The Market Outlook for Natural Gas

advertisement

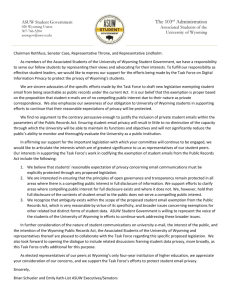

The Market Outlook for Natural Gas: The Wyoming Natural Gas Pipeline Authority’s Perspective Wyoming Geological Association Conference Prepared: July 26, 2004 Presented: September 1, 2004 Nymex vs Wyoming Prices - 2002 Nymex vs W yoming Prices 2002 10.00 9.00 Price ($/MMBtu) 8.00 7.00 6.00 5.00 4.00 3.00 2.00 CIG 2002 1.00 Nymex 2002 0.00 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Nymex vs Wyoming Prices - 2003 Nymex vs Wyoming Prices 2003 10.00 9.00 8.00 Kern River Online Price ($/MMBtu) 7.00 6.00 5.00 4.00 3.00 2.00 CIG 2003 Nymex 2003 1.00 0.00 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Gas Facts and Observations Wyoming and the Central Rockies have about a ten-year supply of natural gas for the U.S. (more than 250 Tcf). Because of pipeline constraints, it would take about 150 years to bring this gas supply to market. Wyoming and the Central Rockies have more than 20% of the remaining North American supply, but less than 7% of the U.S. market. Based on the foregoing, Wyoming should export 12 Bcf/d, rather than the current rate of 4 Bcf/d. Other gas supply provinces in North America are mature and are declining (Canada, Mid-Continent, Texas, & Louisiana). Wyoming has the opportunity to gain market, ahead of the expansion of LNG terminals or development of Alaska pipelines. Gas Facts and Observations (Continued) There are many alliances and benefits to developing this gas resource: • Pipelines will increase their business with new facilities. • Producers can market the resources profitably. • Consumers will be assured a secure and competitive supply. • Wyoming has revenue to run the state. • The U.S. benefits from a currently underutilized energy supply. The single-most important objective for Wyoming and the country’s foreseeable energy needs is to build more natural gas pipelines into Wyoming and the Central Rockies. Wyoming legislation provides the tools to plan, finance, build, and operate natural gas pipelines. Wyoming Pipeline Authority Resolution May 2004 Resolution No. 1 By statue, (37-5-103 (a)(iv)), the Wyoming Natural Gas Pipeline Authority is authorized to “plan, finance, construct, develop, acquire, maintain and operate within or without the state of Wyoming, pipelines, pumps, storage, and other attendant facilities and equipment necessary therefore and all other property, structures, equipment, facilities and works of public improvement necessary or useful for the accomplishment of the purposes for which the Authority was created.” And By statue, (37-5-103 (a)(xiii)), the Wyoming Natural Gas Pipeline Authority is authorized to “Do any and all things necessary or proper for the development, regulation and accomplishment of the purpose of the authority within the limitations of authority granted by this act.” Hereby be it resolved that the Wyoming Natural Gas Pipeline Authority, shall involve itself or intervene as necessary in any and all matters it deems necessary related to the timely and reasonable development of natural gas in the state of Wyoming in order that the Authority accomplishes its goals and statutory responsibilities. Where is Production Growing ……………….. ……………The Rockies!!!!! 150,000 0.9 bcfd loss 100,000 Production Mcf/mo Wyoming vs Kansas 250,000 200,000 50,000 0 Jan-04 Jan-03 Jan-02 Jan-01 Jan-00 Jan-99 Jan-98 Jan-97 Jan-96 Jan-95 Jan-94 Jan-93 Jan-92 Jan-91 EIA data Wyoming vs Oklahoma 250,000 1.9 bcfd loss Production Mcf/mo 200,000 2.3 bcfd gain 150,000 Oklahoma 100,000 50,000 Wyoming 0 Jan-04 Jan-03 Jan-02 Jan-01 Jan-00 Jan-99 Jan-98 Jan-97 Jan-96 Jan-95 Jan-94 Jan-93 Jan-92 Jan-91 EIA Data Critical Success Factors For Resource Development Access to Lands in a Timely Manner Price Timing of Regulatory Approvals Gathering System Capacities and Pressures Transportation Export Capacity Capital Efficiency Public Acceptance Wyoming Natural Gas Pipeline Authority Proposed Pipeline Projects El Paso - Cheyenne Plains Project Kinder Morgan - Advantage Pipeline Project Kinder Morgan-TransColorado Gas Transmission Company Expansion Northern Border Partners, L.P.-Bison Pipeline Project Williston Basin Interstate Pipeline-Grasslands Pipeline Expansion Kern River Gas Transmission Company - Kern River Pipeline Expansion Entrega Gas Pipeline, Inc.- Meeker Hub to Cheyenne Hub Questar Pipeline – Greasewood Hub to Kanda Hub Kinder Morgan – Greasewood Hub to Cheyenne Hub NWP 175,000 MMBtu/day Kern River/Questar 906,000 MMBtu/day WBI 80,000 MMBtu/day Trailblazer/Kinder Morgan Wyoming NWP/TransColorado 125,000 MMBtu/day CIG/Cheyenne Plains/Xce 560,0000 MMBtu/dayl Cost of Limited Infrastructure to Wyoming $130 + million in Federal/State royalties and severance taxes – 2002. $1 million per day in March 2003. Stalled investment in development of mineral resources. Limited ability to predict revenues with certainty. The Wyoming Pipeline Authority Will Promote all industry sponsored and supported projects. Proactively promote infrastructure development within the state and the Rocky Mountain Region. Promote efficient utilization of existing infrastructure in a cost effective manner. Promote development of Wyoming’s mineral resource base in a systematic, streamlined and environmentally responsible manner. Utilize its bonding authority to build or cause to be built infrastructure projects that will enhance state netbacks and promote development of a resource base that is in the nation’s best interests. Wyoming Natural Gas Pipeline Authority Work Plan Goals: Reduce price differential for all Wyomingproduced gas to historic levels of $0.50 or less. Increase markets for Wyoming-produced gas and increase exports from 4 to 6 Bcf/d within 5 years. Wyoming Legislation Effective March 6, 2003 Increase the bonding authority from $250 million to $1 billion and deletes the 50% cost of the project restriction. The bonds authorized are revenue bonds and thus no obligation of the state. Expands the permissible projects (from natural gas) to include associated natural resources (carbon dioxide, etc.). Expands the powers of the WPA to allow it to purchase and sell capacity in pipelines. Expands the powers of the WPA to allow it to conduct hearings to obtain data, identify markets for Wyoming natural gas, and be an advocate before FERC for new pipeline capacity. Specifies that the purpose of the WPA extends to all Wyoming production, including both the State and Federal mineral royalties. Wyoming Legislation Effective March 6, 2003 (Continued) Removes the restriction that bond proceeds not be expended until construction of a financed pipeline is completed. Increases the bond maturity to maximum of 50 years. Makes numerous other amendments suggested by bond firms to allow greater flexibility to the WPA. Provides for permanent staffing of the WPA. Contact Information Mark J. Doelger – Chairman Wyoming Natural Gas Pipeline Authority 225 S. David Street Casper, WY 82601 Phone: (307) 234-1574 Email: mjdoelgerbh@bresnan.net