1. Introduction

advertisement

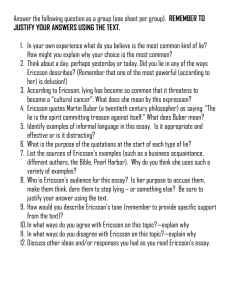

UNEDITED WORKING DRAFT 9 March 2011 Nordic small countries in the global high-tech value chains: the case of telecommunications systems production Marek Tiits, Institute of Baltic Studies Tarmo Kalvet, Tallinn University of Technology Contents 1. Introduction .................................................................................................................................. 2 2. Literature........................................................................................................................................ 3 3. The state of the art in the global telecommunications equipment production ... 4 4. The importance of the telecommunications equipment industry for the Nordic countries.............................................................................................................................................. 9 5. Case studies ................................................................................................................................ 13 5.1. Established major brand names: the cases of Nokia and Ericsson............... 13 5.2. Integrated manufacturing service provider: the case of Elcoteq .................. 13 5.3. Disruptive telecommunications service: the case of Skype ............................ 17 6. Discussion and conclusions .................................................................................................. 21 6.1. Industry life cycles and the relocation of the production and innovation. 21 6.2. Open or closed innovation networks, which model will prevail? ................. 22 6.3. Catching-up strategies for the latecomers ............................................................. 23 7. References ................................................................................................................................... 24 Corresponding author: Marek Tiits, Institute of Baltic Studies, Lai 30, Tartu, Estonia, marek@ibs.ee 1. Introduction The liberalisation of markets and the globalisation the world has witnessed in the course of the recent decades has made the movement of capital and goods in and between the different continents easier than ever before. The greater size of the market allows for the deepening specialisation. Thereby, the globalisation allows also for the increasing fragmentation and delocalisation of the various economic activities that are part of a value chain of any specific product or service. Indeed, the total world trade of merchandise and commercial services has increased from 4,230 billion USD in 1990 to 19,900 billion USD in 2008 (in current prices)(WTO 2009). At this, the volume of the trade of manufactured intermediate goods increased between 1988 and 2006 from 2,018 billion USD to 9,580 billion USD (in constant prices). Furthermore, It appears that the electronics industry has benefited from the on-going trend of globalisation by far the most, as the share of electronics has increased from 8.1% to 17.4% of the total trade of manufactured intermediate goods (Cattaneo et al 2010:248). For long time, the globalisation entailed primarily for off-shoring the production or customer care activities to lower costs locations. It has, however, become increasingly apparent since the turn of the century that it is not only the more cost sensitive production tasks but also the R&D and design of the new products and services that get increasingly relocated from developed to developing countries. One can therefore argue that we are witnessing the transformation of the global production networks into the global innovation networks, where not only the production but also innovation takes place on the global scale (INGINEUS). The aim of the current research paper is twofold. First of all, we seek to understand at the firm level the strategic considerations that influence both the location decisions for the production and R&D, and the related global cooperation with other firms and public actors. Secondly, we seek to gather new knowledge on the possible capability building and catching-up strategies for the latecomers to the global innovation networks. We focus on the electronics industry which is characterised both by the very high R&D investments and the very rapid growth of the global trade. More specifically, we analyse the grossly different development paths of the four major telecommunications systems producers in the Nordic countries: Nokia, Ericsson, Elcoteq and Skype. Nokia was born in 1865, and Ericsson was established in 1876. Both have been well known brand names for decades. Contrastingly, Elcoteq grew from a small company to the global multinational corporation in less than a decade only in the 1990s. Skype has become a global communications solution even faster, and serves today more international calls than any other telecommunications operator on the planet. 2 2. Literature Originally, the main focus of the innovation literature was the evolution of production and innovation systems, as it takes place within the borders of specific national or regional economies (List 1841; Freeman 1987, Lundvall 1985 & 1992; Porter 1990, Fagerberg et al 2005) Although the global sourcing and manufacturing arrangements have been around for some three decades, this attracted among the innovation scholars for long time only modest interest.1 One of the reasons for this is likely to be that the main focus of the innovation research has been the R&D activities that are characteristic to the developed nations while the off-shoring of the production processes to the low cost locations has not included much R&D activities. Furthermore, it has been a common wisdom among the policy makers that the off-shoring of the relatively simpler manufacturing or service activities does not pose to the living standards of the developed countries any significant risks as long as the ‘core activities’ such as the R&D, product design and marketing are retained at home. Therefore also the policy interest to the globalisation of R&D and innovation has been relatively limited. The today’s reality is however that the multinational corporations scout increasingly the globe for suitable mixes of new markets and lower cost production possibilities as well as the local competences for the further development of the product portfolio itself. Such location search is not any more limited to the developed nations, but includes also the various developing countries on all continents. The above is together with the increasing uptake-up of the innovation systems theory and practice in the developing countries perhaps one of the main reasons why the innovation studies community has started to pay since the early-2000s increasing attention to the globalisation (see, e.g., GLOBELICS). The popular Open Innovation theory is an example of one of the new approaches that takes a rather idealistic view on the globalisation. Chesbrough draws his ideas from the success of the open source software (e.g., Linux) but also multinational firms like IBM or 3M. He argues that the borders between the enterprise and its environment are blurring, and therefore “the firms can and should use external ideas as well as internal ideas, and internal and external paths to market, as the firms look to advance their technology” (Chesbrough 2003, Chesbrough et al 2006). Essentially, the open innovation literature points out the increasing knowledge intensity of the modern high-tech industries and the increasingly broad distribution of the various pieces of the useful knowledge. In an ideal world, therefore, all universities and firms could eventually cooperate in a global open innovation network and share benefits that emerge from such an arrangement. Dieter Ernst (2002) is one of the few, who has been advancing this research agenda for a long time. 1 3 Contrastingly, other strands of the economics literature continue to show that there continue to be good reasons for the firms to not open up the access to their R&D results or intellectual capital (Porter 1980), and the globalisation continues to evolve predominantly in the