Using Credit Cards in B2B Transactions:

What Every Credit Manager Needs to Know

Presented by:

Robert L. Day

Assistant Vice President

Commercial Interchange

The information presented in this seminar is for information purposes only, and is not intended as legal or financial

advice. The information does not amend or alter your obligations under your agreement with Fifth Third Bank, or under

the Operating Regulations of any credit card or debit card association.

Confidential and Proprietary

Fifth Third Bank | All Rights Reserved

Robert Day 1-800-884-0353

Sept 2007

Can you relate?

Your Profit

Confidential and Proprietary © Fifth Third Bank All Rights Reserved Robert Day 1-800-884--0353

2

Agenda

•

•

•

•

•

•

•

•

What is Interchange?

Why is everything downgrading?

What are you really paying ????

Statements: From Best to Worst

Convenience Fees

Risk & PCI

Fraud Protection

Choosing a business partner versus a processor

What is Interchange?

Interchange makes us the largest cost component for merchant

transactions.

— Does not include Dues & Assessments, Access Fees, etc.

Fee collected by Acquirer from the merchant for every Visa and

MasterCard transaction.

The Fee is then passed through Visa and MasterCard to the

issuing bank.

Depending on detail that is passed with the transaction (Level I, II

or III), the transaction may qualify for lower interchange rates.

Confidential and Proprietary © Fifth Third Bank All Rights Reserved Robert Day 1-800-884--0353

4

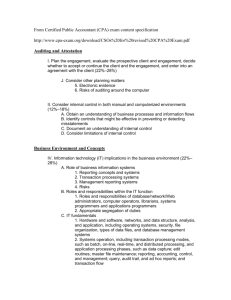

Three key entities manage the payment system

Issuers

Issue cards

Assume buyer’s credit risk

Generate reports

Provide customer service

Networks

Provides systems/operations

Develops products

Provides risk management

Provides advertising

and promotions

Sets standards and rules

Acquirers

Sign up suppliers

Underwrite supplier risk

Provide processing

—Authorization

—Capture

—Settlement

Generate reports

Provider customer service

Confidential and Proprietary © Fifth Third Bank All Rights Reserved Robert Day 1-800-884--0353

5

Breakdown of Cost

$50 Visa Credit Card Transaction

$0.001

$0.0463

$0.005

$0.0150

$0.87

Interchange (1.54% + $0.10)

Base II Fee

$0.0017

Tran Fee

Total Cost = $0.94

Access Fee

Assessment Fee

Risk Fee

Interchange represents 92% of the cost of this transaction.

*Based on Average Ticket currently qualifying for the Visa Credit Retail Rate, 1.54% + 0.10

Confidential and Proprietary © Fifth Third Bank All Rights Reserved Robert Day 1-800-884--0353

6

Interchange Management

Evaluate payment strategies within a framework

that closely considers your unique customer

demographics as well as your overall business

strategies

Minimize the overall impact to your bottom line

by monitoring the interchange qualifications

affecting your transactions

Understand how interchange downgrades and

surcharges increase your effective rates.

Electronic payments continue to grow rapidly and at

the same time the cost per transaction is increasing

due to payment industry evolution

Confidential and Proprietary © Fifth Third Bank All Rights Reserved Robert Day 1-800-884--0353

7

Why is everything

downgrading?

Consumer Cards

Some interchange surcharges are unavoidable

•International, Rewards, World etc..

Most can be avoided.

This should be your focus!!!!

Visa Consumer Card Not Present

Consumer card

transaction where

card/ cardholder

are not present

Electronically

authorized?

Yes

No

Authorized

through Intl.

Automated

Referral

Service?

No

One

authorization Yes

per clearing

message?

Cleared

within two

days?

No

No

Yes

No

Yes

No

AVS

performed?*

Yes

Cleared

within three

days?

No

Shipped within 7 days

and transaction

includes order number

and MOTO/ECI

Indicator?

Yes

Yes

Standard

EIRF

CPS Card Not

Present

• Transactions originating from a Visa Corporate or Purchasing card do not require

AVS. Business Cards do require and AVS attempt for interchange qualification.

• Recurring payment transactions do not require AVS as long as the transaction is

not the first payment and the time between payments is less than a year.

Confidential and Proprietary © Fifth Third Bank All Rights Reserved Robert Day 1-800-884--0353

9

MasterCard Consumer Card Not Present

Consumer

card

transaction

where card/

cardholder

are not

present

Authorize

d?

