Strategic Audit Lowes Inc Rev 2

advertisement

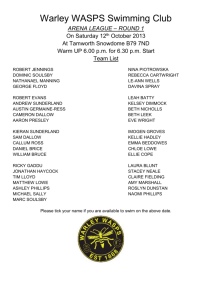

Strategic Audit Lowes Home Improvement Inc. Case Number 33 Group #1 Steve Shapiro, Michael Egan, Ketrone Wallace, Chris Stubbs, Dylan Young November 10 2010 th I. Current Situation A. Current Performance Good financials exceeded $10 Billion in sales for the first time in history, price/earnings ratio positive. Company aggressively grew with from 15 stores in 1962 to over 1000 by 2004. In 1989 the company redefined its business and positioned itself as a “big box” home improvement retailer. Company made conscience decision in 2004 to gain market share domestically across the United States versus introducing itself internationally. Has become the second largest U.S. home improvement retailer with approximately 9% of the market share. From 1999 have increased their actual store locations approximately by 100 each year through the year 2004. B. Strategic Posture Mission Stores incorporated in 1952 and operated 15 stores selling commodity-type products to home builders by 1962. In 1989, redefined its business and positioned itself as a “big box” home-improvement retailer, selling a wide variety of higher margin merchandise. The Company serves homeowners, renters and commercial business customers. Homeowners and renters primarily consist of do-it-yourself (DIY) customers and do-it-for-me (DIFM) customers who utilize its installed sales programs, as well as others buying for personal and family use. Commercial business customers include those who work in the construction, repair/remodel, commercial and residential property management, or business maintenance professions. Objectives "Lowe's has been helping our customers improve the places they call home for more than 60 years”. Driven to be one of the most successful companies in the world. H “We will provide customer-valued solutions with the best prices, products and service to make Lowe’s the first choice for home improvement." In order to make their vision a reality, Lowe's focuses its employees on these values, Customer Focused, Teamwork, Ownership, Passion for Execution, Respect, and Integrity Strategies Multi-domestic growth through targeted geographic locations, increased leverages with vendors and focus on promoting “doit-yourself home improvement. Stores diversified by appealing to more women shoppers with the merchandise that is offered. These products consisted of interior home decorating items, including lamps, window treatments, and designer towels which were non-existent in their competitors stores. Differentiate themselves by offering higher margin merchandise. Policies Diversity of thought is fundamentally supported throughout the company. Building from this corporate-wide platform of inclusion, and going beyond mere words to put the beliefs into action. Aggressively seeks programs that involve the community. II. Strategic Managers A. Board of Directors Mix of Management Directors and Independent Directors Management Directors- both present and former employees of Lowe’s Independent Directors- (majority) does not have a material relationship with Lowe’s Size of Board is no less than 3 members (usually 9-12) The Governance Committee of the Board recommends individuals for nomination to the Board Must possess: High professional ethics Policy-making experience in business, government, education, or technology Willingness to allocate time required to carry out duties Must commit to several years for knowledge development Represent best interests of shareholders Board retirement age of 72 Should retirement age be flexible if a member possesses irreplaceable knowledge? Is the ratio of Management and Independent Directors sufficient? B. Top Management Chairman & CEO- preferred to have vast experience in business financial and executive responsibilities President & COO- responsible for store operations, merchandising, marketing, logistics, and store support Executive Vice Presidents- multiple positions specializing in finance, business development, operations, merchandising, and logistics III. External Environment (EFAS Table; see Exhibit 1) A. Natural Environment. Availability of land for development. Fees and regulations for the development of land. B. Societal Environment Economic Current Housing market is soaring, through which new homeowners and existing owners are performing upgrades and renovations. (O) Store size will be an important factor in determining what markets to enter and which store size to choose. (T) Technological Advances in the effectiveness and affordability of “Green” building products will drive for wider product selection. (T and O) Advances in manufactured product offerings will dictate the inventory needs for the coming years. (T) Political- Legal National minimum wage increases increasing the costs associated with operating expenses. (T) Pending legislation regarding the reduction of emissions and reducing the carbon footprint. (T) 1st Time Home-buyer programs making it more affordable for citizens to purchase their first home. (O) Sociocultural With the increase of televised and advertised product placement, the need to maintain a high quality of life and have designer products in rapidly increasing. (O) The current split household rate, due to divorce and career mobility, causes the need for increased products per family. (O) Dual-career couples with limited time resources, causes