form of the regionalisation (OECD 2007). Moreover, it appears from the empirical literature that both the technological and managerial capabilities for participation in truly global innovation networks vary significantly both within and between the different major economic powers such as, e.g., the United States, China, Japan or the European Union (see, e.g., Annerberg et al 2010, Tiits & Kalvet 2010). The transformation of the existing R&D and business networks into truly global open innovation networks is thereby anything but automatic. In fact, one could still find both from the economics and business management literature good arguments for maintaining closely knit multinational corporate structures or business alliances which continue to control the global value chains and offer only to a limited number of selected partners access to the core technological assets or marketing and sales channels. Thereby, a number of questions remain open both on the theoretical and more practical policy-making or business strategy level in relation to the globalisation of the innovation networks. Including the most fundamental one, which is the more feasible model for a particular enterprise or economy – closed or open innovation? When are or should be the firms actually employing one approach or the other? How can the latecomer economies integrate the best into the global economy so that the benefits to the particular economy would be the greatest? In order to shed some light on these questions, we undertake in the following an analysis of the four European firms in one of the most R&D intensive and globalised industries – the production of the telecommunication systems. In the following, we introduce these case studies with a brief review of the general dynamics in this industry and of the role this industry for the three Nordic economies: Sweden, Finland and Estonia. 3. The state of the art in the global telecommunications equipment production The modern ICT visions seek to develop enjoyable information services available to anyone, anywhere and any time. The fulfilment of the above aspirations assumes for the continued explosive growth of the computing power and the bandwidth of the fixed and mobile communications channels and increasing user friendliness of the information systems that run on top of the more and more powerful infrastructures (Ducatel et al 2001). In this broad context, the following two major technological disruptions continue to take place in the telecommunications industry simultaneously and in a mutually reinforcing manner: 4 - the continued technological development and the increase of the communication bandwidths allows for a shift from the fixed to mobile broadband communications, and from the PC to all kinds of mobile devices; the shift from the time-division multiplexing digital networks to the Internet Protocol (IP) based networks allows for the convergence of a variety of multimedia communications, including voice, video, file exchange, etc. In the 1990-2000s, with the advent of the GSM standard and the broad take-up of the mobile telephony services by consumers, the Nordic telecommunications equipment manufacturers became the global market leaders both in the manufacturing of the mobile telephones and the related network equipment.2 The United States and Japan were developing competing standards which have had internationally less success. This is also why the non-European manufacturers, such as for example Motorola or Sony, were less successful in the early phases of the evolution of the mobile telephony industry. As the result, Nokia had 31%, Motorola 15% and Ericsson 10% of the mobile phone handsets market in 2000. Ericsson (30%) and Nokia (10%) faced tougher competition at the mobile telecommunications infrastructure market, where Motorola (USA) had 13%, Lucent (USA) 11% and Nortel (Canada) 9% of the market in 1999. (Rouvinen and Ylä-Anttila 2003, Porter & Sölvell 2006: 13). Nasdaq crash and the emergence of the next generation (3G) mobile telephony standards3 led to a significant consolidation of the industry in the early 2000s. For example, Ericsson who was the market leader in network infrastructures, but had in handsets a weaker market position merged its handsets business with Sony’s. Siemens merged, for similar reasons, its network infrastructures business with Nokia, and sold its handsets business all together to the Taiwanese BenQ. Although the market share of the Asian producers was negligible in the turn of the century. Various emerging markets actors, such as Samsung, LG (both Korea), Huawei (China), and others have been, however, building up their capabilities rapidly. What is more, various integrated microchips and readymade integrated platforms that are instrumental for developing mobile telephones have became readily available from the various semiconductor manufacturers, e.g., Qualcomm, Infineon, ST-Ericsson, MediaTek, etc. Thereby, the mobile telephone market has become from the technological point of view much easier to enter for the new actors. What matters in the low end of this market the most is the market power and access to the end customers at large emerging markets such as, e.g., South-East Asia, Africa, etc. In order to properly understand the sources of the Nordic competitive strengths in the mobile communications industry, one should consider the respective investments and the evolution of the mobile telecommunications in the Nordic countries at least since 1970-1980s. 3 At the time of the development of the original GSM standards, no one could properly estimate the future importance of the mobile data communications. Therefore, the original GSM standard foresaw only the possibilities for a very limited (9600 bps) speed of data communications. The shift from the GSM (2G) mobile telephony systems to the 2.5G (EDGE), 3G and the forthcoming 4G networks is, therefore, foremost about the increasing of the bandwidth that could be made available for the mobile data communications. 2 5 In the 1990s, the product development and manufacturing were, although dependent on the independent suppliers of microelectronics components, fairly closely knit in the Western Europe and in the United States. However, with the saturation of the European and other developed country markets, the Asia became both the greatest growing market and the largest manufacturing base. The whole product development and the whole mobile telephony production value chain have become truly globalised in the course of the last decade. For example, the Apple’s iPhone, which is one of the today’s most eye catching electronics products, is actually manufactured by the Taiwanese Hon Hai Precision Industry Co Ltd, while the various microelectronics components are sourced from different companies and manufacturing plants across the globe. Thus, the various parts of the mobile telephony value chain (Figure 1) are indeed dispersed across the globe. Figure 1. Mobile telephony value chain Source: Sölvell & Porter 2006. The iPhone 4 display, application processor and memory come from LG and Samsung in Korea, radio chips come from Broadcom and Intel in the U.S., and Infeon in Germany; and the various smaller components come from elsewhere (iSuppli 2010). The Apple’s iOS platform is in terms of the design of the user interface design in many ways superior to the competing offers, but there is much more to the Apple’s success. Apple is unique in its ability to control the whole global value chain from the product design to sales to end users that takes place in partnership with local telecommunications operators in a way no other 6 competitor has managed to do. This together with the specialisation in the upper end of the market allows Apple to reap unrivalled economic benefits.4 Although Apple sells only 4% of all mobile telephones, it collects a remarkable 50% of the total profits of in the mobile handset industry. Contrastingly, the market leader Nokia has underperformed recently rather badly. Nokia sells 32% of all handsets, but it has been increasingly competing in the overcrowded lower end of the market, and this has