Cleared within

three days?

Yes

No

No

Yes

MCC in auth

and settle

match?

Yes

Merit I

No

Standard

• For MasterCard MO/TO transactions, the authorization and settlement

amounts MUST match unless the MCC is a Direct Marketing MCC.

• If the transaction is properly identified as E-Commerce, auth and

settlement do not have to match

Confidential and Proprietary © Fifth Third Bank All Rights Reserved Robert Day 1-800-884--0353

10

Why is everything

downgrading?

Commercial Cards

Level II and Level III Processing

Commercial Card Trends

• Commercial payment solutions are emerging as the most efficient way to

manage corporate payments and receivables.

• With the recent increase for MasterCard Data Rate 2, merchants need to

re-evaluate the cost/benefit of transmitting Level III data!

U.S. Segment for Corporate and Purchasing Cards (billions)

$800

$700

$600

$500

Purchasing

$400

$300

$200

Corporate (T&E)

$100

$1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009

Source: Packaged Facts – the US Market for Corporate an Purchasing Cards, January 2005

Confidential and Proprietary © Fifth Third Bank All Rights Reserved Robert Day 1-800-884--0353

12

Authorization/Settlement Time Frames

Visa – CNP & E-Commerce Interchange

1

Transaction Date must be within 7 days of the

Authorization Date

Transaction Date should equal the Shipment Date

Transaction must be settled / cleared to your Processor

within 2 days of the Transaction Date

2

Auth on Day 1

3

4

5

6

7

Ship on Day 7

Tran Date = Day 7

9

8

Settle/Clear transaction

to Processor by Day 9

As Visa has the stricter requirements of the 2 networks, it is

best to follow the Visa requirements as Best Practices.

Confidential and Proprietary © Fifth Third Bank All Rights Reserved Robert Day 1-800-884--0353

13

Authorization/Settlement Variance

Depending on your Industry and MCC Code, the variance

varies from 0-25%

MasterCard MOTO: Tran amount have a 0% Auth/Settlement

tolerance and all transactions not matching will go to

Standard if not set-up with the MCC codes below.

Visa MOTO: Tran amount may be different than the original

auth amount. As long as the auth amount in settlement

matches the original auth amount (and all other requirements

are met), the transaction should qualify for the optimal rate.

MOTO (Mail Order Telephone Order) MMC Codes

4816,5960,5962,5964,5965,5966,5967,5968,5969,6531

Confidential and Proprietary © Fifth Third Bank All Rights Reserved Robert Day 1-800-884--0353

14

MasterCard Commercial Card

Level I

Must include merchant zip code, location, description, Tax ID

Level II

Must include merchant zip code, location, description, Tax ID

AND

Level III

Must include Sales Tax and Customer Code

Sales tax must be between 0.1% and 22%

Customer Code must be sent if provided by customer

Effective April 2008: Tax Exempt transactions must be properly

identified as such or they cannot qualify for Data Rate 2 (Level II)

Must include Level I and Level II data

AND

Line Item Detail

Unlike Visa, MasterCard’s Business, Corporate and Purchasing

Cards are eligible for the Level III rate - Data Rate III

Large Ticket Requirements: Transactions > $7,272, Level II and

Level III, no registration required.

The greater the amount of data provided…

the better the interchange rate.

Confidential and Proprietary © Fifth Third Bank All Rights Reserved Robert Day 1-800-884--0353

15

This is not a complete

description of all

required data elements,

but a high level

overview

NOTE:

Dial Terminal and

Host Capture

applications cannot

support Level III

data transmission.

