource sector: Scarcity: • Demand and supply constraints • Elasticity of demand and supply Ore quality: • Reduces processing • Commands higher price in market • Comparative advantage lost to transport Technology: • Advanced technology • Specialization to mine site or industry 15 Example: Economic Rent from Scarcity Low price Turnover High price $80 Turnover $130 Fresh extraction 20 Fresh extraction 22 Grinding costs 10 Grinding costs 10 Development costs 18 Development costs 18 Management fees 8 Management fees 8 Marketing costs 5 Marketing costs 6 Freight 9 Freight 9 Operating income 10 Operating income 57 ‘Normal’ earnings 30 ‘Normal’ earnings 30 Differential 27 Differential (20) 16 Example: Economic Rent from Technology Low price Turnover High price $100 Turnover $100 Fresh extraction 20 Fresh extraction 20 Grinding costs 10 Grinding costs 10 Development costs 18 Development costs 12 Management fees 8 Management fees 8 Marketing costs 5 Marketing costs 5 Freight 9 Freight 9 Operating income 30 Operating income 36 ‘Normal’ earnings 30 ‘Normal’ earnings 30 Differential 6 Differential 0 17 Attributing Economic Rent At arm’s length a number of factors influence contracts Unrelated parties negotiate to protect economic interests Third party contracts include complex formulae which consider: • Net return • Content and composition of concentrate • Production costs • Market power • Risk • Contract duration and potential re-negotiation • Terms of payment 18 Arm’s Length Contracts Recall: Nature of contract is dependent on resource and industry 1. Zinc: Silver: Price paid: $1.02/lb x 2 204.6 = $2 250 /MT (average LME spot price) $17.00 / oz 2. Expected value of resource realized by processing Zinc: 55% x 85% = 46.75% x $2 250 = $1 051.88 Silver: (5oz – 3oz) x 70% x $17.00 = 23.80 Total Payable = $1 075.68 3. Processing deductions Processing Costs: Base fee = $275.00 Adjust for price change: $2 250 – 2 500 = 250 x 4C/1$ Penalty for Fe 8.5% - 8% = 0.5% x $1.50 $/1% Penalty for MgO 0.5% - 0.35% = .015% x 2.00 $/0.1% Total deductions Paid to mine Percentage realized by mine =$ = = 10.00 (0.75) (3.00) = (268.75) = $ 806.93 = 75% 19 Arm’s Length Contract (cont’d) Terms are dependent on mineral/resource and bargaining power of mine and processor Key elements • Expected prices – primary and secondary metals • Expected production output – 55% and 85% • ‘Penalties’ for impurities • Price adjustments accounting for additional metals and changes in market price Comparable Uncontrolled Transaction (CUT) 20 Audit Considerations Types of transactions: • Resource sales – final product and/or concentrate • Financial transactions – debt; equity; derivatives • Equipment transfer – sales and leases • Intangibles – creation and transfer of know-how Nature of resource • Understanding demand and supply dynamics; levels of competition and regulation Industry and market value chain • Note: Oil and gas markets have changed significantly since the 1980s 21 Audit Considerations (cont’d) Pricing benchmarks • Market indices and posted rates • Comparability at concentrate level as a significant challenge Mining project life cycle • Differences in cost, market price over time Functional roles and capacity of related parties • With consideration of the assets used and the risks expected by the market 22 Canadian Resource Tax Environment Income taxes • Federal and provincial levels Mining taxes • Provincial level – including royalties Three distinct stages: • Exploration and development • Commercial production • Processing 23 Canadian Resources 24 Provincial Resource Royalties Provinces and territories administer royalties Royalty rates and calculations differ across regions and mineral/resource Royalties are intended to be non-distortionary • Taxes on economic rents do not affect investment and operational decisions Link between various levels and form of taxation • Can help identify transfer pricing issue and Taxpayer 25 motivation Provincial Resource Royalties (cont’d) Example: Saskatchewan Resource Royalty Base payment: Net base payment = Gross base payment – [Crown royalties + Freehold royalties + Saskatchewan resource credit – Excess deductions] – Tax credits (prior year) Profit Tax: Net profit tax = Gross profit tax – Base payment credits – Tax credits 26 ‘Half-time’ Thoughts Understanding the resource market • World vs. regional markets Economic factors unique to resource industry and mining company transactions The resource value chain and system profits Identifying the stage of the transfer pricing issue: extraction, processing, distribution Economic rents Types and form of taxes typically applied to resources 27 Case Studies Commodity marketing (1) – Related marketer Commodity marketing (2) – Functional deficiency Commodity marketing (3) – Financial transactions Business restructuring / expansion Mining and intangibles 28 Commodity Marketing - General North American oil and gas industry as wonderfully transparent source of arm’s length terms, conditions and pricing • Deregulated and highly competitive Marketers exist to facilitate trade • Interested in underlying value of resource • Paid on a per volume basis: $X / BTU or / ST • Marketers enter into financial transactions – speculative and hedges • Various types of marketers, depending on functional 29 and risk capacity – impacts value and pricing Commodity Marketing – General (cont’d) Arm’s length contracts historically based on netback pricing terms and conditions – resale price Inter-company commodity marketing • Centralization of functions and risks • Emphasis on Parent company’s control and intangibles • Location of activity v signed contract • What is/are value added activity? Ultimately transactions occur given demand for the resource in question 30 Case Study 1: Commodity Marketing – Related Party Marketer Facts: • US Parent • USCO distributes Canadian Resource A in US • CANCO is a mining entity • Three mines in Canada - oligopoly • CANCO distributes Resource B in Canada for USCO • Canadian operations account for more than 30% of world production of Resource A 31 Case Study 1: Related Party Marketer Mine 1 3rd Parties CANCO Mining and Processing Mine 2 Mine 3 Mineral Sales CAN US USCO Parent US Distribution 3rd Parties 32 Case Study 1: Related Party Marketer Taxpayer model • Fixed commission fee based on netback pricing (NBP) • NBP = End Selling Price – Marketing Fee – Costs (agreed to in contract negotiation) • Essentially resale price: Jun-01 Dec-01 Dec-02 Third party freight and logistical 3.35 3.34 3.43 SG&A 7.65 7.54 6.56 Total Cost per ST 11 10.88 9.99 Commission Rate 21.09 18.50 18.50 Mark-up 10.09 7.77 8.51 91.70% 85.20% 70.00% Percentage return 33 Case Study 1: Related Party Marketer Taxpayer Rationale: • “The ultimate discount...is based on the principle that the gross margin to be earned...must cover operating costs and earn a reasonable return for the functions.” (CDocs) Did not use arm’s length distribution fee comparables Provided little economic rationale or analysis of fees Commission fees selected by the Taxpayer resulted in a profit split of 55 / 45 in favour of the mine (CANCO) The Taxpayer used a Profit Split comparability analysis to verify the commission fees – assumed the answer 34 Case Study 1: Related Party Marketer The CRA challenged the validity of the fees and the usefulness of the profit split analysis given the differences in industry and commodity resource The Taxpayer intimated that they would use the profit split analysis on a go-forward basis The profit split was a ‘sanity’ check for the CRA – clearly the results were not arm’s length 35 Case Study 1: Related Party Marketer Characterization: • CANCO as producer/processor of Resource A • USCO as a ‘routine’ commodity distributor Taxpayer claimed USCO provided much more than distribution functions • Supply and product management • Integration of activity required application of profit split 36 Case Study 1: Related Party Marketer ‘Routine’ implying no significant intangibles • Processes • Technology Taxpayer’s claim of non-routine or high integration counter to market data and realities USCO carries same expectations and risks, and completes the same functions as comparables Corporate reality v arm’s length expectations 37 Case Study 1: Related Party Marketer The CRA accepted netback pricing in principle: • Proposed use of Berry ratio to determine level of fees • Berry ratio = Gross Profit / OE • OE as representing value added activity • Reward entity in line with functions performed as captured in OE Arm’s length producer expects to capture/carry price changes – price risk Profit split linked to prevailing market price and so unreasonably rewards distributor in good times • An issue of Base Erosion (BEPS) – think of royalty calculation38 Case Study 1: Related Party Marketer CRA: Relied on independent functional and economic analysis Analysis of changing market dynamics – crucial Comprehensive review of comparable data USCO expected to act as evident in the comparable and other market indicators Berry ratio used to measure distributor’s role directly – ‘back’ us into expected arm’s length net back price 39 Case Study 1: Related Party Marketer Commission fee Implied by Berry ratio analysis: Jun-01 Dec-01 Dec-02 Third party freight 3.35 3.34 3.43 and logistical SG&A Total Cost per ST 7.65 11.00 7.54 10.88 6.56 9.99 Commission Rate implied by CRA methodology 13.25 12.91 11.99 Mark-up Percentage return 2.25 2.03 2.00 20.45% 18.66% 20.02% Recall Taxpayer commission fee: Third party freight and logistical SG&A Total Cost per ST Commission Rate Mark-up Percentage return Jun-01 3.35 Dec-01 3.34 Dec-02 3.43 7.65 11.00 7.54 10.88 6.56 9.99 21.09 10.09 91.70% 18.50 7.77 85.20% 18.50 8.51 70.00% 40 Case Study 1: Related Party Marketer Taxpayer argued ‘strategic management’ of Parent Oligopolistic nature of industry Assessment is under consideration in competent authority Future years under an APA are also part of the negotiation process Fingers crossed 41 Case Study 2: Commodity Marketing – Functionally Deficient Marketer Facts: • Resource extracted in Canada • Sell Resource into US market through USCO – transfer of ownership