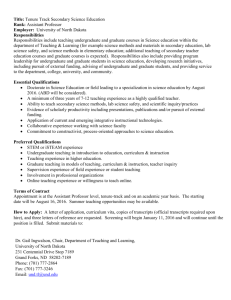

Involving the Campus Community in Reordering Budget & Strategic

advertisement

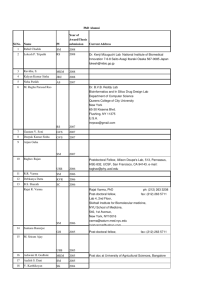

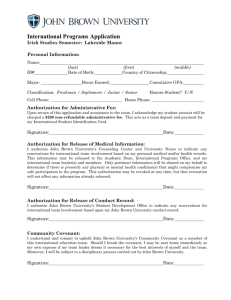

Delegated Budgeting: Strategies to Increase Institutional Buy-In and to Save Money Dr. Ed Ericson III CAO, John Brown University Ms. Pat Gustavson Former CFO, John Brown University Dr. Cal Piston Assoc. Dean of Institutional Effectiveness, John Brown University Overview • Key Questions How do we make resource decisions that will have buy in from the entire institution? How do we give faculty and staff budget information that they can handle, digest, and respond to appropriately? • Case Study in Creating campus-wide input and resourceallocation processes in response to a budget crisis at John Brown University Three examples: Cost Allocation Models, Operating Budget Input Systems, & Ancillary Budget Processes • Closing Thoughts and Discussion The Need • Difficult Economic Circumstances • Require Creative and Collaborative Solutions • Goals are more efficient allocation of resources & greater institutional buy-in JBU’s Case Study • John Brown University’s CounterCyclical Success Story . . . OR • Why JBU had a crisis when others did not and why we appear to be avoiding a crisis when others are experiencing one. • And it’s not just because we are a partially-owned subsidiary of . . . Wal-mart! JBU’s Non Crisis • $3mill reserve (10% of Undergraduate budget) • $1mill operating surplus (2.5% of overall budget) • CFI (Composite Financial Index) in the top 10% of the CCCU • Annual average fund-raising in the top 5% of the CCCU • Enrollments are stable (though discount is up a point) • Adding programs and positions (though less so this year than last) • Two new buildings on track JBU’s 2005-07 Crisis • 10% incoming undergraduate enrollment shortfall • 25% spike in health care costs • Flying “blind” with no “controls” JBU’s Revenue Changes • Strategic Focus • New Markets Initiative • Student Scholarships Initiative • Paperless Office JBU’s Expense Changes • Leveraging the crisis (targeted reductions instead of across the board cuts) • Setting up basic guidelines (size of majors, size of courses, student-faculty ratios, % of fulltime faculty, % of aid to offcampus programs, % of teaching hours to total hours) Delegated Budgeting • Cost Allocation Models for Each JBU “Boat” • Input Systems for Basic Operating Budgets • Ancillary Budget Process for Costs on the Margins Underlying Principles • Principle #1– Accuracy & Fairness Each budget group needs to know what the “rules” are regarding budget decisions • Principle #2 - “Wisdom of the Crowds” Superior decision making by aggregating diverse opinions that are independently derived and based on decentralized “local” knowledge • Principle #3 - Subsidiarity Matters ought to be handled by the smallest, lowest or least centralized competent authority Cost Allocation Models 1. Incubation Approach • • Support is undefined, minimal Has potential value to mission 2. Direct Incremental Cost Approach • Support is partially quantified – mainly staff hours Cost Allocation Models 3. Taxation Approach • • Can combine with direct cost assignment Percentage of revenue or expense or per unit amount 4. Full Overhead Costing Approach • • Attempts to quantify all costs Theoretical “stand-alone” model Revenue Centers at JBU Traditional Undergraduate • 1,200 FFTE • $26 MM Budget Auxiliaries • • • • • Residence Halls Food Service Bookstore Health Complex $5 MM Budget Revenue Centers at JBU KLRC • • • • Noncommercial FM, funded by gifts Provides internships Regional ministry $700 K Budget Revenue Centers at JBU Adult Degree Completion • 3 sites, 3 degree programs • 400 FFTE • $4 MM Budget Graduate • 3 departments, 2-3 degree programs apiece • 200 FFTE • $2 MM Budget Revenue Centers at JBU Centers (heavily endowed, selfsupporting, 1998) • Center for Relationship Enrichment • 8 staff • $ 1 MM Budget • Soderquist Center for Leadership & Ethics • 20 staff • $2 MM Budget Allocation Tiers - Plant Costs allocated: Plant Administration General Maintenance Custodial Grounds & Landscaping Utilities Central Plant Minor annual renewal/replacement/renovation Security Allocation Tiers - Plant Allocation basis: Square Footage (1 FTE “office” = 200 SF) (Direct costs excluded) (Plant SF excluded) (Allocated to Gen. Inst., Academic Support) Allocation Tiers – General Institutional Costs allocated: President’s Office Board Business Office IT Departments Print Services (net) Unallocated Benefits General Costs – Audit, Legal, Insurance, Net services (eg. Fleet, mail room) Allocation Tiers – General Institutional Allocation basis: Staff / Faculty FTE (includes adjunct faculty) (excludes work-study, graduate assistants) (Plant, Gen. Inst. Staff FTE excluded) Allocation Tiers – Academic Support Costs allocated: General Academic Administration Registrar Library Financial Aid Office Faculty Development Allocation Tiers – Academic Support Allocation basis: Student FTE (adjusted for adult degree completion, graduate) (not allocated to Centers, KLRC) Allocation Tiers - Misc. Not allocated / presumed fully Traditional Undergraduate or Direct-Costed Undergraduate Academic Administration and Support Admissions (3 departments) Student Development University Advancement Revenue Center Offset Credits • Graduate scholarships provided by 2 Centers • 50% rebate of General Institutional for Centers, KLRC • 33% rebate of Academic Support for Adult Degree Completion, Graduate • Annual review of “soft dollars” with Centers Budgetary Input Systems • Budget prioritization models • “Rule” by CAO/CFO Mandate • “Rule” by Committee Consensus Budgetary Input Systems • Alternative Approach – “Wisdom of the Crowds” • Diverse opinions • Independently derived • Based on local knowledge • Aggregated centrally Budgeting by Secret Ballot • Academic Councils for Undergraduate, Graduate, and Degree Completion • Councils hear relevant academic operating budget requests • CAO provides his priority order and rationales • Council members respond to a prioritization survey with their lists • Results are tabulated and brought to cabinet as the “final” order 2009-10 Examples • 27 undergraduate requests • • • • • • • 9 Replacement Faculty Lines 3 New Faculty Lines Ancillary Budget of $130,000 An “extra” 1% salary increase 4 part-time slots or load increases New initiative for student research 8 catalog copy and departmental budget increases 2009-10 Examples • 12 of 27 items currently funded • 8 of 9 Replacement Faculty (meaning we let one person go) • Ancillary Budget • Part of the “extra” salary increase • 2 of the part-time or load increases • Next fall, we may get another “bite” at the apple Ancillary Budget Process • Purpose of Funds • Able to be saved – rolled over to the next fiscal year • Budgetary Decisions on the Margins • Student and Faculty Projects • Special Equipment Needs • Offering of Low-Enrollment Courses • Pilot operations • Focus on Divisional Goals and Student Learning Outcomes Ancillary Budget Process • Amount of Funding • $130,000 per year • 7 Academic Divisions @ $10K - $20K • 5 Support Units @ $5K - $10K • Allocated on competitive and benchmark basis • Incentives for Improvement Ancillary Budget Process • Analysis of Academic Divisions • Point Systems Developed in Six Areas • Student Numbers • Majors, Completions, Student-Faculty Ratio • Teaching • Student Evaluations, Formal Faculty Evaluations • Scholarship Ancillary Budget Process • Analysis of Academic Divisions • Service • Advising, Institutional Citizenship, Service to the World • Spiritual Modeling • Academic Rigor Ancillary Budget Process • Other Factors • Deductions • One-half cost of adjunct for • Courses with 4 – 7 students enrolled • Multi-section courses with extra section • Full cost of adjunct for courses with less than 4 students enrolled • Additions for courses with enrollment over cap Ancillary Budget Process • Extensions to Academic Support Units • • • • • Honors Scholars Program Student Support Services Library Faculty Development Leader Scholars Institute Dangers & Complications 1. Arbitrary judgments must be made 2. Difficulty of unwinding 3. Encourages cost analysis, consideration of outsourcing 4. Takes administrative time 5. Does not resolve unequal demands 6. Creates transparency, more accountability Advantages 1. Necessary for accurate cost knowledge 2. Creates transparency, requires more accountability 3. Raises cost consciousness, motivates cost control (space, staffing) 4. Allows centralization of technical expertise and insights 5. Generates useful data for other purposes Questions for Discussion • How do you build systems of communication on resource issues in an institution that hasn’t had such dialogue in the past? • What is the budget planning culture at your institution and how does that culture affect your pragmatic allocation decisions? • How can you define the nature of your resource concerns, especially when you have multiple sources of revenue and expense, such as both traditional and adult programs? • How much of the reallocation of your resources should follow “mission” priorities as opposed to more pragmatic concerns?