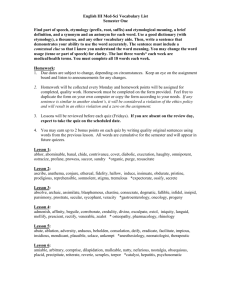

ACCT 2301 - Spring `15 RT Syllabus (Mon)

advertisement

Course Syllabus Principles of Accounting I ACCT 2301 Semester with Course Reference Number (CRN) Principles of Accounting I CRN # 48756 Instructor contact information (phone number and email address) Debbie P. Payne Southeast Campus – Workforce Building debbie.payne@hccs.edu Office Location and Hours By appointment Course Location/Times Southeast Campus – Workforce Building Course Semester Credit Hours (SCH) (lecture, lab) If applicable Credit Hours: 3 Lecture Hours: 3 Laboratory Hours: External Hours: Total Course Contact Hours 48.00 Course Length (number of weeks) 16 Type of Instruction Lecture Course Description: This course covers the fundamentals of financial accounting, including double-entry accounting and the accounting cycle. Other topics include cash, receivables, inventories, plant assets, liabilities, partnerships, corporation, investments, statement of cash flows and interpretation of financial statements. Course Prerequisite(s) PREREQUISITE(S): ACNT 1303 FREQUENT REQUISITES Departmental approval Academic Discipline/CTE Program Learning Outcomes 1. Students will be able to read, listen, speak, and write proficiently in preparation for presentations with clients, accounting firms and compliance work. 2. Students will demonstrate complete understanding of the complete accounting cycle. 3. Students will be able to prepare financial statements and tax returns utilizing computerized software packages, ie. Turbo Tax, Peachtree, and/or Quick Books. 4. Students will be able to reconcile and verify account balances, audit for internal control, and prepare financial statements. Course Student Learning Outcomes (SLO): 4 to 7 1. Illustrate accounting for service & merchandising business 2. Illustrate reporting for assets & current liabilities 3. Illustrate reporting & analysis of financial statements Learning Objectives (Numbering system should be linked to SLO - e.g., 1.1, 1.2, 1.3, etc.) Illustrate accounting for service & merchandising business 1. Illustrate accounting cycle for one period for service business 2. Journalize & post transactions using subsidiary ledgers & special journals 3. Journalize adjustments & closing for merchandising business Illustrate reporting for assets & current liabilities 1. Report Current Assets in Balance Sheet 2. Report Fixed & Intangible assets in Balance Sheet & Income Statements 3. Journalize current liabilities Illustrate reporting & analysis of financial statements 1. Prepare statement of equity 2. Report bonds in Balance Sheet 3. Report securities in balance sheet 4. Prepare statement of cash flows 5. Compute analytical measures SCANS and/or Core Curriculum Competencies: If applicable Core Curriculum Competencies: Illustrate accounting for service & merchandising business Intellectual - Mathematics Intellectual - Reading Intellectual - Writing Intellectual - Speaking Intellectual - Listening Intellectual - Critical Thinking Intellectual - Computer Literacy Perspectives - 5. Develop personal values for ethical behavior; Perspectives - 7. Use logical reasoning in problem solving; Illustrate reporting for assets & current liabilities Intellectual - Mathematics Intellectual - Reading Intellectual - Writing Intellectual - Speaking Intellectual - Listening Intellectual - Critical Thinking Intellectual - Computer Literacy Perspectives - 5. Develop personal values for ethical behavior; Perspectives - 7. Use logical reasoning in problem solving; Illustrate reporting & analysis of financial statements Intellectual - Mathematics Intellectual - Reading Intellectual - Writing Intellectual - Speaking Intellectual - Listening Intellectual - Critical Thinking Intellectual - Computer Literacy Perspectives - 5. Develop personal values for ethical behavior; Perspectives - 7. Use logical reasoning in problem solving; Instructional Methods Web-enhanced (49% or less) Hybrid (50% or more) Distance (100%) Face to Face Student Assignments Illustrate accounting for service & merchandising business No assignments selected for this outcome Illustrate reporting for assets & current liabilities No assignments selected for this outcome Illustrate reporting & analysis of financial statements No assignments selected for this outcome Student Assessment(s) Instructor's Requirements Program/Discipline Requirements: If applicable HCC Grading Scale: 1. EXCEL-Students will work in EXCEL following textbook example formats, labels, and formulas 2. Internet-Students will use HCC webmail, learning web, blackboard, lockdown browser, and HCC LibLine (24/7 Library) 3. Ethics-Students will develop personal values for ethical behavior A = 100- 90 B = 89 - 80: C = 79 - 70: D = 69 - 60: 59 and below = F FX (Failure due to non-attendance) IP (In Progress) W (Withdrawn) I (Incomplete) AUD (Audit) 4 points per semester hour 3 points per semester hour 2 points per semester hour 1 point per semester hour 0 points per semester hour 0 points per semester hour 0 points per semester hour 0 points per semester hour 0 points per semester hour 0 points per semester