Islamic Finance – an introduction

advertisement

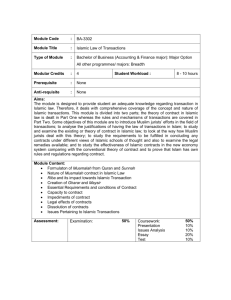

Islamic Finance: Concepts, Products, Issues 30 Oct, 2009 Usman Hayat, CFA, FRM Director Islamic Finance & ESG Investing Agenda Islamic finance @ CFA Institute Big picture & common misconceptions Concepts & applications Issues Q&A Page 2 Islamic Finance @ CFA Institute •Growing field, GBOK, CBOK? •Academic & professional qualifications available Approach: Integrate in life long learning •Publications •Events (SRP) •Multimedia www.cfawebcasts.org •Globally, 10% members “interested”, regional variations (2009 survey) Page 3 Old Ideas, Young Industry 2009 AD = 1430 Hijri; but industry barely 40 50s & 60s: initial theoretical work, some experimentation 70s: DIB, IDB, petrodollars 80s: OIC’s IFA, initiatives Bahrain, Pakistan, Sudan in Malaysia, 90s: AAOIFI, Dow Jones & FTSE indexes, growth in number & type of funds 00s: IFSB, IIRA, more innovation, credit cards to hedge funds, more petrodollars Page 4 Industry Statistics •Size estimates go up to US $1 trillion (small) •2007 asset mix, as per IFSL 2009 Report: Commercial banks (74%) Investment banks (12%) Sukuk (11%) Funds (2%), Takaful (1%) •Major countries, as per The Banker: Iran, Saudi Arabia, Malaysia, Kuwait, UAE, Bahrain, Qatar, UK •Estimated 300 IFI, 50+ countries •Industry reports available on the net for free •Growth story, favorable outlook Page 5 Common Misconceptions Practice exclusive to Muslims, modes exclusive to Islam No time value of money in pricing Dominant form of finance in Muslim countries No gap between theory & practice All Muslims highly sensitive to Shari’a compliance in finance Islamic finance Page 6 Islamic finance • Finance that complies with Shari’a • Primary Sources Qura’n (the Holy Book) Sunnah (or tradition of Prophet Mohammad) “The obligation of the Shari’a is to provide the wellbeing of all humankind, which lies in safeguarding their faith, their human self (nafs), their intellect (’aql), their progeny (nasl) and their wealth (mal)” Al-Ghazali Page 7 Religion & Economics •Economics takes human behaviour as given •Religion seeks to influence human behaviour – Accountability to permanent concern God should be a – Earning an honest living an act of worship – Moral economy of Islam (a theoretical ideal) neither communism, nor capitalism •Depends on belief in God (which is up to the individual) Islamic finance Concepts •Islamic commercial jurisprudence: human dealings, default ruling is permissibility Test of impermissibility: _Purpose involves prohibited activities (socially responsible, ethical) _Structure involves Riba or Gharar or both •On riba & gharar: “…the talented jurist Ibn Taymiyya …famously stated that two prohibitions can explain all distinctions between contracts that are deemed valid or invalid: those of riba and gharar.” Page 8, “Islamic Finance: Law Economics, and Practice” (2006) by Mahmoud A. El - Gamal Riba & Gharar (simplified) Riba • • • • No perfect translation; excess, usury Lending money on interest Absolute prohibition; money not commodity Why? unnatural? unfair? evidence? Excessive Gharar • • • • No perfect translation; risk, uncertainty Trading of risk unbundled from an asset Applies to commutative contacts Why? disputes? externalities? evidence? Implication: asset & enterprise, risk-sharing Application Riba Gharar Capital Market _Equity funds: business, debt & income screening _Sukuk: ownership of assets _Debt trading constrained Derivatives (or at least their trading) largely avoided Banking _Trade, lease, share _No money borrowing/lending Sales/leases of assets after purchases Insurance Avoid interest bearing / Takaful investments Note: Sin industries to be avoided in all cases Mutuality (risksharing, solidarity group) Opportunities • Inclusive, simple, tied to real economy • Small size means growth potential; petrodollars to invested • Responsible investments also growing • More countries finance promoting Islamic • Industry reports & surveys suggesting double digit growth still Page 12 Challenges • Covering gap of centuries in decades • Global economy - lending money, trading risk • Legal, regulatory, tax issues • Lack of global Shari’a standards • Industry requires multidisciplinary expertise • And the form versus substance debate… Page 13 Form vs Substance • Concern on similarity (banking & fixed income) in substance • Profit/rent on trade/lease or price of credit? • Innovation or replication? sharing? economic justice? risk-reward • Conflict of interest in Shari’a governance? • Shari’a adjustments: • AAOIFI statement 2008 • OIC’s IFA resolution on tawarruq 2009 Page 14 Financial Crisis & Islamic Finance • We did better (Proponents) • You got hit by real estate (Critics) • Much noise, but not a sound debate: What were the reasons toxic products were avoided by IFI? Real estate investments business or Shari’a issue? Can a small segment in the same market be unaffected in a market wide turmoil? Page 15 Summary • Old ideas, young industry, long term future • Belief in God implies moral economic behaviour • Avoid sin industries, don’t lend money on interest, don’t trade risk • Asset & enterprise required; equity preferred • Business & career opportunities, lots to happen! Page 16 Q&A Page 17 Learning Resources • Books • Webcasts/podcasts • Websites & social media • Training • Professional qualifications • Academic qualifications Page 18