MC Commercial Card Changes

U.S. COMMERCIAL CARDS

BUSINESS CARD

Commercial Standard

Commercial Data Rate 2

Commercial Face-To-Face

Current

2.70%

2.05%

+ $

+ $

0.10

-

2.95% + $

2.32% + $

2.05%

+ $

-

2.32% + $

CORPORATE CARD, CORPORATE WORLD, and CORPORATE WORLD ELITE

Commercial Standard

2.70% + $

0.10

Commercial Data Rate 2

2.05% + $

Commercial Face-To-Face

October 2007

2.05%

+ $

-

2.95% + $

2.05% + $

2.05% + $

0.10

0.10

0.10

0.10

0.10

0.10

-

-

2.20%+ $0.10

-

PURCHASING CARD

Commercial Standard

Commercial Data Rate 2

2.70%

2.05%

+ $

+ $

0.10

-

2.95% + $

2.33% + $

2.05%

+ $

-

2.33% + $

BUSINESS WORLD and BUSINESS WORLD ELITE

Commercial Standard

2.85%

Commercial Data Rate 1

2.80%

Commercial Data Rate 2

2.20%

+ $

+ $

+ $

0.10

0.10

-

+ $

+ $

-

Commercial Face-To-Face

Commercial Data Rate 3

Commercial Face-To-Face

1.90%

2.20%

2.95%

2.65%

2.32%

2.20%

1.75%

2.32%

+

+

+

+

+

+

$

$

$

$

$

$

0.10

0.10

0.10

0.10

0.10

0.10

0.10

-

Confidential and Proprietary © Fifth Third Bank All Rights Reserved Robert Day 1-800-884--0353

16

2.70%+ $0.10

2.20%+ $0.10

2.20%+ $0.10

2.10%+ $0.10

2.00%+ $0.10

Visa Commercial Card

Level II

Level III

Additional

Info

Must include merchant zip code, location, description, Tax ID, and

Sales Tax.

Sales Tax amount must be between 0.1% and 22% of the amount of

the transaction.

Customer Code is no longer required for Level II on Purchasing

Cards at non-fuel locations. Customer Code is required for

Purchasing Cards at fuel locations

Available to Purchasing Cards ONLY

Must include merchant zip code, location, description, Tax ID, and

Message Identifier/Line Item Detail

NOTE: Level II Data (specifically Sales Tax and Customer Code) is no

longer required for Level III on Purchasing Cards at non-fuel

locations

Tax Exempt transactions can no longer qualify for Level II rates.

They may get Level III on P-Cards if Level III data is provided

GSA and Large Ticket requirements have NOT changed (Sales Tax,

Customer Code and Line Item Detail still required)

Large Ticket Requirements: Level II and Level III data required,

registration required, $1,000 set-up fee, transactions > $4,105

Confidential and Proprietary © Fifth Third Bank All Rights Reserved Robert Day 1-800-884--0353

17

This is not a

complete

description of all

required data

elements, but a

high level

overview

NOTE:

Dial Terminal and

Host Capture

applications

cannot support

Level III data

transmission.

Visa Commercial Card Changes

April 2007 (Non-T&E Merchants)

• Visa Business, Corporate, and Purchasing transactions that are CPS

qualified, however do not meet Level 2 data requirements, will no longer

receive the Commercial Electronic rates.

• These transactions will be eligible for the new Commercial Card CNP,

Commercial Card Retail, or Commercial Card B2B rates.

• Fleet Purchasing card fuel transactions will now be eligible for the new

Purchasing Retail rate under certain conditions.

• These changes to the Commercial card interchange fee structure

should benefit a number of tax-exempt merchants currently receiving

the Commercial Electronic rates.

Fee

Program

Standard

Electronic

CNP

Retail

B2B

Level 2

Level 3

.25

Purchasing

Current

New

2.70% + $0.10 2.70%+ $0.10

2.20% + $0.10 2.45%+ $0.10

2.40%+ $0.10

N/A

2.20%+ $0.10

N/A

2.10%+ $0.10

N/A

2.00% + $0.10 2.00%+ $0.10

1.70% + $0.10 1.80% + $0.10

.10

.20

Business

Current

New

2.70%+ $0.10 2.70%+ $0.10

2.20%+ $0.10 2.40%+ $0.10

2.25%+ $0.10

N/A

2.20%+ $0.10

N/A

2.10%+ $0.10

N/A

2.00% + $0.10 2.00%+ $0.10

N/A

N/A

NOTE – Increases in Electronic, Level II and Level III

Confidential and Proprietary © Fifth Third Bank All Rights Reserved Robert Day 1-800-884--0353

18

.10

Corporate

Current

New

2.70%+ $0.10 2.70%+ $0.10

2.20%+ $0.10 2.20%+ $0.10

2.20%+ $0.10

N/A

2.20%+ $0.10

N/A

2.10%+ $0.10

N/A

1.90% + $0.10 2.00%+ $0.10

N/A

N/A

Sample Transaction Costs:

Interchange Expense

Visa Purchasing Card: $500 transaction

Purchasing B2B Rate (Level I):

$10.60

Purchasing Level II Rate:

$10.10

Purchasing Level III Rate:

$ 9.10

14% reduction in cost by processing Level III versus Level I data

MasterCard Purchasing Card: $500 transaction

Purchasing Data Rate I (Level I):

$13.35

Purchasing Data Rate II (Level II):

$11.75

Purchasing Data Rate III (Level III):

$ 8.75

34% reduction in cost by processing Level III versus Level I data

Confidential and Proprietary © Fifth Third Bank All Rights Reserved Robert Day 1-800-884--0353

19

Level III Incentive Interchange Rates

•

•

•

Case Study

Visa Commercial Card

• $10,000,000 sales

• 100,000 transactions

• $100 average ticket

MasterCard Commercial Card

• $7,500,000 sales

• 75,000 transactions

• $100 average ticket

Visa Commercial Cards

Corporate/Business Level II – 2.00% + $.10

Purchasing Level III – 1.80% + $.10

MasterCard Commercial Cards

Corporate/Business Data Rate III – 1.75%

Purchasing Data Rate III – 1.75%

Visa: 15% Purchasing, 16% Corporate, 69% Business

MasterCard: 11% Purchasing, 89% Corporate/Business

Merchant does Level I, but not Level II or III

Visa Fees

MC Purchasing

$22,688

(Data Rate I: 2.65% + $.10)

Visa Purchasing

$34,500

(Purchasing Retail: 2.20% + $.10)

Visa Corporate

$36,800

(Corporate Retail: 2.20% + $.10)

V/MC Business

$158,700

$183,563

TOTAL

$230,000

$206,250

Current Effective Interchange

2.30%

2.75%

*Optimal Effective Interchange

2.07%

1.75%

Interchange Improvement %

0.23%

1.00%

(Business Retail/Data Rate I)

(Visa: 2.20% + $.10, MC: 2.65% + $.10)

Interchange Savings = $98,000

Confidential and Proprietary © Fifth Third Bank All Rights Reserved Robert Day 1-800-884--0353

20

MC Fees

Why Upgrade to Level III Support?

• Retain current customers requiring Level III detail

– Fortune 500 companies

– Government

– Universities

• Gain new customers with competitive edge

• Realize interchange savings opportunity

– For MasterCard, Data Rate III (Level III) interchange is 58 basis

points lower than Data Rate II (Level II) interchange and up to 90

basis points lower than Data Rate I (Level I) interchange!

• Significant interchange savings opportunity available on Large

Ticket commercial card transactions greater than $4,105 (Visa) &

$7,272 (MasterCard)

Confidential and Proprietary © Fifth Third Bank All Rights Reserved Robert Day 1-800-884--0353

21

Purchasing Card Usage:

Buyer Benefits

Streamlines the Purchasing Power

Eliminates Paperwork

Increases Employee Productivity

Reduces Costs

Provides Automated Controls

Offers Customized Reporting

Confidential and Proprietary © Fifth Third Bank All Rights Reserved Robert Day 1-800-884--0353

22

Card Acceptance:

Supplier Benefits

Increased Sales Volume

Increased Productivity

Improved Cash Flow

New Sales Channel

Less Paperwork to Process

Enhanced Competitive

Position

Fewer Credit Approvals

and Collection Activities

Customer Acquisition

and Retention

Reduced Costs

Improved Customer

Service

Confidential and Proprietary © Fifth Third Bank All Rights Reserved Robert Day 1-800-884--0353

23

Common myths to dispel...

There are misperceptions and misunderstandings about Level III

enhanced line item detail information for Commercial Cards...

Level-3 is hard for a supplier to implement

It’s expensive - the supplier will have to pay more to the banks

and will just pass the cost along to buyer

Level-3 requires significant volumes to be worthwhile

The supplier has to write an interface directly to the processing

bank OR, the related...

The supplier has to purchase expensive software in order to

provide Level-3 data

The supplier only has limited need for this...

Historically, there was some truth to these generalizations.

For the last several years they have not been accurate and yet their

persistence holds back many organizations from participating with

enhanced data.

Confidential and Proprietary © Fifth Third Bank All Rights Reserved Robert Day 1-800-884--0353

24

Credit Card Fees:

What are you really paying

????????????

