T's D's & C's Intro. Assignment Clear the Clutter A couple of months

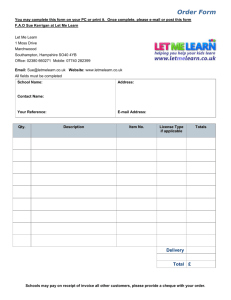

advertisement

T’s D’s & C’s Intro. Assignment Clear the Clutter A couple of months ago, C. Atinhat started a small business called Clear the Clutter. The business offers cleaning and organizing services to people and businesses. If you have a room or area that has become clutter and unorganized then Clear the Clutter will come in and remove what you don’t want, re-organize what you have as well they will paint, install shelving, etc. to make the area suit your needs. They will also set up an area for celebrations and events and remove everything when the event is done. So far Catarina has been running the business out of her home and keeping records on a spreadsheet. She would like to learn how to keep proper accounting records and has asked you to show her some examples of ‘double-entry’ accounting using debits and credits. At this point Clear the Clutter has the following ‘account’ balances: Cash ........................................ 7,000 A/P – Acme Suppliers ................. 3,400 A/R – Bee Leave Ltd. ............... 2,300 A/P – A2Z Rentals ...................... 5,900 A/R – MIR Teck ....................... 2,800 A/P – Everything Events ............. 2,700 Supplies ................................... 4,700 Equipment ............................. 19,000 Bank Loan ................................ 30,000 Truck/Van .............................. 68,000 C. Atinhat, Capital ..................... 61,800 REQUIRED: A. On a separate page, set up a T-account ledger of Clear the Clutter. You may want to leave a few blank Taccounts in the asset and liability areas so you can keep things organized when adding accounts. Title the page “Clear the Clutter ~ General Ledger” TIPs: The Cash and Capital accounts will have the most activity so make them bigger. If your writing is big then you could use two pages for the T-accounts. B. Record the transactions below in the ledger. Be sure all transactions balance (total debits = total credits) and put a number reference beside each entry 1). C. Take balances for each of the T-accounts. Recall, the balance is the difference between the debits and credits for the account and goes ‘higher side’. D. Check if the account balances do balance by totaling the balances after transactions are recorded. “Trial Balance” Total Debits = _________________ Total Credits = _________________ Transactions: 1) Catrina picked up additional supplies from Acme Suppliers $1,500. Company debit card was used to pay $150 and the remainder is on account. 2) Check received from Bee Leave Ltd. ($2,300) to pay the amount owing for the setup and takedown at their customer appreciation day last month. 3) Catrina has moved her business out of her garage and into an office/warehouse space. Cheque ($950) issued to Dumphy Realty to pay rent for the first month. 4) Invoice received from Sunar Systems ($8,460) for the purchase of office furniture ($3,950), computers and printers ($4,100) and office supplies ($410). Terms 5/5, n/45. 5) Cheque ($2,700) issued to Everything Events as payment on account. 6) Bank credit memo received from Catrina (owner) showing a transfer of $15,000 from her investment account to the business bank account. To boost business cash balance. 7) Invoice from D-Sign Services ($985) for large sign rental advertising the new business location. 8) Cheque issued to A2Z Rentals ($3,500) to pay invoices that are due. Invoices were for rental of tables and accessories used at last months Bee Leave and MIR Teck events. 9) Sales slip summary for the week totaled $4,750. This is a result of debit transactions and cheques received – all have been deposited. 10) Cheque issued to Sunar Systems ($8,037) to pay recent invoice ($8,460) less the 5% discount. 11) Invoice issued to Dunphy Realty ($1,680) for cleanup and staging of house, buildings and property of a large property they are trying to sell. Term 5/10, n/30. 12) Returned some supplies to Acme Suppliers. Credit invoice for $419 was received. 13) Monthly cheque ($2,500) issued to Catarina. 14) Invoice received from Everything Events ($2,200) for the purchase of some equipment ($1,500) and $700 for additional supplies. 15) Cheques issued to part-time employees – total $3,754. 16) Credit invoice received from D-Sign Services ($27) since the original invoice was for $985 and it should have been for $958. 17) Bank statement received and bank reconciliation completed. Reconciling items were business loan payment ($900 which consisted of $300 interest and $600 principal). 18) Cheque issued to R.U. Dunn ($424) as a refund to a customer who was not satisfied with the job completed and felt some services were not required or provided. 19) Debit memo received from bank showing the withdrawal of $790 to pay Catrina’s home mortgage payment. Catrina included a receipt showing $400 interest and $390 principal. “I know this is important on the business loan payment so thought would be important here.” 20) Cheque received from MIR Tech ($2,660) to pay balance owing ($2,800) less a 5% discount ($140) for early payment. Catrina examined the invoice and the payment was too late for the discount and it should not be allowed. 21) Invoice ($690) received from Service ONE for hydro and natural gas services. 22) Credit invoice ($150) from Everything Events since the equipment purchased was on sale for 10% off and we were charged full price. 23) Catrina picked up the business truck from Grease & Gears. Paid for repairs ($639) with her personal debit card. She submitted the paid invoice with a memo that she was not to be reimbursed for this payment. E. Calculate Net Income – resulting from these transactions Net Income = Revenue = ____________ = ____________ – Operating Expenses – _____________