allowed it to benefit from only 15% of the industry profits (Figure 2 & Figure 3). Figure 2. Market shares of the major mobile telephone producers. Source: Asymco 2010. The fact that the various components of the mobile telephones are increasingly readily available to anyone and the whole production chain has become truly global has shifted the very nature of the market competition in this industry. The high end mobile telephones have become increasingly powerful networked computers, and the market competition is not any more about the mastering of the development and production of the individual telephones, but about the development and commanding the whole ecosystems of telephones and the various third party applications which are run on these. We argue that the Nokia’s and Sony Ericsson’s recent failure in capitalising on the smartphone market is largely due to the failure5 of the Symbian operating system (OS) Nokia and Sony-Ericsson have been advancing jointly with some other manufacturers. Unfortunately, the Symbian consortium has been never able to establish a consistent OS that would allow for development applications The various iPhone components cost only $187.5 and the assembly only $6.5 of the $600 iPhone 4 sales price (iSuppli 2010). 5 Sony Ericsson introduced its first Android powered smartphone in the spring of 2010. On 11 February 2011, Nokia announced a new software partnership with Microsoft, another ailing giant that has failed to establish its software stronghold in the mobile telephone industry (Bloomberg 2011). 4 7 that run without modifications on a myriad of different handsets produced by Nokia, Sony Ericsson and others. The development and maintenance of applications that run on multiple similar but mutually incompatible platforms is costly. It is also confusing for the end users to figure out what specific version of the software they should acquire. As the result, the Symbian mobile applications market never took off, and Apple has overtaken the market leadership with its innovative touch-screen user interfaces and iTunes App Store, which everyone else attempts at copying now. Figure 3. Earnings of the major mobile telephone producers. Source: Asymco 2010. The competition for the establishment of a de facto standard of the mobile operating system is, however, still on-going. Google, another newcomer at the mobile telephony market, is currently the Apple’s fastest growing and strongest contender in the fierce competition for establishment of a dominant software platform6 (Table 1). Both Apple and Google have also taken serious steps at extending their iOS and Android platforms beyond mobile telephones to other devices such as, e.g., the tablet computers and flat screen TVs, and have come up with the Apple TV and Google TV systems respectively. 6 8 Table 1. Worldwide smartphone sales to end users by Operating System. Q2 2010 Q2 2009 Units Market Units Market Company (thousan Share (thousan Share ds) (%) ds) (%) Symbian 25,386.8 41.2 20,880.8 51.0 Research In Motion 11,228.8 18.2 7,782.2 19.0 Android 10,606.1 17.2 755.9 1.8 iOS 8,743.0 14.2 5,325.0 13.0 Microsoft Windows Mobile 3,096.4 5.0 3,829.7 9.3 Linux 1,503.1 2.4 1,901.1 4.6 Other OSs 1,084.8 1.8 497.1 1.2 Total 61,649.1 100.0 40,971.8 100.0 Source: Gartner 2010. The wireless communications networks market is, however, another completely different market segment of the telecommunications equipment manufacturing industry. This market contracted in 2009-2010, as the as operators cut spending during the recession and aggressive Chinese vendors drove down prices. In this segment, Ericsson continues to be a market leader of (33.6% of the market in Q3 2010), while the Chinese Huawei (20.6%) has performed recently slightly better than Nokia Siemens Networks (19.8%). The fourth largest player, the U.S. based Alcatel-Lucent had 16.2% of the market7. Overall, the developed countries continue to be the main market both for the high-end smartphones and for the 4G (Long-Term Evolution, LTE) infrastructure equipment, while the continued rolling-out of the simpler telephones, and the 2G and 3G network infrastructure will drive the growth at the developing markets. At this, some of the large developing nations, e.g. China, are also moving very fast to the 4G technologies. Furthermore, they continue to compete with the major developed nations for the standardisation of their particular specifications of the 4G networks and protocols. The mobile telecommunications market continues thereby to be anything but a fully harmonised global market that relies on universally adopted global standards. 4. The importance of the telecommunications equipment industry for the Nordic countries ICT sector is one of the most knowledge and R&D intensive industries both globally and in the Baltic Sea Region. However, both the size and the knowledge intensity of the ICT sector vary both across the different ICT sub-sectors substantially in the different countries in the region. The share of the ICT sector in the GDP is in Finland and Sweden, among the highest in Europe. This is largely due to the major contribution of the manufacturing industry, in particular the manufacturing the telecommunications equipment. The presence of a strong ICT 7 Reuters, 18 Nov 2010, http://www.reuters.com/article/idUSTRE6AI0BN20101119 9 manufacturing sector is indeed what distinguishes the Nordic countries from the majority of the other European economies, where the ICT sector accounts only for 3-4% of the GDP (Figure 4). Finland is particularly strong specialisation in the manufacturing of the telecommunications equipment. In fact, the Nokia’s remarkable success in the last decades has made Finland as a small economy in the success of this company. Nokia contributed more than 2% of the Finnish GDP growth in 2000. More recently, the consolidation of the industry and the rise of the U.S. and Asia based competitors changed, however, the situation substantially. The Nokia’s contribution to the economic growth in Finland was even negative in the course of the global crisis in 2008-2009 (Ali-Yrkkö 2010: 12). Contrastingly, the Sweden’s industry is much more diversified which makes it much less dependent on particular large companies such as Ericsson, or other multinationals that are headquartered in Sweden. Figure 4. The ratio of the ICT sector value added to the GDP, 2005 Source: Turlea et al 2009: 46. The important role of the telecommunications equipment manufacturing in Finland and Sweden is even more visible in the export figures. The Finland’s and Sweden’s exports of goods doubled between the 1995 and 2009. The Estonia’s exports have grown in this period even more rapidly. While this is the case, a very clear peak can be observed in the exports of the telecommunications equipment in all three countries around the turn of the century (Figure 5). 10 Figure 5. The share of the telecommunications equipment in the total exports of goods 0.35 Percent of the total exports 0.3 0.25 0.2 0.15 0.1 0.05 0 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 Estonia Finland Sweden Denmark EU27 Source: Authors’ calculations, ComExt 2011. This has, once again, to do with Nokia in case of Finland, Ericsson in Sweden. The Estonia’s exports in the telecommunications equipment have also predominantly to do with the above two companies. Their manufacturing service provider Elcoteq has been for more than a decade responsible for the vast majority of the imports and exports of the telecommunications equipment to and from Estonia. The on-going globalisation and in particular the rise of the Asian emerging economies have brought about the relocation of the manufacturing activities to the major mass consumption markets in Asia, while the exports from the United States and Europe have declined. As the result, China became between 1997 and 2007 by far the largest exporter of the telecommunications equipment, while the market share of the Nordic countries has diminished significantly (Figure 6). 