at border • US marketing hub contracts with 3rd party end users throughout US • US marketing hub has no employees or physical office • Marketing is outsourced to division of CANCO • Contracts are signed by US company 42 Case Study 2: Functionally Deficient Marketer CANCO Sale of resource Netback price OPCO (Marketing office) CAN 100% USCO 'outsource' marketing functions to CANCO marketing division US USCO Marketer 3rd Party Co-Gen Plant 43 Case Study 2: Functionally Deficient Marketer Issues • Transfer price of resource • Transfer price for US ‘marketing’ CRA audit • Completed functional analysis • Industry review and analysis Assessing positions considered • Transfer pricing • Permanent Establishment 44 Case Study 2: Functionally Deficient Marketer Taxpayer model: Provided market CUPs for net back price of resource • Net Back Price = End Selling Price – Transportation – Marketing Fee Outsource marketing functions to Canada – paid Canada its Cost • Changed to Cost + 7.5% based on comparability analysis 45 Case Study 2: Functional Deficient Marketer CRA position: Verified marketing fee CUPs and transportation costs • Accepted terms of sale of resource Challenged remuneration of USCO for marketing functions • US did not complete functions of marketer • Assets were routine if valuable • Marketing risks are mitigated by the netback pricing terms 46 Case Study 2: Functional Deficient Marketer Considered two assessing positions Permanent establishment • Mind and management was clearly in Canada Transfer pricing • Did not accept ‘outsourcing’ model • Marketing fee CUPs are the benchmark for Canada’s functional role • Taxpayer’s representations for PE defence supported CRA transfer pricing model 47 Case Study 2: Functional Deficient Marketer Taxpayer argued that US profits were attributable to three assets: • Import license • Transportation assets • Sales contracts CRA argued all three contracts were routine for this transaction and that Functions were the key determinant of profit • Industry and Taxpayer documentation supported position • Risks limited by the netback formula – essential for resource distribution transactions 48 Case Study 2: Functionally Deficient Marketer Re-assessed Taxpayer based on transfer pricing legislation Relied on third party contracts • Unrelated marketing contracts • Unrelated delivery and distribution contracts Position was up-held in Competent Authority negotiations 49 Case Study 2A: Functionally Deficient Marketer Similar fact base as above • Resource extracted in Canada • Resource sold into US market through US marketing hub with no employees • USCO ‘outsources’ marketing functions to CANCO • US signed import license, transportation and sales contracts Audit challenges • Statue barred dates • Incomplete functional analysis • Limited Taxpayer documentation 50 Case Study 2A: Functionally Deficient Marketer (2) Guarantee (1) Guarantee CANCO OPCO CAN 100% US Sells/transports 75% of gas USCO* Sells Gas (25% + 75%) GASCO 1 End Users (4) Agreement to transport 25% of gas (3) Guarantee 100% Parent Sells 25% of gas TransC O GASCO 2 51 Case Study 2A: Functionally Deficient Marketer Taxpayer position: Reasonable to ‘outsource’ functions Key profit drivers: right to deliver and sell gas USCO exploited ‘arbitrage’ opportunities 52 Case Study 3: Functional Deficient Marketer Relied on industry knowledge Appealed to function, asset and risk profiles of related parties • Functions as key determinant of the marketers profit • Assets as non-contributory • Risks as limited, but identifiable in US Contracts • Multiple performance guarantees – internal and external 53 Case Study 3: Functional Deficient Marketer CRA analysis and position Important fact difference – ability to exploit arbitrage opportunities • Relies on functions – people on the ground • However, does create risk in this transaction • USCO had signed contracts – though guarantees were in place Required to measure risk of USCO 54 Case Study 2A: Functionally Deficient Marketer For any transaction to exist, rational parties must recognize value in the arrangement • This is reinforced by the arrangement itself: consider why GasCo1 would not sell to lake and End User directly Identified types of risks associated with the transaction and accorded each party a share of these risks 55 Case Study 2A: Functionally Deficient Marketer Consider: Two sources of gas: GasCo 1(75%) and CasCo 2 (25%) Four types of risk: • ¾ GasCo 1; ¼ GasCo 2 • Sales risk • Purchase risk • Transport risk • Supply risk 56 Case Study 2A: Functionally Deficient Marketer Appealing to the shares of risk determined by our analysis, we attributed the following to USCO: Assume USCO/CANCO bear risk of supply: • 1/16 of all risk = 6.25% of π Assume supply risk bore by third parties: • 1/12 of all risk = 8.33% of π Quantum implied was supported by arm’s length contracts 57 Case Study 3: Commodity Marketing Financial Transactions At arm’s length commodity marketers often enter into financial transactions • Transportation optimization • Arbitrage – speculative transactions Generally