Financial Risk Management

advertisement

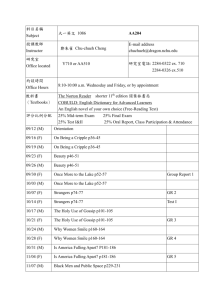

Azerbaijan University School of Business Fi 4400 Financial Risk Management Spring, 2012 NOTE: It is your responsibility to read, understand and abide by all of the course information and policies listed below. This course syllabus provides a general plan for the course; deviations may be necessary. Instructor: Orkhan Ismayilov E-mail: orxan.027@gmail.com, orkhan_ismayilov@cbar.az Cell Phone: (055) 3700027 Class Hour: see the course schedule Office hour: by appointment 1. Course Description This course provides a clear and concise overview of specific ratios that are used to measure financial performance. Performance areas covered include liquidity, asset management, profitability, leverage, market value ratios, and comparative analysis. The objective of the course is to provide the user with ratios that can be useful in measuring and monitoring financial performance in conjunction with a set of financial statements. In addition, course will focus on bank loan capital; however, other sources of capital will also be discussed, especially with regards to determining a firm’s appropriate financial structure 2. Prerequisites You will need the knowledge of elementary calculus and statistics. 3. Office Hours I do not have a specific office hour, but I can make an appointment or I can answer any questions after the lectures or just send me an email. I also encourage you to share with me any comments you might have on the course. 4. Policies on Class Attendance and Class Discipline Please arrive on time to the class Turn-off or switch to silence regime cell phones or any other electronic devices (except calculators) Students must ask the teacher the questions that worries them, not the students during the lectures Students are expected to attend all lectures and do all take-home assignments and case study. If the student misses any lecture, she/he is still responsible for catching up on the material covered in the absence of that student before coming to the next lecture. Therefore, it is responsibility of the student to arrange with student colleagues to obtain notes if he or she misses a class or classes. Each student is expected to attend ALL scheduled class meetings for the entire duration of the class meeting. An attendance sign-up sheet will be circulated each class period. It is your responsibility to sign the attendance sheet. If you do not sign the list, you will be considered absent. Students arriving late may be permitted to sign the sheet only at the discretion of the instructor. Attendance will be graded to ensure the discipline in the class. 5. Academic Honesty Plagiarism in any form is not acceptable. While discussion with classmates regarding assignments and lecture topics is encouraged, all work submitted must be your own. Any student found copying during exams or quizzes, signing someone else's name to the attendance list, using stored formulas in programmable calculators, using non-authorized formula sheets or other notes during exams will get a failing grade for that exam. 6. Grading The course requirements are the Final exam, Mid-Term Exam and five graded Take-home assignments. Weights on the various components of the final grade are as follows Final Exam 40% Mid-Term Exam 20% Group research presentation 20% Attendance and Participation 20% All course grades, once assigned, are final and cannot be changed except in the rare event of a mathematical miscalculation by the instructor. Attendance and participation during the discussions are highly encouraged. Do not miss mid-term and final. Requests for make-ups may be granted only under exceptional cases. 7. Final grades will base on this scoring: Scores A+ = 97 – 100 AKTS scores A = 93 – 96 A- = 90 – 92 B+ = 87 – 89 B = 83 – 86 B- = 80 – 82 C+ = 77 – 79 C = C- = 70 – 72 D+ = 67 – 69 D = 63 – 66 D- = 60 – 62 F = 0 – 59 73 – 76 A = 90 – 100 B = 80 – 89 C = 70 – 79 D = 60 - 69 E = 50 – 59 Fx = 40 – 49 F = 0 – 39 8. Exams There will be a final exam. This exam will be closed-book. Calculators are permitted, except those with word-processing capabilities. The final exam is cumulative and will be given on the day listed in the course outline. You must attend the final exam on the scheduled date. 9. Group research presentation Additionally, you will write a group research paper. This paper will be written by multiple students with each part reviewed and edited prior to submission by everyone in the group. Specific instructions and information about the paper will be posted on WebCT and discussed in depth during the second week of class. 10. Course Materials Required Text Financial Reporting and Analysis, CFA Institute 2009, 2008, 2007 Recommended Text . Financial and Managerial Accounting, Williams, Haka, Bettner 14th edition (2008) McGraw-Hill Lecture Slides and Handouts These resources are the main part of your study package. You can get lecture slides and handouts from the course webpage. You are responsible from the topics covered in the lectures. Week 1 – Lecture 1-2 Review of Financial Markets Financial Markets Different tradable financial products Financial Agents Week 2 – Lecture 3-4 Risk Management in Banking sector Week 3 – Lecture 5-6 Fundamentals of Probability Week 4 – Lecture 7-8 Risk factors existing in banking operations Introduction to Credit, Liquidity and Operational risk Characterizing random variables Multivariate distribution functions Functions of Random variables Probability distributions Fundamentals of Statistics Parameter estimation Regression analysis Quiz 1 Week 5-6 – Lecture 9- Risk Management 12 Week 7 – Lecture 13-14 Absolute and relative risk Evaluation of the risk measurement process Portfolio construction Asset pricing theories Arbitrage pricing theory Risk of a portfolio Different statistical and risk management exercises Week 8 – Lecture 15-16 Mid-term exam Week 9-10 – Lecture Bond Fundamentals 17-20 Discounting, present and future value Linear transformation of random variables and their application to bond pricing theory Price-yield relationship from risk measurement tools for these relationship Bond price derivatives Duration and convexity Week 11-12 – Lecture Valuation and risk models 21-24 Risk management tools VaR models Stress-testing Week 13 – Lecture 25- Managing linear risk 26 Week 14 – Lecture 27- Unitary Hedging Optimal hedging Application of optimal hedging Review for Final Exam 28 Week 15 – Lecture 2930 Final Exam