Document

advertisement

CHAPTER

TWENTY-FOUR

OPTIONS

1

TYPES OF OPTION

CONTRACTS

• WHAT IS AN OPTION?

– Definition: a type of contract between two

investors where one grants the other the right to

buy or sell a specific asset in the future

– the option buyer is buying the right to buy or

sell the underlying asset at some future date

– the option writer is selling the right to buy or

sell the underlying asset at some future date

2

CALL OPTIONS

• WHAT IS A CALL OPTION CONTRACT?

– DEFINITION: a legal contract that specifies four

conditions

– FOUR CONDITIONS

• the company whose shares can be bought

• the number of shares that can be bought

• the purchase price for the shares known as the exercise or

strike price

• the date when the right expires

3

CALL OPTIONS

• Role of Exchange

• exchanges created the Options Clearing Corporation

(CCC) to facilitate trading a standardized contract

(100 shares/contract)

• OCC helps buyers and writers to “close out” a

position

4

PUT OPTIONS

• WHAT IS A PUT OPTION CONTRACT?

– DEFINITION: a legal contract that specifies

four conditions

• the company whose shares can be sold

• the number of shares that can be sold

• the selling price for those shares known as the

exercise or strike price

• the date the right expires

5

OPTION TRADING

• FEATURES OF OPTION TRADING

– a new set of options is created every 3 months

– new options expire in roughly 9 months

– long term options (LEAPS) may expire in up to

2 years

– some flexible options exist (FLEX)

– once listed, the option remains until expiration

date

6

OPTION TRADING

• TRADING ACTIVITY

– currently option trading takes place in the

following locations:

•

•

•

•

the Chicago Board Options Exchange (CBOS)

the American Stock Exchange

the Pacific Stock Exchange

the Philadelphia Stock Exchange (especially

currency options)

7

OPTION TRADING

• THE MECHANICS OF EXCHANGE

TRADING

– Use of specialist

– Use of market makers

8

THE VALUATION OF OPTIONS

• VALUATION AT EXPIRATION (E)

– FOR A CALL OPTION

E

-100

value

of

option

0

100

stock price

200

9

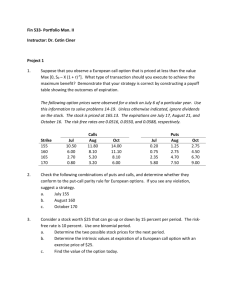

THE VALUATION OF OPTIONS

• VALUATION AT EXPIRATION

– ASSUME: the strike price = $100

– For a call if the stock price is less than $100,

the option is worthless at expiration

– The upward sloping line represents the intrinsic

value of the option

10

THE VALUATION OF OPTIONS

• VALUATION AT EXPIRATION

– In equation form

IVc = max {0, Ps, -E}

where

Ps is the price of the stock

E is the exercise price

11

THE VALUATION OF OPTIONS

• VALUATION AT EXPIRATION

– ASSUME: the strike price = $100

– For a put if the stock price is greater than $100,

the option is worthless at expiration

– The downward sloping line represents the

intrinsic value of the option

12

THE VALUATION OF OPTIONS

• VALUATION AT EXPIRATION

– FOR A PUT OPTION

value 100

of

the

option

E=100

0

stock price

13

THE VALUATION OF OPTIONS

• VALUATION AT EXPIRATION

– FOR A CALL OPTION

• if the strike price is greater than $100, the option is

worthless at expiration

14

THE VALUATION OF OPTIONS

– in equation form

IVc = max {0, - Ps, E}

where

Ps is the price of the stock

E is the exercise price

15

THE VALUATION OF OPTIONS

• PROFITS AND LOSSES ON CALLS AND PUTS

PROFITS

PROFITS

CALLS

100

0

PUTS

p

P

0

LOSSES

100

LOSSES

16

THE VALUATION OF OPTIONS

• PROFITS AND LOSSES

– Assume the underlying stock sells at $100 at

time of initial transaction

– Two kinked lines = the intrinsic value of

the options

17

THE VALUATION OF OPTIONS

• PROFIT EQUATIONS (CALLS)

