Attune Marketing Plan INTERNAL CONDITIONS – THE COMPANY

advertisement

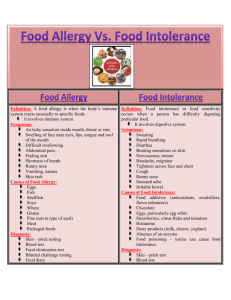

Attune Marketing Plan 1.0 INTERNAL CONDITIONS – THE COMPANY Attune wishes to double their sales, thus increasing profit. Dedicated to having the healthiest content in their cereals Attune would like to become a more prominent brand in the probiotic, organic, and gluten free categories. Overall they would like consumers to see them as a company focused on digestive health. Very small company Attune is willing to take some calculated risks. Their first risk was the probiotic-rich chocolate bar to compete against yogurts. They’re going for a sense of authenticity. That consumers should believe them because they have been around for so long. They are the elder teaching the young ones how to take care of themselves. Focus on honesty and transparency True to their brand all the way through 2.0 INTERNAL CONDITIONS – THE BRAND Attune – probiotic chocolate bar Uncle Sam’s cereal Erewhon cereals Brand loyalty is high for all products, including the acquired Uncle Sam and Erewhon. Attune made sure to keep loyalty a priority be keeping the brand images intact while updating them to be more relevant in the present time as they were seen as ‘old fashioned’. Attune makes sure to keep Uncle Sam’s brand image cohesive and consistent by only allowing 100% American products to be used in making it. People don’t want to talk about the thing that these products are targeted for (digestive health) No longer needs to fortify their cereal Dedicated to brand image and consistency High loyalty with Uncle Sam and Erewhon Straightforward and non-GMO ingredient panel, clean products, and product-specific characteristics 3.0 CONSUMER CONDITIONS Natural foods shoppers are more adventurous and have more discretionary income to spend on food Attune found it difficult in fitting into established categories. They marketed the probiotic chocolate bar in a novelty way, leading consumers to adopt a new behavior (seeing chocolate bars in the refrigerated aisle). Organic cereals, probiotics, crackers, granola, and gluten free products Cereals is a huge market in the U.S. and is in its mature stage Digestive health products, digestive health beverages and foods Growth for the ‘good-for-you’ food segment – because there are still many products being created for these categories as the need for them continues to rise with consumers requiring more health driven foods. Many consumers hope on and off food trends and fads, however the idea of healthy food and beneficial products will always be an apparent trend. Consumers seek for the most beneficial product in these types of categories. Want food to be food, not medicine. People have an inherent trust in things that have been around for a long time People are more inquisitive in where their food comes from, and how it was prepared Understands social media is key to keep up with authenticity with consumers 4.0 COMPETITIVE CONDITIONS Kashi o Focus on experimenting with whole grains and sees o Health-conscious lifestyle as well as others o Wants to provide nutritious whole gran foods to a growing number of people o Small company, 70 employees Cascadian Farms o Balance between nature and humans o Organic frozen fruits and breakfast cereals Barbara’s Bakery o Inspired by good health, family, and the kitchen table o Whole grains and oats like nature intended o Natural products Nature’s Path o Organic breakfast foods and snacks o Relatively small company o Does not use GMOs Danon o activia Competition has Attune beat with advertisements Attune uses social media as their selective target marketing strategy Sold in supermarkets and through distributors Sold through 400 supermarket chains Some ingredients are hard to find and be available in required quantities and quality Organic products are more difficult to export Timing problem with shipping organic ingredients based on seasons Has only one co-packer for small chocolate products 5.0 STEEPLE ANALYSIS Social An increase in digestion awareness and digestive diseases such as diabetes, celiac disease, and overall obesity. Increase in health fad creating more need for health foods Increase awareness of gluten allergies and intolerances Technological The health sector is now more equipped in diagnosing digestive diseases which has affected the health food categories. The internet allows people to research into health and nutrition and learn what to eat to counteract digestive diseases Economic Recession in 2007 made Attune think on what consumer’s were spending money on. That being the absolute necessities. Environmental Increase in production of organic foods Political Legal Clear and honest labeling practice due to gluten-free and peanut-free requirements. Ethical Controversy of GMOs being sold in markets, some labeled as such, some not STRENGTHS Critical Success Factors: OPPORTUNITIES Consumer Conditions: High levels of brand loyalty for Uncle Sam’s and Erehwon. Focus on honesty, transparency, and authenticity. Superior use of social media. Uncle Sam’s more than 100 years old. Differentiation/SCA: They take care of brand consistency and imaging 100% American ingredients for their very American branded brand Dedicated to best cereal health content. No GMOs, antibiotics or hormones. High fibre content. Resources: Food specialists familiar with manufacturing organic, non-GMO, and digestive health recipes. Relationships: Strong relationships with organic farms. Strong relationships with natural foods retailers. Natural foods shoppers are more adventurous and have more discretionary income to spend on food. Cereal