the need for more energy and time efficient household products and materials. (O) C. Task Environment High amount of new homes being built will lead to the increased need to improve more homes. (O) Increased market competition, while relatively small in the “Big Name” department, is an issue that must always be evaluated. (T) Merging with partners that are established in areas of proposed expansion. (O) Opening new stores in heavily populated metropolitan areas increases visibility and potential profitability. (O) 1st Time Home-buyer program increasing the amount of homes manufactured and improved. (O) Maintaining a variety in vendor products allows Lowe’s survivability if one or more vendors were to go under. (O) Housing forecast for the next 10 years. (T) Increasing government regulation on “Green” building supplies and the need to reduce carbon emissions. (T) Brand Identification. Ensuring that the Company name is associated with excellence and quality. (O) IV. Internal Environment A. Corporate Structure In the service sector of the home improvement industry Capitalize on the nationwide growth of the housing market and the “do it yourself’ in the metropolitan populations Projected an annual growth rate of 16% to 17% a year over the next three years B. Corporate Culture A equal balance between employees and shareholders Very involved with communities, public education Promotes social responsibilities within company C. Corporate Resources A. Marketing Developed an installed sales programs in the “buy-it-yourself” (BIY, or “do-it-for-me”) market that was successful. Lowe’s targeted retail and commercial business customers through promotional mix that included television, radio, direct mail, newspaper, event sponsorships, and in-store programs. Stores with wider aisles, brighter lighting, more signs and its more in stock of products for home decorating attracted more customers B. Finance Saw significant product/market growth opportunities expanded into western United States to build 100+ new stores to also increase profit. Net earnings, assets, shareholder’s equity and company’s recorded sales increased significantly from 2002 to 2003. Home Depot leads Lowes with an overall market share 18% to 9%. C. Research and Development (R&D) N/A D. Operations and Logistics Operates 10 regional distributions centers (RDC) and nine smaller support facilities strategically located throughout the US to handle special merchandise. No plans of international expansion, competitive edge goes to competition. Fifty percent of merchandise is shipped through RDC while remaining through Global Sourcing Division is shipped through vendors. E. Human Resources N/A F. Information Systems N/A EXHIBIT 1 EFAS TABLE FOR LOWES EXTERNAL FACTORS Opportunities Expansion to Western States Focusing on highly populated metropolitan areas Buying out established businesses in new markets Current Housing Market Transition from D-I-Y to B-I-Y base Maintaining an Equal percentage of vendor based products WEIGHT 2 0.2 0.2 0.1 0.1 WEIGHTED RATING SCORE COMMENTS 3 4 5 By 2004, 45 states had 4.25 0.85 stores Concentrating on Metro areas with 500,000 + 4.00 0.80 population 1999- Bought out Eagle Hardware an existing West 3.50 0.35 Coast hardware store Current Housing Market is rising considerably 2.00 0.20 0.05 3.00 0.15 0.05 4.50 0.23 0.05 1.75 0.09 Expanding Supply Chain vendor base This transition adds profit through installation services Diversity within vendors means not too much risk if a vendor goes under Identifying new product lines that may provide reduced costs to the company and increase customer satisfaction. Threats Need for higher quality product lines and product advances 0.05 2.50 0.13 0.05 4.00 0.20 0.1 2.00 0.20 0.1 1 1.50 0.15 3.34 Competition from "Big Name" home improvement stores Current and Forecasted Housing Market over the next 10 years Increased government regulation on green building products TOTAL SCORES Revitalizing product offerings and providing customers with the best products available on the market. One other known "Big Name" competitor. But must surpass their growth and product offering to maintain market share Unknown volatility in the housing market could lead to increase or decrease in profitability US Government is pushing towards regulations on building requirements EXHIBIT 4 Ratio Analysis for Lowe's Company Inc. 2002 2003 2002 2003 2004 1.56 0.36 1.55 0.42 1.22 0.14 0.94 0.84 0.84 4.58 4.64 4.05 79.69 78.66 90.12 1.62 1.64 1.72 5.66% 5.94% 6.39% 10.20% 21.10% 11.04% 22.03% 11.55% 21.21% 1. LIQUIDITY RATIOS Current Quick 2. LEVERAGE RATIOS Debt to Total Assets Debt to Equity 3. ACTIVITY RATIOS Inventory Turnover-sales Inventory Turnover-cost of sales Avg. Collection Period-days Fixed Asset Turnover Total Assets Turnover 3. PROFITABILITY RATIOS Gross Profit Margin Net Operating Margin Profit Margin on Sales Return on Total Assets Return on Equity 10.70% 22.00% 11.70% 22.60% EXHIBIT 5 Common Size Income Statements for Lowe's Company Inc. 2002 2003 2004 Net Sale Cost of Sales Gross Profit Selling, general/admin. Expenses Reorganization Expenses Operating Income Interest Expense Other-net Income before accounting changes Effect of accounting changes for post-retirement benefits other than pensions and income taxes Total Operating Costs and Expenses Net Income 100.00% 100.00% 100.00% 71 69 69 29 30 31 18 18 18 0 0 0 8 10 10 1 1 1 0 0 0 0 0 0 0 0 5 0 0 6 0 0 6