11 Figure 6. The communications equipment export by nation, 1997-2007 Source: ICCP 2010. One could argue that the rise of the Asian producers has to do with the relatively lower cost base of these economies and the fact that the Asian markets are among the fastest growing consumer markets for the (mobile) telecommunications equipment. However, it is not, as shown above, only the manufacturing but also the R&D and product development activities where the Asia is gaining the grounds as compared to the United States and Europe. We are witnessing a transition of the global production networks that were about off-shoring certain production activities to the global innovation networks, where the actual R&D, product development and manufacturing activities are carried our on the different continents. In order to shed a light on the location decisions both for the R&D and manufacturing activities of the major players in the telecommunications equipment manufacturing, we present first the case studies of Ericsson and Elcoteq. Thereafter, we analyse the strategy and development of Skype, a disruptive global telecommunications systems provider that has become in less than a half decade the largest provider of international calls and challenges the whole business model of the established telecommunications industry. 12 5. Case studies 5.1. Established major brand names: the cases of Nokia and Ericsson Ericsson was founded more than a century ago in 1876 as a telegraph repair shop. What followed was a remarkable success story. Ericsson telephone exchange supported the first international telephone call in 1950. It was one of the pioneers of the Nordic Mobile Telephone (NMT) and GSM telephone systems. Today Ericsson continues to be the market leader for the mobile telephone network equipment manufacturing. It continues to manufacture in its subsidiary Sony Ericsson the mobile telephones, and offers from and ST Ericsson also the mobile telephone components and kits to the third parties. This chapter is to be finalised. 5.2. Integrated manufacturing service provider: the case of Elcoteq Elcoteq8 was founded as Lohja Microelectronics in 1984 to support the Lohja Corporation’s (Finland) development and production of electroluminescent displays. This business did not advance, however, fast enough and some free capacity became available in Lohja Microelectronics. Meanwhile, Nokia Mobira in Finland and Ericsson in Sweden had both developed their first NMT mobile telephones, for which the full-scale production was held back by the small components assembly capacity, and they were looking for additional manufacturing expertise. This is how Lohja Microelectronics became an electronics manufacturing service (EMS) provider with Nokia and Ericsson as its largest customers in the early 1990s (Elcoteq 2010). In 1990, in a way of the preparation for merger with another Finnish industrial conglomerate Wärtsilä, Lohja Corporation restructured itself and registered its different business operations as separate companies. The microelectronics was renamed to Elcoteq. Metra corporation, that had emerged as the result of the merger, did not consider, however, microelectronics to be its core business, and Elcoteq went for the management buy-out in 1991. In the early 1990s, when Swedish and Finnish entrepreneurs were the first to invest into Estonia, the Elcoteq started with the pilot production in Estonia already in 1992, and established formally a subsidiary in Estonia in 1993. This was the very first subsidiary Elcoteq established outside homeland. Although initially various Asian countries had been considered as a potential location, eventually a better alternative was found closer to home in Tallinn. Hereinafter ‘Elcoteq’ refers to the Elcoteq corporation globally, and ‘Elcoteq Tallinn’ refers to the particular subsidiary which has been established in Estonia. 8 13 One of the Elcoteq Tallinn veterans described the creative destruction that took place in the early 1990s with the following words: “It was a productive time, the industry had collapsed and the town was full of unemployed engineers.” The newly employed engineers were initially sent for training to Finland or Sweden. Later on, training was increasingly organised locally in Estonia.9 In 1996, Elcoteq Tallinn started to operate as the GSM repair center. Already in the following year, volume production of the GSM mobile telephones was initiated, and Elcoteq became the very fist EMS business that started to ‘box build’ mobile phones for a major brand name from the start to finish. The fact that Ericsson had subcontracted the whole production of its Ericsson 628 mobile telephones brought Elcoteq to a completely new level of collaboration with its clients. Most notably, soon also Nokia followed the suit. What followed can be characterised as a true co-evolution of the major brand names and and Elcoteq as an EMS part of their value chain. For the late 1990s, Elcoteq was producing in Estonia mobile handsets for two market leaders of the time.10 This was a big time both for the Nordic mobile telephone producers and the EMS businesses, which were working with them, as the European mobile telephony market was booming and the production and sales volumes went up very rapidly. This is also very vividly visible both in the Nordic and Estonian foreign trade statistics. In Estonia, telecommunication equipment reached for the turn of the century up to 20% of the manufactured exports. In this period, most of the production technologies and components were imported and virtually all of the produced goods were exported. The share of local content other than labour remained virtually nonexistent. Thence, not surprisingly, also the value added generated in the Estonian electronics industry remained significantly lower than that in traditional industries, e.g., wood processing, etc. (Tiits et al 2006) In this period, Elcoteq started also to expand internationally, as it made increasingly sense to locate the manufacturing activities close to their end market. To finance the enlargement, the Elcoteq’s shares were listed on the Helsinki Stock Exchange in 1997. New manufacturing site was established in Hungary, and an office was established in the United States. The office established in Hong Kong started to manage manufacturing activities located in the Southern China, etc. In effect, Elcoteq became within the two short years a truly global corporation. By the end of the 1999, the Elcoteq’s network of plants covered already more than ten countries in the three word regions which experienced the fastest growth: Europe, America and Asia. When Estonia restored its independence in 1991, its economy was in deep trouble. So was the whole ex-USSR. Therefore, Estonia started, both for the political and economic reasons, immediately to reorient its economy to the western markets, which had both a greater purchasing power and growth prospects. However, as it became evident very soon, the majority of the electronics industry, which Estonia had inherited, was not competitive at the western markets and was, therefore, forced to close down (Tiits 2006). As a result of this, experienced workforce was readily available for the electronics industry in Estonia in the early 1990s. 10 Both the Nokia and Ericsson were the clients of the Finnish EMS firm Elcoteq already since mid-1980s; and Elcoteq had manufactured the mobile telephone boards for Ericsson already for a number of years. 