Effective Rate Calculations

Per Item Effective Rate:

•

To convert a Per Item Fee into a %…

1) Take the total Per Item Fee and divide it by the Average Ticket

2) Multiply the result by 100

•

This will assist in determining the effective rate for a transaction or converting

from a “rate + transaction fee” model to a model “rate only”

Example 2:

Example 1:

Discount Rate:

1.95% + $0.25

Average Ticket:

$75

Effective Rate:

$0.25/$75 X 100 = .33%

1.95% + .33% = 2.28%

Effective Rate 2.28%

Discount Rate: 1.95% + $0.25

Auth Fee:

$0.20

Average Ticket: $75

Effective Rate:

$0.45/$75 X 100 = .60%

1.95% + .60% = 2.55%

Effective Rate 2.70%

Confidential and Proprietary © Fifth Third Bank All Rights Reserved Robert Day 1-800-884--0353

26

What is Padding?

•

Some processors do not charge interchange fees as “pass through”, meaning

that in addition to paying the surcharge on a downgraded transaction, they

mark-up or “pad” the surcharge

•

Be on the look out for “hidden” or “padded” fees on your processing statement

Processor A

Swiped Transaction

EIRF Transaction

Total

Processor A

Swiped Transaction

Keyed Transaction

Total

1.75%

.76%

2.51%

1.75%

.31%

2.06%

Processor B (re-seller/ ISO)

Swiped Transaction

1.55%

EIRF Transaction

1.20%

Total

2.75%

.44% Pad

Processor B (re-seller/ ISO)

Swiped Transaction

1.55%

Keyed Transaction

.61%

Total

2.16%

.30% Pad

Confidential and Proprietary © Fifth Third Bank All Rights Reserved Robert Day 1-800-884--0353

27

Statements

From Best to Worst

Sometimes things are not as they appear

Best

This one requires a little work. It does not show the downgrade rate, only the base rate; however, it

gives all the information needed to calculate your rate as well as manage your Interchange. While it is

not misleading, it could be improved by giving the downgrade rates as long as partial rates are not

located in several places. This one is an overall favorite for the novice (98% fall into the novice

category). We call this one a “Factual Statement” while it could give more facts, it does give all the

necessary information without becoming the dangerous “Lawyer’s Statement”.

Confidential and Proprietary © Fifth Third Bank All Rights Reserved Robert Day 1-800-884--0353

29

Best

The transaction volume is $10.00 the adjustment amount .11 is the surcharge from MC and passed on

to the merchant. To calculate your percentage, divide the fee by the transaction volume 0.11 divided by

10.00 This shows the merchant the percentage they are paying for the Data Rate I downgrade .11%

Confidential and Proprietary © Fifth Third Bank All Rights Reserved Robert Day 1-800-884--0353

30

Good

Like the best statement it shows the number and volume of transactions which is crucial in managing

your cost as well as your Interchange. What’s very dangerous is, at first glance, it looks like the merchant

is only paying 1.95% + a ten cent transaction fee. After further review; the merchant is also paying a

sales discount of .002200 as well as a Dues and Assessment fee of .000950 (on second page of

statement not shown). Not counting the transaction fee can be a crucial oversight. The effective rate of

2.27% versus 1.95% is very misleading. This one is nicknamed the “Lawyer’s Statement” because they

data dump to the point you can’t find the truth buried in the pile of evidence. This one is a favorite for

those highly skilled in Interchange

Confidential and Proprietary © Fifth Third Bank All Rights Reserved Robert Day 1-800-884--0353

31

Bad

This one is nicknamed the “Political Statement”. It says a lot while saying nothing. It shows a ton of data

while leaving out one key element - the downgrade transaction volume. With this missing you have no

way to calculate your rate. Yes, it shows the base (contract) rate which is usually a lowball rate. Seeing

how it is the only rate disclosed they typically give you a very low rate while making up their losses (and

a whole lot more) in the non-disclosed rates on the downgrades (which usually make up the bulk of the

merchants transactions).

Transaction Volume

Confidential and Proprietary © Fifth Third Bank All Rights Reserved Robert Day 1-800-884--0353

32

Worst

This statement shows your rate but does not show the Interchange category (QUAL, MID-QUAL and

NON-QUAL are not Interchange categories). In other words, you know how much you’re paying; you just

don’t know for what.This is especially dangerous because you have no knowledge of how your

transactions are qualifying (keeping in mind that Interchange makes up 92% of your cost). You can not

improve when you don’t know what’s wrong. We call this the “No Comment Statement” because it tells

you nothing.