PC = IVC - PC

= max {0,PS - E} - PC

= max {-PC , PS - E - PC }

This means that the kinked profit line for the call

is the intrinsic value equation less the call

premium (- PC )

18

THE VALUATION OF OPTIONS

• PROFIT EQUATIONS (CALLS)

PP = IVP - PP

= max {0, E - PS} - PP

= max {-PP , E - PS - PP }

This means that the kinked profit line for the put

is the intrinsic value equation less the put

premium (- PP )

19

THE BINOMIAL OPTION

PRICING MODEL (BOPM)

• WHAT DOES BOPM DO?

– it estimates the fair value of a call or a put

option

20

THE BINOMIAL OPTION

PRICING MODEL (BOPM)

• TYPES OF OPTIONS

– EUROPEAN is an option that can be exercised

only on its expiration date

– AMERICAN is an option that can be exercised

any time up until and including its expiration

date

21

THE BINOMIAL OPTION

PRICING MODEL (BOPM)

• EXAMPLE: CALL OPTIONS

– ASSUMPTIONS:

•

•

•

•

price of Widget stock = $100

at current t: t=0

after one year: t=T

stock sells for either

$125 (25% increase)

$ 80 (20% decrease)

22

THE BINOMIAL OPTION

PRICING MODEL (BOPM)

• EXAMPLE: CALL OPTIONS

– ASSUMPTIONS:

• Annual riskfree rate = 8% compounded

continuously

• Investors cal lend or borrow through an 8% bond

23

THE BINOMIAL OPTION

PRICING MODEL (BOPM)

• Consider a call option on Widget

Let the exercise price = $100

the exercise date = T

and the exercise value:

If Widget is at $125 = $25

or at $80

= 0

24

THE BINOMIAL OPTION

PRICING MODEL (Price Tree)

$125 P0=25

Annual Analysis:

$100

$80 P0=$0

Semiannual Analysis:

$125 P0=65

$111.80

$100

$100 P0=0

$89.44

$80

t=0

t=.5T

t=T

P0=0

25

THE BINOMIAL OPTION

PRICING MODEL (BOPM)

• VALUATION

– What is a fair value for the call at time =0?

• Two Possible Future States

– The “Up State” when p = $125

– The “Down State” when p = $80

26

THE BINOMIAL OPTION

PRICING MODEL (BOPM)

• Summary

Security

Payoff:

Up state

Payoff:

Down state

Stock

Bond

Call

$125.00

108.33

25.00

$ 80.00

108.33

0.00

Current

Price

$100.00

$100.00

???

27

BOPM: REPLICATING

PORTFOLIOS

• REPLICATING PORTFOLIOS

– The Widget call option can be replicated

– Using an appropriate combination of

• Widget Stock and

• the 8% bond

– The cost of replication equals the fair value of

the option

28

BOPM: REPLICATING

PORTFOLIOS

• REPLICATING PORTFOLIOS

– Why?

• if otherwise, there would be an arbitrage opportunity

– that is, the investor could buy the cheaper of the two

alternatives and sell the more expensive one

29

BOPM: REPLICATING

PORTFOLIOS

– COMPOSITION OF THE REPLICATING

PORTFOLIO:

• Consider a portfolio with Ns shares of Widget

• and Nb risk free bonds

– In the up state

• portfolio payoff =

125 Ns + 108.33 Nb = $25

– In the down state

80 Ns + 108.33 Nb = 0

30

BOPM: REPLICATING

PORTFOLIOS

– COMPOSITION OF THE REPLICATING

PORTFOLIO:

• Solving the two equations simultaneously

(125-80)Ns = $25

Ns = .5556

Substituting in either equation yields

Nb = -.4103

31

BOPM: REPLICATING

PORTFOLIOS

• INTERPRETATION

– Investor replicates payoffs from the call by

• Short selling the bonds: $41.03

• Purchasing .5556 shares of Widget

32

BOPM: REPLICATING

PORTFOLIOS

Portfolio

Component

Stock

Loan

Net Payoff

Payoff In

Up State

.5556 x $125

= $6 9.45

-$41.03 x 1.0833

= -$44.45

$25.00

Payoff In

Down State

.5556 x $80

= $ 44.45

-$41.03 x 1.0833

= -$ 44.45

$0.00

33

BOPM: REPLICATING

PORTFOLIOS

• TO OBTAIN THE PORTFOLIO

– $55.56 must be spent to purchase .5556 shares

at $100 per share

– but $41.03 income is provided by the bonds

such that

$55.56 - 41.03 = $14.53

34

BOPM: REPLICATING

PORTFOLIOS

• MORE GENERALLY

V0 N S PS Nb Pb

where

V0

Pd

Pb

Nd

Nb

= the value of the option

= the stock price

= the risk free bond price

= the number of shares

= the number of bonds

35

THE HEDGE RATIO

• THE HEDGE RATIO

– DEFINITION: the expected change in the

value of an option per dollar change in the

market price of an underlying asset

– The price of the call should change by $.5556

for every $1 change in stock price

36

THE HEDGE RATIO

• THE HEDGE RATIO

Pou Pod

h

Psu Psd

where

P = the end-of-period price

o = the option

s = the stock

u = up

d = down

37

THE HEDGE RATIO

• THE HEDGE RATIO

– to replicate a call option

• h shares must be purchased

• B is the amount borrowed by short selling bonds

B = PV(h Psd - Pod )

38

THE HEDGE RATIO

– the value of a call option

V0 = h Ps - B

where h =

B=

the hedge ratio

the current value of a short

bond position in a portfolio

that replicates the payoffs of

the call

39

PUT-CALL PARITY

• Relationship of hedge ratios:

hp = h c - 1

where hp = the hedge ratio of a call

hc = the hedge ratio of a put

40

PUT-CALL PARITY

– DEFINITION: the relationship between the

market price of a put and a call that have the

same exercise price, expiration date, and

underlying stock

41

PUT-CALL PARITY

• FORMULA:

PP + PS = PC + E / eRT

where PP and PC denote the current

market prices of the put and the call

42

THE BLACK-SCHOLES

MODEL

• What if the number of periods before

expiration were allowed to increase

infinitely?

43

THE BLACK-SCHOLES

MODEL

• The Black-Scholes formula for valuing a

call option

E

Vc N (d1 ) Ps RT N (d 2 )

e

where

ln( Ps / E ) ( R .5 )T

d1

T

2

44

THE BLACK-SCHOLES

MODEL

ln( Ps / E ) ( R .5 )T

d2

T

2

and where Ps = the stock’s current market price

E = the exercise price

R = continuously compounded risk

free rate

T = the time remaining to expire

= risk (standard deviation of the

stock’s annual return)

45

THE BLACK-SCHOLES

MODEL

• NOTES:

– E/eRT = the PV of the exercise price where

continuous discount rate is used

– N(d1 ), N(d2 )= the probabilities that outcomes

of less will occur in a normal distribution with

mean = 0 and = 1

46

THE BLACK-SCHOLES

MODEL

• What happens to the fair value of an option

when one input is changed while holding

the other four constant?

– The higher the stock price, the higher the

option’s value

– The higher the exercise price, the lower the

option’s value

– The longer the time to expiration, the higher the

option’s value

47

THE BLACK-SCHOLES

MODEL

• What happens to the fair value of an option

when one input is changed while holding

the other four constant?

– The higher the risk free rate, the higher the

option’s value

– The greater the risk, the higher the option’s

value

48

THE BLACK-SCHOLES

MODEL

• LIMITATIONS OF B/S MODEL:

– It only applies to

• European-style options

• stocks that pay NO dividends

49