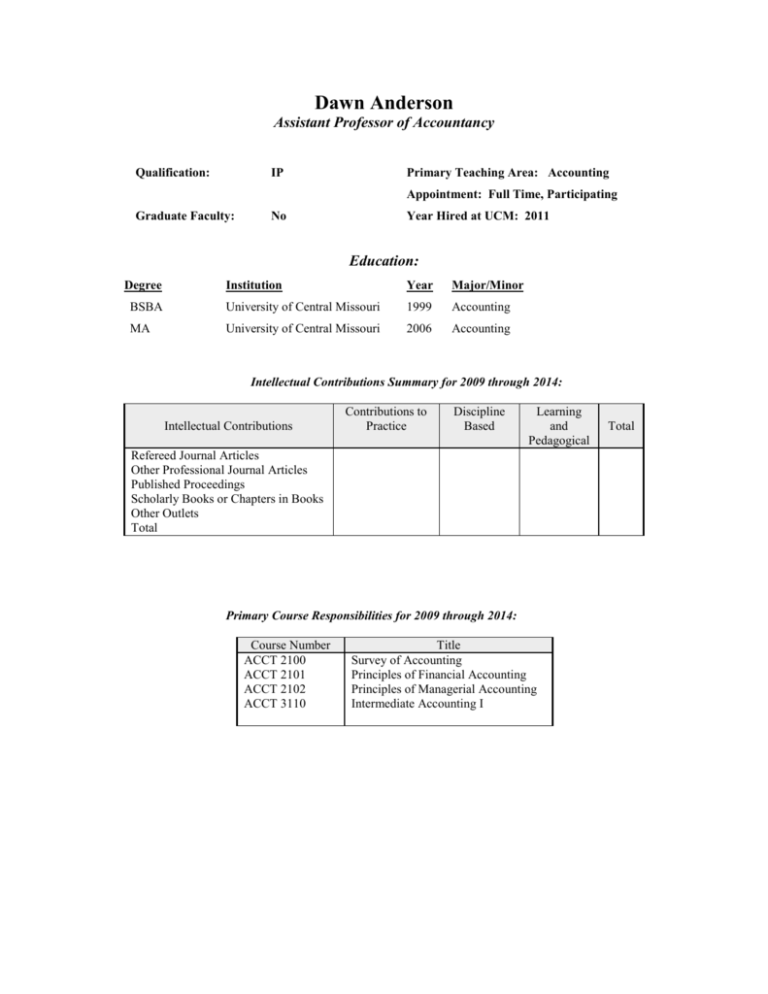

Dawn Anderson - University of Central Missouri

advertisement

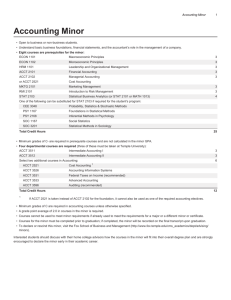

Dawn Anderson Assistant Professor of Accountancy Qualification: IP Primary Teaching Area: Accounting Appointment: Full Time, Participating Graduate Faculty: No Year Hired at UCM: 2011 Education: Degree Institution Year Major/Minor BSBA University of Central Missouri 1999 Accounting MA University of Central Missouri 2006 Accounting Intellectual Contributions Summary for 2009 through 2014: Intellectual Contributions Contributions to Practice Discipline Based Learning and Pedagogical Refereed Journal Articles Other Professional Journal Articles Published Proceedings Scholarly Books or Chapters in Books Other Outlets Total Primary Course Responsibilities for 2009 through 2014: Course Number ACCT 2100 ACCT 2101 ACCT 2102 ACCT 3110 Title Survey of Accounting Principles of Financial Accounting Principles of Managerial Accounting Intermediate Accounting I Total Dawn Anderson Assistant Professor of Accountancy Education Graduate: Master of Arts in Accountancy, University of Central Missouri, Warrensburg, Missouri, August 2006 Undergraduate: Bachelor of Business Administration (Major: Accounting), University of Central Missouri, Warrensburg, Missouri, May 1999 Academic Appointments Assistant Professor of Accountancy, University of Central Missouri, Warrensburg, Missouri August 2011-present Graduate Teaching Assistant, University of Central Missouri, Warrensburg, Missouri January 2005-May 2006 Relevant Non-Academic Experience Dawn Anderson Accounting Services Self-Employed Provided consulting, accounting and payroll services to clients Prepared monthly, quarterly and annual payroll tax forms Prepared monthly and annual financial statements Prepared monthly budget analyses Administered bi-weekly payroll for approximately 45 employees Consulted with management regarding proper treatment of accounting matters Examined investment alternatives and initiate investment transactions University of Central Missouri Career Development Coordinator Developed and maintained employer relations Planned, coordinated and executed seminars and workshops Assisted students with career choices, resume writing and interviewing Pleasant Hill, MO July 2010-December 2013 Warrensburg, MO March 2004-April 2005 BKD, LLP Kansas City, MO Audit Supervisor August 2003-March 2004 Audit Senior Accountant August 2001-July 2003 Audit Staff Accountant July 1999-July 2001 Examined clients’ financial records and reports to determine compliance with standards of preparation and reporting Consulted on a variety of financial matters Revised accounting systems to better meet the needs of end users Supervised and organized audit engagement teams Served as primary contact for clients’ inquiries Primary Teaching Area Accounting Primary Course Responsibilities Fall 2009 Course N/A Fall 2010 Course N/A Fall 2011 Course ACCT 2101 ACCT 2102 ACCT 2100 Fall 2012 Course ACCT 2100 ACCT 2101 ACCT 3110 Fall 2013 Course ACCT 3110 ACCT 2101 Title Title Title Principles of Financial Accounting Principles of Managerial Accounting Survey of Accounting Section Spring 2010 Course N/A Title Section Section Spring 2011 Course N/A Title Section Title Intermediate Accounting I Section 1 Section 2 Spring 2012 Course ACCT 3110 1 ACCT 2101 Section 2 Principles of Financial Accounting Intermediate Accounting I 1 ACCT 3110 Title Intermediate Accounting I Section 1 Spring 2014 Course ACCT 2102 3 ACCT 3110 Principles of Financial Accounting 3 1 Spring 2013 Course ACCT 2102 Title Survey of Accounting Principles of Financial Accounting Title Principles of Managerial Accounting Intermediate Accounting I Section 3 Title Principles of Managerial Accounting Intermediate Accounting I Section 3 1 1 Faculty Development 2009-2014 N/A Professional Development 2009-2014 Professional Experience Relevant to Teaching Assignment April 2013 – March 2014 Provided consultation to clients and individuals through the following projects: - Coordinated transition of Treasurer responsibilities. - Provided training on withholding and reporting requirements of employers. - Provided training on accounting techniques, financial statement preparation and payroll requirements. - Assisted with the training of new general accountant. - Coordinated audit of financial statements and review of internal controls. - Attended monthly board meetings to present financial statements and provide guidance on financial matters. - Attended board meetings as client representative. 