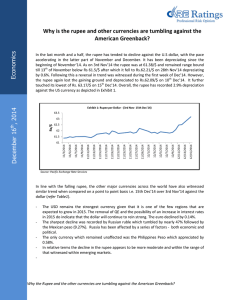

Asia Currencies Gain, Led by India, as Fed Easing Spurs Inflows

advertisement

Asia Currencies Gain, Led by India, as Fed Easing Spurs Inflows Bloomberg.com Sep 17, 2012 Asian currencies strengthened as the Federal Reserve’s asset-purchase plan spurred inflows into the region’s higher-yielding assets. India’s rupee rose to a four-month high after the government eased investment rules. International investors increased holdings of Indonesian South Korean, and Taiwanese financial assets (i.e., money market instruments and stocks) by $1.8 billion on Sept. 14, a day after the Fed announced it would expand holdings of long- term securities with open-ended buying of $40 billion of mortgage debt per month in a third round of quantitative easing. India’s government allowed overseas retailers to invest in Asia’s third-largest economy, and said foreign airlines can own minority stakes in local carriers. The MSCI Asia Pacific Excluding Japan Index (MXAPJ) of shares rose to a four-month high. “The QE3 is giving a boost to sentiment and expectations of capital inflows,” said Wee-Khoon Chong, a fixed-income strategist at Societe Generale SA in Hong Kong. “The boost for the foreign-exchange rate from QE3 is likely to be temporary,” he said. The risk of India’s reforms being rolled back, “given past Indian government behavior, is a natural concern,” he wrote in a separate note to clients. The rupee strengthened 0.6 percent to 55.97 per dollar as of 2:33 p.m. in Mumbai, according to data compiled by Bloomberg. Indonesia’s rupiah appreciated 0.1 percent to 9,515 and Taiwan’s dollar rose 0.2 percent to NT$29.399, touching a four-month high earlier. The Philippine peso slid 0.5 percent to 41.600, retreating from a four-year high, as some investors judged gains in the currency as excessive. The Bloomberg-JPMorgan Asia Dollar Index, which tracks the region’s most active currencies, snapped a four-day rally. The gauge’s 60-day historical volatility rose one basis point, or 0.01 percent, to 3.43 percent. “It looks like there’s a lot of speculative money coming into Taiwan,” said Tarsicio Tong, a foreign-exchange trader at Union Bank of Taiwan (2838) in Taipei. “The Taiwan dollar’s surge was also caused by panic selling of the greenback” (i.e., U.S. dollar) due to speculation the local currency will strengthen beyond the NT$29 per dollar level, he said. Policy makers must control volatile capital flows as quantitative easing measures taken in the U.S. and Europe have a “negative spillover” into developing countries, Bank of Korea Governor Kim Choong Soo said on Sept. 14. The won added 0.1 percent to 1,115.97 per dollar. Philippine central bank Governor Amando Tetangco said today that the nation will stay watchful of inflows and indications of asset-price bubbles, adding the central bank will guard against “any disruptions” that may lead to sharp foreign-exchange rate fluctuations.