Confidential and Proprietary © Fifth Third Bank All Rights Reserved Robert Day 1-800-884--0353

33

Commercial Card Compliance

Merchants and processors have historically “enhanced”

some of the commercial card data obtain better rates

The networks have the ability to edit on certain fields

such as Customer Code, Sales Tax Indicator, Sales Tax

Amount and Line Item Data

The Networks have begun active compliance efforts to

ensure the integrity and validity of the data

Merchants must insure that data submitted is

valid and accurate.

Confidential and Proprietary © Fifth Third Bank All Rights Reserved Robert Day 1-800-884--0353

34

Manage You Cost of Acceptance!

Watch for hidden or padded fees in your

processing proposals.

Many processors will surcharge or “pad” downgraded

transactions and charge you higher fees!

Ensure you take advantage of the best

interchange

rates

by processing Level III data.

Many processors

do not have Level III solutions!

Keep

an eye onyour

your rates

and fees and

ensure your locations

Review

merchant

statements!

are properly configured on your processor’s system!

Confidential and Proprietary © Fifth Third Bank All Rights Reserved Robert Day 1-800-884--0353

35

Convenience Fees

Rules of Engagement

Convenience Fee Definition

Charged for a bona fide convenience in the form of an alternative

payment channel outside the merchant’s customary payment

channels.

—

Disclosed to the cardholder as a charge for the alternative payment

channel convenience.

—

Example: A face-to-face merchant allows customers the convenience of

paying by phone or Internet.

The fee must not be disclosed as a processing fee or fee to cover

merchant costs associated with card acceptance.

Added only to a non face-to-face transaction.

—

Merchants who only operate exclusively in a MO/TO or Internet

environment may not assess a convenience fee, as there is not an

added convenience to pay through the current payment channel.

General Visa rules as they

tend to be the strictest

Confidential and Proprietary © Fifth Third Bank All Rights Reserved Robert Day 1-800-884--0353

37

Convenience Fee Definition (cont.)

Added as a flat or fixed amount, regardless of the value of the

payment due.

—

—

There are certain exceptions to this rule for specific pilots in specific

industries (e.g. tax, government, schools)

Applicable to all forms of payment accepted in the alternative payment

channel.

—

The fee may not be assessed as a percentage of the transaction amount.

The fee may not be assessed only to customers paying by debit or credit

card through the alternative payment channel, but rather to any kind of

payment accepted through that channel.

Disclosed prior to the completion of the transaction and the cardholder

is given the opportunity to cancel.

Included as part of the total transaction amount, with the exception of

certain industries like utilities and tax pilot

General Visa rules as they

tend to be the strictest

Confidential and Proprietary © Fifth Third Bank All Rights Reserved Robert Day 1-800-884--0353

38

Convenience Fee Usage

Regulated Industries

—

—

Convenience Fee often broken out separately

Un-Regulated Industries

—

—

Typically Utilities, not allowed to pass the cost of Interchange

through normal costing methodologies

Typically government, education, or other businesses who

offer a non-traditional payment channel

Typical alternative channels include IVR, Website, etc.

Taxing Authorities

—

The networks have created special “pilot” programs for tax

payments that allow percentage based convenience fees

Confidential and Proprietary © Fifth Third Bank All Rights Reserved Robert Day 1-800-884--0353

39

Risk and PCI

Payment Card Industry Standards…

What Is It?

Types of Risk

Systemic Risk

— Primarily Risk associated with large scale data breaches

— Increasingly sensitive due to PR impact and potential for civil litigation

— Often associated with organized crime and sophisticated IT “break ins”

— PCI ( Payment Card Industry Data Security Standards) meant to address

major challenges

Operational Risk

—

Normal fraud risk associated with individual transactions

—

Can often be prevented by operational best practices

Confidential and Proprietary © Fifth Third Bank All Rights Reserved Robert Day 1-800-884--0353

41

PCI – Merchant Levels

Merchant Level 1

— Any merchant processing 6,000,000 Visa or MasterCard transactions

per year, or identified by another card brand as Level 1, or

compromised in the last year

Merchant Level 2

—

Merchant Level 3

—

Any merchant processing 1 million to 6 million Visa or MC transactions

per year

Any merchant processing 20,000 to 1 million Visa or MC E-Commerce

transactions per year

Merchant Level 4

—

Any merchant processing less than 20,000 Visa or MC E-Commerce

transactions per year, and all other merchants processing up to 1

million Visa transactions per year.