9 14 Figure 7. The location of Elcoteq sites Source: Elcoteq Annual Report 2009. The business models, which were originally adopted in Finland and Estonia provided a good starting point, but needed adapting for Hungary, Russia, Germany, Mexico and China. The Elcoteq’s Finnish and Estonian business development and engineering staff was therefore actively involved in the establishment of the new sites elsewhere in the world, and training the local staff. Also, through these experiences, a well-documented system was established in Elcoteq for transferring any specific production line from one site to another. As opposed to some other multinational corporations, the individual units within Elcoteq continue to rely on uniform standardised technologies and processes also today. As discussed above, the NASDAQ crisis brought about consolidation and global restructuring in the whole ICT and electronics industry from the 2001 onwards. The large-scale manufacturing of consumer electronics, incl. mobile telephones and similar, has shifted increasingly to the low cost locations that are nearby to the final markets. For example, Ericsson moved, as the part of streamlining its value chains, the manufacturing of its mobile telephones from Elcoteq Tallinn to the St. Petersburg (Russia). Also, a number of mergers and acquisitions took place between the ICT enterprises. The establishment of Sony Ericsson Mobile Communications company and the subsequent sale of the Ericsson’s own mobile telephone manufacturing plants to a competitor was, further to the general market downturn, another major blow for Elcoteq (Elcoteq 2010). Despite the above, in Tallinn (and in other sites) manufacturing of the Ericsson mobile network gear and Nokia telephones was maintained for the time being. Elcoteq had to adjust for a weaker demand and a general slowdown in the ICT industry. It was acknowledged that the manufacturing activities alone would not be sufficient for sustaining the profit margins in the changed market environment. Consequently, Elcoteq started to further its own design, R&D, engineering and after-sales services. Special New Product Introduction (NPI) 15 centres were established within the Elcoteq to strengthen the co-operation with clients and their design houses in testing prototypes and preparation for the actual production. Initially, Elcoteq engineering centre, which is in charge of the testing the prototypes and new product introduction, was located in Finland. In 2000, a new engineering centre was established in Tallinn, Estonia. In 2002 one more engineering centre was established in Beijing, China. To strengthen its engineering capabilities even further, Elcoteq bought the R&D unit of the Finnish mobile telephone and telematics company Benefon in 2002 (Elcoteq 2010). Although Elcoteq had all capabilities for designing the mobile telephones and even developed at one point in time one handset for Ericsson, it did not challenge its main customers in R&D and product development, but remained a contract manufacturer. The competition continued to intensify in the EMS business on all fronts in the 2000s. For example, Nokia started to source some of its printed circuit boards from Foxconn (Hon Hai) and GKI in Asia, and handled the manufacturing all together in-house in Brazil. In the mid-2000s, Nokia continued to streamline its supplier network, and gave a preference to larger vertically integrated suppliers such as the Foxconn and BYD. As the result, eventually, Elcoteq was forced to downsize significantly also its Nokia handset business (Seppälä 2010). Elcoteq started therefore to capitalise increasingly on its telecommunications equipment manufacturing competences by manufacturing later in the 2000s to an even broader set of clients. Along with this also a new plants were inaugurated in Bangalore (India) and St. Petersburg (Russia) in 2005. In the same year Elcoteq was reincorporated as European Company (SE) and the regional headquarters were established in Budapest (Hungary) for managing the European operations. Furthermore, the domicile of the company was transferred from Lohja to the Luxembourg in 2008. The recent global financial and economic crisis brought about another restructuring of the Elcoteq global network. During the 2009, the factories in Arad (Romania), Richardson (US) and St. Petersburg (Russia) were closed down. The factory in Shenzhen was consolidated into the factory in Beijing in China. Part of the Elcoteq Tallinn plant, which served earlier Ericsson, was sold to Ericsson. With this transaction, some 1200 employees of Elcoteq Tallinn moved also to Ericsson (Elcoteq Annual Report 2009). After this transaction, Ericsson continues to produce in Tallinn 4G (LTE) mobile network gear, for which the Swedish TeliaSonera is among the Ericsson’s first customers. Today, Elcoteq continues to be in the global comparison a fairly small electronics manufacturing service provider.11 It continues, nonetheless, to produce both the mobile handsets and infrastructure systems. Globally, basically all major telecommunications equipment producers, incl. Nokia, Samsung, LG, Motorola, Elcoteq revenues were 2090 million USD in 2009. The revenues of the Foxconn and Flextronix – largest contract manufacturing companies in the world – were respectively 44065 million USD and 30949 million USD in the same year. 11 16 Sony Ericsson, Huawei, etc., continue to be the clients of Elcoteq. Further to this, Elcoteq has established itself also in the production of flat screen TVs. (Elcoteq Annual Report 2009) In Europe, the plant located in Hungary is the main Elcoteq’s main mass production plant, while Elcoteq Tallinn continues to produce with its approximately 200 staff for smaller niche markets. Capacity building and innovation in Elcoteq First of all, the timing of the internal manufacturing capacity building in Elcoteq (Lohja Microelectronics) in relation to the emergence of a new industry and the relative geographical proximity in the Nordic countries were crucial for Elcoteq to be actually able to attract the market leaders of an emerging new industry as customers in the early 1990s. The other side of the coin is, however, that Nokia and Ericsson as large clients managed to lock in Elcoteq into their supply chains in such a way that it was, despite the upgrading of competences that took place internally, never able to fully upgrade from the OEM to an ODM business. In fact, only the world’s largest Taiwan / China-based contract manufacturing service providers have managed to upgrade themselves into the ODM businesses. In practical terms, this has often required for spinning the design and product development activities out from the original EMS business, and establishing a separate ODM firms that operate fully independently from the original OEM business (Cattaneo et al 2010: 258). Elcoteq upgraded their engineering capabilities to an extent that they would be able to go from OEM to ODM, but unlike some larger Asian (Taiwanese) competitors, they never did it big time. They cannon compete with their clients in the same technologies everyone has, so they continue to be dependent on their clients, such as Ericsson, Huawei or others. Overall, in Elcoteq Tallinn, internally, a substantial capacity building and upgrading of the business functions has taken place. However, the Elctoteq’s business model itself has not allowed for competing with major brand names in the telecommunications equipment manufacturing. The failure to establish a strong cluster of local suppliers is perhaps the strategically most important aspect, where the Estonian economic development strategy has fallen short. 5.3. Disruptive telecommunications service: the case of Skype Internet was in the 1970-1980s, where the early development of the digital telephony systems standards started, anything but widespread, and most of the fixed line data communications run at what is in today’s standards a very low speed. Voice communications were the primary means of communications, and the business models and the architecture of the telecommunications systems were built for billing per minute of use. The explosive growth of Internet in the 1990s brought a major disruption to the whole telecommunications business. The provision of the Internet services, which was in the early 1990s a minor side business, became in less than a decade a major business. 