is a huge market in the U.S. Digestive health benefits can be attached to many different foods and beverages. ‘Good-for-you’ food segment growing. People have an inherent trust in things that have lasted a long time through many obstacles. People are becoming more inquisitive about what they are eating. Competitive Conditions: Major competitors are owned by large conglomerates. Major competitors underdeveloped in health and natural food stores. STEEPLE: Increase in digestion and digestion disease awareness and diagnosis. Technological advancement in food preparation. Increase in production of organic foods. Clear and honest food labeling. Consumers trust their social media networks, bloggers and forums more than commercial advertising. WEAKNESSES Critical Success Factors: THREATS Consumer Conditions: Access to ingredients: timing and scheduling challenges with organic ingredients based on seasons. Some ingredients are hard to procure. Uncle Sam: old man’s image. Erehwon: old hippie image. Comparatively low levels of distribution. Differentiation/SCA: Low levels of brand awareness. Forcing consumers to think differently about established food and food placement. Cereal is a mature category. Want food to be food, not medicine. Competitive Conditions: Competition spending heavily on advertising and promotion. Competitors have the support of large conglomerates. Large conglomerates can assure higher distribution levels. Resources: Very limited financial resources. STEEPLE: GMO controversies. Consumers cut back on more expensive foods during a recession. MATCHES S: Focus on honesty, transparency, and authenticity. O: People have an inherent trust in things that have lasted a long time through many obstacles. S: Use of social media. O: Competition cannot stop or make social media “too noisy” for consumers to hear. S: Dedicated to best cereal health content. O: ‘Good-for-you’ food segment growing. O: Natural food shoppers are more adventurous with money. S: Dedicated to best cereal health content. T: Many food trends and fads, i.e. gluten free. S: No longer need to fortify cereals. S: Dedicated to best cereal health content. T: Want food to be food, not medicine. S: High loyalty factor for all attached brands. T: People are more inquisitive in what they are eating. S: Focus on honesty, transparency, and authenticity. S: Use of social media. . T: Want food to be food, not medicine. T: People are more inquisitive in what they are eating. W: Can be seen as old fashioned or for just the elderly. O: Natural food shoppers are more adventurous with money. W: The brands targeted towards situations consumers don’t wish to talk about. O: Increase in digestion and digestion disease awareness and diagnosis. W: The brands targeted towards situations consumers don’t wish to talk about. T: Want food to be food, not medicine. STRATEGY ALTERNATIVE We recommend highlighting how long lasting the brand is. Perhaps use this theme of persevering through time as a campaign. We recommend focusing advertising through social media and growing loyalty bases through said social media. We recommend expanding into “natural food shoppers” as a target. We recommend establishing an image of general better health than piggybacking on food trends and fads. Health is not a fad. We recommend building on the image of all natural ingredients and healthy food to combat the idea of the brands being medicine or the like. We recommend reaching out to consumers through social media and posting content about what goes into the products and how they are made. Transparency campaign. We recommend creating a social media campaign based on the brands products being food and not medicine, however comparing the two through benefits. We recommend crafting a campaign for “natural food shoppers” that focuses on the healthy and natural ingredients that have stood the test of time. We recommend establishing marketing messages developed to talk about digestive health without actually talking about it, via allusions and comedic writing. We recommend creating a campaign based on the products being food that happens to be healthy. “You could take a pill, or you could have breakfast” Consistent with Mission & Vision Expand into new target (Natural Food Shoppers) Yes. This new target is a part of the ‘natural foods’ niche. Volume/Share Increase Medium: Segment is rather new, however people are becoming more aware of the benefits of natural food. Resources Yes. There is very little that would be needed to change. Positioning and the creative side of advertisements would be the focal point. Loyalty Potential High. This new segment is looking for honest and trustworthy brands that supply them with the best quality natural products. Relationships Unknown as of yet. Little research has gone into this new segment and their relationship with Attune. New social media campaign (Food vs Medicine) Yes. It will strengthen the brand image of natural foods with health benefits rather than medicine. Medium: Consumers are fickle and may not believe the campaign, however social media has a high chance of being shared to other consumers. Yes. Social media is very open whereas traditional media is cluttered with competition. Social is also very inexpensive and has the highest potential of being shared and spread. The company may need to hire web content creators for this campaign. High. People are very interested in what they eat and want to know more about what they eat, therefore this campaign focusing on authenticity will show consumers what Attune and Attunes brands stand for. Facebook: 56,392 likes Twitter: 7,640 followers Pinterest: 7,419 followers