Confidential and Proprietary © Fifth Third Bank All Rights Reserved Robert Day 1-800-884--0353

42

PCI Compliance

Merchant Compliance Validation

Level

1

Validation Actions

Annual On-Site

Security Audit

Scope

Authorization

and Settlement

Systems

Internet facing

perimeter

systems

And

2 and 3

Quarterly Network

Scans

Annual SelfAssessment

Questionnaire

And

4

Quarterly Network

Scan

Annual Self –

Assessment

Questionnaire

Recommended

Network Scan

Recommended

Any systems

storing,

processing, or

transmitting

cardholder data

Internet-facing

perimeter

systems

Any systems

storing,

processing, or

transmitting

cardholder data

Validated By

Independent

Assessor or

internal auditor if

signed by officer of

company

Qualified

Independent Scan

Vendor

Merchant

Qualified

Independent Scan

Vendor

Merchant

Qualified

Independent Scan

Vendor

Internet facing

perimeter

systems

Confidential and Proprietary © Fifth Third Bank All Rights Reserved Robert Day 1-800-884--0353

43

Key PCI Considerations

Do not store magnetic-stripe data after transaction authorization

— Merchants must not retain full-track magnetic-stripe data on any of their

systems once a transaction has been authorized.

— Per PCI DSS requirements, merchants can retain only cardholder names,

account numbers, and expiration dates.

Do not store PIN blocks after transaction authorization

— Merchants should examine all transaction journals and logs to verify that

their payment systems do not retain PIN block data – even if it is encrypted –

after transaction authorization.

Avoid CVV2 Storage

— When requesting cardholder CVV2 online or in mail order/telephone orders,

merchants should not document this information on paper or store it in their

databases after transaction authorization.

Confidential and Proprietary © Fifth Third Bank All Rights Reserved Robert Day 1-800-884--0353

44

Key PCI Considerations

(cont.)

Guard against SQL injection attacks caused by insecure shopping carts

(primarily an E-Commerce phenomenon)

— Test SQL vulnerability using automated tools or manual techniques

— Ensure that all payment applications were developed using secure coding

practices that included independent code reviews

— Validate that all merchant payment software includes all applicable up-todate security patches

Protect against remote access vulnerabilities

— Implement a policy prohibiting group-shared passwords

— Determine from your software vendor how to securely configure your

payment application.

Never use vendor-supplied defaults

— Visa encourages merchants to change vendor-supplied defaults – remove or

disable features, set specific parameters, etc. – before installing payment

application systems in your networks.

Confidential and Proprietary © Fifth Third Bank All Rights Reserved Robert Day 1-800-884--0353

45

Fraud

Best Practices for Merchant

Protection

(Card Present)

Quick Steps to Card Acceptance

1. Check the card security features.

•

•

Hologram, matching 4 digits under embossed 4 digits, CVV2 value, etc.

Make sure that the card has not been altered.

2. Swipe the stripe.

•

Swipe the card through the terminal in one direction only to obtain authorization.

3. Check the authorization response.

•

Take appropriate action for the specific response:

Approved

Ask the customer to sign the sales receipt

Declined

Return the card to customer and ask for another Visa card

Call or Call

Center

Call your voice authorization center and tell the operator that you have a “Call”

or “Call Center” response. Follow the operator instructions.

Note: In most cases, a “Call” or “Call Center” message just means the card

Issuer needs some additional information before the transaction can be

approved.

Pick Up

Keep the card if you can do so peacefully

No Match

Swipe the card and re-key the last four digits. If “no match” response appears again,

keep the card if you can do so peacefully. Request a Code 10 authorization.

Confidential and Proprietary © Fifth Third Bank All Rights Reserved Robert Day 1-800-884--0353

47

Quick Steps to Card Acceptance

(cont.)

4. Match the numbers.

–

Check the embossed number on the card against the four digits of the

account number displayed on the terminal.

5. Request a signature.

–

Have the cardholder sign the transaction receipt.

6. Check the signature.

–

Be sure that the signature on the card matches the one on the

transaction receipt.

If you suspect fraud, immediately make a Code 10

call to your voice authorization center.