resource owners seek to mitigate risk – only enter into hedge contracts In related party context risk will be shifted For the marketer, however, functions remain the key determinant of profit 58 Case Study 3: Commodity Marketing Financial Transactions CANCO OPCO (Marketing office) Sale of resource Netback CAN 100% price USCO 'outsource' marketing functions to CANCO marketing division US USCO Marketer The marketers 'trade' supply to reduce transport costs Creates gains and losses 3rd Party Marketer 59 Case Study 3: Commodity Marketing Financial Transactions Issue: • Transfer of risk • Functional capacity • Legal ownership – contracts • Speculative transactions are ‘notional’ don’t require supply Assessing positions: • Pricing – profit splits: rely on arm’s length contracts • Re-characterization: would parties enter into this transaction 60 Case Study 4: Business Restructuring Canadian drilling company Secures drilling contract in Europe Establishes European subsidiary Local labour regulations require employment of local drilling apprentices Drilling contract for 5-year project 61 Case Study 4: Business Restructuring Related party transactions • Sale of drills from CANCO to EuroCO • Provision of management by CANCO • Provision of drilling services by CANCO • CANCO hired and trained EuroCO employees Taxpayer model: • Drills sold at Cost + 10% • Management fee of Cost + 10% • CANCO drilling services of Cost + 10% 62 Case Study 4: Business Restructuring Private Owners CANCO Parent and Operating Company Provision of drilling services International Drilling (CANCO) Canada secures contract sells drills and trains employees PortCo 63 Case Study 4: Business Restructuring CRA audit position Sale of drills problematic but reasonable Transaction really restructuring or a business expansion – CANCO as ‘entrepreneur’ Implied profit split • Tested PortCo contribution – ‘residual’ earned by CANCO • Weighed heavily to CANCO in early years, but allows 64 for adjustment to account for increased PortCo role Case Study 4: Business Restructuring A variation: Private Owners CANCO Parent and Operating Company International Drilling (CANCO) Canada secures contract sells drills Provision of drilling services CAN Luxembourg LuxCo Employee training PortCo 65 Case Study 4: Business Restructuring Insertion of an OpCo in a Tax Haven Equipment sold to the OpCo in Luxembourg LuxCo signs final drilling contract • CANCO and PortCo receive Cost + Approaches: • Re-Characterization – challenge sale of drills and transfer of business to LuxCo • Pricing – value transfer of drills AND transfer of contracts and business • Pricing – treat as a series of transactions and value contributions through Functions, Assets and Risks: determine reasonable profit split 66 Mining and Intangibles Identification of the intangible Differentiation of the nature of intangible Intangible transfer or service provision Contribution to operational profitability Contribution of the development Application of profit split methodologies Generally technology and know-how 67 Case Study 5: Technology Royalty Facts: Non-AL royalty payment for technological know-how Know-how involved the application of a mining process Process was developed in the early 1960s and built off publicly available concept Canadian involvement in technology’s development 68 Case Study 5: Technology Royalty (cont’d) Patents relating to the process expired by the late 1970s Taxpayer had failed to license the technology at AL Taxpayer argued that the payment was linked to ‘core technology’ 69 Case Study 5: Technology Royalty (cont’d) Q: Is a royalty payment reasonable? A: It depends Fundamental considerations • Diffusion of technological know-how • In-house skilled personnel • Cost and financing 70 Case Study 5: Technology Royalty (cont’d) Diffusion of Technology • CANCO used technology for 30+ years • Expired patents Personnel • CAN involved in development • CAN responsible for enhancements Cost • ? 71 Case Study 5: Technology Royalty (cont’d)Example (cont’d) Challenged • Reasonableness of payment • Duration of agreements • Economic circumstances Favourable conclusion achieved – just about 72 Case Studies: Final Thoughts Importance of industry and company data Thorough functional analysis Sound application of economic theory to facts of the file Significance of individual case’s facts and circumstances 73 Case Studies: Final Thoughts (cont’d) Identify internal value chain and system profits CUPs may be difficult to obtain • Request information from foreign entity • Arm’s length processing contracts • Third party sales contracts Industry knowledge to create framework for transfer pricing model Useful to consider more than one methodology – verification of results 74 Mining, Resources and Transfer Pricing Unique economic factors to be considered Comparable prices • Minerals, equipment, processing and distribution Third party and market data as essential • Independent research; industry annual reports Mining is a geographically specific operation Control of resource is essential to realizing value 75 ¿Preguntas? 76