17 The spread and increasing speed of the Internet access brought, however, also a major disruption to the business models and billing. The international telephone calls have been traditionally for the public telephone operators a premium market from where significant revenues can be generated. With broadband Internet access, there is no billing per minute, and international communications are virtually free of charge. Furthermore, as the potentially available Internet bandwidth is today in the most occasions already greater than that the bandwidth of the voice channels in digital (mobile) telephone networks12, it makes increasingly sense to route the voice calls over the Internet. This is exactly what Skype and other Voice over IP (VoIP) systems do. Skype is VoIP software that allows anyone to talk to anyone else in the Internet free of charge. It allows, for a modest fee, also to route the calls to the ‘old school’ telephone network. VoIP is, thus, a disruptive technology that benefits enormously from the continued advent of the Internet communications and carries a potential for altering drastically the business models of the whole telecommunications industry. Skype was founded in 2003 the Swedish and Danish entrepreneurs Niklas Zennström and Janus Friis. Skype’s software development team was from the very beginning located in Tallinn, Estonia, which became immediately its largest office in terms of the number of staff. Skype was not the first company to enter the VoIP market, but its strength in the ease of use, hugely scalable peer-to-peer architecture and clever marketing made it an immediate success. The first “beta” version of Skype, which was released in August 2003, allowed for computer-to-computer voice calls. No other services were available. This very first software attracted the first 1 million registered users only in a matter of months. Subsequently additional services (text chat, SkypeOut and SkypeIn calls to and from the regular telephones, video calls, etc.) and support to additional devices (Apple Mac, Linux, special Skype Phones and Skype application for various smartphones) appeared. Two years later, in Q4 2005, when eBay bought Skype, it had already 75 million registered users. For today, Skype has more than 560 million registered users, and, although only a percent of users pay for its services, it has become by far the largest international voice carrier. What is more, 40 percent of Skype calls are actually video calls. The ease of use, and possibility of (multiparty) video calls along with the free service differentiate Skype very strongly both from the other traditional and VoIP telephone services.13 Skype has gone truly global not only in terms of its customer base, but also in terms of the location of its business functions during the last five years. As noted above, it was the combination of the experienced Scandinavian start-up managers and Estonian engineering talent that were the in the core of the The bandwidth of the voice channel in the GSM mobile telephone network is 9.6 kbps. Fixed line digital telephone networks allocate for voice channel 64 kbps. The bandwidth of the usual end-user Internet access is at the same time between a few hundred kbps and a few mbps. 13 In the first six months of 2010, Skype users made 95 billion minutes of voice and video calls. 12 18 Skype’s immediate success. Soon, as the Skype was seeking to attract international venture capital and to get closer to major marketing channels, the corporate headquarters were established in Luxembourg and an office was also set up in London. Although the headquarters were in Luxembourg, Tallinn and London remained to be the largest offices, and most of the decision-making continued to take place between these two offices. Figure 8. The location of Skype sites Source: Skype, October 2010. Once eBay bought Skype in 2005, an office was also set up in the United States, close to the eBay HQ14. After eBay sold Skype in 2009, the U.S. office continues essentially as a marketing, sales and support office servicing the Americas15. Recently, general management of the Skype4Business business line was also moved to the U.S., as the Americas are globally the largest market for enterprise communications, and some of the Skype’s strategic partners for this business line, e.g., Avaya, are also located there. Skype has also tiny offices the Singapore and Hong Kong in Asia. These offices are in charge of the marketing, sales and support in Asia. Their perhaps even more important function is still to keep close contacts with the manufacturers of the increasing variety different Skype enabled devices (Skype phone, flat screen TVs, etc.) in Asia. In Q4 2005, eBay purchased Skype for approximately 2.5 billion U.S. dollars (2.1 billion euros) of upfront payment, plus potential performance-based consideration (eBay). http://investor.ebay.com/ReleaseDetail.cfm?ReleaseID=176402&FYear= 15 In November 2009, eBay sold, however, 70% of Skype to a consortium comprising Silver Lake Partners, CPPIB, Andreessen Horowitz, and the original founders valuing the business at 2.75 billion dollars. In August 2010, Skype filed with the SEC for listing at the NASDAQ stock exchange, where it seeks to raise up 100 million dollars to in an initial public offering. http://techcrunch.com/2010/08/09/skype-ipo/ ; http://www.theregister.co.uk/2009/03/25/skype_biggest/ 14 19 Skype has been, typically to a venture capital backed start-up, essentially from its birth in an aggressive growth phase, ensuring the supply of suitably qualified labour has been one of the important concerns. Therefore, as it emerged that no enough suitable labour was available in Estonia, second engineering centre was established in the Prague in 2007. The Prague centre operates as a satellite of the primary engineering centre in Tallinn, and the engineers who are based there report to the team leaders located in Estonia. In Estonia, also some attempts have been made for initiating co-operation with higher education institutions for strengthening the supply of the qualified labour. The co-operation with the education systems of the respective countries has remained so far, nonetheless, fairly limited, as the public education systems are always slow to respond and the company in an early expansion phase could not wait for too long to actually see the results. Instead, Skype has acquired the required talents rather aggressively, where they could be found easier and faster, relocating, if necessary, the persons concerned to one of its offices. The purchase of the Norwegian start-up Sonorit Holding AS, a provider of voice technology for the Internet, in April 2006 is an example of the flexibility companies like exhibit in attracting the very top talent. The main motivation behind this acquisition was really the knowledge and talent this Norwegian company had on audio-video codecs and on the VoIP systems in more broadly. As the acquired company itself did not have even office yet in Norway, an office was set up for them in Stockholm, closest possible location to the engineering centre in Tallinn. Nowadays, in this Skype Stockholm office some of the most advanced audio-video R&D takes place in Europe. Given the deep specialisation and the knowledge pool that is available in this Skype unit, also close exchange of information takes place there with different research institutes and universities across the globe. This is pretty much Skype globalisation story in a nutshell. It is for the most part about securing the supply of necessary staff or being close to some important partners/markets. We can add a lot of details on the internals of the VC industry, and the management / location decisions this has called for, as well as on the disruptive potential of the technology and business model they have. There is, however, much less to tell about the capacity building that has taken place in terms of the engineering and R&D staff. Capacity building and innovation in Skype As described above, the majority of the Skype’s engineering activities take place in Estonia, where these activities were historically rooted. However, as the need has arisen, globally new subsidiaries have been established either to attract the required talent (engineering – Stockholm & Prague) or to be close to other important activities (relations with the international VC and marketing – London & U.S.; relationships with hardware manufacturers – Asia, etc.). The cost of an explosive growth, which a successful VC backed start-up must achieve, is, however, the extremely rapid growing complexity of its corporate management. This is why Skype has now started to streamline its HR strategy, 20 and to concentrate of specific functions to no more than two locations within the company. While the very top R&D talents may possibly remain an exception, where there is a lot of flexibility and interest for co-operation across the globe, majority of the personnel is now increasingly employed to the existing locations of the specific teams within Skype that require additional workforce. 