Document

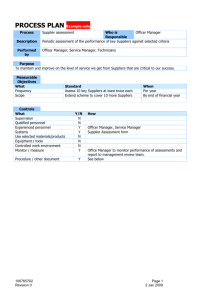

advertisement

Word Count: 490 PQI Annual supplier evaluation: Suppliers with strong technical abilities with average performance. Our Tier 3 suppliers can provide PQI with innovation and cost savings while assuming the risk of the plastic and molding production process. We want to establish strong relationships with these suppliers. Looking at the trust capability-commitment matrix (Supply Chain Trust Fawcett, 6) our tier 3 suppliers currently fall into quadrant II with high performance capabilities but where our commitment is at arm’s length. Valuable data has been collected on the suppliers but the question is how best to disseminate the data. Scorecard Evaluation: Highlights No info on “Industry Assessment” category brought all scores down. • Supplier A is innovative but has average management. Suggesting a strong framework or innovative lower to mid-level employees. • Supplier C scored low but they have solid management and many of their deficiencies come in areas where more support from PQI can improve their scores rapidly: standardization, roadmap meeting, marketing meeting, and pricing. Who to place new rush orders with Even though each has its own strength, Supplier B is best fitted to fill this order. They scored well in several major areas from technical support, production management, responsiveness, capability in improving product quality and guarantee against damage. The most important is their supply capabilities and have both strong technical support and production management. Stable supply capability will affect PQI’s flexibility in responding to its customers’ needs and competitiveness. With critical role such as die casting, strong technical capability is needed to help PQI to bring new products to the market in timely manner. Strong Production management certainly will keep the quality control in check for PQI. To share or not to share We need to establish trust with the suppliers and the best steps we can take is to begin aligning our incentives. By revealing how we evaluate our suppliers we show our prospective partners what aspects of supply chain management drive us. Once that information is on the table we can begin making steps towards reconciling their incentives/goals with ours. Sharing scorecard results push collaborative efforts for all parties involved. Setting and maintaining short-term and long-term visions and plans can ensure continued support for a common goal. Such visions would highlight KPI measures, while encouraging the intangible bonds to grow. These bonds can be identified as trust, transparency, and a visibility. Adding transparent scorecards would make real-time information available for the purpose of self-evaluation, as well as providing clarity of those set goals and requirements. Relationships built on this type of information sharing could open up additional opportunities and strategy-involvement within the supplier groups. Instant availability of information in the form of corrective action reports, to follow-up requirements, would allow the overall group to adjust accordingly. Such initiatives have the potential to further strengthen relations among the suppliers and management. Images:http://www.qualitydigest.com/inside/quality-insider-article/taking-quality-outside-your-fourwalls-supplier-quality-part-2.html