1 - Attended board meetings as liaison between independent auditor and board members. - Assisted student organization with developing accounting system and internal controls. Prepared monthly and annual financial statements Prepared monthly budget analysis Provided general accounting and payroll services to clients Prepared monthly, quarterly and annual payroll tax forms Continuing Professional Education April 2013 – March 2014 AICPA Update: New and Recent SASs, SSARSs, and SQCSs (2 hours) Annual Accounting and Auditing Update (8 hours) General Ethics (2 hours) Internal Control and Fraud Detection (8 hours) Introduction to the Limited Liability Company (2 hours) Real-World Fraud: War Stories From The Front Lines (8 hours) Tax Issues and Planning Using Roth IRAs (2 hours) The Top 50 Business Tax Mistakes Practitioners Make and How to Fix Them (8 hours) Professional Experience Relevant to Teaching Assignment July 2012 – March 2013 Provided consultation to clients through the following projects: - Researched payroll reporting discrepancies from prior years and formulated response to Social Security Administration and Internal Revenue Service. - Researched charges and late fees from Division of Employment Security. Provided explanatory report to client. - Implemented new payroll system. - Provided guidance on structuring employee payroll deductions. - Revised current budgeting structure and budgeting techniques. - Provided training on withholding and reporting requirements of employers. - Provided training on accounting techniques, financial statement preparation and payroll requirements. - Created new accounting system to improve efficiency. - Coordinated audit of financial statements and review of internal controls. - Attended monthly board meetings to present financial statements and provide guidance on financial matters. - Attended board meetings as client representative. - Attended board meetings as liaison between independent auditor and board members. Prepared monthly and annual financial statements Prepared monthly budget analysis Provided general accounting and payroll services to clients Prepared monthly, quarterly and annual payroll tax forms Professional Experience Relevant to Teaching Assignment July 2011 – June 2012 Provided consultation to clients on the following topics: - Implementing a vacation/sick policy for employees - Selecting health and life insurance coverage for employees - Structuring employee payroll deductions - Revising current budgeting structure and budgeting techniques - Financial statement elements and the modified cash basis - PILOT (payments in lieu of taxes) agreement - Restructuring of billing process - Adoption of hiring and payroll policies Prepared monthly and annual financial statements Prepared monthly budget analysis Provided general accounting and payroll services to clients Prepared monthly, quarterly and annual payroll tax forms Instructional Activities and Development 2009-2014 Attended Accounting Educators’ Seminar, March 2012 and March 2014 Completed Adobe Presenter Training, December 2012 Completed Quality Matters: Applying the Rubric, September 2012 Instructional Innovations 2009-2014 Developed online sections of ACCT 2101, ACCT 2102 and ACCT 3110 Incorporated use of on-line homework and quizzes in ACCT 2101, ACCT 2102 and ACCT 3110 Created assembly line demonstration using snacks to illustrate Job Order Costing and Process Costing Developed a candy store example to aid in the learning of inventory costing methods Professional Memberships and Certifications American Institute of Certified Public Accountants Certified Public Accountant (active license) Missouri Society of Certified Public Accountants Honors and Special Recognitions Beta Alpha Psi National Accounting Honor Society Publications N/A Service Professional National and International N/A Regional N/A State and Local Missouri Society of Certified Public Accountants Committee Member – Accounting Careers, 2012 – present Institutional University N/A College/School N/A Department Faculty Search Committee, 2013 and 2014 Textbook Selection Committee, 2012-2014 Beta Alpha Psi, Faculty Advisor, 2012 – present Strategic Planning Work Group, 2012 and 2013 Scholarship Selection Committee, 2011 – present Assessment Committee, 2011 – present