6. Discussion and conclusions 6.1. Industry life cycles and the relocation of the production and innovation As discussed above, the global production networks have been evolving rapidly at least since the 1980s. For example, IBM was in the beginning of the personal computers (PC) era a vertically integrated firm. Almost all PC components were initially designed and produced within one firm, except for the Intel microprocessor, and the PC operating system that was deliberately sourced from Microsoft. IBM chose from the very beginning to establish its design as an industry standard, and hoped to achieve this by allowing the other firms to produce also the IBM compatible personal computers. Soon, the manufacturing of the personal computers was farmed out to many firms that produced the different components, assembled the computers, etc. In the course of the time, not only the manufacturing and assembly functions but also the development of the different computer components was increasingly relocated to the East Asia and to elsewhere in the developing countries. While Intel and Microsoft have managed to sustain their dominant positions, IBM sold eventually its whole PC manufacturing business to the Chinese Lenovo in 2004. The more recent developments in the (mobile) telecommunications equipment have followed a similar pattern. Nokia and Ericsson, as the Nordic industry pioneers, designed and manufactured originally all critical components of their products in-house. Soon, they started contract certain manufacturing functions out to the firms like Elcoteq or Foxconn while keeping the critical technology know-how, product design and marketing functions in-house. This did not deny, however, the competitors from developing similar technologies and products. Moreover, as the developed markets saturated, the manufacturing as well as the product design started to be increasingly relocated to the developing markets which continued to exhibit faster growth. For today, the Nordic manufacturers find themselves increasingly squeezed between Apple as a new entrant to the high end of the market, and the various Asian manufacturers, e.g., Samsung, LG, Huawei, etc., who keep also increasing their market share. Although it does not get too often referred to in the innovation studies, the industry life cycles and techno-economic paradigms literature (Vernon 1966, Perez 2002) explains the above development patterns very nicely. According to this literature, the various economic activities get gradually relocated from the developed to the developing economies, as the technologies disseminate, the initial knowledge advantages vanish and, thereby, the importance of the economies of scale increases in time. Traditionally, the off-shoring entailed 21 primarily for the relocation of production, after-sales support and customer care, etc. What has changed in the recent decades is that the liberalisation of markets, the development of the ICTs have made working across the borders or even on different continents easier than it was ever before. This has allowed for an increasing fragmentation of the production value chains, and has also given raise to the discussion of the global production networks in the academic literature. More recently, against the broadly shared assumptions, also the R&D activities have started to delocalise and relocate. For many, this has given a raise to a completely new phenomenon: global innovation networks. Conversely, we argue on the basis of the current case study that the changes have been actually less than often assumed or feared. First of all, we find it very important to note that both the main production inputs and the internal dynamics are very different in the different industries. The ICTs, biopharmaceutical and automotive industries are responsible for the vast majority of the global private R&D investments, while the traditional industries significantly less industrial R&D takes place (Moncada-Paternò -Castello et al 2010). As discussed above, the foundations of the modern ICT industry, which is more R&D intensive than any traditional industry, were established in the developed nations only a few decades ago. Now, that the ICT industry experiences a phase in the industry life cycle, where the various manufacturing and services activities get increasingly off-shored to the developing countries, obviously also the importance of the R&D activities has increased in the off-shoring and foreign direct investments.16 In our view, much of the earlier global production networks (global value chains) literature remains, nonetheless, largely valid. 6.2. Open or closed innovation networks, which model will prevail? Both Nokia and Ericsson are clear focal points of the respective global production and innovation networks, but these networks are far from being fully open. It is rather the other way around. Telecommunications industry is highly likely to continue to experience a major consolidation, as the smaller actors continue to adopt the more dominant technology platforms and standards. Thereby, for the major brand names, maintaining the control over the proprietary technology platforms and thereby the whole global production and innovation networks continues to be paramount objective in to the corporate strategy. This is a clear commonality for Nokia, Ericsson and Skype, but also other major brands like Apple or Google that we have not discussed extensively in this case study. Usually, the as the natural resource seeking, market seeking, and efficiency seeking have been the main motivation for the investment into developing countries. With the relocation of the science based industries, the strategic technological assets or capabilities seeking behaviour has also become more important as a motivation for the foreign direct investments. See, e.g., Dunning & Lundan 2008:67. 16 22 There is a strong argument for the (partial) opening of the production and innovation networks, when the formation of strategic alliances or similar carries a promise of extending the already existing market share, or supports the standardisation of the specific products or services.17 For example, Nokia and Ericsson involved Elcoteq, and later the other contract manufacturing firms, into their production network in order rapidly boost the volume of production. Skype has also started to open up its communications platform for the third party developers, as the number of different platforms (from PCs to the various mobile devices to the flat screen TVs, cars, etc.) keeps exploding. Apple and Google introduced their own smartphone operating systems in order to extend their existing product range to new hopefully rapidly growing markets. It is, however, not sufficient to have only an operating system. Therefore, they use their respective on-line application stores in order to capitalise further on the third party software and/or content development. The opening of the production and innovation networks offers, however, obviously to anyone involved no any guarantees for success. Although Nokia and Ericsson were originally backing the Symbian smartphone operating system, they failed to compete with the Apple’s and Google’s in-house developed operating systems even though it was ultimately made open source. Elcoteq was eventually cut out of the production of the Nokia and Ericsson mobile phones, as the market situation changed. It is, thence, perhaps the most important lesson and reminder from the current case studies that the ICT industry is internally highly diverse, and the formation and composition of the specific global production and innovation networks continues to be highly specific to the individual product or service groups, and the generalisations at the industry level are necessarily not very useful. The open innovation model has in certain market situations clear advantages. In the other situations the ‘closed innovation’ continues to prove more beneficial. Overall, in our view, the universal open innovation practice remains still a rather distant dream. It seems perhaps more applicable for the not-for-profit sector rather than for the firms, where the control of the critical elements of the intellectual property remains the main source of the market power and revenue generation. 