Confidential and Proprietary © Fifth Third Bank All Rights Reserved Robert Day 1-800-884--0353

48

Fraud

Best Practices for Merchant

Protection

(Card Not-Present)

CNP Payment Acceptance

Take these steps to accept Card Not Present payments:

— Obtain an authorization

— Verify the card’s legitimacy:

– Ask the customer for the card expiration date, and include it in you

authorization request. An invalid or missing expiration date might indicate

that the customer does not have the actual card in hand.

– Use fraud prevention tools such as Address Verification Services (AVS),

Card Verification Value 2 (CW2)

— Look for general warning signs of fraud

— If you receive an authorization, but still suspect fraud:

– Ask for additional information during the transaction (e.g., request the

financial institution name on the front of the card)

– Contact the cardholder with any questions

– Confirm the order separately by sending a note via the customer’s billing

address rather than the “ship to” address.

Confidential and Proprietary © Fifth Third Bank All Rights Reserved Robert Day 1-800-884--0353

50

12 Potential Signs of CNP Fraud

Keep your eyes open for the following indicators!

When more than one is true during a card-not-present transaction,

fraud might be involved.

1. First-time shopper: Criminals are always looking for new victims.

2. Larger-than-normal orders: Because stolen cards or account numbers

have a limited life span, crooks need to maximize the size of their purchase.

3. Orders that include several of the same item: Having multiples of the

same item increases a criminal’s profit

4. Orders made up a “big-ticket” items: These items have maximum resale

value and therefore maximum profit potential.

5. “Rush” or “overnight” shipping: Crooks want these fraudulently obtained

items as soon as possible for the quickest possible resale, and aren’t concerned

about extra delivery charges.

6. Shipping to an international address: A significant number of fraudulent

transactions are shipped to fraudulent cardholders outside of the U.S. Visa AVS

can’t validate non-U.S., except in Canada and the United Kingdom.

Confidential and Proprietary © Fifth Third Bank All Rights Reserved Robert Day 1-800-884--0353

51

12 Potential Signs of CNP Fraud (cont.)

7. Transactions with similar account numbers: Particularly useful in the

account numbers used have been generated using software available on the

internet (e.g., CreditMaster)

8. Shipping to a single address, but transactions placed on multiple

cards: Could involve an account number generated using special software, or

even a batch of stolen cards.

9. Multiple transactions on one card over a very short period of time:

Could be an attempt to “run a card” until the account is closed.

10. Multiple transactions on one card or a similar card with a single

billing address, but multiple shipping addresses: Could represent

organized activity, rather than one individual at work.

11. In online transactions, multiple cards used from a single IP (Internet

Protocol) address: More than one or two cards could definitely indicate a fraud

scheme.

12. Orders from Internet addresses that make use of free e-mail

services: These e-mail services involve no billing relationships, and often neither

an audit trail nor verification that a legitimate cardholder has opened the account.

Confidential and Proprietary © Fifth Third Bank All Rights Reserved Robert Day 1-800-884--0353

52

Handling Key-Entered Transactions

If a card cannot be swiped, you must key-enter the card account data into

your POS terminal…

When you key-enter a transaction, you run the risk of accepting a

counterfeit card because the magnetic stripe information is unavailable.

1. Check the terminal. Be sure your terminal is working properly. If the terminal is

okay and the problem appears to be with the magnetic stripe, continue to step 2.

2. Match the account number. Check to see that the embossed account number

on the front of the card matches the number indent-printed on the back.

3. Check the expiration date. Look at the “good thru” or “valid thru” date to be

sure the card hasn’t expired. If the card has a “valid from” date, be sure the card

isn’t being used before it is valid.

4. Make an imprint. Get a manual imprint of the card.

5. Get a signature. Ask the customer to sign the imprinted sales draft.

6. Check the signature. Be sure that the signature on the card matches the one on

the sales draft. Do not accept an unsigned card.

You can also do a Zip Code check

for additional protection.

For Visa, if the Zip Code matches,

it will also allow you to qualify for a

Confidential and Proprietary © Fifth Third Bank All Rights Reserved Robert Day 1-800-884--0353

lower interchange rate.

53

Choosing a Business Partner

Versus a Processor

Find a partner that will help you manage the evolving payment

landscape and “navigate the networks” for you!

Has expertise in the Business to Business market segment

Promotes Proactive Interchange Program

Shares Industry Best Practices

Supports Level II and Level III Data Transmission

?

The Evolution of Credit Cards in B2B Transactions Presented by:

Robert L. Day, AVP Commercial Interchange

1-800-884-0353