hour IP (In Progress) is given only in certain developmental courses. The student must reenroll to receive credit. COM (Completed) is given in non-credit and continuing education courses. FINAL GRADE OF FX: Students who stop attending class and do not withdraw themselves prior to the withdrawal deadline may either be dropped by their professor for excessive absences or be assigned the final grade of "FX" at the end of the semester. Students who stop attending classes will receive a grade of "FX", compared to an earned grade of "F" which is due to poor performance. Logging into a DE course without active participation is seen as non-attending. Please note that HCC will not disperse financial aid funding for students who have never attended class. Students who receive financial aid but fail to attend class will be reported to the Department of Education and may have to pay back their aid. A grade of "FX" is treated exactly the same as a grade of "F" in terms of GPA, probation, suspension, and satisfactory academic progress. To compute grade point average (GPA), divide the total grade points by the total number of semester hours attempted. The grades "IP," "COM" and "I" do not affect GPA. Health Sciences Programs Grading Scales may differ from the approved HCC Grading Scale. For Health Sciences Programs Grading Scales, see the "Program Discipline Requirements" section of the Program's syllabi. Instructor Grading Criteria Instructional Materials Wild/ Financial & Managerial Accounting; 5th. Edition; Chapters 1-12 w/ConnectPlus Loose-Leaf Publisher: MHHE HCC Policy Statement: Access Student Services Policies on their Web site: http://hccs.edu/student-rights EGLS3 -- Evaluation for At Houston Community College, professors believe that thoughtful student feedback is necessary to improve teaching and learning. During a designated time near the Greater Learning Student Survey System end of the term, you will be asked to answer a short online survey of research-based questions related to instruction. The anonymous results of the survey will be made available to your professors and department chairs for continual improvement of instruction. Look for the survey as part of the Houston Community College Student System online near the end of the term. Distance Education and/or Continuing Education Policies Access DE Policies on their Web site: http://de.hccs.edu/Distance_Ed/DE_Home/faculty_resources/PDFs/DE_Syllabus.pdf Access CE Policies on their Web site: http://hccs.edu/CE-student-guidelines DATE 1/19 1/26 DAY Mo Mo 2/02 2/09 2/16 2/23 3/02 3/09 3/16 – 3/22 3/23 Mo Mo Mo Mo Mo Mo Mo Mo 3/24 3/30 Tu Mo 4/06 4/13 Mo Mo 4/20 Mo 4/27 5/03 5/04 5/10 5/11 5/15 Mo Su Mo Su Mo Fr ACCT 2301-Spring2015 HCC Regular Start See Connect for online assessment due dates Ch TOPIC MLK Holiday (All HCC campuses closed) 1 Introduction Introducing Accounting in Business Regular Term (RT) Official Date of Record 2 Analyzing and Reporting Transactions President’s Day (All HCC campuses closed) 3 Adjusting Accounts and Preparing Financial Statements 4 Accounting for Merchandising Operations Class Exam #1 (chapters 1 – 4) Spring Break 5 Inventories and Cost of Sales 6 Cash and Internal Controls Last Day to Withdraw with a "W" @ 4:30 pm 7 Accounts and Notes Receivables 8 Long Term Assets Class Exam #2 (chapters 5 – 8) 9 Current Liabilities 10 Long Term Liabilities 11 Corporate Reporting and Analysis 12 Reporting Cash Flows Class Exam #3 (chapters 9 – 12) Instruction Ends Class Final Exam (chapters 1 – 12) Spring Semester Officially Ends Grades due to admin @ 12noon Grades available on line Chapter Type Connect Pts 1 Learn Smart Quiz Total LS 20 80 100 2 Learn Smart Exercises LS 2-1 2-4 2-5 2-6 2-8 2-10 20 3 6 16 6 9 20 20 100 Quiz Total 3 Learn Smart Exercises LS 3-1 3-2 3-5 3-6 3-7 Quiz Total 4 Learn Smart Exercises LS 4-2 4-3 4-4 Quiz Total 1-4 Sectional Exam 5 Learn Smart Exercises Problem 20 2 20 6 17 15 20 100 20 20 7 10 20 100 100 LS 5-1 5-3 5-5 P5-3a 20 6 28 15 11 15 MC and 5 TF 15 MC and 5 TF 15 MC and 5 TF 10 MC Comprehensive Problem Quiz Total 6 Learn Smart Exercises Problem Quiz Total 7 Learn Smart Exercises Problem Quiz Total 8 Learn Smart Exercises Problem Quiz Total 5–8 Sectional Exam 9 Learn Smart Exercises Problem Quiz 20 100 LS 6-1 6-5 6-6 6-7 P6-2a LS 7-3 7-7 7-8 7-9 P7-1a LS 8-2 8-4 8-6 8-8 P8-6a LS 9-1 9-2 9-3 9-6 9-8 P9-3a 20 10 4 21 5 20 20 100 8 3 5 10 30 20 100 20 6 14 14 11 15 20 100 15 MC and 5 TF 15 MC and 5 TF 15 MC and 5 TF 15 MC and 5 TF 100 10 MC Comprehensive Problem 20 6 2 4 20 8 20 20 15 MC and 5 TF Total 10 Learn Smart Exercises Problem Quiz Total 11 Learn Smart Exercises Problem Quiz Total 12 Learn Smart Exercises Problem Quiz Total 9 – 12 Sectional Exam 13 Learn Smart Exercises 100 LS 10-2 10-3 10-4 10-5 10-6 10-7 P10-1a LS 11-2 11-3 11-4 11-5 11-7 11-8 11-18 P11-2a LS 12-3 12-5 12-7 P12-2a 20 18 8 8 4 7 6 9 20 100 20 8 8 4 4 4 8 18 25 20 100 20 12 5 8 35 20 100 100 LS 13-3 13-4 13-5 20 38 8 14 15 MC and 5 TF 15 MC and 5 TF 15 MC and 5 TF 10 MC Comprehensive Problem Quiz Total 1 – 12 Final Exam 20 100 125 15 MC and 5 TF 10 MC Comprehensive Problem