6.3. Catching-up strategies for the latecomers The telecommunications industry has faced in the recent decades an increasing consolidation, as the dominance of a small number of major telecommunications equipment manufacturers has increased. In fact the consolidation has not taken place only on the supply side, but also on the demand side, as the large telecommunications service providers, e.g., Vodafone, France Telecom, We do not consider here the acquisition of the start-ups that have relevant assets or capabilities, or the mergers and acquisitions with the competitors as the ‘openning up’ of the production and innovation networks, but rather a form of the consolidation of the industry. 17 23 Telefonica, etc., have continued to acquire the shares of the various smaller operators across the globe. As the result, both the clients’ and suppliers’ market power has increased remarkably, and the barriers to entry have been heightened for the latecomers to the telecommunications industry. The established major actors continue to enjoy the vast economies of scale across their whole value chain from the R&D and production to marketing and sales. For these reasons, the independent market entry has become increasingly difficult for the latecomers, unless they are able to challenge the established technological standards or business models, altering this way ‘the rules of the game’. China has been successful in utilising the vast market size of its domestic market in order to reinforce its own technological standards. This has forced the major equipment manufacturers to customise their already existing products or to develop new ones. This has, however, allowed also for the domestic latecomer firms more time for the product development. China has been also successful in implementing the usual FDI policy recommendations – in increasing the importance of the local inputs in the actual production, and upgrading gradually the capabilities of the local suppliers. The above is obviously not so easy to do in the smaller economies. The case of the Skype illustrates, nonetheless, that even the tiny newcomer actors can actually outcompete established major multinational firms, if they are able to adopt the new disruptive technologies and business models, transforming this way the rules of the game. 7. References Ali-Yrkkö, Jyrki ed. (2010) Nokia and Finland in a Sea of Change, ETLA: Helsinki. Annerberg, Rolf et al (2010) Interim Evaluation of the Seventh Framework Programme: Report of the Expert Group, http://ec.europa.eu/research/evaluations/pdf/archive/other_reports_studies_a nd_documents/fp7_interim_evaluation_expert_group_report.pdf. (Accessed on 28 February 2011) Asymco (2010) http://www.asymco.com/2010/10/30/last-quarter-applegained-4-unit-share-22-sales-value-share-and-48-of-profit-share/ (Accessed on 30 October 2010) Bloomberg (2011) Nokia Tumbles on Concern Partnership With Microsoft `May Kill' Phonemaker, 11 February, http://www.bloomberg.com/news/2011-0211/nokia-joins-forces-with-microsoft-to-challenge-dominance-of-applegoogle.html Cattaneo, Olivier; Gary Gereffi & Cornelia Staritz (2010) Global Value Chains in a Postcrisis World: A Development Perspective, The World Bank, Washington DC. 24 Chesbrough, H.W. (2003). Open Innovation: The new imperative for creating and profiting from technology. Boston: Harvard Business School Press Henry Chesbrough, Wim Vanhaverbeke and Joel West, eds. (2006) Open Innovation: Researching a New Paradigm. Oxford: Oxford University Press. ComExt (2011) Eurostat ComExt database. (Accessed on 28 February 2011) Ducatel, Ken et al (2001) Scenarios for Ambient Intelligence in 2010, European Commission DG JRC/IPTS, Seville, February, ftp://ftp.cordis.europa.eu/pub/ist/docs/istagscenarios2010.pdf. John Dunning & Sarianna Lundan (2008) Multinational Enterprises and the Global Economy, Edwad Elgar, 2nd edition. Elcoteq (2010), History at http://www.elcoteq.com/en/About+us/History/ (Accessed on 15 December 2010) Ernst, Dieter (2002) Global Production Networks and the Changing Geography of Innovation Systems. Implications for the Developing Countries, Economics of Innovation and New Technology, Volume 11, Number 6, January, 497-523. Ernst, Dieter (2003). “Digital information systems and global flagship networks: how mobile is knowledge in the global network economy?” In Christensen JF, ed., The Industrial Dynamics of the New Digital Economy. Cheltenham: Edward Elgar. Fagerberg, Jan, David C. Mowery and Richard R. Nelson (eds.), The Oxford Handbook of Innovation, Oxford University Press, 2005. Freeman, C. (1987) Technology, Policy, and Economic Performance: Lessons from Japan, Pinter Publishers, London. Gartner (2010) Android Blows Past iPhone To Capture 17% Of Global Market Share In Q2, http://www.businessinsider.com/android-iphone-market-share2010-8, 12 August (Accessed on 28 February 2011) GLOBELICS, The global network for economics of learning, innovation, and competence building systems, http://www.globelics.org/ (Accessed on 28 February 2011) INGINEUS, Impact of Networks, Globalisation, and their INteraction with EU Strategies, http://www.ingineus.eu (Accessed on 28 February 2011) ICCP (2010) International Cluster Competitiveness Project, Institute for Strategy and Competitiveness, Harvard Business School (Accessed on 9 December 2010) List, Friedrich (1841) Das Nationale System der politischen Ökonomie [The national system of political economy], *** 25 Lundvall, B-A. (1985) Product Innovation and User-producer Interaction. Aalborg University Press, Denmark. Lundvall, B-A ed. (1992) National Systems of Innovation: Towards a Theory of Innovation and Interactive Learning, London: Pinter Publishers. Pietro Moncada-Paternò -Castello, Constantin Ciupagea, Keith Smith, Alexander Tü bke, Mike Tubbs (2010) “Does Europe perform too little corporate R&D? A comparison of EU and non-EU corporate R&D performance”, Research Policy, 39, 523-536. OECD (2007) Globalisation and Regional Economies: Can OECD Regions Compete in Global Industries?, OECD, Paris. Perez, Carlota (2002) Technological Revolutions and Financial Capital: The Dynamics of Bubbles and Golden Ages. Cheltenham - Northampton, MA: Edward Elgar Publishing. Porter, M.E. (1980) Competitive Strategy, Free Press, New York. Rouvinen, Petri & Pekka Ylä -Anttila (2003) “Little Finland’s Transformation to a Wireless Giant”, Chapter 5 in S. Dutta, B. Lanvin & F. Paua (eds), The Global Information Technology Report 2003-2004, New York: Oxford University Press 2003, 87-108. Seppälä, Timo (2010) “Transformations of Nokia’s Finnish Supplier Network from 2000 to 2008” in Jyrki Ali-Yrkkö (ed.) Nokia and Finland in a Sea of Change, ETLA: Helsinki, 2010, 37-67. Sölvell, Örjan & Michael Porter (2006) Finland and Nokia: Creating the World’s Most Competitive Economy, Harvard Business School, May. Tiits, Marek (2006) Industrial and trade dynamics in Baltic Sea region – the last two waves of European Union enlargement in historic prospective, Institute of Baltic Studies, Working Paper 1/2006. Tiits, Marek; Rainer Kattel & Tarmo Kalvet (2006) Made in Estonia, Institute of Baltic Studies, Tartu. Tiits, Marek; Kalvet, Tarmo (2010) Estonia - ICT RTD Technological Audit, Detailed Report, European Commission, DG INFSO. Turlea, Geomina et al (2009) The 2009 report on R&D in ICT in the European Union, European Communities, Luxembourg. Vernon, Raymond (1966), “International investment and international trade in the product cycle”. The Quarterly Journal of Economics 80, 2, pp. 190-207. 26 WTO (2009) WTO Statistics database, http://www.wto.org (Accessed on 24 August 2009) 27